We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The New Top Easy Access Savings Discussion Area

Comments

-

That's unfortunate for your friend, but is it accurate to use their experience to generically state that most UK providers shun US citizens? It's not reflective of account T&Cs, application processes or the experiences of the numerous US citizens I know resident in the UK.friolento said:

I am saying this because a friend of mine, US citizen but UK resident since 1988 is unable to open any savings account in the UK. It is not for want of trying.AmityNeon said:friolento said:Most UK providers shun American citizens due to their obligations and resulting costs under FATCA.

You could try one of international banks located in the Isle of Man or the Channel Islands. Skipton International might be an option.

Why do you think this? Do you believe US citizens resident in the UK cannot apply for an account with Skipton Building Society? Skipton's standard online application interface has provisions in place for those with foreign tax obligations, including a question specific to US citizens; applications are allowed to proceed as long as Tax Identification Numbers are provided.

Your tax details

Please confirm your tax and citizenship details below. Under legislation relating to tax reporting, we may need to report your account and interest details to HMRC for onward tax reporting.

It's sometimes necessary to do this if you're a citizen of the United States and/or tax resident outside the UK, depending on the countries in which you are tax resident.

- Are you tax resident only in the UK? Yes / NO

- Are you a citizen only of the UK? Yes / NO

- Are you a citizen of the USA? YES / No

Please select the country or countries in which you are a tax resident and add your tax identification number (TIN) for each. The TIN identifies you with the tax authority in each country.

If you do not have your TIN, call us on 0345 702 5026 to progress.

Many UK banks and building societies have no problems accepting US citizens, just like Skipton BS.

0 -

AmityNeon said:

That's unfortunate for your friend, but is it accurate to use their experience to generically state that most UK providers shun US citizens? It's not reflective of account T&Cs, application processes or the experiences of the numerous US citizens I know resident in the UK.friolento said:

I am saying this because a friend of mine, US citizen but UK resident since 1988 is unable to open any savings account in the UK. It is not for want of trying.AmityNeon said:friolento said:Most UK providers shun American citizens due to their obligations and resulting costs under FATCA.

You could try one of international banks located in the Isle of Man or the Channel Islands. Skipton International might be an option.

Why do you think this? Do you believe US citizens resident in the UK cannot apply for an account with Skipton Building Society? Skipton's standard online application interface has provisions in place for those with foreign tax obligations, including a question specific to US citizens; applications are allowed to proceed as long as Tax Identification Numbers are provided.

Your tax details

Please confirm your tax and citizenship details below. Under legislation relating to tax reporting, we may need to report your account and interest details to HMRC for onward tax reporting.

It's sometimes necessary to do this if you're a citizen of the United States and/or tax resident outside the UK, depending on the countries in which you are tax resident.

- Are you tax resident only in the UK? Yes / NO

- Are you a citizen only of the UK? Yes / NO

- Are you a citizen of the USA? YES / No

Please select the country or countries in which you are a tax resident and add your tax identification number (TIN) for each. The TIN identifies you with the tax authority in each country.

If you do not have your TIN, call us on 0345 702 5026 to progress.

Many UK banks and building societies have no problems accepting US citizens, just like Skipton BS.

I think so. The person in question used to be one of the FT's key correspondents and knows their way round both, savings and investments.Admittedly, we have not talked money for the last year or so.

0 -

friolento said:AmityNeon said:

That's unfortunate for your friend, but is it accurate to use their experience to generically state that most UK providers shun US citizens? It's not reflective of account T&Cs, application processes or the experiences of the numerous US citizens I know resident in the UK.friolento said:

I am saying this because a friend of mine, US citizen but UK resident since 1988 is unable to open any savings account in the UK. It is not for want of trying.AmityNeon said:friolento said:Most UK providers shun American citizens due to their obligations and resulting costs under FATCA.

You could try one of international banks located in the Isle of Man or the Channel Islands. Skipton International might be an option.

Why do you think this? Do you believe US citizens resident in the UK cannot apply for an account with Skipton Building Society? Skipton's standard online application interface has provisions in place for those with foreign tax obligations, including a question specific to US citizens; applications are allowed to proceed as long as Tax Identification Numbers are provided.

Your tax details

Please confirm your tax and citizenship details below. Under legislation relating to tax reporting, we may need to report your account and interest details to HMRC for onward tax reporting.

It's sometimes necessary to do this if you're a citizen of the United States and/or tax resident outside the UK, depending on the countries in which you are tax resident.

- Are you tax resident only in the UK? Yes / NO

- Are you a citizen only of the UK? Yes / NO

- Are you a citizen of the USA? YES / No

Please select the country or countries in which you are a tax resident and add your tax identification number (TIN) for each. The TIN identifies you with the tax authority in each country.

If you do not have your TIN, call us on 0345 702 5026 to progress.

Many UK banks and building societies have no problems accepting US citizens, just like Skipton BS.

I think so. The person in question used to be one of the FT's key correspondents and knows their way round both, savings and investments.Admittedly, we have not talked money for the last year or so.

How does that explain plenty of other US citizens having UK savings accounts, applied for and accepted within published T&Cs? Is there more to this that should be made known to US expats seeking advice, based on your friend's apparent privileged insight and experience that somehow supersedes official practice?

0 -

Meanwhile, back in "The New Top Easy Access Savings Discussion Area"....

15 -

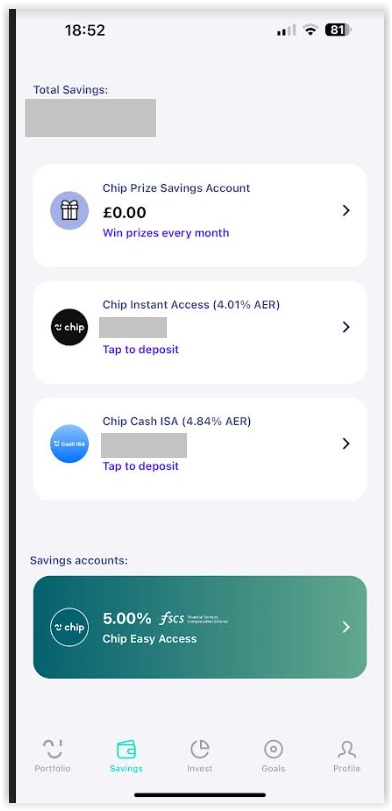

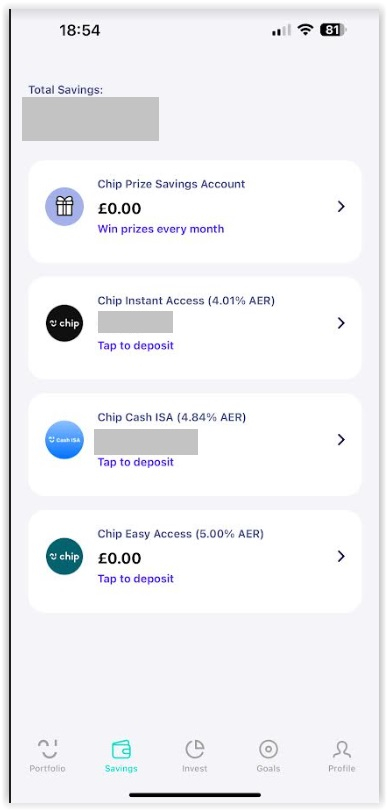

Just because other money providers do it does not make it alright. It “feels” (not is) very wrong when Chip offer a rate and advertise we should change from the Instant Access to Easy Access and get 4.84%. Then less than a fortnight later change it to 5.00% but not offer it to the early adopters which Chip wanted….. Now rub it in and not allow you to close the account and reopen at 5.00% just adds to a negative feeling towards Chip.Bridlington1 said:slinger2 said:

Your right in that in many ways it not unlike the "issue" system that many providers use, offering different rates to new customers. Where Chip have stepped it up a level is by making it impossible for customers with an old "issue" to get the new one even if they're happy to close the old one. Your only option is to take your money elsewhere.Bridlington1 said:

And I've nothing against insurance companies offering better deals to new customers than existing customers either. Those who are proactive and are prepared to shop around for the best deals are rewarded by not having to pay as much as those who are can't be bothered to look for better deals elsewhere.slinger2 said:

Yes. It's like the long-standing principle of insurance companies (and many others) of offering sweeteners to new customers while screwing existing clients. All perfectly legal I assume.Bridlington1 said:

Personally I've no issues with Chip restricting the eligibility of the account if they wish.MichaelAP said:

Chip need to change this to allow those who took up the offer earlier in Sep. By isolating their early opening customers and not giving them the same 5.00% access is downright wrong.slinger2 said:

I seem to remember that you can't close individual savings accounts with them. You can empty them but then you can't open a new one.10_66 said:

Though I've messaged them I've not received a reply, do you know if I need to close the 4.84% in order to have the 5% one become available?Bridlington1 said:

I've managed to open it on my android 9 phone without any issues and my phone was rather cheap to start with and isn't compatible with a few of the other banking apps.10_66 said:

Is this available in the app now as I can't see it, please. I had difficulty with the 4.84% issue, it wasn't available on the app on my old iPad, but was on my iPhone 13. I'm wondering if the 5% isn't available on this one now.Bridlington1 said:@soulsaver

Chip Easy Access Saver `Tri' 5% (up from 4.84%) (4.07% BOE BRT plus 0.93% 12 mth boost (up from 0.77%))

It's no more wrong than when, say, HSBC decided to bring out the 7% version of their regular saver and not allow those who have their 5% version to open it unless they close the 5% version first (which would make them incur a large interest hit) or wait for it to mature.

Moreover some banks often restrict accounts to people who live in certain postcodes, is that also to be considered ``downright wrong"?

They can and should be able to restrict eligibility if they wish. Quite often by doing so it allows them to offer higher rates to those customers they wish to gain or keep hold of which I would consider to be fair enough.

It reminds me of when the BOE base rate was rising and loads of people were wanting banks to be forced to pass on interest rate rises to all savers (I note the same people aren't calling for the banks to be forced to pass on the recent cut to the base rate onto savers though). Again the current system rewards those who are proactive at the expense of those who can't be bothered to look elsewhere for a better rate of interest.

All seems perfectly fair to me.But then what Chip's doing isn't all that different to what other banks/building societies have been doing for years.

Nationwide for example has offered a boosted rate on their FlexDirect account for those who have never had a FlexDirect account before. I remember benefitting from this offer when it was 2%. It was later boosted to 5% and there was no way for me to switch from getting 2% to getting 5%, even though I would've been happy to open a new FlexDirect account and close the old one.

There's nothing wrong with it, it's just a way to encourage new customers to move to them, akin to switching offers in that respect.

I personally have left a comment with Chip and have to wait until tomorrow for a ‘human’ to reply but I know the answer and it will only make me move my entire monies with Chip elsewhere.2 -

This is how markets work. If some people are happy to enter into an agreement under one set of terms and later on the vendor has to offer a better deal to entice more business, then those whose agreement was less generous don't have a reasonable expectation to get the better terms.The good thing is that both you and Chip each have the freedom to end the agreement at any time without penalty and neither party can be forced into an agreement they aren't happy with at the time.6

-

MichaelAP said:

Just because other money providers do it does not make it alright. It “feels” (not is) very wrong when Chip offer a rate and advertise we should change from the Instant Access to Easy Access and get 4.84%. Then less than a fortnight later change it to 5.00% but not offer it to the early adopters which Chip wanted….. Now rub it in and not allow you to close the account and reopen at 5.00% just adds to a negative feeling towards Chip.Bridlington1 said:slinger2 said:

Your right in that in many ways it not unlike the "issue" system that many providers use, offering different rates to new customers. Where Chip have stepped it up a level is by making it impossible for customers with an old "issue" to get the new one even if they're happy to close the old one. Your only option is to take your money elsewhere.Bridlington1 said:

And I've nothing against insurance companies offering better deals to new customers than existing customers either. Those who are proactive and are prepared to shop around for the best deals are rewarded by not having to pay as much as those who are can't be bothered to look for better deals elsewhere.slinger2 said:

Yes. It's like the long-standing principle of insurance companies (and many others) of offering sweeteners to new customers while screwing existing clients. All perfectly legal I assume.Bridlington1 said:

Personally I've no issues with Chip restricting the eligibility of the account if they wish.MichaelAP said:

Chip need to change this to allow those who took up the offer earlier in Sep. By isolating their early opening customers and not giving them the same 5.00% access is downright wrong.slinger2 said:

I seem to remember that you can't close individual savings accounts with them. You can empty them but then you can't open a new one.10_66 said:

Though I've messaged them I've not received a reply, do you know if I need to close the 4.84% in order to have the 5% one become available?Bridlington1 said:

I've managed to open it on my android 9 phone without any issues and my phone was rather cheap to start with and isn't compatible with a few of the other banking apps.10_66 said:

Is this available in the app now as I can't see it, please. I had difficulty with the 4.84% issue, it wasn't available on the app on my old iPad, but was on my iPhone 13. I'm wondering if the 5% isn't available on this one now.Bridlington1 said:@soulsaver

Chip Easy Access Saver `Tri' 5% (up from 4.84%) (4.07% BOE BRT plus 0.93% 12 mth boost (up from 0.77%))

It's no more wrong than when, say, HSBC decided to bring out the 7% version of their regular saver and not allow those who have their 5% version to open it unless they close the 5% version first (which would make them incur a large interest hit) or wait for it to mature.

Moreover some banks often restrict accounts to people who live in certain postcodes, is that also to be considered ``downright wrong"?

They can and should be able to restrict eligibility if they wish. Quite often by doing so it allows them to offer higher rates to those customers they wish to gain or keep hold of which I would consider to be fair enough.

It reminds me of when the BOE base rate was rising and loads of people were wanting banks to be forced to pass on interest rate rises to all savers (I note the same people aren't calling for the banks to be forced to pass on the recent cut to the base rate onto savers though). Again the current system rewards those who are proactive at the expense of those who can't be bothered to look elsewhere for a better rate of interest.

All seems perfectly fair to me.But then what Chip's doing isn't all that different to what other banks/building societies have been doing for years.

Nationwide for example has offered a boosted rate on their FlexDirect account for those who have never had a FlexDirect account before. I remember benefitting from this offer when it was 2%. It was later boosted to 5% and there was no way for me to switch from getting 2% to getting 5%, even though I would've been happy to open a new FlexDirect account and close the old one.

There's nothing wrong with it, it's just a way to encourage new customers to move to them, akin to switching offers in that respect.

I personally have left a comment with Chip and have to wait until tomorrow for a ‘human’ to reply but I know the answer and it will only make me move my entire monies with Chip elsewhere.Are you sure you can't open the 5% account? It took me 3 seconds. I am not planning to use it as I don't like the extreme penalty that comes with mutliple withdrawals.

0

0 -

Anyone know if the FA Bonus Saver is still available to new applicants please? Seems Skipton have an outage just now. TOTP thread says 'NLA?' so seems not 100% guaranteed NLA.

Skipton FA Bonus saver 4.95 NLA? 6 months from opening, early adopters end mid Nov.

If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.0 -

ForumUser7 said:Anyone know if the FA Bonus Saver is still available to new applicants please? Seems Skipton have an outage just now. TOTP thread says 'NLA?' so seems not 100% guaranteed NLA.

The account is no longer available.

The FA Bonus Saver appears on Skipton's list of closed issues at https://www.skipton.co.uk/savings/~/media/skipton-co-uk/pdf/savings/closed-accounts-rates3 -

My post now updated to show NLA. As I have the account I couldn't easily check whether it was NLA for sure. But now we know, thanks @gt94sss2gt94sss2 said:ForumUser7 said:Anyone know if the FA Bonus Saver is still available to new applicants please? Seems Skipton have an outage just now. TOTP thread says 'NLA?' so seems not 100% guaranteed NLA.

The account is no longer available.

The FA Bonus Saver appears on Skipton's list of closed issues at https://www.skipton.co.uk/savings/~/media/skipton-co-uk/pdf/savings/closed-accounts-rates1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards