We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

No Fault Evictions {Merged}

Comments

-

I think many University towns have the same problem. We did a lot of work in Exeter and nearly every time we saw new builds they were for students. They are quite well built because much student accommodation is let to holiday makers in the summer. The non University new builds were very often too expensive for “ordinary” mortals to afford.Chrysalis said:BikingBud said:

Is there really a shortage of housing or is it the enforced musical chairs, due to S21 evictions, that makes it appear that there is insufficientMurphybear said:

If that were to happen what would the outcome be? My best guess is that no-one would be a landlord any more. How would you feel if someone demanded that you sell them your house at a discount? This would end up the same way that social housing has ie not enough to go round. We need to keep rental properties in the system.[Deleted User] said:This is good news. Landlords can't be trusted with no fault evictions.

It will take time but as they leave the market better landlords will take up, and prices will fall so renters can buy.

Combined with 100% mortgages accounting for rent payments, hopefully many will be able to buy the place they are already in at a nice discount.On a national level not sure, but there is LA's that have horrible supply problems.Leicester for example has 2 universities worth of students filling student accommodation and has a huge shortage of housing.For social housing it cant be treated as a national stock, as people can only apply in their own area, or in areas they have ties to.For private housing stock I expect likewise it varies from area to area, but I think at the very least in big parts of the country now, especially in city areas the demand is outpacing the supply, according to a news article its lower end housing worst affected such as terraced housing. Flats have long been under more pressure than larger houses as well. A reason we have the bedroom tax problem.

The country should have never got itself into a position where it’s relying on private landlords to house people.0 -

Here’s the best data I can find, 1966 to present day, from the land registry.As can be seen the rise in house prices is steady and relentless…. But with expected small dips here and there.No crashes. Not ever. Not in at least 57 years anyway.I did see similar somewhere for 1952 onwards, but can’t find it now, but the story is the same.There’s my evidence for yellowsub, crashytime or whatever they’re called.4

-

We build on green field sites before. All sites were green field at one point.

There was a lot of building after WW2, to replace houses that had been destroyed by bombing, and to provide housing for the growing population of baby boomers. Much of it was on greenbelt.

It's frankly disgusting when people who benefitted from that say that now we have reached the limit of how much greenbelt can be built on, so sorry you can only have this overpriced micro house built on a flood plane.0 -

Indeed we did, I remember the prefab houses still standing the early 1960s.[Deleted User] said:We build on green field sites before. All sites were green field at one point.

There was a lot of building after WW2, to replace houses that had been destroyed by bombing, and to provide housing for the growing population of baby boomers. Much of it was on greenbelt.

It's frankly disgusting when people who benefitted from that say that now we have reached the limit of how much greenbelt can be built on, so sorry you can only have this overpriced micro house built on a flood plane.The problem isn’t so much the space…..we have lots of space.

the problem is that most of the space is where people don’t really want to live (not all of it)

the bigger problem is that we don’t have the infrastructure to cope with millions of new houses

we don’t have

enough roads

enough sewage treatment

enough pipes or clean water to run in those pipes to the new houses

enough schools for the extra population living in these yet to built homes

enough hospitals ditto

enough doctors ditto

a big enough electricity grid ditto

and Lots of other things lacking.It’s not just the homes or the space, it’s everything else too.There will never be enough homes to cope with probably an 80m population in 10 years time.So any landlords that still exist will be ultra ultra choosy and careful about who they rent to, only the cream of the prospective tenants will secure a tenancy.But that’s the market all this new regulation will create.3 -

£8000 it`s doable for a couple FTB:CurlySue2017 said:[Deleted User] said:I recently visited Sheffield for a University open day. Part of my research was looking at property to rent/buy.

Coming from SW England, I was amazed at how cheap properties seem to be.

Looking on Rightmove this morning, houses for sale within 40miles of Sheffield (chosen as it's reasonably central and encompasses many towns) up to £100k. There are approx 1,000 properties available, 500 or so at up to £80k

Minimum wage is now £10.42ph or £20,319pa based on a 37.5hr week.

With an £8,000 deposit, a minimum wage worker can buy a two bedroom house for £80,000, with mortgage repayments around £428 per month.

A young couple, both on minimum wage will be earning over £40k per year. That two bed home is a mere 2 x combined salary.

They can comfortably buy a far better home and they're just minimum wage workers.

And some people think there's a crash coming??? Looks like plenty of scope for further price increases to me...This is the problem.How is someone paying out ridiculous amounts in rent and also other spiralling bills supposed to save £8000?That would take me years and of course by the time I have reached the magic target figure, it would be worth much less and the saving would have to start all over again. And so it goes on.

Each to have a Lisa account, that means they need only £6400, if both was done 4 bank account switches( at an average of £150 each switch) that`s taking it to £5200, that means in 2 years each should save monthly less than £110. And if they can do a little bit of stoozing that`s even better.

But they can go for 95% LTV mortgage.

And about jobs, there are now loads of jobs that allow to work from home, the only thing you need is a good Broadband2 -

Thanks for the link, looks like the idea of millions of homeless private renters is still a bit in the future?MultiFuelBurner said:

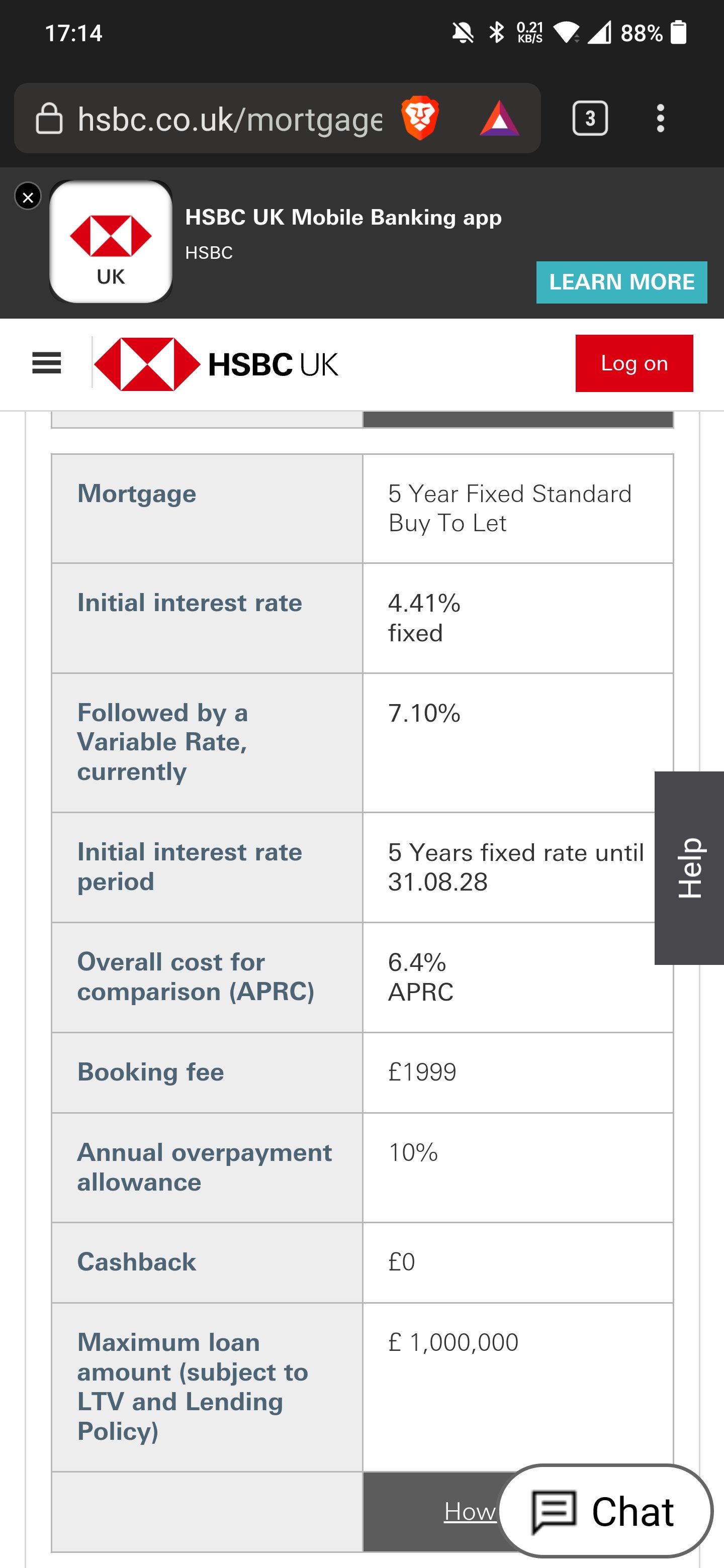

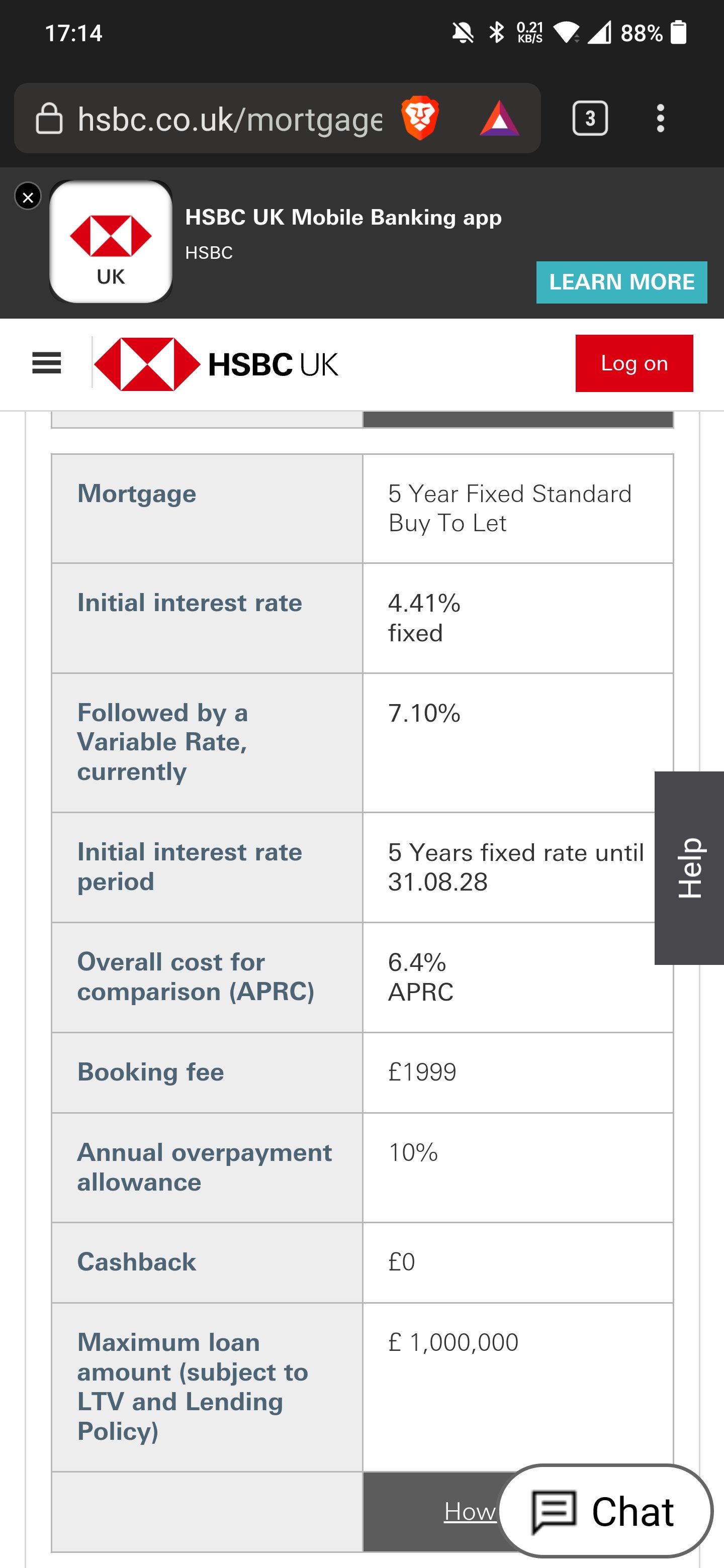

I cant share the broker deal as we don't have an arrangement fee like the one I can share below with a £1999 booking fee.Sarah1Mitty2 said:

Sounds interesting, do you have a link to the deal or similar deals?MultiFuelBurner said:

To add to this there was a mortgage vehicle offered to us by our broker of 4.5% 5 year fix on BTL should we want to increase the portfolio. We have a long history with this broker and the mortgage company behind the curtain.caprikid1 said:

Sad to say, your limited youtube economic theories may be interesting but those who are actually putting their necks on the line and lending money are not seeing it that way.Yellowsub2000 said:The only way to get inflation under control is raise rates above inflation and inflation is raging over 10%.

What are today's UK mortgage rates? | 22 May 2023 | Uswitch

5 year rates are lower than 2 year rates, that is not an indication that the smart people think rates are upward trending. Obviously those making sensational youtube videos for wanabee influencer economists may be upset at this reality but these are the facts by the people making the real decisions with real money.

As you say lenders don't give you below bank rates fixed for 5 years if they believe interest rates will be above what they are lending on average. It suggests the 3% or lower mark in 5 years time.

The below is an off the shelf open to any landlord 4.41% 5 year fix

The fact it is set at this level below the BoE 4.5% rate shows there is confidence in this rate reducing significantly during the 5 years. Banks do like their profits😂👍 @Sarah1Mitty2 0

0 -

We built the infrastructure too back then.motorman99 said:

Indeed we did, I remember the prefab houses still standing the early 1960s.[Deleted User] said:We build on green field sites before. All sites were green field at one point.

There was a lot of building after WW2, to replace houses that had been destroyed by bombing, and to provide housing for the growing population of baby boomers. Much of it was on greenbelt.

It's frankly disgusting when people who benefitted from that say that now we have reached the limit of how much greenbelt can be built on, so sorry you can only have this overpriced micro house built on a flood plane.The problem isn’t so much the space…..we have lots of space.

the problem is that most of the space is where people don’t really want to live (not all of it)

the bigger problem is that we don’t have the infrastructure to cope with millions of new houses

we don’t have

enough roads

enough sewage treatment

enough pipes or clean water to run in those pipes to the new houses

enough schools for the extra population living in these yet to built homes

enough hospitals ditto

enough doctors ditto

a big enough electricity grid ditto

and Lots of other things lacking.It’s not just the homes or the space, it’s everything else too.There will never be enough homes to cope with probably an 80m population in 10 years time.So any landlords that still exist will be ultra ultra choosy and careful about who they rent to, only the cream of the prospective tenants will secure a tenancy.But that’s the market all this new regulation will create.

The shortage of doctors and the like is because of austerity and Tory policy. Again, the demographics skew older when it comes to voting for that stuff, so it's grossly unfair to use it as an excuse not to build enough new houses.

There will always be reasons not to do it, but we need those houses. Stopping the boats or tinkering with the planning rules won't help, we need a major intervention.0 -

Fingers crossed but sadly more on benefits will be homeless. Just a by product of the rent reform bill.Sarah1Mitty2 said:

Thanks for the link, looks like the idea of millions of homeless private renters is still a bit in the future?MultiFuelBurner said:

I cant share the broker deal as we don't have an arrangement fee like the one I can share below with a £1999 booking fee.Sarah1Mitty2 said:

Sounds interesting, do you have a link to the deal or similar deals?MultiFuelBurner said:

To add to this there was a mortgage vehicle offered to us by our broker of 4.5% 5 year fix on BTL should we want to increase the portfolio. We have a long history with this broker and the mortgage company behind the curtain.caprikid1 said:

Sad to say, your limited youtube economic theories may be interesting but those who are actually putting their necks on the line and lending money are not seeing it that way.Yellowsub2000 said:The only way to get inflation under control is raise rates above inflation and inflation is raging over 10%.

What are today's UK mortgage rates? | 22 May 2023 | Uswitch

5 year rates are lower than 2 year rates, that is not an indication that the smart people think rates are upward trending. Obviously those making sensational youtube videos for wanabee influencer economists may be upset at this reality but these are the facts by the people making the real decisions with real money.

As you say lenders don't give you below bank rates fixed for 5 years if they believe interest rates will be above what they are lending on average. It suggests the 3% or lower mark in 5 years time.

The below is an off the shelf open to any landlord 4.41% 5 year fix

The fact it is set at this level below the BoE 4.5% rate shows there is confidence in this rate reducing significantly during the 5 years. Banks do like their profits😂👍 @Sarah1Mitty2

Good news that inflation now 8.7% as well so things may be looking up.1 -

Not going to happen but in this situation, the landlord must sell to a housing association or local authority at a fair market price, and before the tenants are evicted. Everyone wins, house remains as rental stock, landlord sells quickly and tenants get to stay in their home if they choose to.eddddy said:

Although I'm not sure how it will deal with dodgy situations like- The landlord evicts to sell the property - but the sale "unexpectedly" falls through 2 weeks later, and so the landlord decides to rent it out again

0 -

"Not going to happen but in this situation, the landlord must sell to a housing association or local authority at a fair market price, and before the tenants are evicted. "

Can you link to this please, that sounds a really interesting piece of legislation that could further put a nail in the coffin of the rental market.3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards