We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Barclays closed my current account - warning to other expats

Comments

-

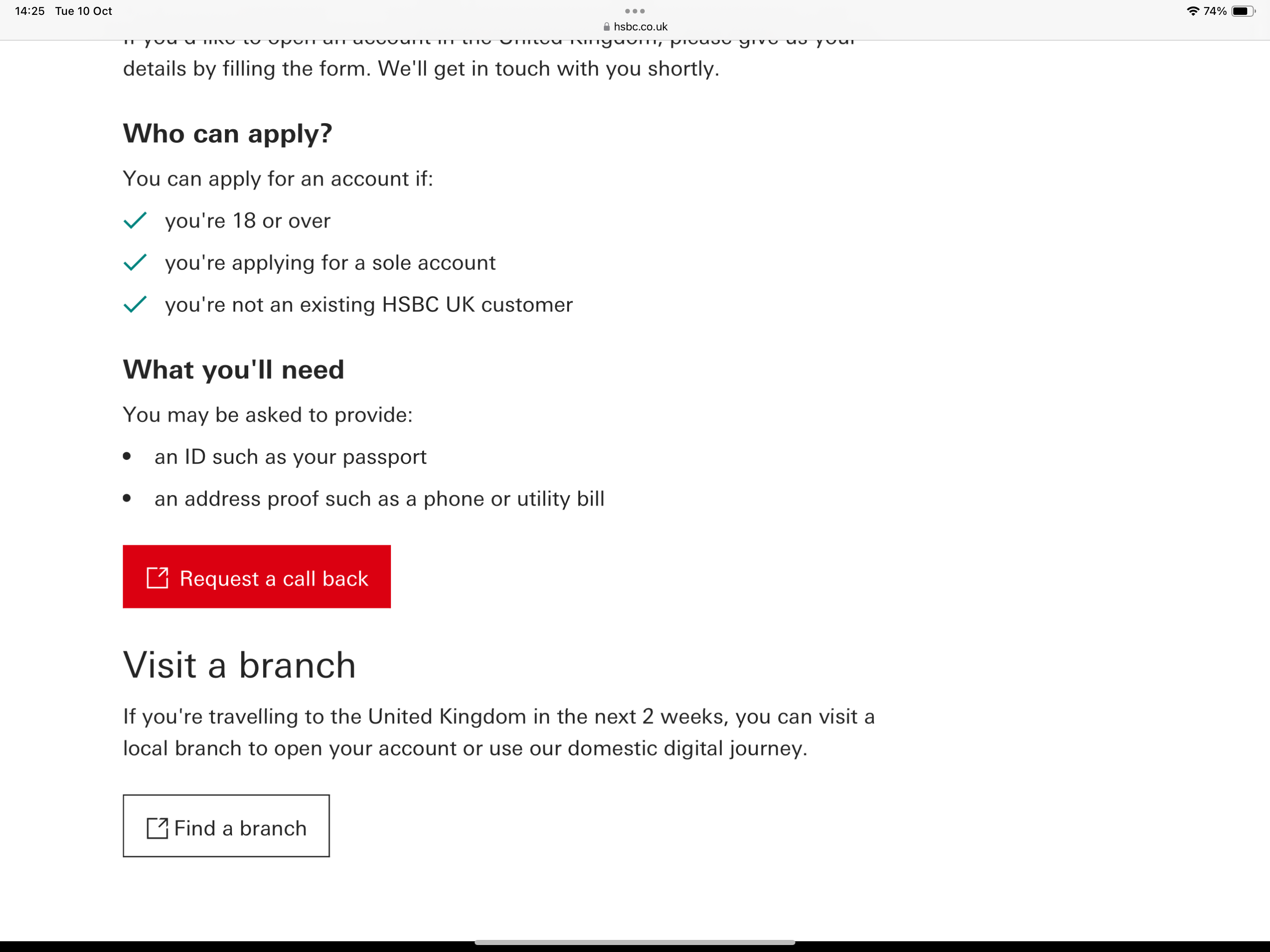

So it does but it mentions a call back and otherwise sounds like you'd need to visit a branch in the UK.gt94sss2 said:

If you follow my instructions and click the link in the black box re: opening an HSBC Bank or Advance account it does indeed mention New Zealand..wmb194 said:

If you're abroad your link leads you to the page linked below which is a checker to see whether you can open a UK account from your location abroad.gt94sss2 said:

The HSBC UK links above are for their normal UK accounts not those aimed at high net worth individuals/held offshoreGeordieinAotearoa said:

Unfortunately I don't qualify for offshore accounts. They are aimed at high net worth individuals.dil1976 said:

Nope they are migrants too, doesnt matter what country you are from, when you move to another for what ever reason you become a migrant. The expat word seems to be used solely by Brits to make it sound like we aren't actually migrants.GeordieinAotearoa said:

Not necessarily true. There are millions of expats working overseas, e.g. Young people on working holidays or postings.dil1976 said:

The word you are looking for here is Migrant.subjecttocontract said:I have every sympathy.

You can't be the only expat with this problem, there must be thousands. Can't you contact an accountant or overseas tax consultant that specialises in UK overseas matters. When I was working abroad we used a firm called Blevins Franks. These and others are easy to find online and may have a solution to your problem.

I don't agree. Amnesty obviously have a particular view related to their line of work, which needs to distinguish between migrants, asylum seekers and refugees. For other, conventional changes of residency, the simple accepted distinction between a migrant and an expat is that a migrant expects to move abroad permanently, whereas an expat is a temporary resident. But while this is an interesting semantic discussion, it makes no difference whatsoever to my particular problem. The banks don't care about migrants versus expats. It's all about residency.gt94sss2 said:

Have you tried contacting HSBC UK as previously suggested?GeordieinAotearoa said:

Your final para - yes, I suspect you are right. I don't hold that against them - they are a business after all - I just wish they had communicated it better. If they could send me email alerts for bank statements, you'd think they'd have at least done that, for such a vital and important letter.[Deleted User] said:

This is simply not accurate. A bank in anywhere in the EU Single Market (EEA) is able to provide banking services across the whole EEA based upon their home country banking licence - however, they aren't obligated to do so.GeoffTF said:

When we were EU members that had to provide the service if you went to another EU country and it did not cost them much more to include NZ. Now that they do not have to provide the service at all, they have decided to discontinue it.Section62 said:friolento said:Section62 said:GeordieinAotearoa said:

I do! Barclays said as much.jaypers said:Blame Brexit!Of course they would. So much more palatable than telling you they can't be bothered to keep your accounts open when it is more hassle (to them) than it is worth. A standard MO of corporations to say "we are unable to" when what they mean is "we don't want to".Somewhere there is a quote from the FCA saying that whether to provide accounts to people living overseas is a commercial decision for the individual banks, not a matter of regulation. If I can find the quote I'll copy it here (unless someone finds it before me)The first post in this thread -

The FCA has no say in the regulations of other countries. Banks, however, have to comply with the regulations of the countries they are offering a service in. Providing a current account to a resident of country X means that they have to have a licence, or a passporting arrangement, for country X.So what banking regulations changed in New Zealand as a result of Brexit?Because if the FCA are saying there is no regulatory issue (from a UK perspective) then it could only be something New Zealand have done (or not done) which has led Barclays to close the OP's account ("due to Brexit")...or it could be that the somewhat more obvious explanation is correct - that Barclays simply don't want to provide banking facilities to people not living in the UK.

The OP has emigrated from the UK and is therefore no longer a UK resident. Barclays has obviously taken a business decision to not support non-residents unless they're HNW. It's not entirely surprising as they can't sell them most products, can't easily pursue them locally for debts and cost them more than they make.

https://www.hsbc.co.uk/international/apply-for-a-uk-account/

Click the link in the black box re: opening an HSBC Bank or Advance account depending on your requirements

I suspect others in your position would be interested to know if they allow you to open an account.

(Just click on the links in this post for a direct link)

0 -

HSBC have two separate customer journeys depending on where you live.wmb194 said:

So it does but it mentions a call back and otherwise sounds like you'd need to visit a branch in the UK.gt94sss2 said:

If you follow my instructions and click the link in the black box re: opening an HSBC Bank or Advance account it does indeed mention New Zealand..wmb194 said:

If you're abroad your link leads you to the page linked below which is a checker to see whether you can open a UK account from your location abroad.gt94sss2 said:

The HSBC UK links above are for their normal UK accounts not those aimed at high net worth individuals/held offshoreGeordieinAotearoa said:

Unfortunately I don't qualify for offshore accounts. They are aimed at high net worth individuals.dil1976 said:

Nope they are migrants too, doesnt matter what country you are from, when you move to another for what ever reason you become a migrant. The expat word seems to be used solely by Brits to make it sound like we aren't actually migrants.GeordieinAotearoa said:

Not necessarily true. There are millions of expats working overseas, e.g. Young people on working holidays or postings.dil1976 said:

The word you are looking for here is Migrant.subjecttocontract said:I have every sympathy.

You can't be the only expat with this problem, there must be thousands. Can't you contact an accountant or overseas tax consultant that specialises in UK overseas matters. When I was working abroad we used a firm called Blevins Franks. These and others are easy to find online and may have a solution to your problem.

I don't agree. Amnesty obviously have a particular view related to their line of work, which needs to distinguish between migrants, asylum seekers and refugees. For other, conventional changes of residency, the simple accepted distinction between a migrant and an expat is that a migrant expects to move abroad permanently, whereas an expat is a temporary resident. But while this is an interesting semantic discussion, it makes no difference whatsoever to my particular problem. The banks don't care about migrants versus expats. It's all about residency.gt94sss2 said:

Have you tried contacting HSBC UK as previously suggested?GeordieinAotearoa said:

Your final para - yes, I suspect you are right. I don't hold that against them - they are a business after all - I just wish they had communicated it better. If they could send me email alerts for bank statements, you'd think they'd have at least done that, for such a vital and important letter.[Deleted User] said:

This is simply not accurate. A bank in anywhere in the EU Single Market (EEA) is able to provide banking services across the whole EEA based upon their home country banking licence - however, they aren't obligated to do so.GeoffTF said:

When we were EU members that had to provide the service if you went to another EU country and it did not cost them much more to include NZ. Now that they do not have to provide the service at all, they have decided to discontinue it.Section62 said:friolento said:Section62 said:GeordieinAotearoa said:

I do! Barclays said as much.jaypers said:Blame Brexit!Of course they would. So much more palatable than telling you they can't be bothered to keep your accounts open when it is more hassle (to them) than it is worth. A standard MO of corporations to say "we are unable to" when what they mean is "we don't want to".Somewhere there is a quote from the FCA saying that whether to provide accounts to people living overseas is a commercial decision for the individual banks, not a matter of regulation. If I can find the quote I'll copy it here (unless someone finds it before me)The first post in this thread -

The FCA has no say in the regulations of other countries. Banks, however, have to comply with the regulations of the countries they are offering a service in. Providing a current account to a resident of country X means that they have to have a licence, or a passporting arrangement, for country X.So what banking regulations changed in New Zealand as a result of Brexit?Because if the FCA are saying there is no regulatory issue (from a UK perspective) then it could only be something New Zealand have done (or not done) which has led Barclays to close the OP's account ("due to Brexit")...or it could be that the somewhat more obvious explanation is correct - that Barclays simply don't want to provide banking facilities to people not living in the UK.

The OP has emigrated from the UK and is therefore no longer a UK resident. Barclays has obviously taken a business decision to not support non-residents unless they're HNW. It's not entirely surprising as they can't sell them most products, can't easily pursue them locally for debts and cost them more than they make.

https://www.hsbc.co.uk/international/apply-for-a-uk-account/

Click the link in the black box re: opening an HSBC Bank or Advance account depending on your requirements

I suspect others in your position would be interested to know if they allow you to open an account.

(Just click on the links in this post for a direct link)

The one above for those living overseas (the response differs depending on what country you live in and the type of HSBC account you want). For New Zealand, it involves a call back.

Their normal "domestic" application process if you live in the UK (or are visiting the UK)

It's not particularly complex to follow and could help the original poster to find a mainstream UK alternative (not a offshore account) to their closed Barclays account.

At a quick glance, HSBC seem to be the only big bank willing to entertain "normal" account holders overseas1 -

Unfortunately, if you look at the T&Cs, they are indeed for high net worth individuals.gt94sss2 said:

The HSBC UK links above are for their normal UK accounts not those aimed at high net worth individuals/held offshoreGeordieinAotearoa said:

Unfortunately I don't qualify for offshore accounts. They are aimed at high net worth individuals.dil1976 said:

Nope they are migrants too, doesnt matter what country you are from, when you move to another for what ever reason you become a migrant. The expat word seems to be used solely by Brits to make it sound like we aren't actually migrants.GeordieinAotearoa said:

Not necessarily true. There are millions of expats working overseas, e.g. Young people on working holidays or postings.dil1976 said:

The word you are looking for here is Migrant.subjecttocontract said:I have every sympathy.

You can't be the only expat with this problem, there must be thousands. Can't you contact an accountant or overseas tax consultant that specialises in UK overseas matters. When I was working abroad we used a firm called Blevins Franks. These and others are easy to find online and may have a solution to your problem.

I don't agree. Amnesty obviously have a particular view related to their line of work, which needs to distinguish between migrants, asylum seekers and refugees. For other, conventional changes of residency, the simple accepted distinction between a migrant and an expat is that a migrant expects to move abroad permanently, whereas an expat is a temporary resident. But while this is an interesting semantic discussion, it makes no difference whatsoever to my particular problem. The banks don't care about migrants versus expats. It's all about residency.gt94sss2 said:

Have you tried contacting HSBC UK as previously suggested?GeordieinAotearoa said:

Your final para - yes, I suspect you are right. I don't hold that against them - they are a business after all - I just wish they had communicated it better. If they could send me email alerts for bank statements, you'd think they'd have at least done that, for such a vital and important letter.[Deleted User] said:

This is simply not accurate. A bank in anywhere in the EU Single Market (EEA) is able to provide banking services across the whole EEA based upon their home country banking licence - however, they aren't obligated to do so.GeoffTF said:

When we were EU members that had to provide the service if you went to another EU country and it did not cost them much more to include NZ. Now that they do not have to provide the service at all, they have decided to discontinue it.Section62 said:friolento said:Section62 said:GeordieinAotearoa said:

I do! Barclays said as much.jaypers said:Blame Brexit!Of course they would. So much more palatable than telling you they can't be bothered to keep your accounts open when it is more hassle (to them) than it is worth. A standard MO of corporations to say "we are unable to" when what they mean is "we don't want to".Somewhere there is a quote from the FCA saying that whether to provide accounts to people living overseas is a commercial decision for the individual banks, not a matter of regulation. If I can find the quote I'll copy it here (unless someone finds it before me)The first post in this thread -

The FCA has no say in the regulations of other countries. Banks, however, have to comply with the regulations of the countries they are offering a service in. Providing a current account to a resident of country X means that they have to have a licence, or a passporting arrangement, for country X.So what banking regulations changed in New Zealand as a result of Brexit?Because if the FCA are saying there is no regulatory issue (from a UK perspective) then it could only be something New Zealand have done (or not done) which has led Barclays to close the OP's account ("due to Brexit")...or it could be that the somewhat more obvious explanation is correct - that Barclays simply don't want to provide banking facilities to people not living in the UK.

The OP has emigrated from the UK and is therefore no longer a UK resident. Barclays has obviously taken a business decision to not support non-residents unless they're HNW. It's not entirely surprising as they can't sell them most products, can't easily pursue them locally for debts and cost them more than they make.

https://www.hsbc.co.uk/international/apply-for-a-uk-account/

Click the link in the black box re: opening an HSBC Bank or Advance account depending on your requirements

I suspect others in your position would be interested to know if they allow you to open an account.0 -

wmb194 said:

If you're abroad your link leads you to the page linked below which is a checker to see whether you can open a UK account from your location abroad. If you're in New Zealand - not actually listed, so I chose 'other' - it looks like the answer is no.gt94sss2 said:

The HSBC UK links above are for their normal UK accounts not those aimed at high net worth individuals/held offshoreGeordieinAotearoa said:

Unfortunately I don't qualify for offshore accounts. They are aimed at high net worth individuals.dil1976 said:

Nope they are migrants too, doesnt matter what country you are from, when you move to another for what ever reason you become a migrant. The expat word seems to be used solely by Brits to make it sound like we aren't actually migrants.GeordieinAotearoa said:

Not necessarily true. There are millions of expats working overseas, e.g. Young people on working holidays or postings.dil1976 said:

The word you are looking for here is Migrant.subjecttocontract said:I have every sympathy.

You can't be the only expat with this problem, there must be thousands. Can't you contact an accountant or overseas tax consultant that specialises in UK overseas matters. When I was working abroad we used a firm called Blevins Franks. These and others are easy to find online and may have a solution to your problem.

I don't agree. Amnesty obviously have a particular view related to their line of work, which needs to distinguish between migrants, asylum seekers and refugees. For other, conventional changes of residency, the simple accepted distinction between a migrant and an expat is that a migrant expects to move abroad permanently, whereas an expat is a temporary resident. But while this is an interesting semantic discussion, it makes no difference whatsoever to my particular problem. The banks don't care about migrants versus expats. It's all about residency.gt94sss2 said:

Have you tried contacting HSBC UK as previously suggested?GeordieinAotearoa said:

Your final para - yes, I suspect you are right. I don't hold that against them - they are a business after all - I just wish they had communicated it better. If they could send me email alerts for bank statements, you'd think they'd have at least done that, for such a vital and important letter.[Deleted User] said:

This is simply not accurate. A bank in anywhere in the EU Single Market (EEA) is able to provide banking services across the whole EEA based upon their home country banking licence - however, they aren't obligated to do so.GeoffTF said:

When we were EU members that had to provide the service if you went to another EU country and it did not cost them much more to include NZ. Now that they do not have to provide the service at all, they have decided to discontinue it.Section62 said:friolento said:Section62 said:GeordieinAotearoa said:

I do! Barclays said as much.jaypers said:Blame Brexit!Of course they would. So much more palatable than telling you they can't be bothered to keep your accounts open when it is more hassle (to them) than it is worth. A standard MO of corporations to say "we are unable to" when what they mean is "we don't want to".Somewhere there is a quote from the FCA saying that whether to provide accounts to people living overseas is a commercial decision for the individual banks, not a matter of regulation. If I can find the quote I'll copy it here (unless someone finds it before me)The first post in this thread -

The FCA has no say in the regulations of other countries. Banks, however, have to comply with the regulations of the countries they are offering a service in. Providing a current account to a resident of country X means that they have to have a licence, or a passporting arrangement, for country X.So what banking regulations changed in New Zealand as a result of Brexit?Because if the FCA are saying there is no regulatory issue (from a UK perspective) then it could only be something New Zealand have done (or not done) which has led Barclays to close the OP's account ("due to Brexit")...or it could be that the somewhat more obvious explanation is correct - that Barclays simply don't want to provide banking facilities to people not living in the UK.

The OP has emigrated from the UK and is therefore no longer a UK resident. Barclays has obviously taken a business decision to not support non-residents unless they're HNW. It's not entirely surprising as they can't sell them most products, can't easily pursue them locally for debts and cost them more than they make.

https://www.hsbc.co.uk/international/apply-for-a-uk-account/

Click the link in the black box re: opening an HSBC Bank or Advance account depending on your requirements

I suspect others in your position would be interested to know if they allow you to open an account.

The OP should look at Wise.

https://internationalservices.hsbc.com/overseas-account-opening/where-to-open/?vid=018b195d43e80015c47898a5582c05075003c06d00bd0_uk&sid=1696937624553

New Zealand is indeed mentioned, but if you follow through the process it then excludes New Zealand as an eligible country. Frustratingly! I called them just to double check this, and they confirmed that it's a 'no'.gt94sss2 said:

If you follow my instructions and click the link in the black box re: opening an HSBC Bank or Advance account it does indeed mention New Zealand..wmb194 said:

If you're abroad your link leads you to the page linked below which is a checker to see whether you can open a UK account from your location abroad.gt94sss2 said:

The HSBC UK links above are for their normal UK accounts not those aimed at high net worth individuals/held offshoreGeordieinAotearoa said:

Unfortunately I don't qualify for offshore accounts. They are aimed at high net worth individuals.dil1976 said:

Nope they are migrants too, doesnt matter what country you are from, when you move to another for what ever reason you become a migrant. The expat word seems to be used solely by Brits to make it sound like we aren't actually migrants.GeordieinAotearoa said:

Not necessarily true. There are millions of expats working overseas, e.g. Young people on working holidays or postings.dil1976 said:

The word you are looking for here is Migrant.subjecttocontract said:I have every sympathy.

You can't be the only expat with this problem, there must be thousands. Can't you contact an accountant or overseas tax consultant that specialises in UK overseas matters. When I was working abroad we used a firm called Blevins Franks. These and others are easy to find online and may have a solution to your problem.

I don't agree. Amnesty obviously have a particular view related to their line of work, which needs to distinguish between migrants, asylum seekers and refugees. For other, conventional changes of residency, the simple accepted distinction between a migrant and an expat is that a migrant expects to move abroad permanently, whereas an expat is a temporary resident. But while this is an interesting semantic discussion, it makes no difference whatsoever to my particular problem. The banks don't care about migrants versus expats. It's all about residency.gt94sss2 said:

Have you tried contacting HSBC UK as previously suggested?GeordieinAotearoa said:

Your final para - yes, I suspect you are right. I don't hold that against them - they are a business after all - I just wish they had communicated it better. If they could send me email alerts for bank statements, you'd think they'd have at least done that, for such a vital and important letter.[Deleted User] said:

This is simply not accurate. A bank in anywhere in the EU Single Market (EEA) is able to provide banking services across the whole EEA based upon their home country banking licence - however, they aren't obligated to do so.GeoffTF said:

When we were EU members that had to provide the service if you went to another EU country and it did not cost them much more to include NZ. Now that they do not have to provide the service at all, they have decided to discontinue it.Section62 said:friolento said:Section62 said:GeordieinAotearoa said:

I do! Barclays said as much.jaypers said:Blame Brexit!Of course they would. So much more palatable than telling you they can't be bothered to keep your accounts open when it is more hassle (to them) than it is worth. A standard MO of corporations to say "we are unable to" when what they mean is "we don't want to".Somewhere there is a quote from the FCA saying that whether to provide accounts to people living overseas is a commercial decision for the individual banks, not a matter of regulation. If I can find the quote I'll copy it here (unless someone finds it before me)The first post in this thread -

The FCA has no say in the regulations of other countries. Banks, however, have to comply with the regulations of the countries they are offering a service in. Providing a current account to a resident of country X means that they have to have a licence, or a passporting arrangement, for country X.So what banking regulations changed in New Zealand as a result of Brexit?Because if the FCA are saying there is no regulatory issue (from a UK perspective) then it could only be something New Zealand have done (or not done) which has led Barclays to close the OP's account ("due to Brexit")...or it could be that the somewhat more obvious explanation is correct - that Barclays simply don't want to provide banking facilities to people not living in the UK.

The OP has emigrated from the UK and is therefore no longer a UK resident. Barclays has obviously taken a business decision to not support non-residents unless they're HNW. It's not entirely surprising as they can't sell them most products, can't easily pursue them locally for debts and cost them more than they make.

https://www.hsbc.co.uk/international/apply-for-a-uk-account/

Click the link in the black box re: opening an HSBC Bank or Advance account depending on your requirements

I suspect others in your position would be interested to know if they allow you to open an account.

(Just click on the links in this post for a direct link)0 -

Thank you to everyone who has suggested HSBC. I appreciate it. But it's a definite 'no'. New Zealand residents don't qualify - I called them to check this and they confirmed it.1

-

You never said what happened when you asked your pension provider to pay into your Wise account.

1 -

I don't have a Wise account.friolento said:You never said what happened when you asked your pension provider to pay into your Wise account.0 -

It takes less than 2 minutes to open oneGeordieinAotearoa said:

I don't have a Wise account.friolento said:You never said what happened when you asked your pension provider to pay into your Wise account.3 -

I did look at this but I feel very unsure about it. After talking to my pension provider I have decided to have my payments made to NZ. Not ideal but it will do for now until we visit the UK next year. Once in the country we can convert my spouse's Halifax account into a joint one. This can only be done in branch.friolento said:

It takes less than 2 minutes to open oneGeordieinAotearoa said:

I don't have a Wise account.friolento said:You never said what happened when you asked your pension provider to pay into your Wise account.2 -

I think the important factor is that the OP did arrange things before they left for NZ and Barclays have been ok taking his UK pension deposits for a while. They have now changed the rules on the OP.jaypers said:Aside from the business and Brexit logistics, I’m stunned that people who have decided to no longer live in the UK and have no longer have a residence here take it for granted that any organisation should still be providing them with the same services. I do agree that these things must be communicated clearly but I have little sympathy for anyone who hasn’t amended their situation to ensure that they have the correct account and finance channels for expats.And so we beat on, boats against the current, borne back ceaselessly into the past.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards