We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

Have Banks spotted a way to unfairly not raise the interest rate on customers' savings accounts?

Comments

-

'on the other hand, sluggishly raising the interest rates for savers is not acceptable'

Where have you been these past few months? Nothing sluggish about rate rises broadly speaking.

Several banks and BSs use the new issue route. And have been doing so for a long time. That's their choice of business model. You don't have to use them, other providers are available.2 -

I took a one year fix at 4.5% with Al Rayan in March, I am still crying into my beer.

LOL3 -

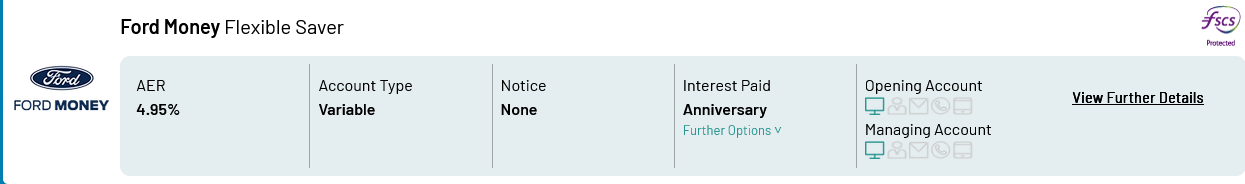

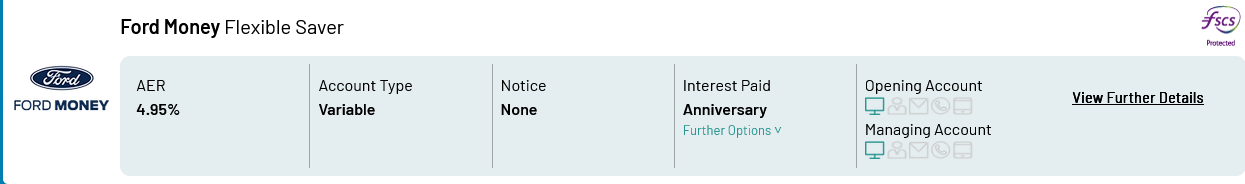

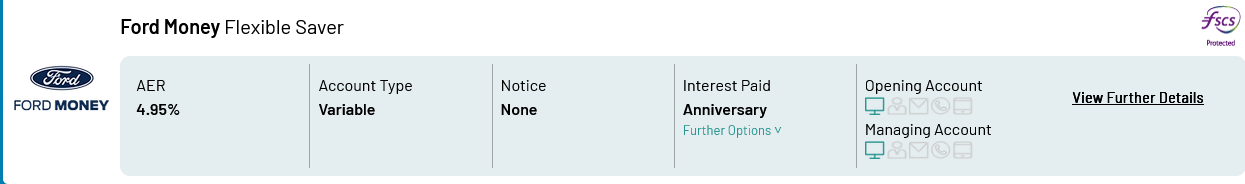

sheslookinhot said:Ford Money do increase their savings rates for customers, but do not appear in moneyfacts easy access saver. ( would be 4th choice on interest rate).????????????????14th on the list, 12 providers at a higher interest rate

0 -

I've got 10K sitting in a Barclays 1 yr ISA at 4% until January. That niggles.Ayr_Rage said:I took a one year fix at 4.5% with Al Rayan in March, I am still crying into my beer.

LOL2 -

As in most businesses where there is free competition, the supplier/provider sets the price( interest rate in this case) and the customer decides whether to buy/engage with the product or not.MalC4 said:Has anyone else noticed that there appears to be a growing pattern of unfair/unscrupulous behaviour by some banks (etc) when it comes to not increasing the interest rates on the savings account of their customers, but instead bringing out a new product (really the same product under a new Issue number)?

It feels like the banks are trying to adopt an unfair system by taking advantage of the trust of their loyal customers. Take for example Easy Access savings accounts. Banks state that the interest rate is variable, i.e. it can go up or down. However, whilst I'd imagine that if the BoE were to start decreasing interest rates then the banks would rapidly follow suit and yet, with the increase in BoE rate there seems less and less chance of an increase in rate offered on these variable accounts (let alone rapid).

I have noticed this pattern of behaviour over the past year and it appears to be heading towards quite systemic behaviour. More and more intuitions appear to be adopting this approach. It is my understanding that the government has told the banking sector that rapidly withdrawing mortgage products in order to relaunch them at higher interest rates whilst, on the other hand, sluggishly raising the interest rates for savers is not acceptable and they need treat savers fairly. It is my suspicion that the banks have found a way to circumnavigate raising interest rates on savings accounts by quietly ignoring loyal customers whilst bringing out, what is essentially the same product with a better rate. This is an abuse of trust. When a bank says the rate can go up or down we expect them to be honest and offer us the same rates as new customers. We do not expect to have to keep checking back to see if our bank has brought out a better rate product to attract new customers and we do not expect to incur the hassle of regularly moving money from one account to another within the same institution (which only really works for easy access accounts. We are over a barrel and locked in with notice accounts). We do expect fair and reasonable treatment.

I don't know how to contact Martin and his MSE team, but if they're reading this, I hope this would be something that they would find interesting to look into - fingers crossed

It is not for the customer to dictate to the supplier what their offering should be.

We are over a barrel and locked in with notice accounts).

A good example. You the customer decided to go for a notice ( or fixed term ) account because they pay better interest than easy access. That was your decision, nobody forced you take up the offer.0 -

Albermarle said:

As in most businesses where there is free competition, the supplier/provider sets the price( interest rate in this case) and the customer decides whether to buy/engage with the product or not.

It is not for the customer to dictate to the supplier what their offering should be.

We are over a barrel and locked in with notice accounts).

A good example. You the customer decided to go for a notice ( or fixed term ) account because they pay better interest than easy access. That was your decision, nobody forced you take up the offer.You clearly don't understand the issue at hand.It's not about forcing banks or Building Societies to offer a better rate but it's about them issuing new variable products with better rates with the same product name and (at most) a new issue number. In my experience, Building Societies are by far the worst for this as bank's tend to just offer the same (poor) rate to everyone.1 -

Absolutely. Abbey National used to do this back in the days when you went to the branch with your pass book. Sometimes the teller would point it out, if you'd missed the posters advertising the latest rates. Either way you'd have to go through the process of opening a new account and transferring the balance in the branch.It's nothing new and to my certain knowledge has been going on for decades. Your first mistake is to be, "loyal." You've always needed to be as sharp as they are. It isn't just banks, btw. Building Societies do the same.1 -

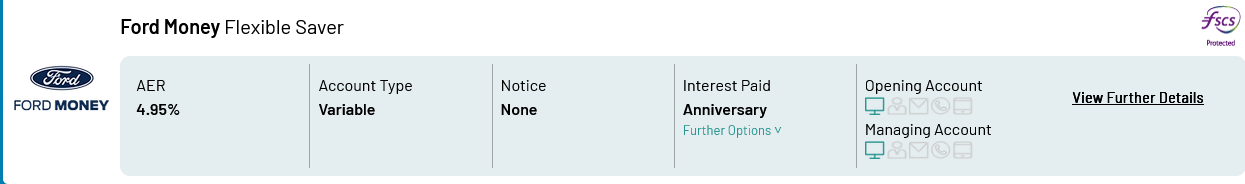

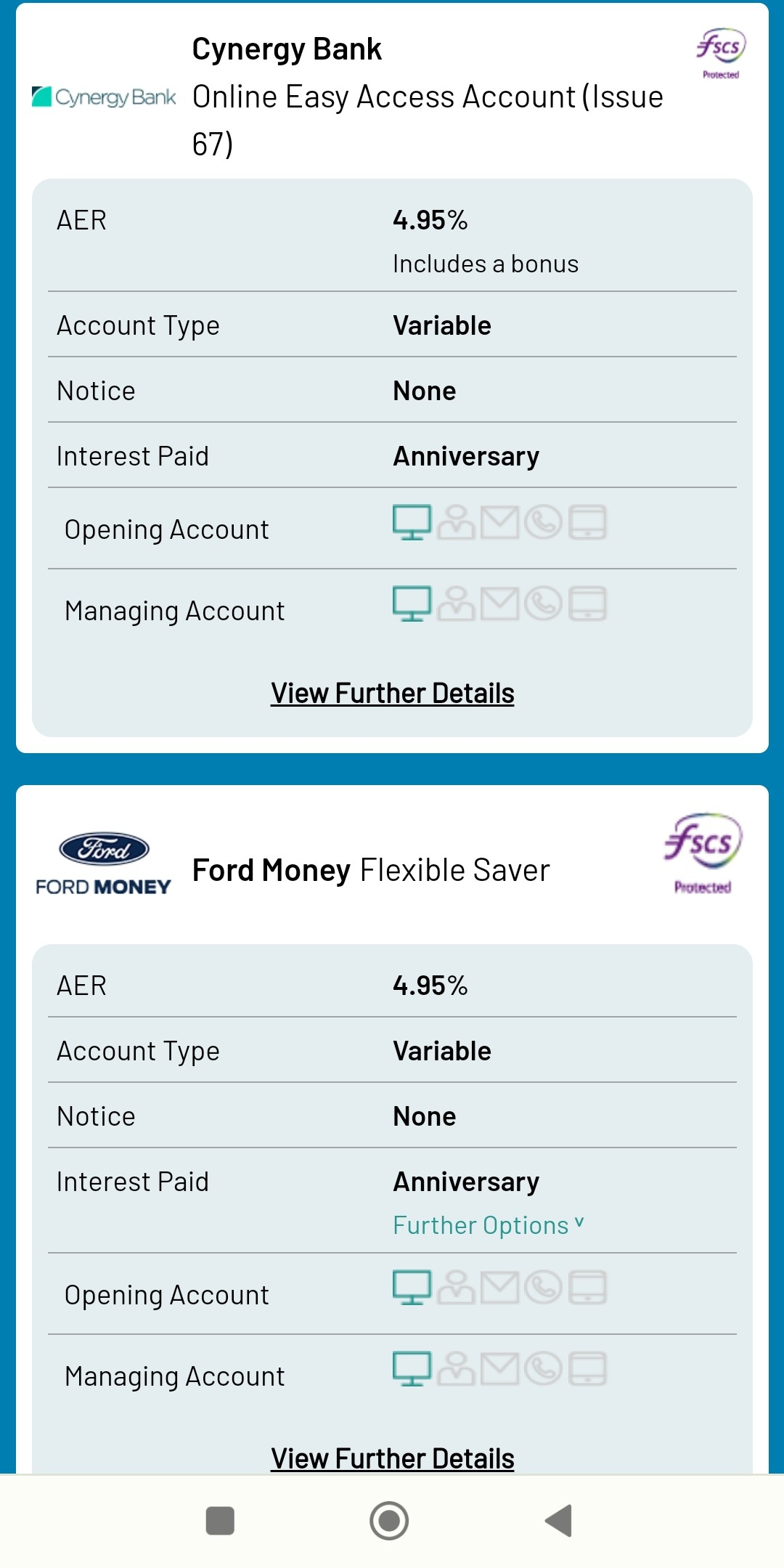

I looked again, not on the list and as I said above. Should be 4th.molerat said:sheslookinhot said:Ford Money do increase their savings rates for customers, but do not appear in moneyfacts easy access saver. ( would be 4th choice on interest rate).????????????????14th on the list, 12 providers at a higher interest rate

https://moneyfactscompare.co.uk/savings-accounts/easy-access-savings-accounts/

Mortgage free

Vocational freedom has arrived0 -

sheslookinhot said:

I looked again, not on the list and as I said above. Should be 4th.molerat said:sheslookinhot said:Ford Money do increase their savings rates for customers, but do not appear in moneyfacts easy access saver. ( would be 4th choice on interest rate).????????????????14th on the list, 12 providers at a higher interest rate

https://moneyfactscompare.co.uk/savings-accounts/easy-access-savings-accounts/

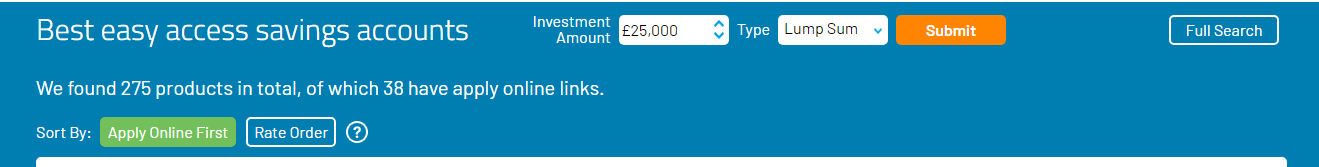

Moneyfacts show accounts they have links for first by default so it will be on there, you'll just have to scroll fairly far down to get it. If you change the settings slightly you will see Ford Money's Flexible Saver much quicker. Click "Rate Order" on the above part of the page.

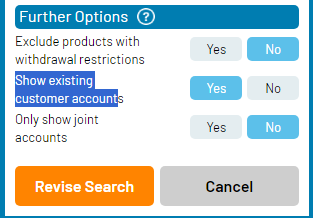

You can also find existing customer only accounts e.g. Barclays Rainy Day Saver by clicking "Full Search" in the image above and then selecting "Yes" to "Show existing customer accounts" followed by "Revise Search" in the image below (should appear on the left hand side of your screen after you've selected "Full Search":

You can do the same with regular savers etc, just have a play around with the settings a bit.1 -

It is there number 15 on the listsheslookinhot said:

I looked again, not on the list and as I said above. Should be 4th.molerat said:sheslookinhot said:Ford Money do increase their savings rates for customers, but do not appear in moneyfacts easy access saver. ( would be 4th choice on interest rate).????????????????14th on the list, 12 providers at a higher interest rate

https://moneyfactscompare.co.uk/savings-accounts/easy-access-savings-accounts/

You need to click the "Rate Order" button and scroll down then select show more

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.4K Banking & Borrowing

- 253.3K Reduce Debt & Boost Income

- 453.8K Spending & Discounts

- 244.4K Work, Benefits & Business

- 599.6K Mortgages, Homes & Bills

- 177.1K Life & Family

- 257.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards