We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

advice on regular payments into a SIPP please

Comments

-

spaniel101 said:incus432 said:sadexpunk said:

haha ok. i didnt realise they could be THAT volatile, in just a matter of a few seconds :-)MallyGirl said:

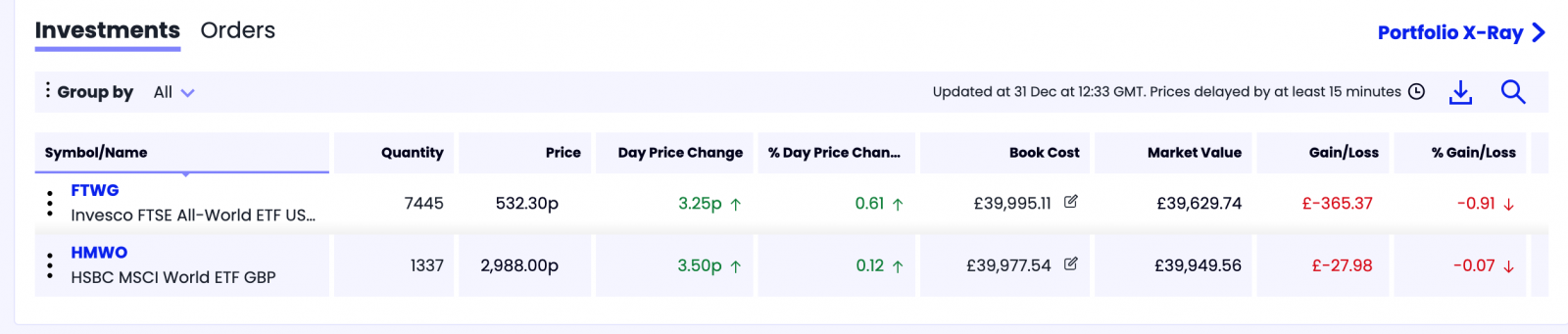

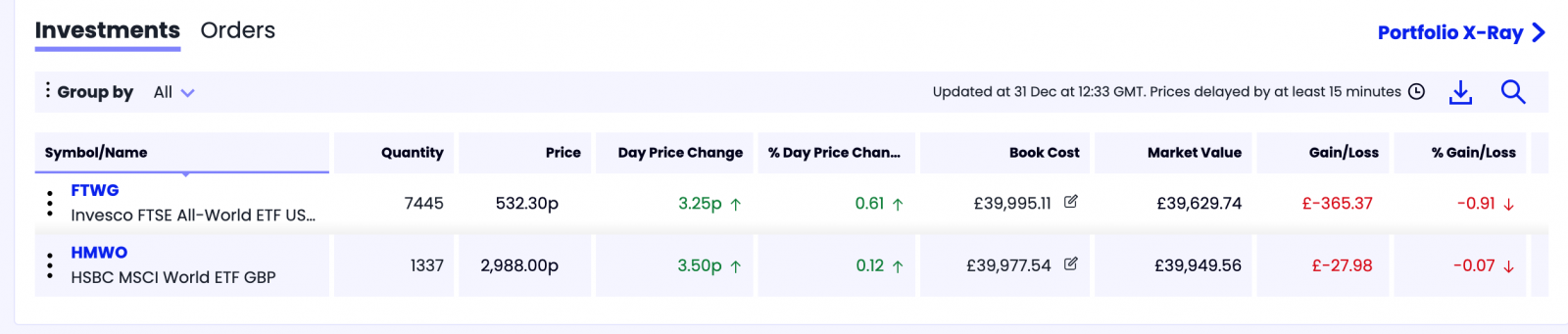

Yes, but it could go the other way tomorrow. Checking it daily is the route to madness - step away from the portal.sadexpunk said:well ive just gone for 2 ETFs initially, the HMWO and FTWG. havent decided on the other yet. just looking at my portfolio now...... have i really just lost around £400 in a matter of seconds?? The advice not to check in too often is good but I dont understand that loss

The advice not to check in too often is good but I dont understand that loss

Purchased @ todays peak 537.21, just before 12.00pm. Markets closed today @ 12.30pm @ 537.00.Would there be a buy / sell spread? ie ETF just bought at the buying price, but portfolio priced at the selling price??I think ETF's have a spread like shares do, so you do see an immediate "loss", but that's how things go. It usually isn't too long before the sell price goes up above the buy price.I think the difference covers the market makers costs? (insurance, compliance etc?)For future reference, OIEC's have just a single price (normally)0 -

Yes, you bought 2 things - each will incur a trade fee. 1 will have been free - the other probably not unless you opened the SIPP more than a month ago. At the top of the II screen you will see a figure for 'trading credits' with an expiry date.sadexpunk said:

i suppose i know that i wont remember to check in each month and re-invest. how often do the 'acc' funds do it automatically, quarterly? that would suit me just fine. i guess id just prefer the acc version of these funds.noclaf said:

HMWO is well-established and I used this ETF in the past)......just be aware that 100% Equities (irrespective of OEIC or ETF's) will be volatile (choppy waters!)..£400 is just a minor blip on the radar ..'noise' in the grand scheme but if you stay the course over longer term Equities tend to go upwards (not in a straight line) and if purchasing units each month will help to iron out the peaks and troughs i.e: prices will fluctuate over time and hopefully purchases at lower prices will help to give you an higher overall total once you start to need funds from the SIPP....

have i just done '2 trades'? so one was free and ill be charged for the other? and ill also be charged for investing the rest of my balance unless i wait a month?Next month you will get another free trade.

thank youWhen you invest the rest maybe just choose 1 fund?

With acc funds you don't need to worry about when dividends happen- you just won't see them. Simpler all round.I’m a Senior Forum Ambassador and I support the Forum Team on the Pensions, Annuities & Retirement Planning, Loans

& Credit Cards boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com.

All views are my own and not the official line of MoneySavingExpert.0 -

more confusion on my part again, i suppose i didnt understand the difference between 'trading' and 'investing'. so is a trade buying a fund, and investing is chucking more and more money into that pre-existing fund?MallyGirl said:Yes, you bought 2 things - each will incur a trade fee. 1 will have been free - the other probably not unless you opened the SIPP more than a month ago. At the top of the II screen you will see a figure for 'trading credits' with an expiry date.When you invest the rest maybe just choose 1 fund?

With acc funds you don't need to worry about when dividends happen- you just won't see them. Simpler all round.

so i could buy 1 fund a month, but i have 'free investing' and can put whatever i like into it whenever i like?

learning all the time..... just too late sometimes 0

0 -

LHW99 said:spaniel101 said:incus432 said:sadexpunk said:

haha ok. i didnt realise they could be THAT volatile, in just a matter of a few seconds :-)MallyGirl said:

Yes, but it could go the other way tomorrow. Checking it daily is the route to madness - step away from the portal.sadexpunk said:well ive just gone for 2 ETFs initially, the HMWO and FTWG. havent decided on the other yet. just looking at my portfolio now...... have i really just lost around £400 in a matter of seconds?? The advice not to check in too often is good but I dont understand that loss

The advice not to check in too often is good but I dont understand that loss

Purchased @ todays peak 537.21, just before 12.00pm. Markets closed today @ 12.30pm @ 537.00.Would there be a buy / sell spread? ie ETF just bought at the buying price, but portfolio priced at the selling price??I think ETF's have a spread like shares do, so you do see an immediate "loss", but that's how things go. It usually isn't too long before the sell price goes up above the buy price.I think the difference covers the market makers costs? (insurance, compliance etc?)For future reference, OIEC's have just a single price (normally)

Indeed.

Incus432 demonstrated '1D' +3.25/+0.61%, 537.00 at close today.

sadexpunk purchased at peak this morning @ 537.21 prior to mid-day (not yesterday).

Then the buy/sell spread.0 -

I am not sure I understand your point.sadexpunk said:

more confusion on my part again, i suppose i didnt understand the difference between 'trading' and 'investing'. so is a trade buying a fund, and investing is chucking more and more money into that pre-existing fund?MallyGirl said:Yes, you bought 2 things - each will incur a trade fee. 1 will have been free - the other probably not unless you opened the SIPP more than a month ago. At the top of the II screen you will see a figure for 'trading credits' with an expiry date.When you invest the rest maybe just choose 1 fund?

With acc funds you don't need to worry about when dividends happen- you just won't see them. Simpler all round.

so i could buy 1 fund a month, but i have 'free investing' and can put whatever i like into it whenever i like?

learning all the time..... just too late sometimes

a trade is 'please buy £100 worth of VLS60' or 'please buy 100 units of VLS60' using cash already held in my SIPP/ISA/GIA. II will charge a fee for making that trade - £3.99 for a normal UK investment I think.

if you choose 'regular investing' you setup an instruction to direct debit say £100 from your bank and make 1 or more trades with it. II charge no fee for making these trades because you have committed to a regular activity on fixed dates. You can actually change this instruction as often as you like so it isn't much of a commitment.

it is all investing.I’m a Senior Forum Ambassador and I support the Forum Team on the Pensions, Annuities & Retirement Planning, Loans

& Credit Cards boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com.

All views are my own and not the official line of MoneySavingExpert.0 -

sorry, dont understand a word of that :-) buy/sell spread? 1D? +3.25/+0.61%? which is a good enough reason to follow the subsequent advice of.....spaniel101 said:

Indeed.

Incus432 demonstrated '1D' +3.25/+0.61%, 537.00 at close today.

sadexpunk purchased at peak this morning @ 537.21 prior to mid-day (not yesterday).

Then the buy/sell spread.incus432 said:

I strongly agree this would seem wisest.MallyGirl said:When you invest the rest maybe just choose 1 fund?

ah right, thanks, so trades and investing are the same thing...... if i understand that right then, at the moment i have no free trades available to me. if i set up a DD today (regular investing), would i then have free trades? so i could sell my 'rogue trades' and invest again in just one global acc fund?MallyGirl said:

a trade is 'please buy £100 worth of VLS60' or 'please buy 100 units of VLS60' using cash already held in my SIPP/ISA/GIA. II will charge a fee for making that trade - £3.99 for a normal UK investment I think.

if you choose 'regular investing' you setup an instruction to direct debit say £100 from your bank and make 1 or more trades with it. II charge no fee for making these trades because you have committed to a regular activity on fixed dates. You can actually change this instruction as often as you like so it isn't much of a commitment.

it is all investing.

thank you0 -

I don't think you can sell under the free regular investing functionality. You would have to pay the £3.99 for that or wait for your next monthly trading credit. You have 2 to sell so you either do 1 a month with trading credits or pay the fee as it isn't much in the great scheme of things.sadexpunk said:

sorry, dont understand a word of that :-) buy/sell spread? 1D? +3.25/+0.61%? which is a good enough reason to follow the subsequent advice of.....spaniel101 said:

Indeed.

Incus432 demonstrated '1D' +3.25/+0.61%, 537.00 at close today.

sadexpunk purchased at peak this morning @ 537.21 prior to mid-day (not yesterday).

Then the buy/sell spread.incus432 said:

I strongly agree this would seem wisest.MallyGirl said:When you invest the rest maybe just choose 1 fund?

ah right, thanks, so trades and investing are the same thing...... if i understand that right then, at the moment i have no free trades available to me. if i set up a DD today (regular investing), would i then have free trades? so i could sell my 'rogue trades' and invest again in just one global acc fund?MallyGirl said:

a trade is 'please buy £100 worth of VLS60' or 'please buy 100 units of VLS60' using cash already held in my SIPP/ISA/GIA. II will charge a fee for making that trade - £3.99 for a normal UK investment I think.

if you choose 'regular investing' you setup an instruction to direct debit say £100 from your bank and make 1 or more trades with it. II charge no fee for making these trades because you have committed to a regular activity on fixed dates. You can actually change this instruction as often as you like so it isn't much of a commitment.

it is all investing.

thank you

anything defined in the regular bit is free - even if you only do it once and then change the instruction to something completely different once the first one has completed. When you explore the regular investing screen I think you can set up the regular amount but also specify an additional amount in the first month to mop up any extra balance you have accrued.

you could follow the following steps:- Choose a single investment for the future- you can get more sophisticated later when you have got comfortable with the basics

- sell the 2 you currently hold so you are now holding a chunk of cash. It may take a few days to 'settle'. There will be 2 fees unless you have got any trading credits by the time you act.

- In regular investing functionality set up your £100 monthly investment into your new choice. It will prompt you to set up the matching DD. Also add the initial extra amount to sweep up the big chunk of cash you got from selling in step 2.

I can't try this for you without messing up my own setup but I am sure there is an option for an additional amount in the first regular investment.

I’m a Senior Forum Ambassador and I support the Forum Team on the Pensions, Annuities & Retirement Planning, Loans

& Credit Cards boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com.

All views are my own and not the official line of MoneySavingExpert.0 -

sorry, dont understand a word of that :-) buy/sell spread?

Basically when you buy any share or investment trust unit or ETF unit, you will pay a slightly higher price than if you had sold exactly the same unit at the same time (usually it will be a very small percentage of the actual price, ie pennies on low priced shares, pounds if you're buying something where one unit costs £x00).On the whole if you buy a unit of an OIEC fund, they are "monopriced" ie buying or selling at the same time will be at the same price. I suspect the sort of costs that are involved in the buy/sell spread get rolled up into the unit price, so they are hidden.

0 -

thanks, ive just sold them and came out of it ok considering. looked first thing this morning and it seemed as tho i was up by about £500 so went sell sell sell. said theyd sell at first opportunity (when the markets open i suppose), all done and dusted now but only around £100 up from where i started. could have been much worse tho.I don't think you can sell under the free regular investing functionality. You would have to pay the £3.99 for that or wait for your next monthly trading credit. You have 2 to sell so you either do 1 a month with trading credits or pay the fee as it isn't much in the great scheme of things.

anything defined in the regular bit is free - even if you only do it once and then change the instruction to something completely different once the first one has completed. When you explore the regular investing screen I think you can set up the regular amount but also specify an additional amount in the first month to mop up any extra balance you have accrued.

you could follow the following steps:- Choose a single investment for the future- you can get more sophisticated later when you have got comfortable with the basics

- sell the 2 you currently hold so you are now holding a chunk of cash. It may take a few days to 'settle'. There will be 2 fees unless you have got any trading credits by the time you act.

- In regular investing functionality set up your £100 monthly investment into your new choice. It will prompt you to set up the matching DD. Also add the initial extra amount to sweep up the big chunk of cash you got from selling in step 2.

I can't try this for you without messing up my own setup but I am sure there is an option for an additional amount in the first regular investment.

ill have a look in a bit about setting up the regular investing, and whether that then lets me buy a fund for nothing. if not ill wait a few weeks. and i think ill take tor suggestion on board about just the one fund and go for the one recommended on monevator, the HSBC FTSE all world index fund c (acc of course :-) )

thanks for your continued help, much appreciated.

EDIT: now set up the DD for £100pm into the HSBC fund. gone to stick my 135k into it afterwards and still says no trading credits.

ive looked back at my secure messages, which states.....

"The distinction between the free trade each month and the free regular investing service might seem a bit confusing at first glance, so let me explain further. Under the Pension Builder Plan, while you do not automatically receive a free trading credit each month for ad-hoc trades, our free regular investing service allows you to make monthly investments into your chosen fund without incurring a trading fee. This means that if you set up a Direct Debit to invest a fixed amount into the fund each month, these transactions would not incur the usual trading costs."

so reading between the lines, those regular investments wouldnt incur a fee, but my initial 135k might? unless i wait a month. is this right?

thanks0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards