We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Have Banks spotted a way to unfairly not raise the interest rate on customers' savings accounts?

Comments

-

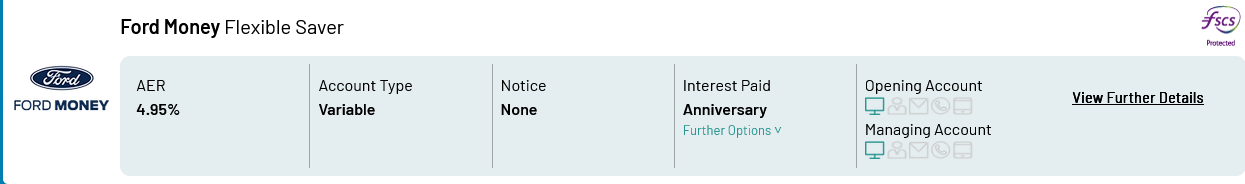

Selecting rate order and on line opening and management it comes in 8th.sheslookinhot said:

I looked again, not on the list and as I said above. Should be 4th.molerat said:sheslookinhot said:Ford Money do increase their savings rates for customers, but do not appear in moneyfacts easy access saver. ( would be 4th choice on interest rate).????????????????14th on the list, 12 providers at a higher interest rate

https://moneyfactscompare.co.uk/savings-accounts/easy-access-savings-accounts/

2 -

Thank you to everyone who has posted. I was a little surprised just how many of you have taken the time

I’ve decided not to reply to each comment because individual replies can be misread as defensive. I don’t feel defensive, but maybe what I wrote lacked clarity and so my point was misunderstood.

I believed that what I saw was a new practice because I’ve been with a number of banks and building societies over the years and found one in particular behaved this way whilst others didn’t. However, some of those others are now adopting such practices I’m not referring to Fixed products (they speak for themselves) and in terms of Notice accounts I currently have one - the provider has been great at increasing the interest rate up until the last BoE increase and now has chosen to bring out a new issue. It reinforced my belief that a new behaviour was being adopted.I have a lot to thank MSE for. I’d like to think MSE would be pleased, as I consider myself to be proactive with regards to my savings and (especially over the last year) regularly check rates and switch. However, stating that “rates can go up as well as down” is dishonest if you have no intention of raising them. The term ‘loyal’ is used loosely to reflect current customers who believe that such statements have their basis in truth.I understand that they are businesses. However, the government drew attention to increasing mortgage rates whilst lagging behind in savings rate rises, but also it highlighted the large differential between these two rates. A differential which was considered more than reasonable for a business to function.Apologies if I mislead anyone into thinking I can’t be bothered to take responsibility for my own savings and I just want to moan about banks (and building societies).I hope I’m raising a concern about an industry wide behaviour that some forumites will now have awareness of and realise that they too always need to reevaluate who they trust.I’m also not expecting MSE staff to respond directly, but I hope that this may be something of interest to them too.0

I’m not referring to Fixed products (they speak for themselves) and in terms of Notice accounts I currently have one - the provider has been great at increasing the interest rate up until the last BoE increase and now has chosen to bring out a new issue. It reinforced my belief that a new behaviour was being adopted.I have a lot to thank MSE for. I’d like to think MSE would be pleased, as I consider myself to be proactive with regards to my savings and (especially over the last year) regularly check rates and switch. However, stating that “rates can go up as well as down” is dishonest if you have no intention of raising them. The term ‘loyal’ is used loosely to reflect current customers who believe that such statements have their basis in truth.I understand that they are businesses. However, the government drew attention to increasing mortgage rates whilst lagging behind in savings rate rises, but also it highlighted the large differential between these two rates. A differential which was considered more than reasonable for a business to function.Apologies if I mislead anyone into thinking I can’t be bothered to take responsibility for my own savings and I just want to moan about banks (and building societies).I hope I’m raising a concern about an industry wide behaviour that some forumites will now have awareness of and realise that they too always need to reevaluate who they trust.I’m also not expecting MSE staff to respond directly, but I hope that this may be something of interest to them too.0 -

Sorry, I feel misquoted on thismebu60 said:'on the other hand, sluggishly raising the interest rates for savers is not acceptable'

Where have you been these past few months? Nothing sluggish about rate rises broadly speaking.

Several banks and BSs use the new issue route. And have been doing so for a long time. That's their choice of business model. You don't have to use them, other providers are available. 0

0 -

Seems standard, I just move my money to who pays well.

When Santander interest rate was crap, moved to Chip and Tanden and now ttheir rate are better moved back.0 -

RCI sent an email this morning to say they are increasing the rate on their easy access Freedom Savings to 4.75%. When the BOE have declined to raise base rates that seems fairly decent of RCI

0 -

Swipe said:

Was that before or after the BOE decision?LHW99 said:RCI sent an email this morning to say they are increasing the rate on their easy access Freedom Savings to 4.75%. When the BOE have declined to raise base rates that seems fairly decent of RCI

Downloaded the email at 08.57 this morning, so before. Whether it will stay at that level for any length of time.....

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.4K Banking & Borrowing

- 253.3K Reduce Debt & Boost Income

- 453.8K Spending & Discounts

- 244.4K Work, Benefits & Business

- 599.6K Mortgages, Homes & Bills

- 177.1K Life & Family

- 257.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards