We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Can I save in my wife's account?

Comments

-

worriednoob said:

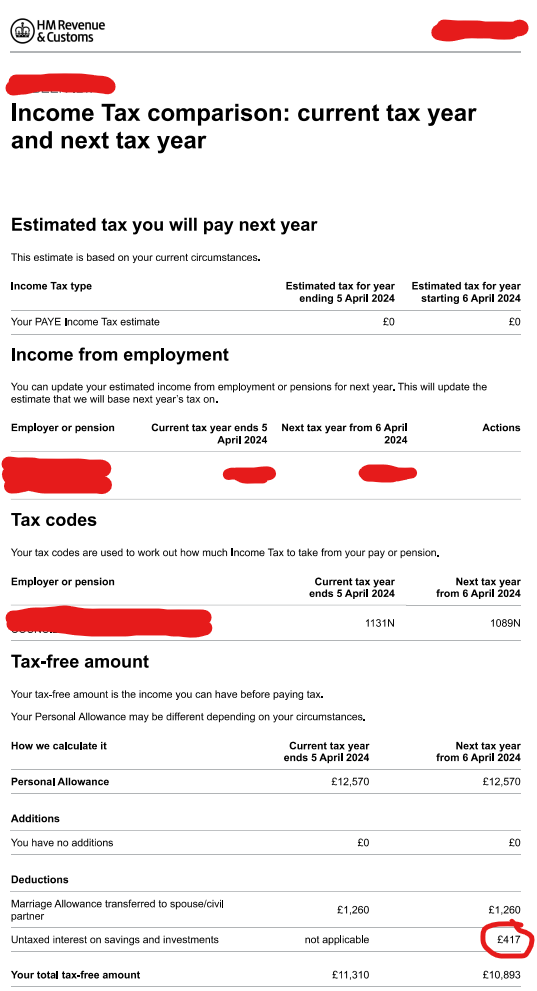

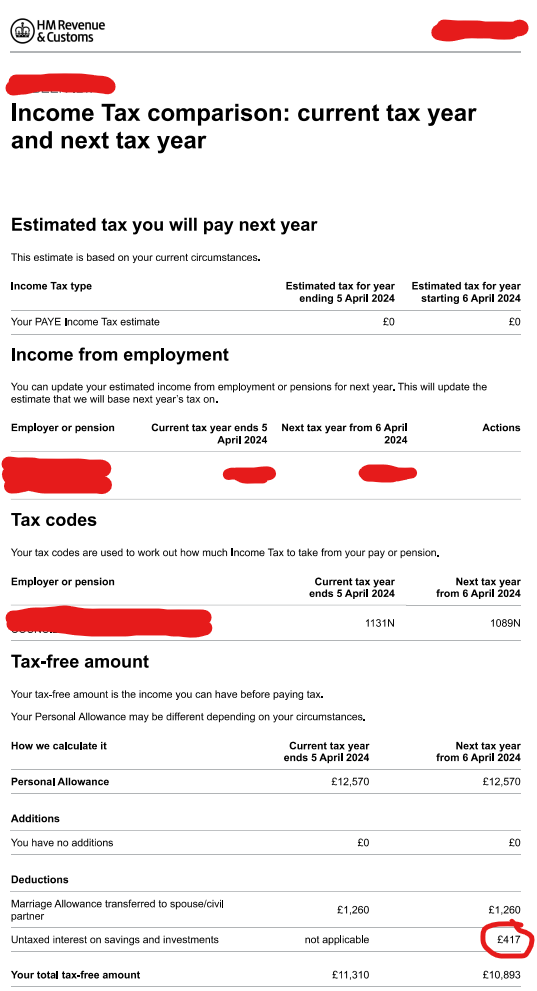

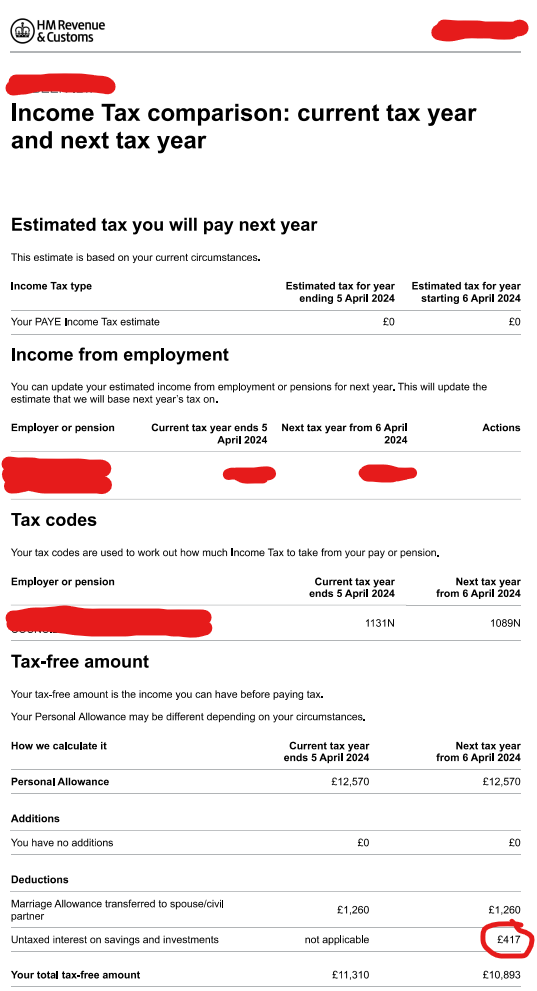

Apologies as I thought that was a personal info, but I can tell you that her estimated income for 2024/25 is well below £10k. Her tax code is 1089N if that helps. That's because she's transferring the marriage allowance to me and then the £417 seems to be reducing it further. But I'm wondering why do they need to reduce the code by £417 if they are not even supposed to deduct any tax on the interest. Sorry just a bit confused.zagfles said:worriednoob said:Hello everyone. I posted on here around 5 months ago and you helped me loads which I'm very grateful for, ut now she's received her tax calculations for next year and I might be wrong, but is she being taxed £417 for the interest on our savings? Please see screenshot below with the circled amount:-

Can anyone explain what this means?

ThanksYou've blanked out the important bit which is her employment earnings estimate. If it's under £10899 she won't pay any tax on it. Presume this is the case as the PAYE tax estimate is 0.It's the totally pointless way the PAYE system works. If they expect PAYE income to be under the PA, they allocate untaxed interest to any spare PA. This is of course nonsense (unless they expect interest to exceed £6000), because if PAYE income ends up being higher than expected you could end up paying too much tax since the interest will be covered by the £5k starting rate and £1k PSA.If her employment income definitely won't exceed £10899 then don't worry as she won't pay tax. If it might exceed it, then update the expected income with the max you think it'll be.Because HMRC haven't updated the PAYE system properly to cope with the 2016 changes (gross interest, PSA etc).Technically, if you don't use up the PA with employment/pension income etc, then any interest you earn uses up the rest of the PA before using the PSA and savings starting rate. So if they expect her to earn say £10k employment income and £417 interest, the £417 interest will use up the spare PA before using up the PSA/starting rate.So if the expectation is correct, she'll pay no tax because the 1089N tax code gives £10899 tax free in that employment.It's only a problem if her earnings are higher than expected. Say she ends up earning £11500. Then she'll pay tax on 11500-10899=601 at 20% = £120.This is completely wrong, because the £417 interest will then be covered by the PSA/starting rate, and she should only be taxed on 11500-11310= 190 which would be £38. They've effectively incorrectly taxed her interest.The obvious, sensible thing to do would be to completely ignore the £417 interest when setting the tax code. Because there is no way on earth it would ever affect the tax due except in very unrealistic scenarios.But they don't. They mess up peoples' tax codes in this way and cause utter confusion and extra work for HMRC and taxpayers. If instead they employed someone to update the PAYE system, it'd save HMRC 100x as much in wasted staff time handling confused customers and incorrectly taxed people.But that's the public sector for you!3 -

Don't tell her. Open an ISA in her name, use your mobile, email, contact details. Be a nice surprise for her if you ever drop down dead, after the initial shock of course. You'll need a bank account in her name if YOU ever need the money but that's easily done.0

-

And why not open an account for the cat and the budgie while you're about itZopa_Trooper said:Don't tell her. Open an ISA in her name, use your mobile, email, contact details. Be a nice surprise for her if you ever drop down dead, after the initial shock of course. You'll need a bank account in her name if YOU ever need the money but that's easily done. 0

0 -

Thank you very much Dazed - I guess what your trying to say is that as long as her income combined with any interest earned is well below the £10900, then there are no issues. For example if she earned £6k + £4k = £10k, then that's still £899 lower than the £10899 PA - Have I got that right?Dazed_and_C0nfused said:

The interest is using some of her spare Personal Allowance.worriednoob said:

Apologies as I thought that was a personal info, but I can tell you that her estimated income for 2024/25 is well below £10k. Her tax code is 1089N if that helps. That's because she's transferring the marriage allowance to me and then the £417 seems to be reducing it further. But I'm wondering why do they need to reduce the code by £417 if they are not even supposed to deduct any tax on the interest. Sorry just a bit confused.zagfles said:worriednoob said:Hello everyone. I posted on here around 5 months ago and you helped me loads which I'm very grateful for, ut now she's received her tax calculations for next year and I might be wrong, but is she being taxed £417 for the interest on our savings? Please see screenshot below with the circled amount:-

Can anyone explain what this means?

ThanksYou've blanked out the important bit which is her employment earnings estimate. If it's under £10899 she won't pay any tax on it. Presume this is the case as the PAYE tax estimate is 0.It's the totally pointless way the PAYE system works. If they expect PAYE income to be under the PA, they allocate untaxed interest to any spare PA. This is of course nonsense (unless they expect interest to exceed £6000), because if PAYE income ends up being higher than expected you could end up paying too much tax since the interest will be covered by the £5k starting rate and £1k PSA.If her employment income definitely won't exceed £10899 then don't worry as she won't pay tax. If it might exceed it, then update the expected income with the max you think it'll be.

If her employment/pension income is less than £10899 then no tax will be deducted.

If her employment/pension income was say £12k then she would have no spare Personal Allowance and the deduction wouldn't be included in her tax code.

You only need to do something if you expect her employment/pension income to be £10900 or more.0 -

Not really no.worriednoob said:

Thank you very much Dazed - I guess what your trying to say is that as long as her income combined with any interest earned is well below the £10900, then there are no issues. For example if she earned £6k + £4k = £10k, then that's still £899 lower than the £10899 PA - Have I got that right?Dazed_and_C0nfused said:

The interest is using some of her spare Personal Allowance.worriednoob said:

Apologies as I thought that was a personal info, but I can tell you that her estimated income for 2024/25 is well below £10k. Her tax code is 1089N if that helps. That's because she's transferring the marriage allowance to me and then the £417 seems to be reducing it further. But I'm wondering why do they need to reduce the code by £417 if they are not even supposed to deduct any tax on the interest. Sorry just a bit confused.zagfles said:worriednoob said:Hello everyone. I posted on here around 5 months ago and you helped me loads which I'm very grateful for, ut now she's received her tax calculations for next year and I might be wrong, but is she being taxed £417 for the interest on our savings? Please see screenshot below with the circled amount:-

Can anyone explain what this means?

ThanksYou've blanked out the important bit which is her employment earnings estimate. If it's under £10899 she won't pay any tax on it. Presume this is the case as the PAYE tax estimate is 0.It's the totally pointless way the PAYE system works. If they expect PAYE income to be under the PA, they allocate untaxed interest to any spare PA. This is of course nonsense (unless they expect interest to exceed £6000), because if PAYE income ends up being higher than expected you could end up paying too much tax since the interest will be covered by the £5k starting rate and £1k PSA.If her employment income definitely won't exceed £10899 then don't worry as she won't pay tax. If it might exceed it, then update the expected income with the max you think it'll be.

If her employment/pension income is less than £10899 then no tax will be deducted.

If her employment/pension income was say £12k then she would have no spare Personal Allowance and the deduction wouldn't be included in her tax code.

You only need to do something if you expect her employment/pension income to be £10900 or more.

Providing her earnings or pension income is less than £10,900 then there won't be an issue. Just ignore the interest.

If her earnings or pension income were going to be say £11,300 and her tax code was 1089T (because of the interest deduction) then she would pay some tax unnecessarily.

It would be automatically refunded in due course but she shouldn't have been paying it in the first place. But that would only happen if her earnings or pension income was £10,900 or more.1 -

Thanks so much Dazed. That's very reassuring. In that case we'll ignore the tax calculation as based on the job she's in, she's never going to hit that amount. Really appreciate your help. Thank you.0

-

Where can I find my cat's purrsonal tax code?artyboy said:

And why not open an account for the cat and the budgie while you're about itZopa_Trooper said:Don't tell her. Open an ISA in her name, use your mobile, email, contact details. Be a nice surprise for her if you ever drop down dead, after the initial shock of course. You'll need a bank account in her name if YOU ever need the money but that's easily done. 2

2 -

purrsonal tax code?

You threw the letter in the litter?

0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards