We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Opening NatWest fixed rate ISA account without photo

Comments

-

This should satisfy those doubtershappybagger said:I had the email asking for a selfie - I don't have a camera phone. Asked in branch if I could take in ID, they said yes that would do, as long as I took in the reference number too. However...

... I brought up what many on the ISA forum are claiming is incorrect advice I was given last week by branch staff, where I was told by a 'greeter' no interest was paid before the "start date". Three separate people - the advisor, her boss, and a "financial advisor", spent about 45 minutes trying to get to the bottom of it. The end result is that they state that the "Fixed Rate" account is "opened" on the "start date" and starts earning interest THEN. Not before. They were unable to state what account is "opened" on the date of acceptance or deposit, or if any interest would be paid.

One of the staff actually said (was it a slip of the tongue?) that it seemed to be "deliberately unclear"

Either way, I'm not going to debate it on here as people are now in two camps; but for me it's too opaque for me to deposit anything in that account.

0 -

Alright no boasting, now you're in the promised land at actually managing to get it open, unlike some of us assuming it's in process, but no real idea if it's happeningStargunner said:

This should satisfy those doubtershappybagger said:I had the email asking for a selfie - I don't have a camera phone. Asked in branch if I could take in ID, they said yes that would do, as long as I took in the reference number too. However...

... I brought up what many on the ISA forum are claiming is incorrect advice I was given last week by branch staff, where I was told by a 'greeter' no interest was paid before the "start date". Three separate people - the advisor, her boss, and a "financial advisor", spent about 45 minutes trying to get to the bottom of it. The end result is that they state that the "Fixed Rate" account is "opened" on the "start date" and starts earning interest THEN. Not before. They were unable to state what account is "opened" on the date of acceptance or deposit, or if any interest would be paid.

One of the staff actually said (was it a slip of the tongue?) that it seemed to be "deliberately unclear"

Either way, I'm not going to debate it on here as people are now in two camps; but for me it's too opaque for me to deposit anything in that account.

0

0 -

Luckily I already had a current account with Nat West, so it literally took a few minutes to open from within the app. I doubt it will all be plain sailing though, as I am transferring a S&S ISA transfer to it and I had to print off and post the transfer form to them due to Bestinvest not being part of the electronic ISA transfer scheme. I only opened the iSA with Bestinvest in April to take advantage of the £350 cashback that Quidco were offering and just put the 20K into a short term money market fund. Now that I have received the cashback I will switch it to Nat West.auser99 said:

Alright no boasting, now you're in the promised land at actually managing to get it open, unlike some of us assuming it's in process, but no real idea if it's happeningStargunner said:

This should satisfy those doubtershappybagger said:I had the email asking for a selfie - I don't have a camera phone. Asked in branch if I could take in ID, they said yes that would do, as long as I took in the reference number too. However...

... I brought up what many on the ISA forum are claiming is incorrect advice I was given last week by branch staff, where I was told by a 'greeter' no interest was paid before the "start date". Three separate people - the advisor, her boss, and a "financial advisor", spent about 45 minutes trying to get to the bottom of it. The end result is that they state that the "Fixed Rate" account is "opened" on the "start date" and starts earning interest THEN. Not before. They were unable to state what account is "opened" on the date of acceptance or deposit, or if any interest would be paid.

One of the staff actually said (was it a slip of the tongue?) that it seemed to be "deliberately unclear"

Either way, I'm not going to debate it on here as people are now in two camps; but for me it's too opaque for me to deposit anything in that account.

0

0 -

I'm still waiting for confirmation too.0

-

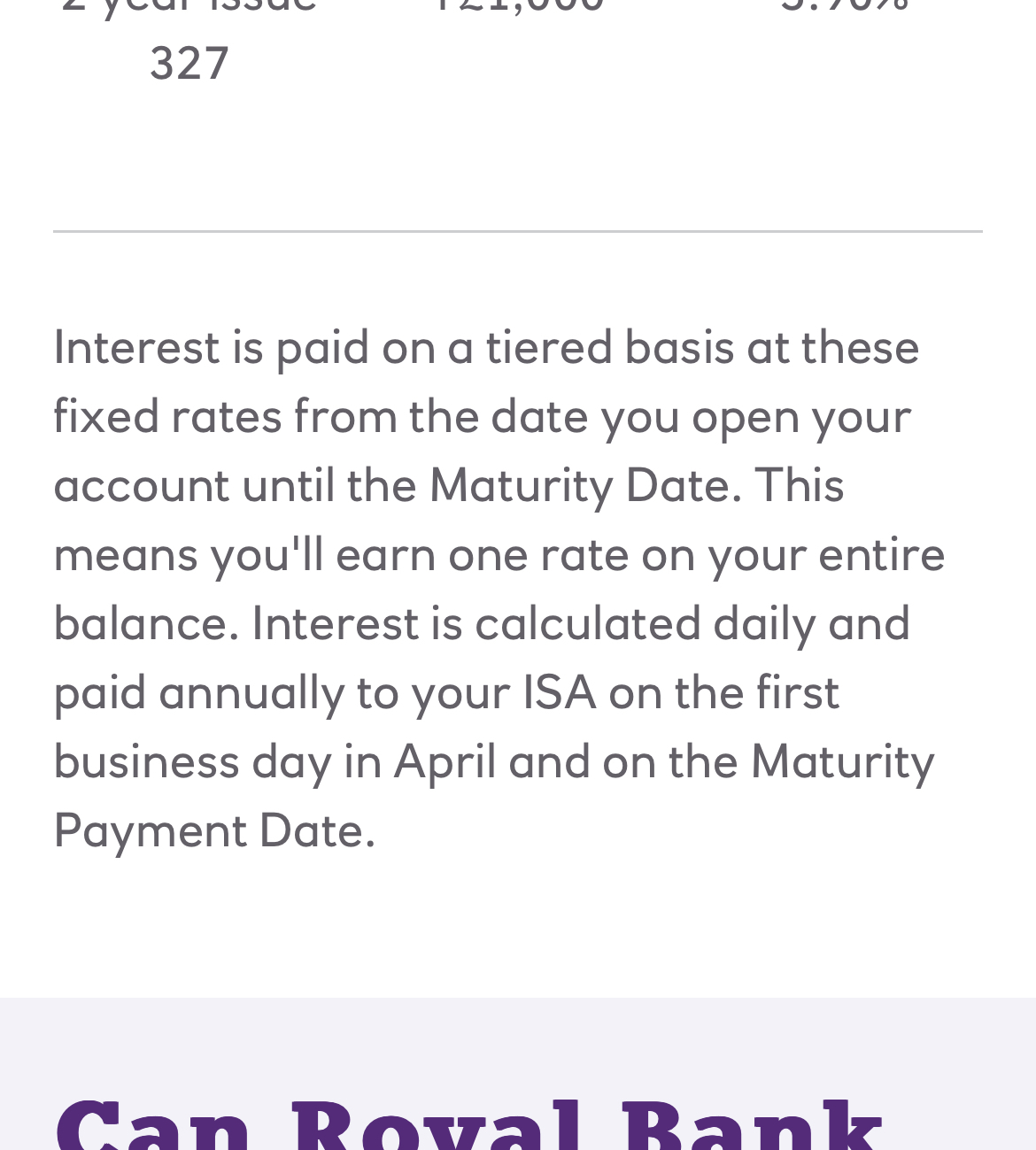

This is what it says on the RBS website. Seems pretty clear to me.happybagger said:I had the email asking for a selfie - I don't have a camera phone. Asked in branch if I could take in ID, they said yes that would do, as long as I took in the reference number too. However...

... I brought up what many on the ISA forum are claiming is incorrect advice I was given last week by branch staff, where I was told by a 'greeter' no interest was paid before the "start date". Three separate people - the advisor, her boss, and a "financial advisor", spent about 45 minutes trying to get to the bottom of it. The end result is that they state that the "Fixed Rate" account is "opened" on the "start date" and starts earning interest THEN. Not before. They were unable to state what account is "opened" on the date of acceptance or deposit, or if any interest would be paid.

One of the staff actually said (was it a slip of the tongue?) that it seemed to be "deliberately unclear"

Either way, I'm not going to debate it on here as people are now in two camps; but for me it's too opaque for me to deposit anything in that account.

Northern Ireland club member No 382 :j1 -

To add insult to injury I was told that "I declined the option to be identified!"

I eventually opened up Shawbrook's 1yr fixed ISA. I applied, opened, funded and confirmed a deposit of 20k, all this morning, although I already had an account with them!

0 -

Sorry didn’t realise I posted that. Of course they are not part of RBS. Have applied to NatWest and awaiting instructions…Stargunner said:

Halifax are not part of RBSJaunty said:

I bank with Halifax, as part of RBS would that make the application process more straightforward do you know?markym3 said:Don't need a photo if an existing customer, as I am. Application was done in a few minutes intitated via app (takes you to a website form to complete the application).0 -

You wonder how hard and fast the "separate FSCS cover" RBS and Natwest have is.Jaunty said:

Sorry didn’t realise I posted that. Of course they are part of RBS. Have applied to NatWest and awaiting instructions…Stargunner said:

Halifax are not part of RBSJaunty said:

I bank with Halifax, as part of RBS would that make the application process more straightforward do you know?markym3 said:Don't need a photo if an existing customer, as I am. Application was done in a few minutes intitated via app (takes you to a website form to complete the application).

If someone went in max allowance on both, for fixed bonds, and then the rules changed, what would happen? An awkward wait for the fixed bond to end to remove your risk?0 -

I don't know for sure, but I imagine if for some reason RBS and NatWest were to be made to share the same licence rather than being on separate licences as they are just now, all customers would have to be permitted to cancel fixes free of charge, and withdraw funds free of charge and close accounts free of charge etc. as it would be a change to their disadvantage under the ts and cs.auser99 said:

You wonder how hard and fast the "separate FSCS cover" RBS and Natwest have is.Jaunty said:

Sorry didn’t realise I posted that. Of course they are part of RBS. Have applied to NatWest and awaiting instructions…Stargunner said:

Halifax are not part of RBSJaunty said:

I bank with Halifax, as part of RBS would that make the application process more straightforward do you know?markym3 said:Don't need a photo if an existing customer, as I am. Application was done in a few minutes intitated via app (takes you to a website form to complete the application).

If someone went in max allowance on both, for fixed bonds, and then the rules changed, what would happen? An awkward wait for the fixed bond to end to remove your risk?If you want me to definitely see your reply, please tag me @forumuser7 Thank you.

N.B. (Amended from Forum Rules): You must investigate, and check several times, before you make any decisions or take any action based on any information you glean from any of my content, as nothing I post is advice, rather it is personal opinion and is solely for discussion purposes. I research before my posts, and I never intend to share anything that is misleading, misinforming, or out of date, but don't rely on everything you read. Some of the information changes quickly, is my own opinion or may be incorrect. Verify anything you read before acting on it to protect yourself because you are responsible for any action you consequently make... DYOR, YMMV etc.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards