We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Fixed 1yr ISAs where you can pay in throughout term

Comments

-

I don't know about the welcome letter - but I would rely on the terms I signed upto which doesn't say when the £3k has to be paid.drphila said:Malchester said:I have opened the Lloyds 2 year ISA as a Club Current Account customer to fund on Saturday with 1/2 next year's ISA allowance and add 2025/2026 allowance later. Putting other half of 2024/2025 allowance in an easy access account to leave room for manoeuvre later

Is there anywhere during the application process or in the welcome email that stipulates how long after opening that the initial £3k must be deposited?

Having said that - since my earlier post Shawbrook have launched a similar 2 year fixed ISA at 4.50% - (and a 3 year et 4.38%) also allows top ups and can be opened with just £1k - AFAICS they don't say by when but do start chasing you for the initial deposit in my experience.

IIRC they also they say they may* refuse transfers in after the first 30 days, but you can add new money throughout the term to the isa max. 2 Year Fixed Rate ISA | Two Year ISA | Shawbrook

*Their CS tell me they don't refuse... and I've done it with £20k last year... but their safety net is if you try to transfer in, say, £200k when rates have dropped to, say, 1.0% again they could refuse it.1 -

Supposedly 60 days.drphila said:Malchester said:I have opened the Lloyds 2 year ISA as a Club Current Account customer to fund on Saturday with 1/2 next year's ISA allowance and add 2025/2026 allowance later. Putting other half of 2024/2025 allowance in an easy access account to leave room for manoeuvre later

Is there anywhere during the application process or in the welcome email that stipulates how long after opening that the initial £3k must be deposited?1 -

I seem to be seeing different to you -soulsaver said:drphila said:Malchester said:I have opened the Lloyds 2 year ISA as a Club Current Account customer to fund on Saturday with 1/2 next year's ISA allowance and add 2025/2026 allowance later. Putting other half of 2024/2025 allowance in an easy access account to leave room for manoeuvre later

Is there anywhere during the application process or in the welcome email that stipulates how long after opening that the initial £3k must be deposited?

IIRC they also they say they may refuse transfers in after the first 30 days, . 2 Year Fixed Rate ISA | Two Year ISA | Shawbrook

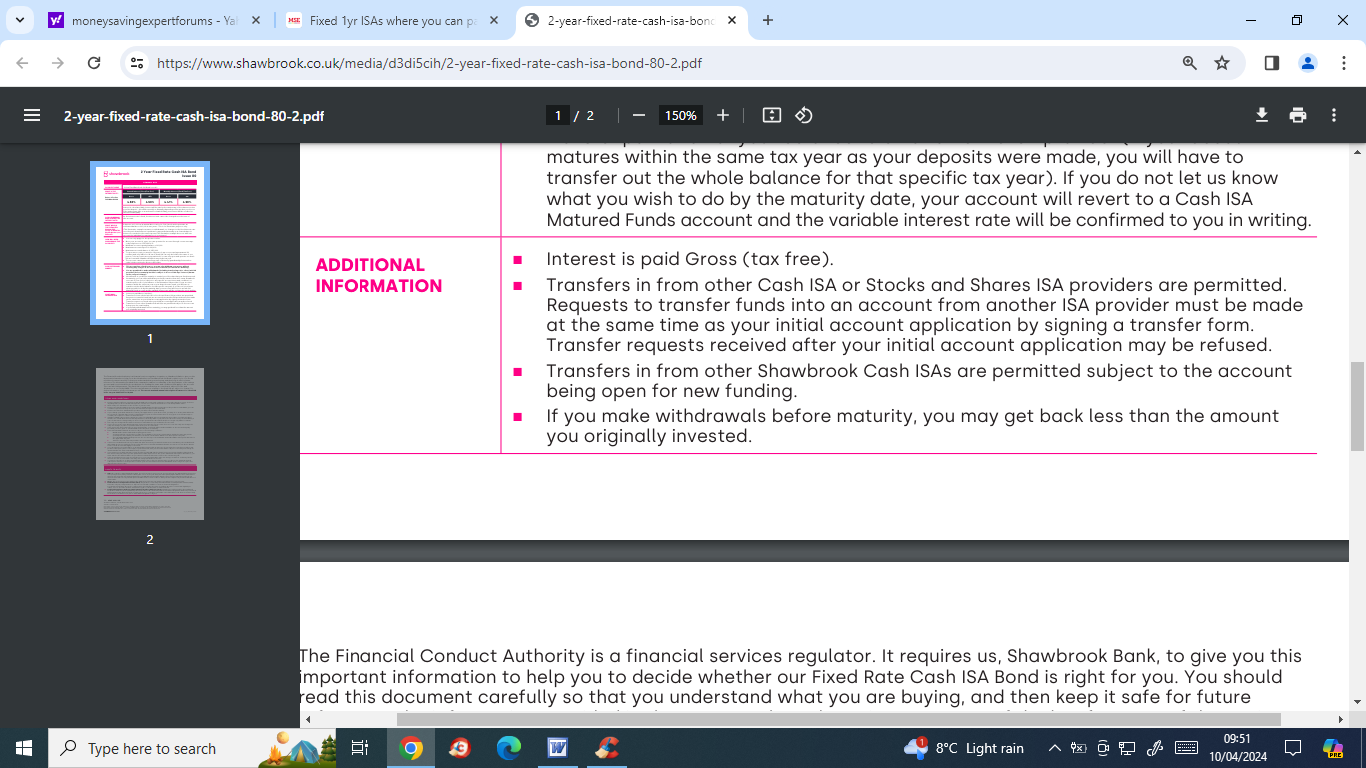

"Requests to transfer funds into an account from another ISA provider must be made at the same time as your initial account application by signing a transfer form. Transfer requests received after your initial account application may be refused"https://www.shawbrook.co.uk/media/d3di5cih/2-year-fixed-rate-cash-isa-bond-80-2.pdf

0 -

I've had a number of fixed rate cash ISAs with Shawbrook and have also experienced the slight mis-match of information between the account T&C's, welcome letter, email (etc) in relation to account funding and transfers. I've always presumed that the information on the official T&C's document will take precedence.

Other posters in this forum have stated that transfer-in requests made at a later stage during the fixed rates period have been successful, although I guess Shawbrook stating that later transfers 'may be refused' gives them the option to do so if (for example) a large transfer-in at a high rate would be detrimental to them.0 -

Why not put it all in easy access at 5% - bar the initial £3k - and then move it when instant access rates fall below 4.25%?Malchester said:I have opened the Lloyds 2 year ISA as a Club Current Account customer to fund on Saturday with 1/2 next year's ISA allowance and add 2025/2026 allowance later. Putting other half of 2024/2025 allowance in an easy access account to leave room for manoeuvre later

You can transfer in/pay into the Lloyds isa any time until April 2026. For every £10,000 invested - you lose £75 a year - if rates stay unchanged? Its up to you if that £75 is material - to avoid the bother.

Its a hedge in my view - not something to invest in now when instant access rates pay better?0 -

Rich2808 said:

Why not put it all in easy access at 5% - bar the initial £3k - and then move it when instant access rates fall below 4.25%?Malchester said:I have opened the Lloyds 2 year ISA as a Club Current Account customer to fund on Saturday with 1/2 next year's ISA allowance and add 2025/2026 allowance later. Putting other half of 2024/2025 allowance in an easy access account to leave room for manoeuvre later

You can transfer in/pay into the Lloyds isa any time until April 2026. For every £10,000 invested - you lose £75 a year - if rates stay unchanged? Its up to you if that £75 is material - to avoid the bother.

Its a hedge in my view - not something to invest in now when instant access rates pay better?

Same principle at Shawbrook.. but it's 4.5% for 2 year fix and only £1k to open..

0 -

You're seeing the same as me. But I asked what they'd consider 'initial' and IIRC they said up to 30 days... for the request. But in the application if you put 'Y' in the transfer in box it asks for the relinquishing ac details there and then.bristolleedsfan said:

I seem to be seeing different to you -soulsaver said:drphila said:Malchester said:I have opened the Lloyds 2 year ISA as a Club Current Account customer to fund on Saturday with 1/2 next year's ISA allowance and add 2025/2026 allowance later. Putting other half of 2024/2025 allowance in an easy access account to leave room for manoeuvre later

Is there anywhere during the application process or in the welcome email that stipulates how long after opening that the initial £3k must be deposited?

IIRC they also they say they may refuse transfers in after the first 30 days, . 2 Year Fixed Rate ISA | Two Year ISA | Shawbrook

"Requests to transfer funds into an account from another ISA provider must be made at the same time as your initial account application by signing a transfer form. Transfer requests received after your initial account application may be refused"https://www.shawbrook.co.uk/media/d3di5cih/2-year-fixed-rate-cash-isa-bond-80-2.pdf

0 -

Thanks to all the contributors on this thread because I didn't realise it was possible to secure a fixed rate ISA for contributions in 25/26 (and possibly beyond), and transfers during the term.

I was intending to max out my Virgin Money FRS11 this tax year. I may now set aside a portion to secure a fix with either Lloyds at 4.25% for 2 years (requiring £3k within 60 days), or risk Shawbrook (requires £1k within 30 days at 4.5% for 2 years, 4.38% for 3, 3.7% for 5, or 3.6% for 7) who appear to accept transfers in during the term although they are within their rights to refuse the transfer.

Perhaps it's worth opening Lloyds 2 year fix and the Shawbrook 3 year fix as a hedge. Fairly low cost in the scheme of things.

It doesn't appear there are any other options/providers allowing transfers in during the term with a 2+ year fix.

Thanks again0 -

For those who aren't aware, pay in times for the Lloyds 2yr cash isa is also being currently discussed on the main cash isas thread.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards