We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Inflation, Interest Rates, yield curves, instant vs fixed rate savings & gilts

Comments

-

Price is based on demand surely? Ie it's what the market thinks is an appropriate level for the current and predicted future interest rates. If you have a formula that can predict what markets think then amazing!gravel_2 said:Is there a simple way for maths dumb-dumbs to calculate rough estimate price for gilts in case of BOE rate changes? I've googled it and found formulae but means nothing to me.

0 -

I'm sure demand plays a part but I understood gilts to be a bit more algorithmic than that.0

-

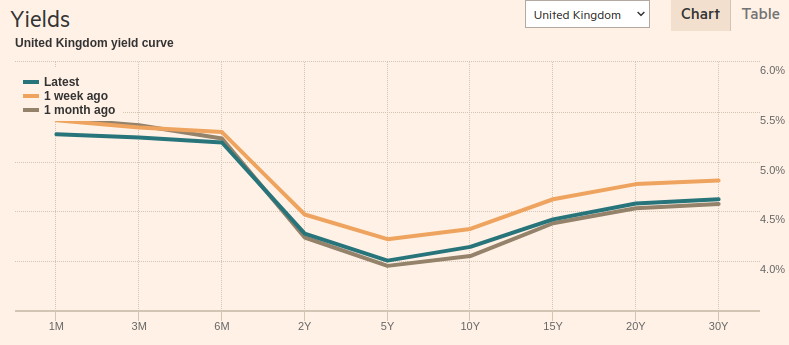

gravel_2 said:I'm sure demand plays a part but I understood gilts to be a bit more algorithmic than that.As a first approximation, the capital value would need to rise or fall enough such that the yield matched the new value in the yield curve. A change in interest rates in a month or two may have very little effect on the yield curve at the longer end, so don't expect a 10 year gilt to move much at the first 0.25% cut to base rate. It is already priced at base rate minus 1% when it is more commonly above base rate. There is already quite a dip priced in beyond 6 months. Normally you'd expect a shallow incline across the yield curve rather than the big inversion at the short end. Note the difference between now and last week to get an idea of normal volatility.

1

1 -

Very roughly, the modified duration gives a way of calculating thisgravel_2 said:Is there a simple way for maths dumb-dumbs to calculate rough estimate price for gilts in case of BOE rate changes? I've googled it and found formulae but means nothing to me.

(change in price in %) ~ -(change in yield in percentage points) * modified duration

Note the minus sign.

So for a bond with a modified duration of 10, an increase in yield of 1 percentage point would lead to a decrease in price of about 10% (i.e., if the price had been 80, it would now be 72). A decrease in yield would see an increase in price.

The formula works best for relatively small changes in yield (hence why it is approximate).

Of course, this doesn't answer the implied question about how much yields will change given a change in the base rate (while bonds of short maturities will have yields similar to the base rate, this is not true for ones with longer maturities).

0 -

To hold until I need the money to drip more into shares (or until maturity if not).gravel_2 said:

What's your strategy with them? Are you holding to maturity or intending to sell if the BOE rate drops and the price heads north?hallmark said:Yields fell shortly after this thread then rose fairly sharply and are currently falling back again. I pulled the trigger a couple weeks ago and locked in about 4.40%.

I still expect the BOE to cut far more than markets are predicting. I know some think the MPC will follow the Fed and won't cut until the Fed does. I think this is incorrect. The MPC waited until after the Fed moved to raise rates, because the MPC is doveish. That won't be true when it comes to reducing rates. I believe the MPC will reduce before the Fed does. We'll see.

I'm gradually moving from nearly all cash to far more in equities but happy to do that fairly slowly (unless there's a substantial crash in which case I'd pile in). I have some dry powder in gilts and some in MMFs in the meantime.0 -

It would! However Andrew Bailey has said and done things that were bad for the pound in the past. I'm not sure that'll stop him....Nebulous2 said:

That would be dangerous for the pound. The UK still hasn't regained the confidence of the markets following the Liz Truss setting ourselves alight episode.hallmark said:Yields fell shortly after this thread then rose fairly sharply and are currently falling back again. I pulled the trigger a couple weeks ago and locked in about 4.40%.

I still expect the BOE to cut far more than markets are predicting. I know some think the MPC will follow the Fed and won't cut until the Fed does. I think this is incorrect. The MPC waited until after the Fed moved to raise rates, because the MPC is doveish. That won't be true when it comes to reducing rates. I believe the MPC will reduce before the Fed does. We'll see.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards