We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Can I save in my wife's account?

Comments

-

It depends what you mean by 'gain back'? Anyone with a large pot of savings will earn interest on that to generate income, and if they have a low employment income then they may pay less, or even no, tax on that interest, but that's not really 'gaining back' all lost income as such, but just potentially paying less tax on it.gele said:If someone earns say £18k pa and is considering reducing their hours, if they were to reduce to the point they were earning £12k and they had savings, they could effectively, with enough savings, gain back almost all the income lost from work with the £5k allowance but still have the benefit of working less, Is that right?

In other words, for those fortunate enough to be earning £5K of savings interest, even if all of that went from being taxed at 20% to being taxed at 0%, that's only a net gain of £1K, which is obviously much less than the employment income foregone to free up that £5K nil-rate band....1 -

Perhaps another example of focusing so much on not paying tax that you lose sight of the bigger picture.eskbanker said:

It depends what you mean by 'gain back'? Anyone with a large pot of savings will earn interest on that to generate income, and if they have a low employment income then they may pay less, or even no, tax on that interest, but that's not really 'gaining back' all lost income as such, but just potentially paying less tax on it.gele said:If someone earns say £18k pa and is considering reducing their hours, if they were to reduce to the point they were earning £12k and they had savings, they could effectively, with enough savings, gain back almost all the income lost from work with the £5k allowance but still have the benefit of working less, Is that right?

In other words, for those fortunate enough to be earning £5K of savings interest, even if all of that went from being taxed at 20% to being taxed at 0%, that's only a net gain of £1K, which is obviously much less than the employment income foregone to free up that £5K nil-rate band....1 -

Older married couples where one party's pension is very much lower than the other's can make good use of the SRS.

For example, where (usually Mr) has a generous DB plus SP and Mrs is on perhaps basic SP or less and where they have saved a substantial amount over the years.0 -

They need to be aware of the traps lurking for the unwary - have a POA in place, and recognise the risk of the person with all or most of the money needing care.xylophone said:Older married couples where one party's pension is very much lower than the other's can make good use of the SRS.

For example, where (usually Mr) has a generous DB plus SP and Mrs is on perhaps basic SP or less and where they have saved a substantial amount over the years.

Having said that in the way you describe it, men don't live as long as women, and often need care first, so the odds may fall in their favour.0 -

Nebulous2 said:

They need to be aware of the traps lurking for the unwary - have a POA in place, and recognise the risk of the person with all or most of the money needing care.xylophone said:Older married couples where one party's pension is very much lower than the other's can make good use of the SRS.

For example, where (usually Mr) has a generous DB plus SP and Mrs is on perhaps basic SP or less and where they have saved a substantial amount over the years.

Would a POA, if invoked, with its additional obligations, not open another can of worms if the intention was for the attorney to then apparently use the money as their own?

0 -

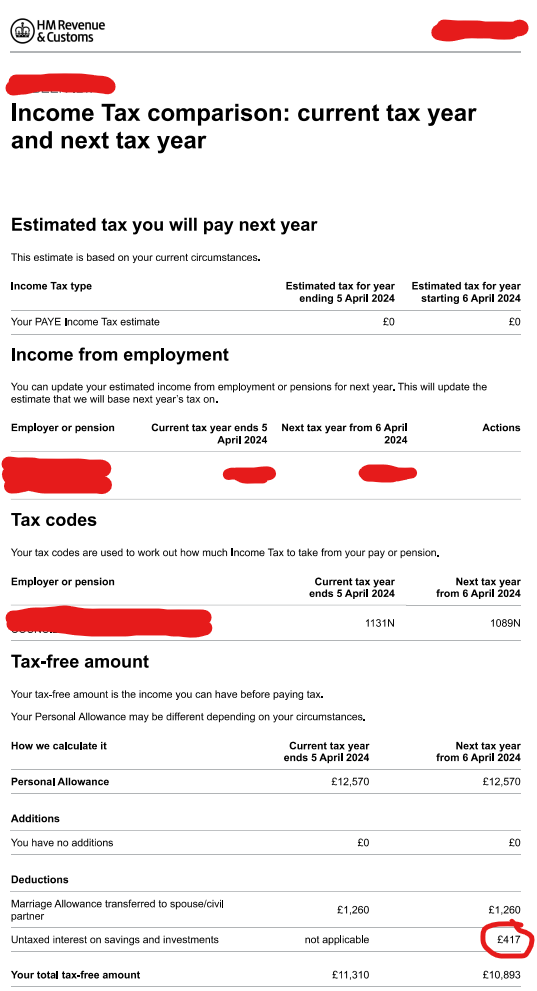

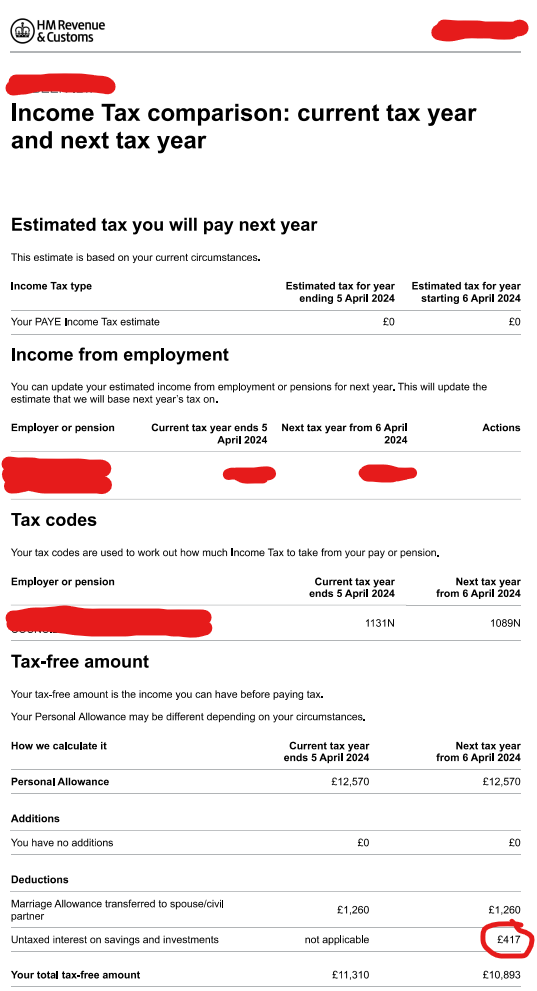

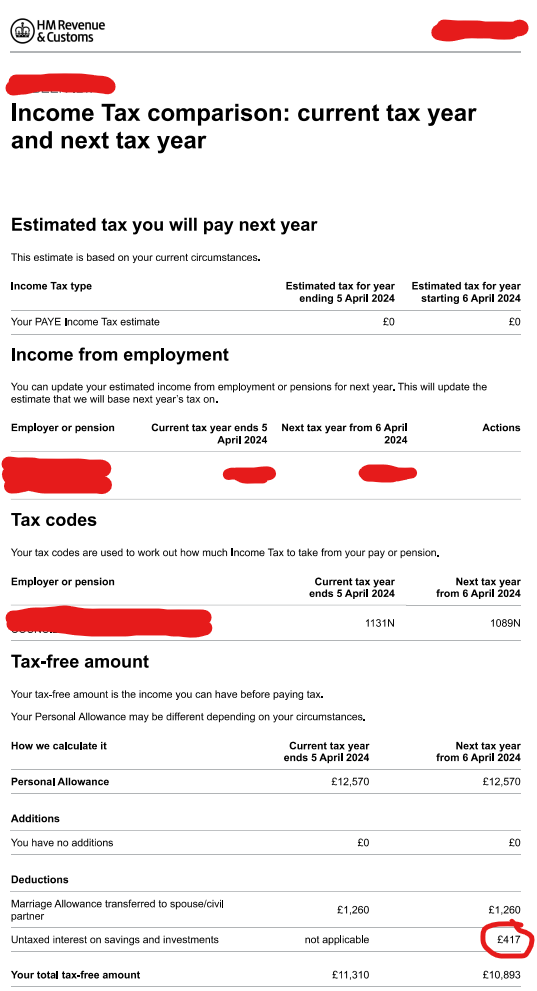

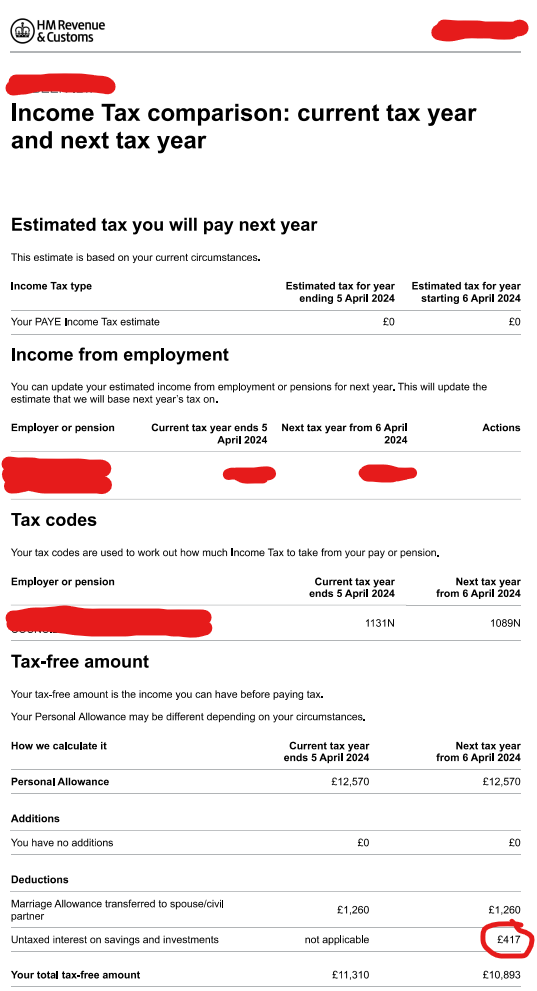

Hello everyone. I posted on here around 5 months ago and you helped me loads which I'm very grateful for, ut now she's received her tax calculations for next year and I might be wrong, but is she being taxed £417 for the interest on our savings? Please see screenshot below with the circled amount:-

Can anyone explain what this means?

Thanks0 -

worriednoob said:Hello everyone. I posted on here around 5 months ago and you helped me loads which I'm very grateful for, ut now she's received her tax calculations for next year and I might be wrong, but is she being taxed £417 for the interest on our savings? Please see screenshot below with the circled amount:-

Can anyone explain what this means?

ThanksYou've blanked out the important bit which is her employment earnings estimate. If it's under £10899 she won't pay any tax on it. Presume this is the case as the PAYE tax estimate is 0.It's the totally pointless way the PAYE system works. If they expect PAYE income to be under the PA, they allocate untaxed interest to any spare PA. This is of course nonsense (unless they expect interest to exceed £6000), because if PAYE income ends up being higher than expected you could end up paying too much tax since the interest will be covered by the £5k starting rate and £1k PSA.If her employment income definitely won't exceed £10899 then don't worry as she won't pay tax. If it might exceed it, then update the expected income with the max you think it'll be.1 -

Apologies as I thought that was a personal info, but I can tell you that her estimated income for 2024/25 is well below £10k. Her tax code is 1089N if that helps. That's because she's transferring the marriage allowance to me and then the £417 seems to be reducing it further. But I'm wondering why do they need to reduce the code by £417 if they are not even supposed to deduct any tax on the interest. Sorry just a bit confused.zagfles said:worriednoob said:Hello everyone. I posted on here around 5 months ago and you helped me loads which I'm very grateful for, ut now she's received her tax calculations for next year and I might be wrong, but is she being taxed £417 for the interest on our savings? Please see screenshot below with the circled amount:-

Can anyone explain what this means?

ThanksYou've blanked out the important bit which is her employment earnings estimate. If it's under £10899 she won't pay any tax on it. Presume this is the case as the PAYE tax estimate is 0.It's the totally pointless way the PAYE system works. If they expect PAYE income to be under the PA, they allocate untaxed interest to any spare PA. This is of course nonsense (unless they expect interest to exceed £6000), because if PAYE income ends up being higher than expected you could end up paying too much tax since the interest will be covered by the £5k starting rate and £1k PSA.If her employment income definitely won't exceed £10899 then don't worry as she won't pay tax. If it might exceed it, then update the expected income with the max you think it'll be.0 -

It's the totally pointless way the PAYE system works.

Indeed.

See https://forums.moneysavingexpert.com/discussion/comment/80510722/#Comment_80510722

1 -

The interest is using some of her spare Personal Allowance.worriednoob said:

Apologies as I thought that was a personal info, but I can tell you that her estimated income for 2024/25 is well below £10k. Her tax code is 1089N if that helps. That's because she's transferring the marriage allowance to me and then the £417 seems to be reducing it further. But I'm wondering why do they need to reduce the code by £417 if they are not even supposed to deduct any tax on the interest. Sorry just a bit confused.zagfles said:worriednoob said:Hello everyone. I posted on here around 5 months ago and you helped me loads which I'm very grateful for, ut now she's received her tax calculations for next year and I might be wrong, but is she being taxed £417 for the interest on our savings? Please see screenshot below with the circled amount:-

Can anyone explain what this means?

ThanksYou've blanked out the important bit which is her employment earnings estimate. If it's under £10899 she won't pay any tax on it. Presume this is the case as the PAYE tax estimate is 0.It's the totally pointless way the PAYE system works. If they expect PAYE income to be under the PA, they allocate untaxed interest to any spare PA. This is of course nonsense (unless they expect interest to exceed £6000), because if PAYE income ends up being higher than expected you could end up paying too much tax since the interest will be covered by the £5k starting rate and £1k PSA.If her employment income definitely won't exceed £10899 then don't worry as she won't pay tax. If it might exceed it, then update the expected income with the max you think it'll be.

If her employment/pension income is less than £10899 then no tax will be deducted.

If her employment/pension income was say £12k then she would have no spare Personal Allowance and the deduction wouldn't be included in her tax code.

You only need to do something if you expect her employment/pension income to be £10900 or more.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.5K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards