We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

We're aware that some users are experiencing technical issues which the team are working to resolve. See the Community Noticeboard for more info. Thank you for your patience.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Quilter S&S ISA - 7%

Options

Comments

-

Yes there were charges from Quilter and the IFAboingy said:

Talking about "Locking in your loss" is a very emotional way to approach investing. Just because a fund has performed badly over five years doesn't mean it is going to automatically recover and more in the next five years. In fact, underperforming funds often continue to under perform, either because of poor management or excessive fees, or both.. Maybe it will make some gains in the next few years but there is almost certainly another fund that will outperform it.Reg_Smeeton said:

If you switch to cash you are locking in your loss and accepting a negative return in the near term as well (when factoring in inflation). I wouldn’t do it.SJG1962 said:The question is should we accept that loss and close the ISA and instead open a fixed interest savings account, 5% rates now & tax free benefit of an ISA is irrelevant to us. At the moment there does not seem any prospect of the s&s ISA increasing in value.

Most of the Wealth Select 4 funds at Quilter look to have done OK over the last five years so I'm wondering if there are charges or commission that have dragged the ISA performance down. I think those funds are only available via financial advisors, which is always a red flag to me.0 -

SJG1962 said:

If I could see performance over last 5 years had been -7.58% I would not make the same investmentInvesterJones said:Would you invest in the fund now that it's at a 7% discount compared to the price 5 years ago?Presumably the answer is yes, since you were willing to invest in it when it was more expensive. Unless something else has changed which affects your investment strategy, in which case, absolutely worth looking what meets your needs now.I'm afraid you'll have to rule out clairvoyance as your criteria for choosing funds. Imagine you're making a fresh investment of the amount currently in the fund. Have your reasons for choosing that style of investment changed? If yes, then consider afresh where to put them. If no, then presumably the same choice will be made, if not more strongly now they're at a 7% discount compared to 5 years ago.I will add that 5 years is a relatively short timeframe to be looking for a positive return from investments, so maybe if you were looking for that then something else might be suitable.1 -

Then it looks like Quilter and the IFA have charged you about 4% per annum between them, which would be excessive.SJG1962 said:

Yes there were charges from Quilter and the IFAboingy said:

Talking about "Locking in your loss" is a very emotional way to approach investing. Just because a fund has performed badly over five years doesn't mean it is going to automatically recover and more in the next five years. In fact, underperforming funds often continue to under perform, either because of poor management or excessive fees, or both.. Maybe it will make some gains in the next few years but there is almost certainly another fund that will outperform it.Reg_Smeeton said:

If you switch to cash you are locking in your loss and accepting a negative return in the near term as well (when factoring in inflation). I wouldn’t do it.SJG1962 said:The question is should we accept that loss and close the ISA and instead open a fixed interest savings account, 5% rates now & tax free benefit of an ISA is irrelevant to us. At the moment there does not seem any prospect of the s&s ISA increasing in value.

Most of the Wealth Select 4 funds at Quilter look to have done OK over the last five years so I'm wondering if there are charges or commission that have dragged the ISA performance down. I think those funds are only available via financial advisors, which is always a red flag to me.

Work out how they've charged you - did the IFA take a fee at the start, and if so, was it comparable to what other IFAs charge? Get the amount Quilter says the underlying fund has grown, and how much they've charged you - again, was there any one-off charge at the beginning, and what have their ongoing charges been?

Tell us whether it was the WealthSelect Managed Active 4, or the WealthSelect Managed Balanced 4, fund. Tell us how much you invested at the start, and how much you invested after that (sorry, but since the IFA fee may be a fixed amount rather than a percentage, we'd have to know that to see if that accounts for the high percentage loss).0 -

Then it looks like Quilter and the IFA have charged you about 4% per annum between them, which would be excessive.That is not possible. It would breach the Quilter software cap. It's more likely be a Quilter FA rather than an IFA but even they do not charge that much.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

I find this confusing. I'm just comparing this to The Vanguard 60% Life Strategy fund which despite the rocky times in recent years would still be up something like 15-20% in five years.I can easily find the charges, performance and what the investments are. Quilter seems very tricky and even looking at a document called making charges clear doesn't make things very clear. This looks more like an advisor making a decent percentage. Did the advisor show different options or were they just a salesman promoting Quilter products?

0 -

Did the advisor show different options or were they just a salesman promoting Quilter products?In one post the OP said it was an FA and in another an IFA. Quilter has a salesforce and the fact that quilter platform and a quilter fund solution was used would lean towards it being a sales rep of Quilter. Whilst an IFA can use the Quilter platform and Quilter DFM portfolio solutions, it would be unusual for an IFA to use the fund solutions.Quilter seems very tricky and even looking at a document called making charges clear doesn't make things very clear.To be fair, Quilter use the industry standard methods of disclosure. These have their quirks and issues (with all platforms) but their disclosures are easy to follow. In seconds I was able see the DFM charge and the weighted fund OCF. Platform charge is not possible to tell as they may not be on the default charge. These are often bespoke to the adviser.I'm just comparing this to The Vanguard 60% Life Strategy fund which despite the rocky times in recent years would still be up something like 15-20% in five years.That is not a fair comparison as the quilter 4 portfolios have much lower allocations to equities. Sitting mostly between VLS20 and VLS40 and performance sits in line with those.This looks more like an advisor making a decent percentage.Or the OP is taking a regular withdrawal (or ad-hoc withdrawals) Or the income is being distributed. or the money wasn't all invested on day 1 but over a period.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.2 -

Even the VLS20 is not showing a negative return over the last 5 years, so for the OP's Quilter fund to be showing a 7% loss over 5 years, I was also wondering if any withdrawals have been made or income distributed. If the money has definitely remained fully invested over the full 5 years, then it would seem to be a poor performer compared to funds of a similar risk level, and/or the costs are higher.That is not a fair comparison as the quilter 4 portfolios have much lower allocations to equities. Sitting mostly between VLS20 and VLS40 and performance sits in line with those.

Or the OP is taking a regular withdrawal (or ad-hoc withdrawals) Or the income is being distributed. or the money wasn't all invested on day 1 but over a period.

My view would be that the OP should consider staying invested if their original intention was to stay invested for the long-term, but not necessarily with that particular fund.

0 -

Thanks for the interest (no pun intended) and responses.

There have not been any withdrawals and it was definitely an IFA that recommended the fund and charged a fee at the beginning. It was the Quilter 'Wealth Select Managed Blend 4', and I’ve asked for a breakdown of total fees and charges per year since 2018 from them.

It may well be that the fees have been higher than the industry standard. When I contacted Quilter about 6 months ago to ask about any performance data available to allow comparisons, they said there was none for them as an organisation, including fees charged or customer feedback, and I should contact my IFA.

I guess at the end of the day my thoughts are do I accept I’ve just had poor performance & look for an alternative S&S ISA with a different provider that might perform better, or should I ‘cash in’ the ISA and put money into a fixed interest savings account? I did have that option 5 years ago when there was a 5 year fix for around 4.5%.0 -

The IFA charge has been 1% per year.0

-

There have not been any withdrawals and it was definitely an IFA that recommended the fund and charged a fee at the beginning. It was the Quilter 'Wealth Select Managed Blend 4', and I’ve asked for a breakdown of total fees and charges per year since 2018 from them.I would say it is very unusual for an IFA to use a solution that is designed to be used by the Quilter FAs. On the paperwork from the adviser back then (headed paper), does it say that they were an appointed representative of Intrinsic? - it doesn't really matter in the scheme of things but just surprised that is all.

You have been getting an annual breakdown of charges since 2018 as that is the year MIFIDII required it to start.

However, that particular portfolio (as its not a fund) costs 0.45% as the weighted OCF and 0.15% for the DFM. Platform charge and adviser charge would be on top. If we guess the platform charge at 0.25% and the adviser charge at 0.50% then that gives you a total of 1.35%. That is not particularly high for a portfolio that is a blend of passive and active.

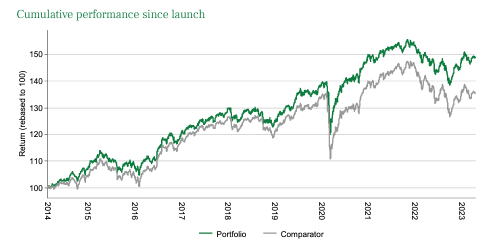

Plus, that portfolio performance shows that it is higher currently than any point in 2018. (that performance is inclusive of all fund charges but not platform and adviser.

So, something is not adding up.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 350.9K Banking & Borrowing

- 253.1K Reduce Debt & Boost Income

- 453.5K Spending & Discounts

- 243.9K Work, Benefits & Business

- 598.8K Mortgages, Homes & Bills

- 176.9K Life & Family

- 257.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards