We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Same as mine but it seems some are getting only 3 green boxes on the postal form. I thought for a fleeting moment that Principality paper system was more switched on than their online system by only offering this option to those who don’t already have a current issue RS (like me) but I know you have at least 1, so that blows that theory out of the window.masonic said:Hattie627 said:

Got my maturity instructions form by post today too. Mine is exactly as described by s71hj. No option to rollover to any RS but literature enclosed for the 6 month RS Issue 4. I did my instructions electronically yesterday (option 4 chosen, then RS4 offered and selected), confirmation of acceptance of instructions is appearing above the account on the online list, no secure message generated. Will see what happens on 24th October.badger09 said:

Really?s71hj said:So myself and my wife have now had maturity options through the post for Principality . As with previous account maturity, the form doesn't contain a tick box for choosing RS 4 presumably as I already have it, although the literature about it is enclosed in the envelope. It is however available in my online options and I intend to submit today or tomorrow although still in two minds between option 2 and 4.

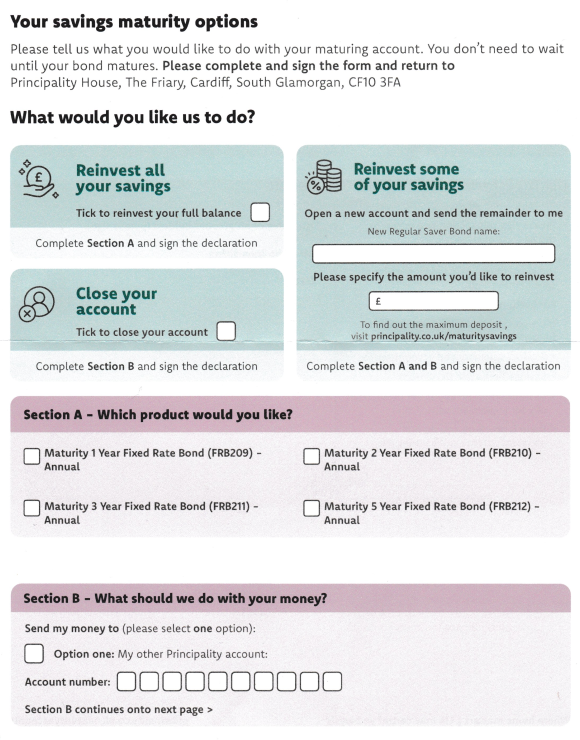

I too have received maturity instructions today by post.There are 4 options in green boxes, one of which is ‘Reinvest some of your savings. Open a new account and send the remainder to me’ below which is printed ‘New Regular Saver Bond name:’ with a white box for me to enter the name.Do you not have that on yours?This is what I received: Presumably you can write in the name of a regular saver in the top-right green box and tick none of the options in Section A. But surely nobody is considering giving postal instructions?1

Presumably you can write in the name of a regular saver in the top-right green box and tick none of the options in Section A. But surely nobody is considering giving postal instructions?1 -

Principality Issue 4

Seems that I am unable to open another one.

I have got two issue 3, and two issue 4. When I had funds maturing last month I was refused after selecting option 2, by secure message by our friend. So, I left it a few days and rang and asked my options, and the lady who answered opened my second issue 4

I have a Regular Saver Issue 34 maturing next Wednesday. I selected option 4 last week and again had the secure message saying no the following day from a different named person, but same message.

I did all this whilst wearing a green jumper, having a banker's lamp switched on, on my desk with a green shade, and humming the National Anthem.

I rang them today and spoke to another lady, and asked what my options were, and she said “You can open an issue 4, oh hang on, you’ve already got one, so, no sorry”.

So, I have asked for my closing funds to be sent to my bank current account.

I am not fussed about opening any more, but with me, I do not think it is possible now anyway. they seem to have cottoned on.

As I say I am not fussed, but thought I would report here, that I do not think I can open any more issue 4’s

4 -

Sounds like a few more of their staff have cottoned on. If I get refused, I won't mind too much, as we were only ever supposed to have one of each issue anyway. And they'll release an Issue 5 at some point which can be held alongside Issue 4.Andystriker said:Principality Issue 4

Seems that I am unable to open another one.

I have got two issue 3, and two issue 4. When I had funds maturing last month I was refused after selecting option 2, by secure message by our friend. So, I left it a few days and rang and asked my options, and the lady who answered opened my second issue 4

I have a Regular Saver Issue 34 maturing next Wednesday. I selected option 4 last week and again had the secure message saying no the following day from a different named person, but same message.

I did all this whilst wearing a green jumper, having a banker's lamp switched on, on my desk with a green shade, and humming the National Anthem.

I rang them today and spoke to another lady, and asked what my options were, and she said “You can open an issue 4, oh hang on, you’ve already got one, so, no sorry”.

So, I have asked for my closing funds to be sent to my bank current account.

I am not fussed about opening any more, but with me, I do not think it is possible now anyway. they seem to have cottoned on.

As I say I am not fussed, but thought I would report here, that I do not think I can open any more issue 4’s

Anyway, not sure if the British national anthem would help, maybe try Hen Wlad Fy Nhadau.1 -

I've already got x2 issue 4's and have been allowed a third issue 4 at maturity. Let's face it, we need a few issue 3's &/or issue 4's cos they only pay £26 in interest each. So only one is hardly worth bothering with.4

-

Is that the Welsh national anthem? I was humming Scotland the Brave when inputting my instructions. Was getting mixed up with Scottish BS.clairec666 said:Andystriker said:Principality Issue 4

Seems that I am unable to open another one.

I have got two issue 3, and two issue 4. When I had funds maturing last month I was refused after selecting option 2, by secure message by our friend. So, I left it a few days and rang and asked my options, and the lady who answered opened my second issue 4

I have a Regular Saver Issue 34 maturing next Wednesday. I selected option 4 last week and again had the secure message saying no the following day from a different named person, but same message.

I did all this whilst wearing a green jumper, having a banker's lamp switched on, on my desk with a green shade, and humming the National Anthem.

I rang them today and spoke to another lady, and asked what my options were, and she said “You can open an issue 4, oh hang on, you’ve already got one, so, no sorry”.

So, I have asked for my closing funds to be sent to my bank current account.

I am not fussed about opening any more, but with me, I do not think it is possible now anyway. they seem to have cottoned on.

As I say I am not fussed, but thought I would report here, that I do not think I can open any more issue 4’s

Anyway, not sure if the British national anthem would help, maybe try Hen Wlad Fy Nhadau.1 -

Hattie627 said:

Is that the Welsh national anthem? I was humming Scotland the Brave when inputting my instructions. Was getting mixed up with Scottish BS.clairec666 said:Andystriker said:Principality Issue 4

Seems that I am unable to open another one.

I have got two issue 3, and two issue 4. When I had funds maturing last month I was refused after selecting option 2, by secure message by our friend. So, I left it a few days and rang and asked my options, and the lady who answered opened my second issue 4

I have a Regular Saver Issue 34 maturing next Wednesday. I selected option 4 last week and again had the secure message saying no the following day from a different named person, but same message.

I did all this whilst wearing a green jumper, having a banker's lamp switched on, on my desk with a green shade, and humming the National Anthem.

I rang them today and spoke to another lady, and asked what my options were, and she said “You can open an issue 4, oh hang on, you’ve already got one, so, no sorry”.

So, I have asked for my closing funds to be sent to my bank current account.

I am not fussed about opening any more, but with me, I do not think it is possible now anyway. they seem to have cottoned on.

As I say I am not fussed, but thought I would report here, that I do not think I can open any more issue 4’s

Anyway, not sure if the British national anthem would help, maybe try Hen Wlad Fy Nhadau.Yes it was the Welsh one they sing at the Rugby (Land of my fathers).If I'm the only one who is being rejected, perhaps they don't like me?????0 -

Well Wales is part of Britain.clairec666 said:

Anyway, not sure if the British national anthem would help, maybe try Hen Wlad Fy Nhadau.Andystriker said:Principality Issue 4

Seems that I am unable to open another one.

I have got two issue 3, and two issue 4. When I had funds maturing last month I was refused after selecting option 2, by secure message by our friend. So, I left it a few days and rang and asked my options, and the lady who answered opened my second issue 4

I have a Regular Saver Issue 34 maturing next Wednesday. I selected option 4 last week and again had the secure message saying no the following day from a different named person, but same message.

I did all this whilst wearing a green jumper, having a banker's lamp switched on, on my desk with a green shade, and humming the National Anthem.

I rang them today and spoke to another lady, and asked what my options were, and she said “You can open an issue 4, oh hang on, you’ve already got one, so, no sorry”.

So, I have asked for my closing funds to be sent to my bank current account.

I am not fussed about opening any more, but with me, I do not think it is possible now anyway. they seem to have cottoned on.

As I say I am not fussed, but thought I would report here, that I do not think I can open any more issue 4’s

2 -

The option was there back in September on another maturing regular saver gave instruction early hours 11th reply came back 10.00 am on the 11th sorry you can't have more than oneCweb said:Principality Maturity options for Xmas Saver now available for those taken out on first day - Regular Saver 4 is an option. Nothing else of interest as options instead.0 -

It depends how you attempted to fund the extra account. I had an easy access saver with Monmouth and transferred the extra £500 into that and then directly transferred the funds into the extra issue 8 RS for 2 months before setting up a regular monthly SO to both, which hasn't triggered a return of funds, yetallegro120 said:

Monmouthshire Regular Saver (issue 8) - duplicate accountWhat_time_is_it said:

That’s a good point. It opened in August, so well past 30 days. But it is still showing as active in my app.Ed-1 said:

You have to fund the account within 30 days of opening, otherwise it automatically deactivates.What_time_is_it said:Monmouthshire Regular Saver (issue 8) - duplicate account

Hi there. I opened the above account at 6%, and subsequently opened both the branch and app exclusive accounts at 7%. So far so good, and all happy… However, when I opened the Regular Saver they accidently opened 2 accounts of the same type and issue. I asked about this at the time and they said they would just close the one that I don’t fund. But they haven’t!So my question is, should I start sticking £500 a month into this “duplicate” account and see what happens? Or is that a bit risky?What do you think?

I've attempted to fund it 3 times, every time the funds were returned the next day. The account was showing in my app for about a month and then disappeared. # No.2 Save 1p A Day Challenge 2026 £118.34 / £667.95 (2)# No.4 Save £12k in 2026 £3635.93 / £12,000 (2)# No.4 £2 Savers Club 2026 - (25/12 - 24/10) £50 / £200 (2)# No.8 Sealed Pot Challenge 19 - 2026 - 24/12 - 24/10 £60+ / £400 (2)# No.5 Fiver Friday Challenge 2026 £40/£230 (2)# Make £2026 in 2026 £1033.98 / £2026 (2)0

# No.2 Save 1p A Day Challenge 2026 £118.34 / £667.95 (2)# No.4 Save £12k in 2026 £3635.93 / £12,000 (2)# No.4 £2 Savers Club 2026 - (25/12 - 24/10) £50 / £200 (2)# No.8 Sealed Pot Challenge 19 - 2026 - 24/12 - 24/10 £60+ / £400 (2)# No.5 Fiver Friday Challenge 2026 £40/£230 (2)# Make £2026 in 2026 £1033.98 / £2026 (2)0 -

Principality Xmas 2025 Maturity Instructions

Did what I did last time - selected the "new Bond" option 4. No secure messages yet. Fingers crossed.

My new theory (given the options / timing doesn't seem to be the trick) is that the review/no review issue might just be a factor of users profiles. E.g. customers from before a certain date don't trigger the review; newer ones do.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards