We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The New Top Easy Access Savings Discussion Area

Comments

-

I've recently made £1 in&out transaction in order to prevent it being closed. The account was dormant for few years now, but this is the only one I have left with AR so better to keep my foot in in case they offer something good again.pecunianonolet said:1 -

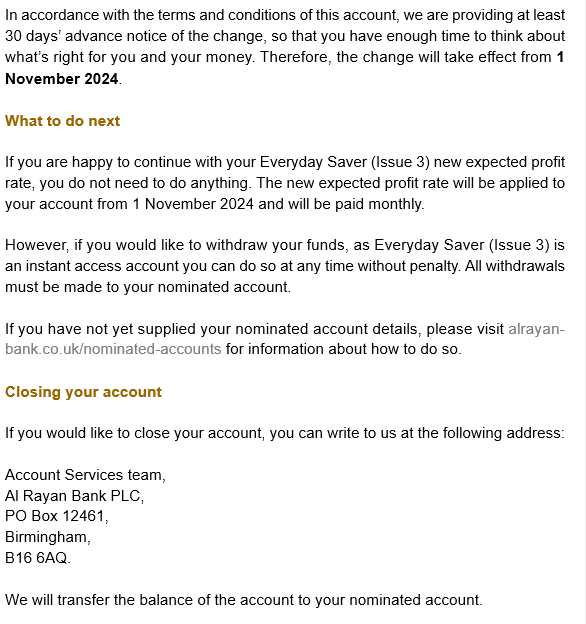

Reductions keep coming.

Kroo.

On 26 November 2024 the tracker interest margin will change from 0.9% to 1.1%. This means the interest rate we pay on the current account tracker will decrease by 0.2% AER. You’re currently earning 4.10% AER / 4.02% Gross (variable). If the Bank of England base rate stays the same as it is today, the new rate would be 3.90% AER from 26 November 2024 onwards.2 -

allegro120 said:

I've recently made £1 in&out transaction in order to prevent it being closed. The account was dormant for few years now, but this is the only one I have left with AR so better to keep my foot in in case they offer something good again.pecunianonolet said:Yes, i have this account at zero balance for ages. Received a letter recently saying account will be closed on 18 Nov.At the bottom of the letter it states ' If you wish to keep the account you will need to fund it to the min deposit required prior to the closure date'I'm not sure what the min deposit is, £5k comes to mind but maybe not correct.I just deposited £1 and left it there to see what happens.If you received the same letter, not sure if a £1 in and out will save it.1 -

It is indeed......https://www.alrayanbank.co.uk/savings/everyday-saver-issue-3Aidanmc said:allegro120 said:

I've recently made £1 in&out transaction in order to prevent it being closed. The account was dormant for few years now, but this is the only one I have left with AR so better to keep my foot in in case they offer something good again.pecunianonolet said:Yes, i have this account at zero balance for ages. Received a letter recently saying account will be closed on 18 Nov.At the bottom of the letter it states ' If you wish to keep the account you will need to fund it to the min deposit required prior to the closure date'I'm not sure what the min deposit is, £5k comes to mind but maybe not correct.I just deposited £1 and left it there to see what happens.If you received the same letter, not sure if a £1 in and out will save it.2 -

Yes, it was the same letter and I wasn't sure what the "minimum required" is. £5k indeed was the initial minimum deposit but it wasn't clear if this sum also applies for keeping the account opened. I've had similar letters from various banks, normally you just have to make a transaction to keep the account alive and £1 in'n'out was always sufficient. So I went with the assumption that it will work for AR too. I could be wrong.Aidanmc said:allegro120 said:

I've recently made £1 in&out transaction in order to prevent it being closed. The account was dormant for few years now, but this is the only one I have left with AR so better to keep my foot in in case they offer something good again.pecunianonolet said:Yes, i have this account at zero balance for ages. Received a letter recently saying account will be closed on 18 Nov.At the bottom of the letter it states ' If you wish to keep the account you will need to fund it to the min deposit required prior to the closure date'I'm not sure what the min deposit is, £5k comes to mind but maybe not correct.I just deposited £1 and left it there to see what happens.If you received the same letter, not sure if a £1 in and out will save it.

2 -

According to Moneyfacts, Coventry Building Society are launching a new Triple Access Saver Online (issue 5) account, paying 4.83%.

I logged onto Coventry online banking and the account already appears as available to open.

The account permits up to 3 penalty-free withdrawals per account year. The minimum opening amount is £1.

There are some other limited withdrawal accounts currently paying higher rates (Chip etc).

Please call me 'Kazza'.11 -

I can't see it - although it won't let me log in online either.Kazza242 said:According to Moneyfacts, Coventry Building Society are launching a new Triple Access Saver Online (issue 5) account, paying 4.83%.

I logged onto Coventry online banking and the account already appears as available to open.

The account permits up to 3 penalty-free withdrawals per account year. The minimum opening amount is £1.

There are some other limited withdrawal accounts currently paying higher rates (Chip etc).

I've currently got issue 2 but if I can get to see this it interests me.0 -

At the time of writing this, you have to login to Coventry BS online banking first (though the account should appear on the savings page of the main website hopefully, later today).[Deleted User] said:

I can't see it - although it won't let me log in online either.Kazza242 said:According to Moneyfacts, Coventry Building Society are launching a new Triple Access Saver Online (issue 5) account, paying 4.83%.

I logged onto Coventry online banking and the account already appears as available to open.

The account permits up to 3 penalty-free withdrawals per account year. The minimum opening amount is £1.

There are some other limited withdrawal accounts currently paying higher rates (Chip etc).

I've currently got issue 2 but if I can get to see this it interests me.

When I login to Coventry online banking there is a link to the right hand side of the page: 'Savings check out our range of available savings accounts'. When I click on this and then 'Our other products', I can then see the new account listed including the 'Apply Now' option.Please call me 'Kazza'.1 -

I see Triple Access Saver (online)(5) 4.83% AER available via the app.Kazza242 said:

At the time of writing this, you have to login to Coventry BS online banking first (though the account should appear on the savings page of the main website hopefully, later today).[Deleted User] said:

I can't see it - although it won't let me log in online either.Kazza242 said:According to Moneyfacts, Coventry Building Society are launching a new Triple Access Saver Online (issue 5) account, paying 4.83%.

I logged onto Coventry online banking and the account already appears as available to open.

The account permits up to 3 penalty-free withdrawals per account year. The minimum opening amount is £1.

There are some other limited withdrawal accounts currently paying higher rates (Chip etc).

I've currently got issue 2 but if I can get to see this it interests me.

When I login to Coventry online banking there is a link to the right hand side of the page: 'Savings check out our range of available savings accounts'. When I click on this and then 'Our other products', I can then see the new account listed including the 'Apply Now' option.

Also via website https://www.coventrybuildingsociety.co.uk/member/product/savings/limited_access/triple-access-saver-online-5.html3 -

I've had £5 in my AR bank. Not had any letters 😁1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards