We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Simple understanding of managed migration please

it475

Posts: 11 Forumite

Hi,not too sure what I am actually asking so please bear with me.i am a 65 year old self employed mechanic and have been for the last 45 years.my health started to go downhill for the last 6 years and i was on tax credits,18 months ago it had got to a point where i claimed pip and was awarded enhanced on both,my wife gets carers allowance although we only applied for this last September.

my health is stopping me doing full time work but with being self employed i can do a couple of hours a day nowadays so my profits aren’t big but i am earning.

i got the managed migration letter and migrated onto uc and am gainfully self employed,I have also put in a fit note 3 weeks ago as I got pneumonia which slowed me down a bit but still carried on a couple of hours a day as I felt I needed to for my mental health to stop me feeling sorry for myself.

my consultant has advised no work and this is likely to be permanent.

i was on the understanding that there is transitional protection which means you won’t be worse off from tc to uc.

Tax credits we was getting £753 and 330 carers allowance.

my payment for uc is now 583 including the carers allowance so I am trying to understand why the big difference in amounts as it looks like I will be £500 worse off?

my health is stopping me doing full time work but with being self employed i can do a couple of hours a day nowadays so my profits aren’t big but i am earning.

i got the managed migration letter and migrated onto uc and am gainfully self employed,I have also put in a fit note 3 weeks ago as I got pneumonia which slowed me down a bit but still carried on a couple of hours a day as I felt I needed to for my mental health to stop me feeling sorry for myself.

my consultant has advised no work and this is likely to be permanent.

i was on the understanding that there is transitional protection which means you won’t be worse off from tc to uc.

Tax credits we was getting £753 and 330 carers allowance.

my payment for uc is now 583 including the carers allowance so I am trying to understand why the big difference in amounts as it looks like I will be £500 worse off?

I suppose my question is what have I misunderstood about protection?

0

Comments

-

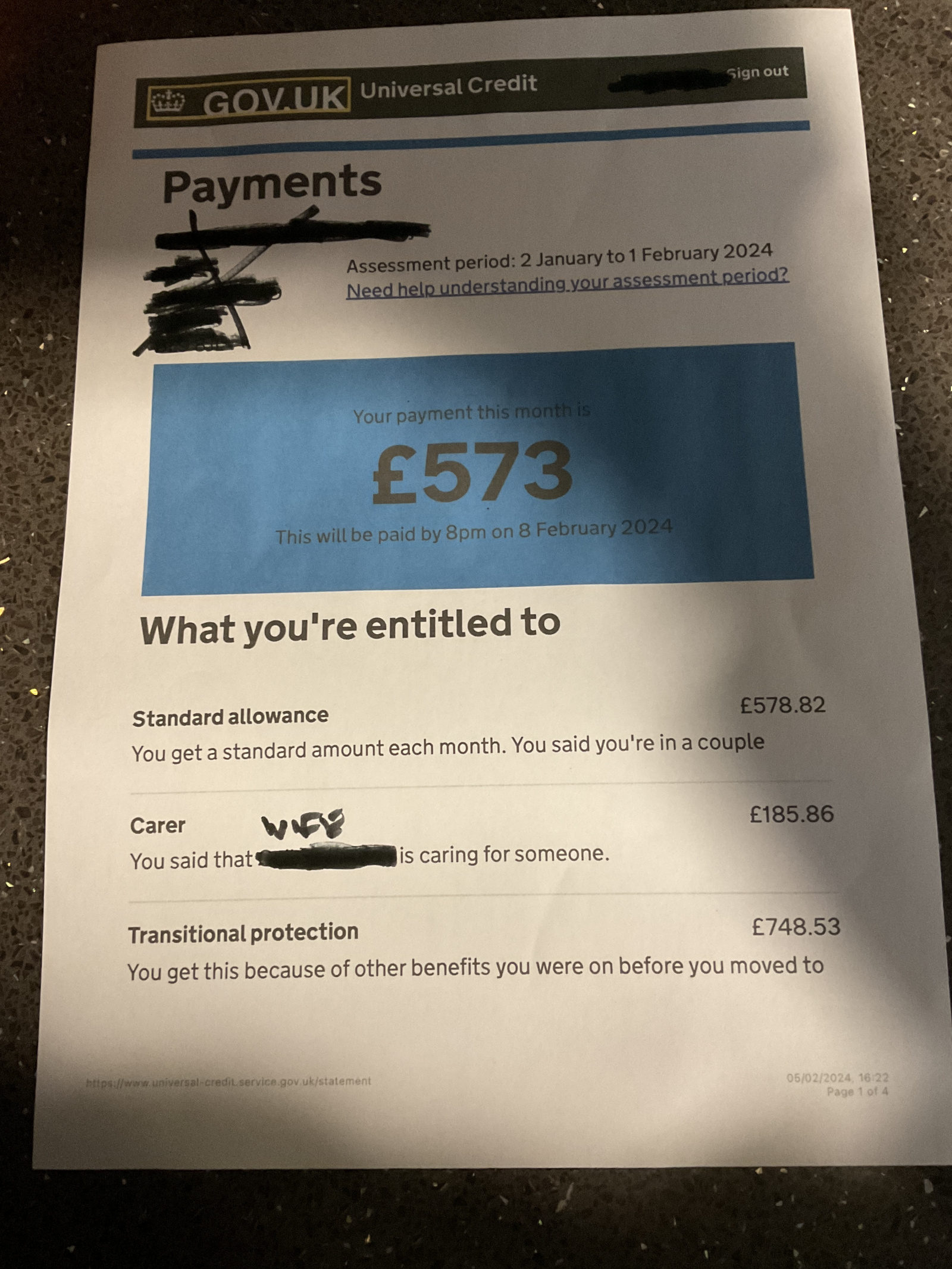

Transitional Protection on migration from Tax Credits is complicated, and despite what politicians say it is not guaranteed to leave you with the same money as before.Our first question has to be - Where are you getting that £583? Have you had a UC statement yet and that is what it is saying?

If so then can you tell us each/all of the amounts that your statement has for payments and deductions.In particular does it have a Carer Element?, does it have a Transitional Element?

It should have a decuction for the Carers Allowance* (see below).

Did you take a UC Advance, does it have a deduction for that?

You say that you are self employed so does it have any deduction for income?

Do you have a pension, is your wife working? Those would/should also show up as deductions on the UC statement.I've tried a few different ways of calculating things from what you have told us so far, but can't get to that £583 for UC.

So we need to know just how they are calculating the UC payment due so that we can work out if something may be wrong.*One thing to remember is that the Carers Allowance is still paid seperately so is additional to the UC payment.

Just like it was additional to the TC payments.So you are looking at a difference of £753-£583 = £170 (and not £500), if you can tell us what the UC statement says then we can see if that's been calculated correctly.

2 -

firstly thank you so much for taking the time to reply in such great detail,I didn’t realise that the carers allowance will still be paid as the reward is as clear as mud to me.

i have attached the reward but I don’t think it’s wrong it’s more a case of me not understanding,I was expecting a deduction for making a profit but in my mind I was thinking transitional meant something different to what it must be,confusing when tax credits was done annually but this is worked out differently with less things to claim allowances on.

0

0 -

That third page (second page of the UC statement but third photo in the post) does take into account your self-employed earnings.1

-

thanks for that,I really hadn’t realised that the ca was paid separately,I just saw the minus and assumed it meant it’s no longer payable and instead there is 169,so my hit isn’t as bad as appeared.

still trying to get my head round all the beaurocracy if I am honest,.last week I got a lcw form and as my handwriting is pretty hard to read I downloaded the form and filled it in on iPad and sent it off,just had a phone call now asking why I hadn’t sent it all back as the last 2 pages was missing?when I checked one of the pages was about cancer which I haven’t got and there wasn’t a tick box to state it’s not applicable,the other page was having help to fill in the form which again wasn’t applicable,no box.the outcome being that they will mark it as not applicable!

thanks again for the explanations.0 -

Just noticed that the carers allowance earlier this month was 307? Where does the figure of 332.58 come from as I recall us telling the dwp my wife gets carers allowance but can’t recall giving a figure as I thought it was a standard payment?0

-

I suspect the 307 is a payment for 4 weeks (carers allowance is paid 4-weekly) and 332.58 is a payment for a calendar monthit475 said:Just noticed that the carers allowance earlier this month was 307? Where does the figure of 332.58 come from

4 weekly would give 13 payments in a year = £3,991

divide by 12 to give monthly = £332.58

3 -

That explains it,I will understand all the figures and beurocracy before too long.0

-

I see you have a capital deduction.

Just to check it's correct the wages, CA & UC are income during the AP they are paid.

If I calculated it correctly that will be about £1500, so as you're allowed £6k capital you can have about £7,500 in monies, and a fair bit more if you have CoL payments, as they are excluded from calculations.

Let's Be Careful Out There1 -

Is this something I need to ask on my journal and if so what would be the best way of putting it across please.HillStreetBlues said:I see you have a capital deduction.

Just to check it's correct the wages, CA & UC are income during the AP they are paid.

If I calculated it correctly that will be about £1500, so as you're allowed £6k capital you can have about £7,500 in monies, and a fair bit more if you have CoL payments, as they are excluded from calculations.

that savings was correct on 31st jan and didn’t receive any uc in jan,there was a ca payment but no col payment in that month but did receive all the ones previous.0 -

Log into your UC account select "Report a Change of Circumstances" then select "Money, savings and investments" then "make a change".

You then report your actual capital.

CoL payments are disregarded no matter what month they were paid in, so add the total of all your CoL payments and that's the figure that's disregarded. Unless they change the law CoL payments are disregarded forever.

It's just income that is disregarded for the AP.

Let's Be Careful Out There2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards