We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

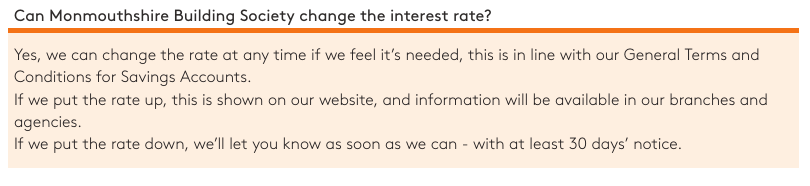

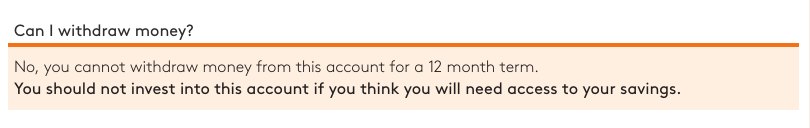

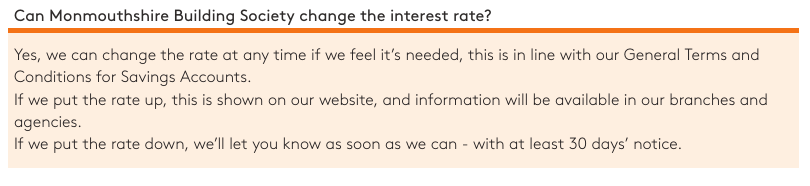

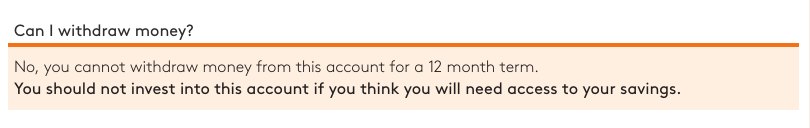

As far as I can see, the specific Ts & Cs for this account do not allow withdrawals or early closure:Bridlington1 said:I attempted to make a withdrawal of £3450 from my Monmouthshire BS Exclusive RS Issue 2 which would've taken the balance down to £50 and received this message in response:Dear Bridlington1I've sent them a message in response quoting the Ts&Cs in relation to being able to withdraw funds or close the account if they decide to reduce the interest rate so shall see what they say in response.

Thank you for your on-line transaction request. Unfortunately, this transaction has been declined for the following reason: Under the terms and conditions of the Exclusive Regular Saver Issue 2 no withdrawals are allowed for the 12 month term.

Kind regards

The general RS Ts & Cs allow such things, but, presumably, the specific Ts & Cs trump those, in respect of the Exclusive RS iss. 2?

EDIT: Addition of opening section from Mon BS general RS Ts & Cs1 -

I’m not convinced. I think @bridlington1 is correct in expecting withdrawal (or closure) to be permitted in the case of a rate decrease - curious to see how Mon BS respond.SJMALBA said:

As far as I can see, the specific Ts & Cs for this account do not allow withdrawals or early closure:Bridlington1 said:I attempted to make a withdrawal of £3450 from my Monmouthshire BS Exclusive RS Issue 2 which would've taken the balance down to £50 and received this message in response:Dear Bridlington1I've sent them a message in response quoting the Ts&Cs in relation to being able to withdraw funds or close the account if they decide to reduce the interest rate so shall see what they say in response.

Thank you for your on-line transaction request. Unfortunately, this transaction has been declined for the following reason: Under the terms and conditions of the Exclusive Regular Saver Issue 2 no withdrawals are allowed for the 12 month term.

Kind regards

The general RS Ts & Cs allow such things, but, presumably, the specific Ts & Cs trump those, in respect of the Exclusive RS iss. 2?If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.3 -

The general RS Ts & Cs state:ForumUser7 said:

I’m not convinced. I think @bridlington1 is correct in expecting withdrawal (or closure) to be permitted in the case of a rate decrease - curious to see how Mon BS respond.SJMALBA said:

As far as I can see, the specific Ts & Cs for this account do not allow withdrawals or early closure:Bridlington1 said:I attempted to make a withdrawal of £3450 from my Monmouthshire BS Exclusive RS Issue 2 which would've taken the balance down to £50 and received this message in response:Dear Bridlington1I've sent them a message in response quoting the Ts&Cs in relation to being able to withdraw funds or close the account if they decide to reduce the interest rate so shall see what they say in response.

Thank you for your on-line transaction request. Unfortunately, this transaction has been declined for the following reason: Under the terms and conditions of the Exclusive Regular Saver Issue 2 no withdrawals are allowed for the 12 month term.

Kind regards

The general RS Ts & Cs allow such things, but, presumably, the specific Ts & Cs trump those, in respect of the Exclusive RS iss. 2?ClosureClosure of your Regular Saver account is allowed at any time without notice or penalty.

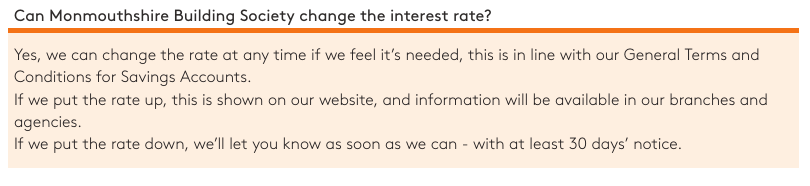

andIf we lower the interest rate, we’ll let you know 30 days before the change happens, using letter, email, orwhichever method you advised is best for you. If you’re not happy about the change, you can close youraccount or move the money to another one. If you do this within the 30 days, you won’t have to pay anycharges or lose any interest. We’ll assume you’re happy with the change unless you tell us otherwise.

The product specific Ts & Cs gives neither option (and goes further by stating that it cannot be closed for a 12 month term), and my reading of the opening to the general terms (now quoted as an edit in my original post) is that they trump the general terms?1 -

I think you'll be permitted to close the account completely, but not make a partial withdrawal3

-

I had the same RS. Last Thursday evening I sent them a secure message from their website advising them that due to the interest rate reduction notification, that I would like to close the account. I received my £3500 plus £63.53 interest into my bank the next day.Bridlington1 said:I attempted to make a withdrawal of £3450 from my Monmouthshire BS Exclusive RS Issue 2 which would've taken the balance down to £50 and received this message in response:Dear Bridlington1I've sent them a message in response quoting the Ts&Cs in relation to being able to withdraw funds or close the account if they decide to reduce the interest rate so shall see what they say in response.

Thank you for your on-line transaction request. Unfortunately, this transaction has been declined for the following reason: Under the terms and conditions of the Exclusive Regular Saver Issue 2 no withdrawals are allowed for the 12 month term.

Kind regards8 -

They could trump the general terms, but cannot trump the law. Without allowing the consumer to dissolve the contract penalty free, this is a unilateral change, which is not being made as a result of a reason specified in the contract (such as linking to base rate). Such a change would automatically be considered unfair under the Consumer Rights Act 2015 and therefore the rate reduction would be unenforceable.SJMALBA said:The product specific Ts & Cs gives neither option (and goes further by stating that it cannot be closed for a 12 month term), and my reading of the opening to the general terms (now quoted as an edit in my original post) is that they trump the general terms?7 -

SJMALBA said:

The general RS Ts & Cs state:ForumUser7 said:

I’m not convinced. I think @bridlington1 is correct in expecting withdrawal (or closure) to be permitted in the case of a rate decrease - curious to see how Mon BS respond.SJMALBA said:

As far as I can see, the specific Ts & Cs for this account do not allow withdrawals or early closure:Bridlington1 said:I attempted to make a withdrawal of £3450 from my Monmouthshire BS Exclusive RS Issue 2 which would've taken the balance down to £50 and received this message in response:Dear Bridlington1I've sent them a message in response quoting the Ts&Cs in relation to being able to withdraw funds or close the account if they decide to reduce the interest rate so shall see what they say in response.

Thank you for your on-line transaction request. Unfortunately, this transaction has been declined for the following reason: Under the terms and conditions of the Exclusive Regular Saver Issue 2 no withdrawals are allowed for the 12 month term.

Kind regards

The general RS Ts & Cs allow such things, but, presumably, the specific Ts & Cs trump those, in respect of the Exclusive RS iss. 2?ClosureClosure of your Regular Saver account is allowed at any time without notice or penalty.

andIf we lower the interest rate, we’ll let you know 30 days before the change happens, using letter, email, orwhichever method you advised is best for you. If you’re not happy about the change, you can close youraccount or move the money to another one. If you do this within the 30 days, you won’t have to pay anycharges or lose any interest. We’ll assume you’re happy with the change unless you tell us otherwise.

The product specific Ts & Cs gives neither option (and goes further by stating that it cannot be closed for a 12 month term), and my reading of the opening to the general terms (now quoted as an edit in my original post) is that they trump the general terms?MonmouthI'd suggest "...this is in line with our General Terms and Conditions for Savings Accounts." from the product specific T&C's arguably has the effect of invoking (rather than trumping) the relevant clause of the general T&C's.Either way, it isn't wholly clear, and since the change in interest rates by Monmouth is detrimental to customers I think they should be willing to allow the T&C's to be interpreted in the way Bridlington1 has.Hopefully they will see sense. But if not, perhaps a complaint referencing the FCA handbook (Fair, clear and not misleading communications) might be in order, since the fact this conversation is taking place points towards the T&C's failing that test.6 -

The West Brom would not allow a 13th payment into the regular saver. But I am looking forward to later this month when I will be able to open another @ 6%..1

-

Indeed. Not the first time that a Bank's/Building Society's Ts & Cs are potentially ambiguous...Section62 said:SJMALBA said:

The general RS Ts & Cs state:ForumUser7 said:

I’m not convinced. I think @bridlington1 is correct in expecting withdrawal (or closure) to be permitted in the case of a rate decrease - curious to see how Mon BS respond.SJMALBA said:

As far as I can see, the specific Ts & Cs for this account do not allow withdrawals or early closure:Bridlington1 said:I attempted to make a withdrawal of £3450 from my Monmouthshire BS Exclusive RS Issue 2 which would've taken the balance down to £50 and received this message in response:Dear Bridlington1I've sent them a message in response quoting the Ts&Cs in relation to being able to withdraw funds or close the account if they decide to reduce the interest rate so shall see what they say in response.

Thank you for your on-line transaction request. Unfortunately, this transaction has been declined for the following reason: Under the terms and conditions of the Exclusive Regular Saver Issue 2 no withdrawals are allowed for the 12 month term.

Kind regards

The general RS Ts & Cs allow such things, but, presumably, the specific Ts & Cs trump those, in respect of the Exclusive RS iss. 2?ClosureClosure of your Regular Saver account is allowed at any time without notice or penalty.

andIf we lower the interest rate, we’ll let you know 30 days before the change happens, using letter, email, orwhichever method you advised is best for you. If you’re not happy about the change, you can close youraccount or move the money to another one. If you do this within the 30 days, you won’t have to pay anycharges or lose any interest. We’ll assume you’re happy with the change unless you tell us otherwise.

The product specific Ts & Cs gives neither option (and goes further by stating that it cannot be closed for a 12 month term), and my reading of the opening to the general terms (now quoted as an edit in my original post) is that they trump the general terms?MonmouthI'd suggest "...this is in line with our General Terms and Conditions for Savings Accounts." from the product specific T&C's arguably has the effect of invoking (rather than trumping) the relevant clause of the general T&C's.Either way, it isn't wholly clear, and since the change in interest rates by Monmouth is detrimental to customers I think they should be willing to allow the T&C's to be interpreted in the way Bridlington1 has.Hopefully they will see sense. But if not, perhaps a complaint referencing the FCA handbook (Fair, clear and not misleading communications) might be in order, since the fact this conversation is taking place points towards the T&C's failing that test.

While I'm not looking to withdraw or close, fingers crossed for a satisfactory outcome for those who are.3 -

MonmouthSection62 said:SJMALBA said:

The general RS Ts & Cs state:ForumUser7 said:

I’m not convinced. I think @bridlington1 is correct in expecting withdrawal (or closure) to be permitted in the case of a rate decrease - curious to see how Mon BS respond.SJMALBA said:

As far as I can see, the specific Ts & Cs for this account do not allow withdrawals or early closure:Bridlington1 said:I attempted to make a withdrawal of £3450 from my Monmouthshire BS Exclusive RS Issue 2 which would've taken the balance down to £50 and received this message in response:Dear Bridlington1I've sent them a message in response quoting the Ts&Cs in relation to being able to withdraw funds or close the account if they decide to reduce the interest rate so shall see what they say in response.

Thank you for your on-line transaction request. Unfortunately, this transaction has been declined for the following reason: Under the terms and conditions of the Exclusive Regular Saver Issue 2 no withdrawals are allowed for the 12 month term.

Kind regards

The general RS Ts & Cs allow such things, but, presumably, the specific Ts & Cs trump those, in respect of the Exclusive RS iss. 2?ClosureClosure of your Regular Saver account is allowed at any time without notice or penalty.

andIf we lower the interest rate, we’ll let you know 30 days before the change happens, using letter, email, orwhichever method you advised is best for you. If you’re not happy about the change, you can close youraccount or move the money to another one. If you do this within the 30 days, you won’t have to pay anycharges or lose any interest. We’ll assume you’re happy with the change unless you tell us otherwise.

The product specific Ts & Cs gives neither option (and goes further by stating that it cannot be closed for a 12 month term), and my reading of the opening to the general terms (now quoted as an edit in my original post) is that they trump the general terms?MonmouthI'd suggest "...this is in line with our General Terms and Conditions for Savings Accounts." from the product specific T&C's arguably has the effect of invoking (rather than trumping) the relevant clause of the general T&C's.Either way, it isn't wholly clear, and since the change in interest rates by Monmouth is detrimental to customers I think they should be willing to allow the T&C's to be interpreted in the way Bridlington1 has.Hopefully they will see sense. But if not, perhaps a complaint referencing the FCA handbook (Fair, clear and not misleading communications) might be in order, since the fact this conversation is taking place points towards the T&C's failing that test.Don't know if this helps in any way, but the MONBS Saving T&Cs state:"Thank you for choosing Monmouthshire Building Society. This document, along with your product terms and conditions, make up the contract between you and us, so please read them carefully. If this document and the product terms and conditions ever disagree, the product terms will apply." (My emboldening.)3

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards