We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Car insurance premiums going through the roof - why?

What_time_is_it

Posts: 899 Forumite

I've heard people saying that the main reason is because of the increased cost of replacing car parts. But is that really the full story? Seems to me that car insurance is increasing at such a rate as to make it unaffordable to many. Does the whole industry need a rethink? Could the state offer a very basic third party cover?

To be honest, I don't really understand the car insurance market at all any more.

To be honest, I don't really understand the car insurance market at all any more.

0

Comments

-

I would say that the main reason is the cost of replacing / repairing electric vehicles which cost a lot more to purchase than a petrol or diesel car and may have to be written off completely for damage that impacts the battery cell structure.

I have also noticed that the acceleration of many "ordinary" EV's can be quite astounding. A newly introduced small Volvo can reach 60 mph in around 4 seconds which used to be supercar territory. Put that in the hands of your typical driver and that's an accident waiting to happen.

I've just received my renewal notice and mine has gone up from around £280 to £380. I've checked prices on various comparison sites and the lowest I get on those is £420.2 -

I agree with the first point, but I'm not sure that we are seeing more RTCs than in the past.

Perhaps people with points should pay (even) more for their insurance? Or shift the balance more in favour of people with a full no-claims history?

It does seem unsustainable in prices continue to increase at this rate.0 -

There are dozens of threads on the same. Look at those for the more complete reasons as to why. Parts have gone up, staffing costs have gone up, parts remain in short supply and so hire car charges have gone up. Motor insurers have made underwriting losses for a few of years in a row now and costs continue to increase so its trying to rebalance prior losses and avoid future ones.

The state certainly could offer the third party element of the insurance but there is then the question of how this is paid for? Cant remember which country it is but one country does this via an additional tax on fuel but then that means someone with a good history but a fuel inefficient car pays more for their insurance than someone who has had 8 accidents in the last 5 years and is only 22 years old but runs a highly efficient car. Also these days it raises a question of how this works for electric vehicles.

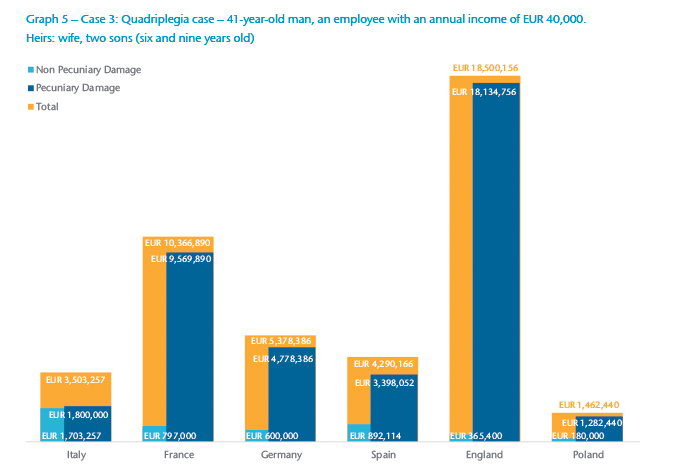

There are other options though. In New Zealand, and other countries, what you can claim is significantly limited and paid out by the government for injuries. Off work for 5 days because of the accident? Bad luck, you dont get paid anything for less than 7 days. Pain? Suffering? Loss of amenities? Dont get a penny. Likewise in a fair amount of Europe takes a very different approach to care for example, in the UK if you will need 24/7 care for life due to an accident the insurer will have to pay out for nurses/carers for life whereas in much of Europe it doesn't fall to the insurer. The below is the theoretical same major injury to a person and how much the insurer would have to pay by country. The person had the same salary so no consideration of lower cost of living in Poland than England.

Government has already capped whiplash injuries, they could change all injuries to a tariff and remove heads of claim.2 -

@DullGreyGuy That is super interesting. Thanks.

In the above example, is that amount paid out regardless of fault? €18m seems like a massive pay out for someone who causes an accident.0 -

slightly changing the thread. I have been a medical courier delivering medical items to people at home. Usually replacement items which are urgent. I have driven over a million miles with no points, no fault accidents and no medical history to affect my driving. I have just been refused further "hire and reward " courier related insurance because of my age (78) . I have SDP and can drive any distance without restrictions. Every day when I worked I witnessed acts of dangerous driving , not just careless but DANGEROUS. Unfortunately this is one of the reasons why your premiums go up .The idiots on our roads, which include those who are uninsured, disqualified , have false driving licences or none of which there are many. What about those e scooters motor bikes etc. who continually cut you up etc .0

-

That is what would be paid out if the person injured was not at fault and had no contributory negligence (eg wasn't wearing a seatbelt) in the countries mentioned.What_time_is_it said:@DullGreyGuy That is super interesting. Thanks.

In the above example, is that amount paid out regardless of fault? €18m seems like a massive pay out for someone who causes an accident.

For the NZ system what's claimable is irrespective of fault.1 -

Irrespective of fault seems like a crazy system to me. I can't stand reckless drivers. F**k 'em!0

-

That could almost be a direct quote from a typical Daily Mail click-bait article.Neil49 said:I would say that the main reason is the cost of replacing / repairing electric vehicles which cost a lot more to purchase than a petrol or diesel car and may have to be written off completely for damage that impacts the battery cell structure.

I have also noticed that the acceleration of many "ordinary" EV's can be quite astounding. A newly introduced small Volvo can reach 60 mph in around 4 seconds which used to be supercar territory. Put that in the hands of your typical driver and that's an accident waiting to happen.

I've just received my renewal notice and mine has gone up from around £280 to £380. I've checked prices on various comparison sites and the lowest I get on those is £420.

Any evidence that the cost of EV repairs is increasing the premiums for non-EVs? All car repair costs have increased significantly. And, the shortage of parts has meant cars sitting in the repair yard longer, meaning increased car-hire costs, which is passed onto policyholders.

The gap between the cost new of an EV and an equivalent ICE car is decreasing too.2 -

To counter this 'across' the board assumption, my insurance went down £4 this year. Not much but very pleasantly surprised after reading some increases on here1

-

The fund in NZ covers all accidents, RTAs, someone falling off a ladder, injury as a manhole cover was missing etc. There is a simplicity to the matter when you strip it back to covering actual losses rather than pain and remove the burden having having to prove liability etcWhat_time_is_it said:Irrespective of fault seems like a crazy system to me. I can't stand reckless drivers. F**k 'em!1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards