We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Inflation, Interest Rates, yield curves, instant vs fixed rate savings & gilts

Comments

-

I dont think that in the immediae post war period inflation was seen as a particular problem. Recovery from the war was the main concern. Also had Keynsian monetary theory been accepted in the corridors of power? I think both these things changed in the 1970s (but I am neither an economist or a historian).coastline said:

Normally is the case that they follow the FED . It's a moving target as seen by the bond yield in the last year alone. UK10 year was 3.25% a year ago. Last September 4.75% . This year 3.50% and now 4% .hallmark said:

This is kind of what I'm getting at in a hamfisted way. At present you can still lock in decent yields on a 2-3 year horizon. I think that's because the markets are underestimating the Doveish nature of the MPC.Albermarle said:

The 'money men' seem not to agree with you . From BBC news.hallmark said:Thanks Linton. It's a good point re historical IRs and FWIW my guess is that moving forward a higher range than the post 2008 years is likely for both inflation and IRs. I'm mid-50s so what I'd class as normal IRs is much more like what we saw pre-2008.

Regarding the next year or two though, I just think it's incredibly unlikely that the MPC, who I believe are Doveish by nature, won't reduce IRs dramatically. The logic among economists seems to be that the MPC were too slow to raise therefore they'll be too slow to cut. My view is that they were too slow to raise, because they are doviesh, and that rather than be sluggish on cuts they'll be the opposite.

To put my predictions on the line, I reckon an IR cut by May is more likely than not and an IR cut by June almost 100% certain. Followed by several more. And that 0.5% cuts are very possible.

I also hope I'm wrong as I think inflation could easily reignite and should be treated with utmost caution.Currency traders are pricing in slightly higher cuts to UK interest rates this year after lower than expected inflation figures.

Money markets are betting there will be 0.7% of rate cuts this year, up from speculation on 0.67% of cuts

Central banks around the world tend to follow the lead of the Fed, which is widely expected to hold rates at 5.25% to 5.5%.

I'm probs going to move some funds from MMF into individual gilts as I think a risk-free 4%+ on that horizon isn't a bad proposition for a part of the portfolio.

UK 10 Year Gilt Bond Yield - Quote - Chart - Historical Data - News (tradingeconomics.com)

This can be seen in VGOV the UK gilt ETF. 1800 a year ago, 1575 and this year 1750 and 1700. Can it go to 1800 again ? Looks like it'll need a fair few rate cuts. What will it mean that's the question ? If base rate cuts are heading under 4% then maybe the economy isn't that healthy. ? We can only wait and see.

Vanguard UK Gilt UCITS ETF, UK:VGOV Advanced Chart - (LON) UK:VGOV, Vanguard UK Gilt UCITS ETF Stock Price - BigCharts.com (marketwatch.com)

[img]https://i.postimg.cc/vT9dZ73q/big.gif[/img]

Can they really control inflation or is it a bit of a myth. ? From 1945 to 1955 there were periods of high inflation yet UK rates were held low similar to the US . Inflation fell regardless . From 1960 to 1980 inflation gradually increased to double figures. Rates were also increased in an attempt to cap the move. Didn't work ?

Chart no 5 in the link.

Historical Interest Rates UK - Economics Help

inflation-interest-rates-1945-2011.png (944×650) (economicshelp.org1 -

hallmark said:This is why I think it's important we think about these things. If 100% of economists get it wrong the absolute worst we can do is "as badly as we would have if we followed the guidance of economists".

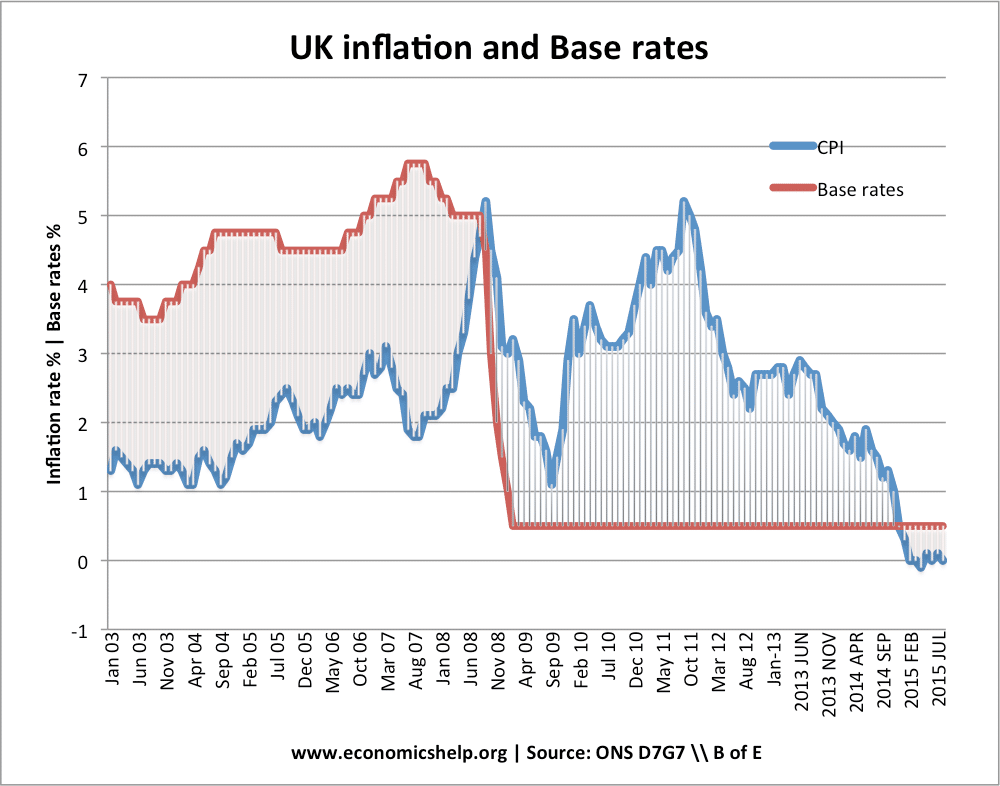

If we go back to 2017 Inflation was rising to 3%+ and the MPC deemed the most appropriate base rate to be 0.5%.

With inflation 3.4% and falling, why on earth would they deem the most appropriate rate to be ten times higher?It was generally considered a bad idea to keep the post-GFC emergency base rate in place for so long. Historically, one would expect the base rate to be above the inflation rate most of the time, and the period before the GFC in the chart below is more typical: Inflation has previously come in waves, and the danger of cutting too fast is that you fuel another more damaging wave as a result of the premature action. As it stands, interest rates are not unusually high. We will probably see one or two small cuts later this year and beyond that who knows.As for what to do, the best time to lock in a rate has passed, but the second best time is today. I wouldn't be locking in for long periods of time because the situation is volatile.4

Inflation has previously come in waves, and the danger of cutting too fast is that you fuel another more damaging wave as a result of the premature action. As it stands, interest rates are not unusually high. We will probably see one or two small cuts later this year and beyond that who knows.As for what to do, the best time to lock in a rate has passed, but the second best time is today. I wouldn't be locking in for long periods of time because the situation is volatile.4 -

The first paragraph is exactly what I think and what I'd like to see. I just don't trust the MPC to have the same view. Too many years of hearing them disregard inflation risk & focus on (IMO anyway) any excuse they can to keep rates low.masonic said:Inflation has previously come in waves, and the danger of cutting too fast is that you fuel another more damaging wave as a result of the premature action. As it stands, interest rates are not unusually high. We will probably see one or two small cuts later this year and beyond that who knows.As for what to do, the best time to lock in a rate has passed, but the second best time is today. I wouldn't be locking in for long periods of time because the situation is volatile.

Agree with the second paragraph too. I think anything over 4% on say a 3-year timeframe might look very good shortly.

Since starting this thread I see some economists are now predicting 1% inflation soon thanks to certain items dropping out of the index. Much as I personally would like it I just cannot see any possible world where inflation is 1% & the MPC keeps rates nearer 5%. Has there EVER been a time when savers could beat easily beat inflation by several percentage points with no risk (can't think of that offhand?) Surely the calls for large reductions in base rate would be deafening at that point.

1 -

The 70's saw the creation of fractional reserve banking. Banks were given the ability to print money and as a consequence leverage up their balance sheets. Hence why many Building Societies demutualised to become banks themselves and gain the freedom. We are know what happened subsequently.Linton said:

I dont think that in the immediae post war period inflation was seen as a particular problem. Recovery from the war was the main concern. Also had Keynsian monetary theory been accepted in the corridors of power? I think both these things changed in the 1970s (but I am neither an economist or a historian).coastline said:

Normally is the case that they follow the FED . It's a moving target as seen by the bond yield in the last year alone. UK10 year was 3.25% a year ago. Last September 4.75% . This year 3.50% and now 4% .hallmark said:

This is kind of what I'm getting at in a hamfisted way. At present you can still lock in decent yields on a 2-3 year horizon. I think that's because the markets are underestimating the Doveish nature of the MPC.Albermarle said:

The 'money men' seem not to agree with you . From BBC news.hallmark said:Thanks Linton. It's a good point re historical IRs and FWIW my guess is that moving forward a higher range than the post 2008 years is likely for both inflation and IRs. I'm mid-50s so what I'd class as normal IRs is much more like what we saw pre-2008.

Regarding the next year or two though, I just think it's incredibly unlikely that the MPC, who I believe are Doveish by nature, won't reduce IRs dramatically. The logic among economists seems to be that the MPC were too slow to raise therefore they'll be too slow to cut. My view is that they were too slow to raise, because they are doviesh, and that rather than be sluggish on cuts they'll be the opposite.

To put my predictions on the line, I reckon an IR cut by May is more likely than not and an IR cut by June almost 100% certain. Followed by several more. And that 0.5% cuts are very possible.

I also hope I'm wrong as I think inflation could easily reignite and should be treated with utmost caution.Currency traders are pricing in slightly higher cuts to UK interest rates this year after lower than expected inflation figures.

Money markets are betting there will be 0.7% of rate cuts this year, up from speculation on 0.67% of cuts

Central banks around the world tend to follow the lead of the Fed, which is widely expected to hold rates at 5.25% to 5.5%.

I'm probs going to move some funds from MMF into individual gilts as I think a risk-free 4%+ on that horizon isn't a bad proposition for a part of the portfolio.

UK 10 Year Gilt Bond Yield - Quote - Chart - Historical Data - News (tradingeconomics.com)

This can be seen in VGOV the UK gilt ETF. 1800 a year ago, 1575 and this year 1750 and 1700. Can it go to 1800 again ? Looks like it'll need a fair few rate cuts. What will it mean that's the question ? If base rate cuts are heading under 4% then maybe the economy isn't that healthy. ? We can only wait and see.

Vanguard UK Gilt UCITS ETF, UK:VGOV Advanced Chart - (LON) UK:VGOV, Vanguard UK Gilt UCITS ETF Stock Price - BigCharts.com (marketwatch.com)

[img]https://i.postimg.cc/vT9dZ73q/big.gif[/img]

Can they really control inflation or is it a bit of a myth. ? From 1945 to 1955 there were periods of high inflation yet UK rates were held low similar to the US . Inflation fell regardless . From 1960 to 1980 inflation gradually increased to double figures. Rates were also increased in an attempt to cap the move. Didn't work ?

Chart no 5 in the link.

Historical Interest Rates UK - Economics Help

inflation-interest-rates-1945-2011.png (944×650) (economicshelp.org

1 -

hallmark said:Since starting this thread I see some economists are now predicting 1% inflation soon thanks to certain items dropping out of the index. Much as I personally would like it I just cannot see any possible world where inflation is 1% & the MPC keeps rates nearer 5%. Has there EVER been a time when savers could beat easily beat inflation by several percentage points with no risk (can't think of that offhand?) Surely the calls for large reductions in base rate would be deafening at that point.As well as the base rate routinely being higher than inflation pre-GFC, it was also normally the case that easy access savings were a percentage point or so below base rate and long term fixed rates were almost but not quite at the level of base rate. One year fixed rates did tend to deliver a real return against CPI in yesteryear IIRC. You can check the research of Paul Lewis of Money Box fame for details of the returns from a ladder of these.The main reason for reducing rates is to stave off a recession, and having the headroom to do that is a mark of a healthy economy. The economy has been quite resilient to the normalisation of rates, and while we are technically in recession now, it looks like a fairly soft landing with no real need to risk inflation biting back. A return to a regime of very low rates gives the MPC nowhere to go when the economy really starts tanking.If CPI went to a sustained 1% or so, then perhaps the 3-3.5% base rate promised originally may materialise, but I don't think it is very likely inflation will settle that low.2

-

Likewise borrowing rates were set above that of BOE base rate. Currently in the throes of a transitional phase. With individual rates being set on the basis of whether's there's a surplus or shortfall of capital.masonic said:hallmark said:Since starting this thread I see some economists are now predicting 1% inflation soon thanks to certain items dropping out of the index. Much as I personally would like it I just cannot see any possible world where inflation is 1% & the MPC keeps rates nearer 5%. Has there EVER been a time when savers could beat easily beat inflation by several percentage points with no risk (can't think of that offhand?) Surely the calls for large reductions in base rate would be deafening at that point.As well as the base rate routinely being higher than inflation pre-GFC, it was also normally the case that easy access savings were a percentage point or so below base rate and long term fixed rates were almost but not quite at the level of base rate.1 -

I hope they don't touch rates for a while, at least until I've opened another fixed rate ISA in April.1

-

There is an inter dealer cash market that I think truly represents the average market expectations on borrowing rates. That expectation will be heavily driven on what they view the various central banks might do. For your retail bank accounts from banks, you'll just get that inter dealer rate plus a markup I think.

If you think that the rates offered for fixed savings seem good value, that's probably just your opinion slightly differing from professional market average. There are of course other factors in play e.g. positions, competition etc.

I also read on Bloomberg that the BoE were just as slow(or fast) on raising rates as the Fed and ECB.

Also, this market expectation jumps around on any inflation news.0 -

hallmark said:

Instant access accounts are 5%+ at the moment, with 2-3 year fixes around 4.7-4.4%. Surely these will sharply de-invert very soon.When base rate is expected to go down, instant access accounts will be higher than fixes. When base rate is expected to go up, fixes will be higher than instant access.Fixes are effectively a proxy for base rate expectations over the length of the fix, the faster base rate is expected to rise or fall, the bigger the gap between instant access, and fixes of different lengthsInstant access reflects what is happening now, fixes what is expected to happen in the future, they will only de-invert when future rate cuts are not expected0 -

Huh? It's been around for hundreds of years.Hoenir said:

The 70's saw the creation of fractional reserve banking. Banks were given the ability to print money and as a consequence leverage up their balance sheets. Hence why many Building Societies demutualised to become banks themselves and gain the freedom. We are know what happened subsequently.Linton said:

I dont think that in the immediae post war period inflation was seen as a particular problem. Recovery from the war was the main concern. Also had Keynsian monetary theory been accepted in the corridors of power? I think both these things changed in the 1970s (but I am neither an economist or a historian).coastline said:

Normally is the case that they follow the FED . It's a moving target as seen by the bond yield in the last year alone. UK10 year was 3.25% a year ago. Last September 4.75% . This year 3.50% and now 4% .hallmark said:

This is kind of what I'm getting at in a hamfisted way. At present you can still lock in decent yields on a 2-3 year horizon. I think that's because the markets are underestimating the Doveish nature of the MPC.Albermarle said:

The 'money men' seem not to agree with you . From BBC news.hallmark said:Thanks Linton. It's a good point re historical IRs and FWIW my guess is that moving forward a higher range than the post 2008 years is likely for both inflation and IRs. I'm mid-50s so what I'd class as normal IRs is much more like what we saw pre-2008.

Regarding the next year or two though, I just think it's incredibly unlikely that the MPC, who I believe are Doveish by nature, won't reduce IRs dramatically. The logic among economists seems to be that the MPC were too slow to raise therefore they'll be too slow to cut. My view is that they were too slow to raise, because they are doviesh, and that rather than be sluggish on cuts they'll be the opposite.

To put my predictions on the line, I reckon an IR cut by May is more likely than not and an IR cut by June almost 100% certain. Followed by several more. And that 0.5% cuts are very possible.

I also hope I'm wrong as I think inflation could easily reignite and should be treated with utmost caution.Currency traders are pricing in slightly higher cuts to UK interest rates this year after lower than expected inflation figures.

Money markets are betting there will be 0.7% of rate cuts this year, up from speculation on 0.67% of cuts

Central banks around the world tend to follow the lead of the Fed, which is widely expected to hold rates at 5.25% to 5.5%.

I'm probs going to move some funds from MMF into individual gilts as I think a risk-free 4%+ on that horizon isn't a bad proposition for a part of the portfolio.

UK 10 Year Gilt Bond Yield - Quote - Chart - Historical Data - News (tradingeconomics.com)

This can be seen in VGOV the UK gilt ETF. 1800 a year ago, 1575 and this year 1750 and 1700. Can it go to 1800 again ? Looks like it'll need a fair few rate cuts. What will it mean that's the question ? If base rate cuts are heading under 4% then maybe the economy isn't that healthy. ? We can only wait and see.

Vanguard UK Gilt UCITS ETF, UK:VGOV Advanced Chart - (LON) UK:VGOV, Vanguard UK Gilt UCITS ETF Stock Price - BigCharts.com (marketwatch.com)

[img]https://i.postimg.cc/vT9dZ73q/big.gif[/img]

Can they really control inflation or is it a bit of a myth. ? From 1945 to 1955 there were periods of high inflation yet UK rates were held low similar to the US . Inflation fell regardless . From 1960 to 1980 inflation gradually increased to double figures. Rates were also increased in an attempt to cap the move. Didn't work ?

Chart no 5 in the link.

Historical Interest Rates UK - Economics Help

inflation-interest-rates-1945-2011.png (944×650) (economicshelp.orgFractional reserve banking supposedly has its roots in an era when gold and silver were traded. Goldsmiths would issue promissory notes, which were later used as a means of exchange. The smiths used the deposited gold to issue loans with interest, and fractional banking was born.

In the U.S., the National Bank Act was passed in 1863 to require banks to keep reserves on hand to protect depositor funds from being used in risky investments.2

St. Louis Fed. “National Bank Act of 1863.”

In 1913 the Federal Reserve Act created the system of Federal Reserve banks we now know collectively as the Federal Reserve System. Banks were required to keep reserve balances with the Federal Reserve Banks.3

Reserve requirements for banks under the Federal Reserve Act were set at 13%, 10%, and 7% (depending on the type of bank) in 1917. In the 1950s and '60s, the Fed had set the reserve ratio as high as 17.5% for certain banks, and it remained between 8% to 10% throughout much of the 1970s through the 2010s.41

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards