We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

TSB £200 switch offer July 2023

Comments

-

I have no need for it, already over my PSA next year as it is and 6% is a very mediocre rate as these things go. I also have other TSB accounts in any case.Stargunner said:

Have either of you not considered keeping your TSB account, so that you can open up the TSB Monthly Saver, which pays a fixed rate of 6% interest for 12 months.WillPS said:

I'm doing the same. My intention is to put a switch request in next week some time, dated for a full month away, that way I'm covered if Natwest subsequently pull the offer.SirHugo said:I'm hoping the £75 bonus arrives sooner rather than later as I'm planning to switch my TSB account to Natwest for their £200 bonus. Don't want to jeopardize the £75 though! I've also still got £20 Topcashback pending on the TSB switch.

If the money from TSB doesn't arrive by the end of March, I'll cancel the Natwest switch so that I can progress the complaint.It is very easy to open another current account to switch to Natwest1 -

Yes, I'm thinking likewise, though I wasn't too sure though how long you could defer the switch date to.WillPS said:

I'm doing the same. My intention is to put a switch request in next week some time, dated for a full month away, that way I'm covered if Natwest subsequently pull the offer.SirHugo said:I'm hoping the £75 bonus arrives sooner rather than later as I'm planning to switch my TSB account to Natwest for their £200 bonus. Don't want to jeopardize the £75 though! I've also still got £20 Topcashback pending on the TSB switch.

If the money from TSB doesn't arrive by the end of March, I'll cancel the Natwest switch so that I can progress the complaint.0 -

Stargunner - yes I already have the TSB Monthly Saver but I think it's worth sacrificing for the Natwest £200 bonus. In all honesty I have more monthly savers than I can keep up with (and afford) at the moment. Most of my savings now are in fixed and notice accounts so I don't have that much 'available cash' currently. I have 3 monthly savers maturing this month, I will only be renewing my reg Club Lloyds saver out of these.Stargunner said:

Have either of you not considered keeping your TSB account, so that you can open up the TSB Monthly Saver, which pays a fixed rate of 6% interest for 12 months.WillPS said:

I'm doing the same. My intention is to put a switch request in next week some time, dated for a full month away, that way I'm covered if Natwest subsequently pull the offer.SirHugo said:I'm hoping the £75 bonus arrives sooner rather than later as I'm planning to switch my TSB account to Natwest for their £200 bonus. Don't want to jeopardize the £75 though! I've also still got £20 Topcashback pending on the TSB switch.

If the money from TSB doesn't arrive by the end of March, I'll cancel the Natwest switch so that I can progress the complaint.It is very easy to open another current account to switch to Natwest0 -

SirHugo said:

Yes, I'm thinking likewise, though I wasn't too sure though how long you could defer the switch date to.WillPS said:

I'm doing the same. My intention is to put a switch request in next week some time, dated for a full month away, that way I'm covered if Natwest subsequently pull the offer.SirHugo said:I'm hoping the £75 bonus arrives sooner rather than later as I'm planning to switch my TSB account to Natwest for their £200 bonus. Don't want to jeopardize the £75 though! I've also still got £20 Topcashback pending on the TSB switch.

If the money from TSB doesn't arrive by the end of March, I'll cancel the Natwest switch so that I can progress the complaint.

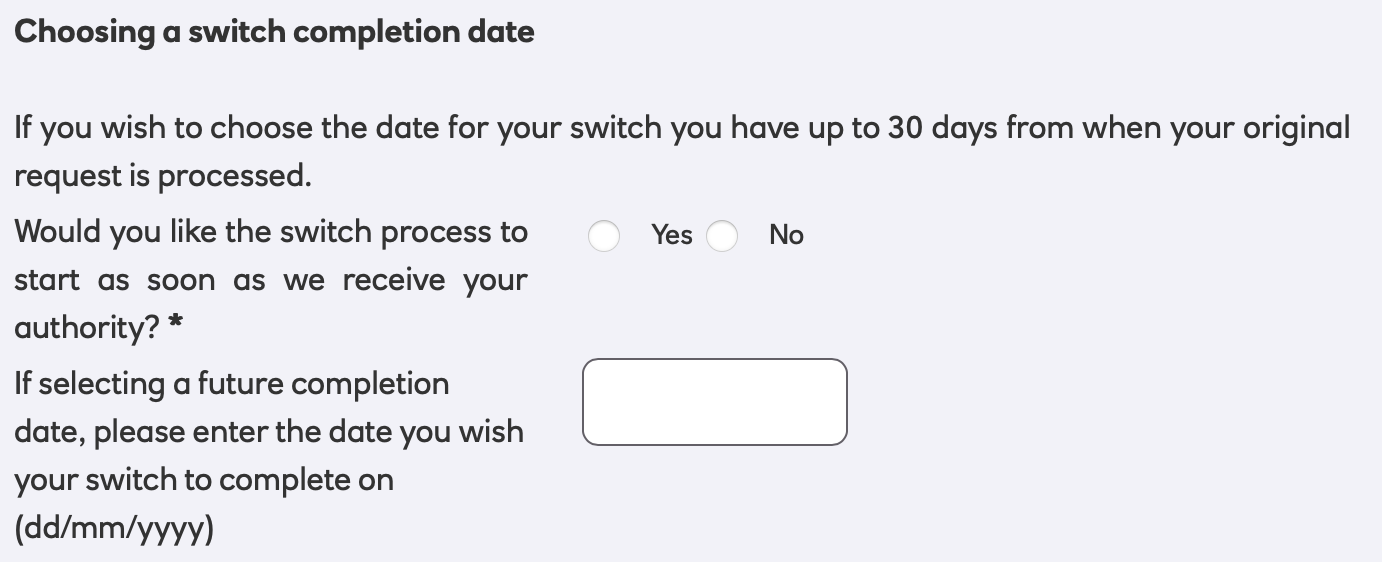

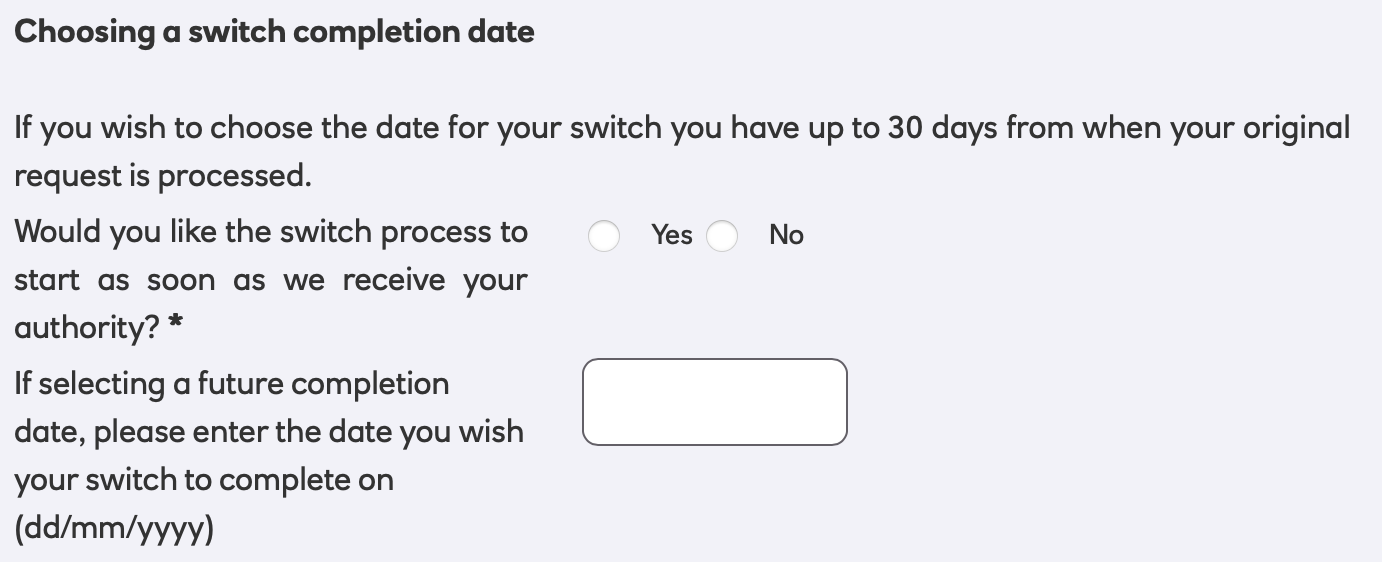

30 days in the future. That's the switch date tho, if you need to cancel it you need to do it 7/8 working days ahead of that, and Easter will throw that a bit, that's why I'm waiting til next week.

1 -

WillPS Not sure where you got your 30 days info from but it didn't work for me. I applied for the account yesterday hoping to set a switch date for April the 8th or 9th. However nowhere during the application process does it allow you to choose a date. Before you know it the application is over.WillPS said:SirHugo said:

Yes, I'm thinking likewise, though I wasn't too sure though how long you could defer the switch date to.WillPS said:

I'm doing the same. My intention is to put a switch request in next week some time, dated for a full month away, that way I'm covered if Natwest subsequently pull the offer.SirHugo said:I'm hoping the £75 bonus arrives sooner rather than later as I'm planning to switch my TSB account to Natwest for their £200 bonus. Don't want to jeopardize the £75 though! I've also still got £20 Topcashback pending on the TSB switch.

If the money from TSB doesn't arrive by the end of March, I'll cancel the Natwest switch so that I can progress the complaint.

30 days in the future. That's the switch date tho, if you need to cancel it you need to do it 7/8 working days ahead of that, and Easter will throw that a bit, that's why I'm waiting til next week.

Although my identity checks were approved and my account was 'reserved' I didn't get a confirmation email until today saying the account is being set up.

Then to my surprise a few hours later I received a text and email saying my switch has started and will be completed by 19/03/24. Although I have my new account details, the pin and password aren't being recognised yet so I can't log in to see what my options are. It's looking very likely now that I'm going to lose my final TSB payment.

I did also apply for the RBS account too using a Chase CA for the switch but that bombed out on me during the application although I did manage to complete the photo identity check. I'll chase this one up after I hopefully sort out the TSB switch.0 -

Open the account without a switch, then switch as an existing customer:SirHugo said:

WillPS Not sure where you got your 30 days info from but it didn't work for me. I applied for the account yesterday hoping to set a switch date for April the 8th or 9th. However nowhere during the application process does it allow you to choose a date. Before you know it the application is over.WillPS said:SirHugo said:

Yes, I'm thinking likewise, though I wasn't too sure though how long you could defer the switch date to.WillPS said:

I'm doing the same. My intention is to put a switch request in next week some time, dated for a full month away, that way I'm covered if Natwest subsequently pull the offer.SirHugo said:I'm hoping the £75 bonus arrives sooner rather than later as I'm planning to switch my TSB account to Natwest for their £200 bonus. Don't want to jeopardize the £75 though! I've also still got £20 Topcashback pending on the TSB switch.

If the money from TSB doesn't arrive by the end of March, I'll cancel the Natwest switch so that I can progress the complaint.

30 days in the future. That's the switch date tho, if you need to cancel it you need to do it 7/8 working days ahead of that, and Easter will throw that a bit, that's why I'm waiting til next week.

Although my identity checks were approved and my account was 'reserved' I didn't get a confirmation email until today saying the account is being set up.

Then to my surprise a few hours later I received a text and email saying my switch has started and will be completed by 19/03/24. Although I have my new account details, the pin and password aren't being recognised yet so I can't log in to see what my options are. It's looking very likely now that I'm going to lose my final TSB payment.

I did also apply for the RBS account too using a Chase CA for the switch but that bombed out on me during the application although I did manage to complete the photo identity check. I'll chase this one up after I hopefully sort out the TSB switch.

1 -

Ahh - easy when you know how. It's a bit annoying as being able to choose your switch date is usually included in the application process. Oh well, at least I know now for next time.WillPS said:

Open the account without a switch, then switch as an existing customer:SirHugo said:

WillPS Not sure where you got your 30 days info from but it didn't work for me. I applied for the account yesterday hoping to set a switch date for April the 8th or 9th. However nowhere during the application process does it allow you to choose a date. Before you know it the application is over.WillPS said:SirHugo said:

Yes, I'm thinking likewise, though I wasn't too sure though how long you could defer the switch date to.WillPS said:

I'm doing the same. My intention is to put a switch request in next week some time, dated for a full month away, that way I'm covered if Natwest subsequently pull the offer.SirHugo said:I'm hoping the £75 bonus arrives sooner rather than later as I'm planning to switch my TSB account to Natwest for their £200 bonus. Don't want to jeopardize the £75 though! I've also still got £20 Topcashback pending on the TSB switch.

If the money from TSB doesn't arrive by the end of March, I'll cancel the Natwest switch so that I can progress the complaint.

30 days in the future. That's the switch date tho, if you need to cancel it you need to do it 7/8 working days ahead of that, and Easter will throw that a bit, that's why I'm waiting til next week.

Although my identity checks were approved and my account was 'reserved' I didn't get a confirmation email until today saying the account is being set up.

Then to my surprise a few hours later I received a text and email saying my switch has started and will be completed by 19/03/24. Although I have my new account details, the pin and password aren't being recognised yet so I can't log in to see what my options are. It's looking very likely now that I'm going to lose my final TSB payment.

I did also apply for the RBS account too using a Chase CA for the switch but that bombed out on me during the application although I did manage to complete the photo identity check. I'll chase this one up after I hopefully sort out the TSB switch.

Thankfully I've heard from RBS today that my application has been successful so if I receive the £200 bonus on both switches it'll make the TSB loss a bit more palatable.0 -

I think the last two post should be in the Feb 24 TSB switch post. Still waiting on my £75 Stay bonus....0

-

pecunianonolet said:I think the last two post should be in the Feb 24 TSB switch post. Still waiting on my £75 Stay bonus....

They're related to the TSB account tho - we want to use the TSB accounts as donors once that same £75 payment comes through

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards