We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Potential threat to annual £20k ISA limit?

Comments

-

https://www.resolutionfoundation.org/comment/expand-the-help-to-save-scheme-to-help-the-poorest/Amoux said:I agree with the arguments but have less confidence that anything will be done about it. We've had successive governments wilfully and disproportionately prioritising the wealthy with generous tax breaks over low-to-middle income earners. Only 7% of people are taking advantage of the full ISA allowance because the vast majority of people do not have 20K to save a year. Abolishing the pension lifetime allowance might be a boon for some here, but it does nothing for low-to-middle income earners. The Lifetime ISA is also poorly targeted and is disproportionately held by individuals in the top income quintile. I think we have also been giving considerably generous tax relief for high-rate pension contributions. All of these things and more come at significant cost to the treasury, and it's becoming increasingly difficult to justify when it's the wealthiest pocketing the lion's share.

I would expand and improve on schemes that demonstrably could make a difference to ordinary peoples lives, like auto-enrolment or targeted schemes like Help to Save.

Naturally the Foundation also had thoughts on the Help to Save scheme as a targeted effort to help low earners, as indicated in the link.

However at only 350,000 accounts opened since 2018, take up rate is miserable ( government expected 10 times this number). On paper a 50% free bonus on what you save should have been highly appealing, but what you can contribute is capped at only £1200 over 4 years ( a miniscule £300 per year) with a bonus award of £600 at end of the term. Although, I would consider this a handsome reward for the discipline of saving £25 per month for 4 years, clearly the target audience are either unimpressed or unaware.

Contrast, the over generous ISA allowances, and one can see why the Foundation is less than impressed with the present Government's commitment to improve the fortunes of lower earners.

2 -

It would be politically very difficult to reduce ISA limits and any "think tank" that thinks that doing so would somehow benefit low and middle earners is, frankly, not thinking hard enough. History shows that when you "take away from the rich" they just find a new way to be "tax efficient". It rarely benefits anyone else.

If a (new) govt wants to increase their tax take on savings they are much more likely to target things like the starting rate for savings, which is not something most people know about, and also the personal savings allowance. A small change to the latter would bring in much more revenue than fiddling with ISAs.2 -

Tax breaks will always favour the wealthy by definition, they're the ones that pay the most tax.Amoux said:I agree with the arguments but have less confidence that anything will be done about it. We've had successive governments wilfully and disproportionately prioritising the wealthy with generous tax breaks over low-to-middle income earners.

Estimates are that 40-50% of the population pays no income tax whatsoever. You cannot give a tax break to somebody who doesn't pay any.

8 -

Do not forget generous tax treatment of DC pension pots on death, which will also disproportionately benefit wealthier people/families.Amoux said:I agree with the arguments but have less confidence that anything will be done about it. We've had successive governments wilfully and disproportionately prioritising the wealthy with generous tax breaks over low-to-middle income earners. Only 7% of people are taking advantage of the full ISA allowance because the vast majority of people do not have 20K to save a year. Abolishing the pension lifetime allowance might be a boon for some here, but it does nothing for low-to-middle income earners. The Lifetime ISA is also poorly targeted and is disproportionately held by individuals in the top income quintile. I think we have also been giving considerably generous tax relief for high-rate pension contributions. All of these things and more come at significant cost to the treasury, and it's becoming increasingly difficult to justify when it's the wealthiest pocketing the lion's share.

I would expand and improve on schemes that demonstrably could make a difference to ordinary peoples lives, like auto-enrolment or targeted schemes like Help to Save.

It is a fine balance as the Govt wants to encourage people to save and build up a pension pot, but as always better off people will tend to get more benefit from these types of measures.1 -

The Resolution Foundation is not suggesting that reducing the ISA limits will improve the savings rate of low and middle earnings. It's saying that the ISA system is poorly targeted, ineffective and disproportionately benefitting the wealthy. That comes at a significant cost to the treasury, money which could be used on better targeted economic policies that could improve overall savings rates.boingy said:It would be politically very difficult to reduce ISA limits and any "think tank" that thinks that doing so would somehow benefit low and middle earners is, frankly, not thinking hard enough. History shows that when you "take away from the rich" they just find a new way to be "tax efficient". It rarely benefits anyone else.

If a (new) govt wants to increase their tax take on savings they are much more likely to target things like the starting rate for savings, which is not something most people know about, and also the personal savings allowance. A small change to the latter would bring in much more revenue than fiddling with ISAs.

I don't think it's politically difficult to do. I think it's entirely the rational and moral thing to do.

As I mentioned, only a small proportion of the UK populace can take advantage of the 20K ISA limit which is going to potentially increase to 25K through the UK ISA. It's been a policy for the wealthy to build more wealth and I think the government's priorities should be elsewhere.hallmark said:Tax breaks will always favour the wealthy by definition, they're the ones that pay the most tax.

Estimates are that 40-50% of the population pays no income tax whatsoever. You cannot give a tax break to somebody who doesn't pay any.

I don't believe that just because the wealthy pay more tax that they should be overwhelming beneficiaries of the ISA and pension system. I am for instance completely in favour of scrapping the higher rate tax relief.3 -

I wish these think tanks would keep their thoughts to themselves.5

-

I am not sure that the wealthy would actually be saving into ISAs unless they are S&S ones, so perhaps they are the ones to stop & let those of us who has saved & in my case are still saving for long term. As I am over 75 a SIPP I believe would not be helpful & could not be left intact to my child.

0 -

I can't save 20,000 per year of new money to put into an ISA, but I still put in the maximum amount every year, mostly from expiring taxable fixed rate accounts, to put more funds out of the clutches of taxation.

Whereas I agree that most people are not in the position to do this, it doesn't necessarily mean that one earns a large amount every year if they can do this. I've had savings accounts since 1987, so have some histgorical savings.2 -

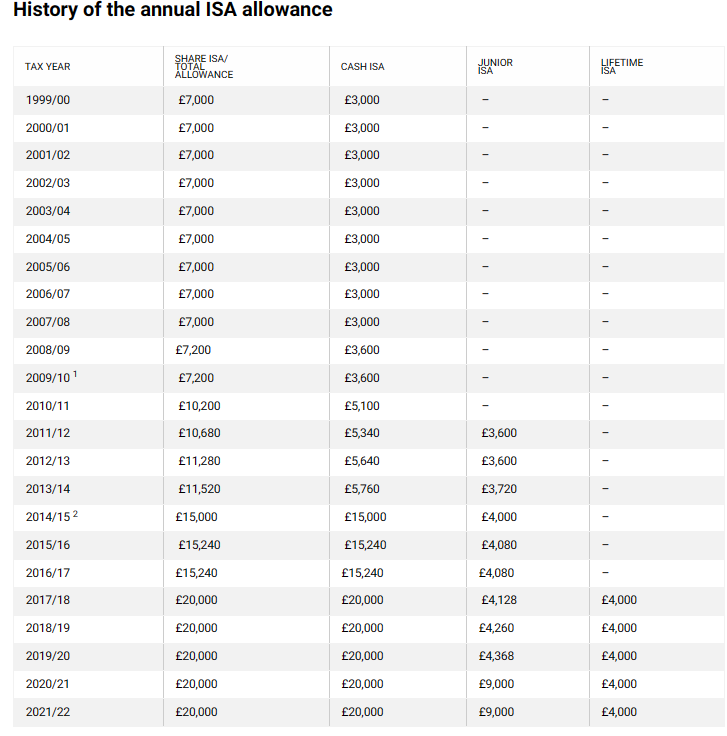

Under Labour the ISA allowance virtually stood still. It's nearly trebled since the Tories have been in power.3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards