We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The New Top Easy Access Savings Discussion Area

Comments

-

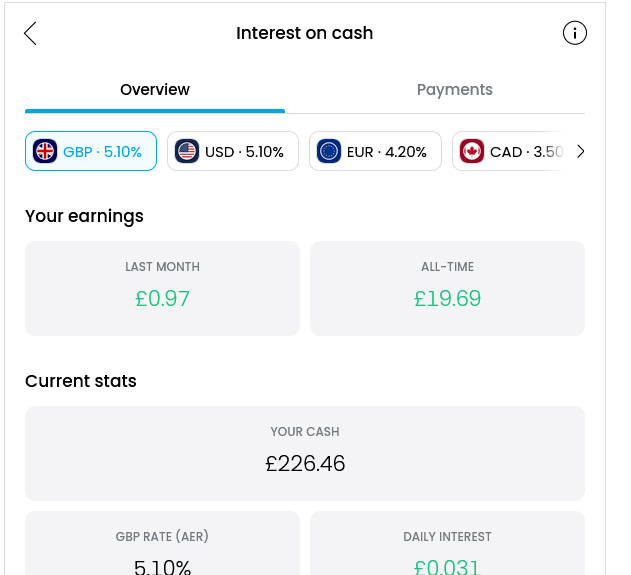

What are those interest rates for different currencies in @pecunianonolet screenshot above on Trading 212?Thousands of candles can be lit from a single candle, and the life of the candle will not be shortened. Happiness never decreases by being shared - Buddha0

-

That's if you hold cash in other currencies.n15h said:What are those interest rates for different currencies in @pecunianonolet screenshot above on Trading 212?1 -

That is correct. They increased it to 5.1% with effect from 16/09/2024.Aidanmc said: Still showing 5.1%0

Still showing 5.1%0 -

Re: Cahoot's Sunny Day Saver rate decrease, I too had the document in my online banking in early September. I finally had the email notification about it now, 12 days later! 🙄🙃wiseonesomeofthetime said:

I received no email or notification to inform me that these documents existed, so how they expect customers to read them, I don't know.janusdesign said:t1redmonkey said:

Pleasantly surprised that they chose to not reduce the existing issue and that it's still at 5.2%.Bridlington1 said:apologies if previously mentioned (searched but couldn't find anything), but I just noticed a document in my Cahoot account announcing that the Sunny Day Saver (Issue 1) currently paying 5.20% will reduce to 5% on 18th November 2024 (so matching the Issue 2).2 -

@simonsmithsays posted the following link in the ToTP thread:

Tipton Loyalty Double Access Saver 5.0%

I've added:

Branch/Postal.

Loyalty Eligibility: Must hold an account that was opened on or before 30th June 2024

£1k min operating balance, £20k max.

1 -

I too received the document a couple of weeks ago online and also received an eMail today telling me about it. Bizzarely, the eMail arrived just after my Postperson put a letter through the door from Cahoot which also told me about the rate reduction. Does seem rather over the top for a £3K balance!moi said:Re: Cahoot's Sunny Day Saver rate decrease, I too had the document in my online banking in early September. I finally had the email notification about it now, 12 days later! 🙄🙃

1 -

Trading 212 Cash ISA

When Trading 212 first announced the reduction of their interest rate to 5.0%, I decided to request a transfer of my trivial holding to Virgin Money's 5.05% fixed rate Cash ISA product, which I did electronically through my Virgin account. On 04/09/2024 I was asked by Trading 212 to confirm the request and provide them with an electronic signature.

The transfer was supposed to happen within 14 days, so I was surprised, and not best pleased, to be advised today that the transfer had been cancelled because of an internal error, and that I needed to provide an electronic signature again. I had already sent a message querying the delay before seeing their emails and messages regarding the issue.

To be fair, after I provided the signature again, they did complete their side of the transfer immediately, and the money is now on its way to Virgin. I then transferred the £1 languishing in my Trading 212 'Invest' pot to their Cash ISA, where it is indeed earning 5.1%, just in case I may want to top it up again.

0 -

Maybe but the way I look at it is they're being very open about the interest rate reduction reminding us,CuparLad said:

I too received the document a couple of weeks ago online and also received an eMail today telling me about it. Bizzarely, the eMail arrived just after my Postperson put a letter through the door from Cahoot which also told me about the rate reduction. Does seem rather over the top for a £3K balance!moi said:Re: Cahoot's Sunny Day Saver rate decrease, I too had the document in my online banking in early September. I finally had the email notification about it now, 12 days later! 🙄🙃0 -

Though it was already mentioned in the ToTP thread last month. First mentioned in this thread on 7/8/24. Admittedly it was a short while back though.soulsaver said:@simonsmithsays posted the following link in the ToTP thread:

Tipton Loyalty Double Access Saver 5.0%

I've added:

Branch/Postal.

Loyalty Eligibility: Must hold an account that was opened on or before 30th June 2024

£1k min operating balance, £20k max.

1 -

Yep, thanks - was linking it back to here to avoid 'chat' in the no chat thread. I could have linked it back to your original post with a bit more time and effort.Bridlington1 said:

Though it was already mentioned in the ToTP thread last month. First mentioned in this thread on 7/8/24. Admittedly it was a short while back though.soulsaver said:@simonsmithsays posted the following link in the ToTP thread:

Tipton Loyalty Double Access Saver 5.0%

I've added:

Branch/Postal.

Loyalty Eligibility: Must hold an account that was opened on or before 30th June 2024

£1k min operating balance, £20k max.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards