We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

PLEASE READ BEFORE POSTING: Hello Forumites! In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non-MoneySaving matters are not permitted per the Forum rules. While we understand that mentioning house prices may sometimes be relevant to a user's specific MoneySaving situation, we ask that you please avoid veering into broad, general debates about the market, the economy and politics, as these can unfortunately lead to abusive or hateful behaviour. Threads that are found to have derailed into wider discussions may be removed. Users who repeatedly disregard this may have their Forum account banned. Please also avoid posting personally identifiable information, including links to your own online property listing which may reveal your address. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

No Fault Evictions {Merged}

Comments

-

Why do you think those houses are so cheap?[Deleted User] said:I recently visited Sheffield for a University open day. Part of my research was looking at property to rent/buy.

Coming from SW England, I was amazed at how cheap properties seem to be.

Looking on Rightmove this morning, houses for sale within 40miles of Sheffield (chosen as it's reasonably central and encompasses many towns) up to £100k. There are approx 1,000 properties available, 500 or so at up to £80k

Minimum wage is now £10.42ph or £20,319pa based on a 37.5hr week.

With an £8,000 deposit, a minimum wage worker can buy a two bedroom house for £80,000, with mortgage repayments around £428 per month.

A young couple, both on minimum wage will be earning over £40k per year. That two bed home is a mere 2 x combined salary.

They can comfortably buy a far better home and they're just minimum wage workers.

And some people think there's a crash coming??? Looks like plenty of scope for further price increases to me...

Maybe if older people were willing to move into them, and sell their house nearer to jobs and schools to someone got £80k, you might have a point.0 -

And much higher interest rates.MultiFuelBurner said:

I was reading this and other sources as I was also looking back to the last recession 2008 and the effects on interest rates and house prices trying to do my own best guess on what might happen.caprikid1 said:I appreciate it's not youtube so limited credibility but..

IMF Expects no recession in the UK...https://www.bbc.co.uk/news/business-65669399

The fact we are likely to skim recession this year just means a likelyhood we have a period of stability.0 -

Sounds interesting, do you have a link to the deal or similar deals?MultiFuelBurner said:

To add to this there was a mortgage vehicle offered to us by our broker of 4.5% 5 year fix on BTL should we want to increase the portfolio. We have a long history with this broker and the mortgage company behind the curtain.caprikid1 said:

Sad to say, your limited youtube economic theories may be interesting but those who are actually putting their necks on the line and lending money are not seeing it that way.Yellowsub2000 said:The only way to get inflation under control is raise rates above inflation and inflation is raging over 10%.

What are today's UK mortgage rates? | 22 May 2023 | Uswitch

5 year rates are lower than 2 year rates, that is not an indication that the smart people think rates are upward trending. Obviously those making sensational youtube videos for wanabee influencer economists may be upset at this reality but these are the facts by the people making the real decisions with real money.

As you say lenders don't give you below bank rates fixed for 5 years if they believe interest rates will be above what they are lending on average. It suggests the 3% or lower mark in 5 years time.0 -

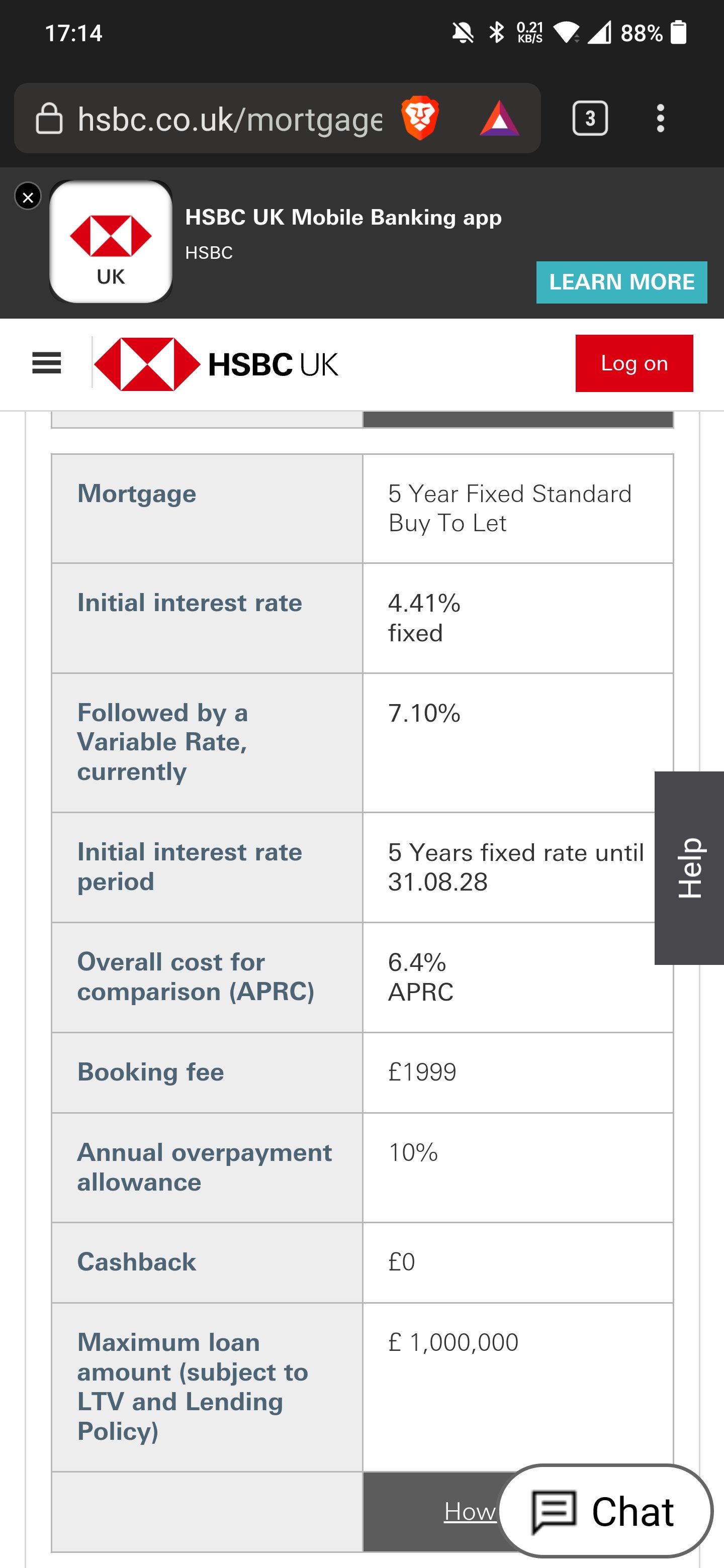

I cant share the broker deal as we don't have an arrangement fee like the one I can share below with a £1999 booking fee.Sarah1Mitty2 said:

Sounds interesting, do you have a link to the deal or similar deals?MultiFuelBurner said:

To add to this there was a mortgage vehicle offered to us by our broker of 4.5% 5 year fix on BTL should we want to increase the portfolio. We have a long history with this broker and the mortgage company behind the curtain.caprikid1 said:

Sad to say, your limited youtube economic theories may be interesting but those who are actually putting their necks on the line and lending money are not seeing it that way.Yellowsub2000 said:The only way to get inflation under control is raise rates above inflation and inflation is raging over 10%.

What are today's UK mortgage rates? | 22 May 2023 | Uswitch

5 year rates are lower than 2 year rates, that is not an indication that the smart people think rates are upward trending. Obviously those making sensational youtube videos for wanabee influencer economists may be upset at this reality but these are the facts by the people making the real decisions with real money.

As you say lenders don't give you below bank rates fixed for 5 years if they believe interest rates will be above what they are lending on average. It suggests the 3% or lower mark in 5 years time.

The below is an off the shelf open to any landlord 4.41% 5 year fix

The fact it is set at this level below the BoE 4.5% rate shows there is confidence in this rate reducing significantly during the 5 years. Banks do like their profits😂👍 @Sarah1Mitty2

0 -

Slightly off topic but I have had mostly bad landlords over the years, it was hugely they thought they knew better than the law and acted like I should be greatful to get a roof over my head, and the times I was unemployed it was even worse as I also got the "my taxes pay for you"The only times I had good landlords were in places I didn't stay long due to income issues (such as leaving college, or losing a job)I always remember the landlord who never turned up to pickup rent despite telling me he would collect it each Friday between 1-4, i'd wait until as late as 8pm (so wasted all day) and go out only to get calls saying I was avoiding him, the same landlord only wanted cash in hand and refused to give out bank details, no surprise he illegally evicted me and kept over £1000 in possessions then left threatening voicemails (and the Police werent interested and said it was a civil matter, and blamed me for "not paying rent")Another told the council I had did a runner so my HB was stopped whilst they investigated (the reality was he wanted rent direct and I refused as he had not done repairs and even blamed me for things like roof leaks) which meant I paid late and then he could get rent paid direct to him, and when I moved out I spent £40 on cleaning materials and spent a few hours a day for a week cleaning and when I moved out he claimed the property hadn't been cleaned in the 3 years I lived there and that I did around £2000 in damages, this was right before protected deposits came in so never got that deposit back.1

-

If mortgage rates rise, savings rates will broadly move in tandem.Sarah1Mitty2 said:

How will it do that?[Deleted User] said:

I pray that you're correct. It'll bring my retirement several years forward.Yellowsub2000 said:Mortgage rates could be double digits by 2025.

many are agreeing here is just one example

https://youtu.be/8BnZvz1bRoM

Sadly, there is absolutely no indication that this is going to happen.

The consensus is that now is a good time to secure fixed term incomes (as rates are likely to fall in the medium term), you're suggesting that returns could double within the next two years. That's quite a prediction!

If rates were to hit 10%, cash savings will double in value every seven years.

Of course, it's not going to happen, so I'll continue praying in the meantime...

0 -

Ah….the fairyland of Walter Mitty, yellowsub et al.

there will be no crash.Nearly 70m people in the uk now. They’ve got to all live somewhere, and since we’re an island, they can’t make any more land.

so house prices, and rents, over time, will only ever go one way

UP.

But do please carry on in your utopia dreamland, and in the meantime, thanks for the rent, I’m going to crack open another bottle of champagne on the very handy monthly rent I have coming in from my very good, very regular, very reliable, and very checked out tenants.CHEERS!3 -

Indeed, but perhaps they don't need to make any more.motorman99 said:Ah….the fairyland of Walter Mitty, yellowsub et al.

there will be no crash.Nearly 70m people in the uk now. They’ve got to all live somewhere, and since we’re an island, they can’t make any more land.

The UK National Ecosystem Assessment (NEA), for example, estimates that less than 1% of the country is "built on". Ordnance Survey data suggests that all the buildings in the UK - all the houses, shops, offices, factories, greenhouses, etc. - cover only 1.4% of the total land surface.

Even if we doubled the number of buildings, an incredibly impossible achievement, they would still cover less than 3% of the UK.

1 -

Thread gone too political for me, I am waving bye bye guys, enjoy the discussions.

1 -

You have it backwards. The higher the base rate the less profit banks make. They could borrow for near zero basic free for last two decades that has come to a end.MultiFuelBurner said:You really know nothing about economics do you. Higher interest rates mean bigger profits for banks.

I have asked the moderators as to why you keep trolling the forum with your nonsense.

Hope they act soon.

https://www.cityam.com/uk-banks-set-to-report-record-profits-of-37bn-beating-pre-financial-crisis-highs/

Now the base rate is creeping up it puts more pressure on everyone

Leas people are borrowing

banks need more people to borrow to make more profit

the less people who borrow the less profit

this is why so many banks around the world are collapsing and so many near to collapse

it’s spreading from USA to Europe even Swiss banks which were thought to be the safest0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.2K Work, Benefits & Business

- 600.9K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards