We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Multiple ISAs

Bluesden

Posts: 4 Newbie

I have a Cash ISA question for the forum that is probably pretty simple but is stumping me...

During this tax year (22/23) I transferred in an existing Cash ISA to a new Fixed Cash ISA. No new money has been paid into this ISA. All money transferred in was deposited in previous tax years.

I am now in a position to be able to add money but obviously cannot add to my existing Fixed ISA.

Am I able to open a new cash ISA (either fixed or 'normal') in this tax year, add my new cash up to this tax years deposit limit and have the two Cash ISAs running side by side?

During this tax year (22/23) I transferred in an existing Cash ISA to a new Fixed Cash ISA. No new money has been paid into this ISA. All money transferred in was deposited in previous tax years.

I am now in a position to be able to add money but obviously cannot add to my existing Fixed ISA.

Am I able to open a new cash ISA (either fixed or 'normal') in this tax year, add my new cash up to this tax years deposit limit and have the two Cash ISAs running side by side?

0

Comments

-

Yes, there is no limit to the number of ISAs you can have. You just need to make sure that you only pay into one cash ISA per tax year.

1 -

If you spend some time reading through this forum, you will see similar questions being answered all the time. So it is a good way to get up to speed with ISA rules.1

-

Why is it obvious (to us) that you cannot add to your existing Fixed ISA?Bluesden said:I have a Cash ISA question for the forum that is probably pretty simple but is stumping me...

During this tax year (22/23) I transferred in an existing Cash ISA to a new Fixed Cash ISA. No new money has been paid into this ISA. All money transferred in was deposited in previous tax years.

I am now in a position to be able to add money but obviously cannot add to my existing Fixed ISA.

Am I able to open a new cash ISA (either fixed or 'normal') in this tax year, add my new cash up to this tax years deposit limit and have the two Cash ISAs running side by side?

0 -

nottsphil said:

Why is it obvious (to us) that you cannot add to your existing Fixed ISA?Bluesden said:I have a Cash ISA question for the forum that is probably pretty simple but is stumping me...

During this tax year (22/23) I transferred in an existing Cash ISA to a new Fixed Cash ISA. No new money has been paid into this ISA. All money transferred in was deposited in previous tax years.

I am now in a position to be able to add money but obviously cannot add to my existing Fixed ISA.

Am I able to open a new cash ISA (either fixed or 'normal') in this tax year, add my new cash up to this tax years deposit limit and have the two Cash ISAs running side by side?There are very few fixed rate ISA products that will allow you to add further money after the initial funding period, as far as I am aware.They might be a very appealing hedge against potential falls in interest rates, if any of the top payers do!0 -

There is nothing to specify whether the OP meant fixed rate or fixed term. Even if it was fixed rate then no information was provided to make it obvious that the OP is outside that initial funding period.Johnjdc said:nottsphil said:

Why is it obvious (to us) that you cannot add to your existing Fixed ISA?Bluesden said:I have a Cash ISA question for the forum that is probably pretty simple but is stumping me...

During this tax year (22/23) I transferred in an existing Cash ISA to a new Fixed Cash ISA. No new money has been paid into this ISA. All money transferred in was deposited in previous tax years.

I am now in a position to be able to add money but obviously cannot add to my existing Fixed ISA.

Am I able to open a new cash ISA (either fixed or 'normal') in this tax year, add my new cash up to this tax years deposit limit and have the two Cash ISAs running side by side?There are very few fixed rate ISA products that will allow you to add further money after the initial funding period, as far as I am aware.They might be a very appealing hedge against potential falls in interest rates, if any of the top payers do!

But I can still answer the question in the final paragraph, which would be 'yes'.1 -

Do variable rate, fixed term accounts exist in practice? I'd have thought it would be a terrible deal for the consumer - what if the provider drops the rate and holds your money hostage for the term? In the case of a cash ISA, the customer could pay a penalty to transfer away, but that itself would be a bad outcome.nottsphil said:

There is nothing to specify whether the OP meant fixed rate or fixed term. Even if it was fixed rate then no information was provided to make it obvious that the OP is outside that initial funding period.Johnjdc said:nottsphil said:

Why is it obvious (to us) that you cannot add to your existing Fixed ISA?Bluesden said:I have a Cash ISA question for the forum that is probably pretty simple but is stumping me...

During this tax year (22/23) I transferred in an existing Cash ISA to a new Fixed Cash ISA. No new money has been paid into this ISA. All money transferred in was deposited in previous tax years.

I am now in a position to be able to add money but obviously cannot add to my existing Fixed ISA.

Am I able to open a new cash ISA (either fixed or 'normal') in this tax year, add my new cash up to this tax years deposit limit and have the two Cash ISAs running side by side?There are very few fixed rate ISA products that will allow you to add further money after the initial funding period, as far as I am aware.They might be a very appealing hedge against potential falls in interest rates, if any of the top payers do!

But I can still answer the question in the final paragraph, which would be 'yes'.

0 -

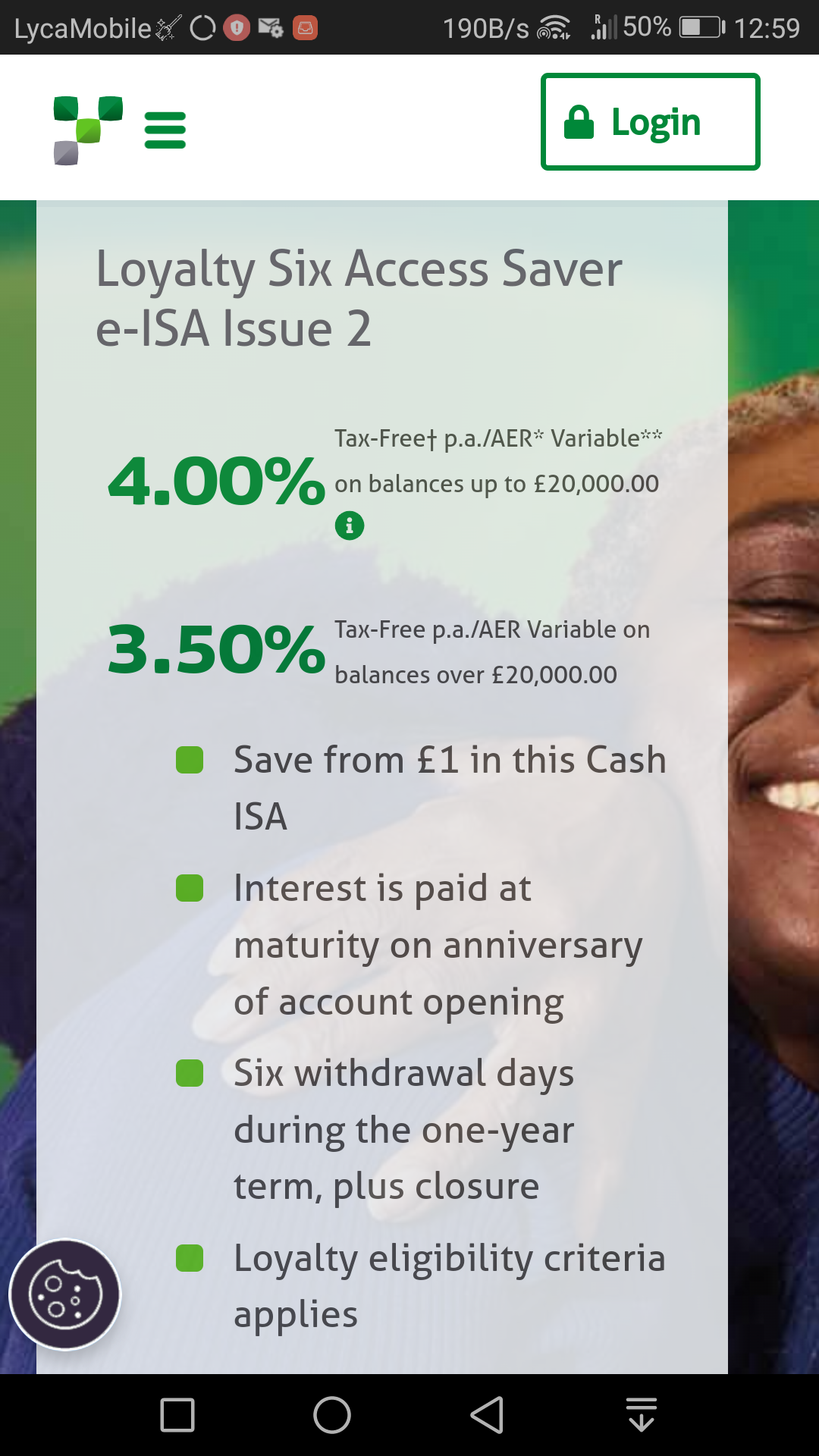

There's no need to take offence, I'm just asking you not to waste your time answering the query I've put on another thread. YBS clearly state it's a one year term with a variable rate.

0 -

That one year term is a maximum, and can be shorter if the customer desires. It is not an uncommon arrangement whereby an access account matures after a certain time. Many regular savers are set up in this way, and some of these are easy access. A fixed term account, as the name suggests, requires that you lock your money away for a fixed period of time, with access subject to a penalty (or not permitted at all in the case of a non-ISA fix). What you have there is what is commonly known as a limited access account, whereby penalty-free access is permitted, subject to some limitations. But there is no risk of being trapped within this account as it can be closed at any time without penalty should it no longer remain attractive. You will not find an account like this in the tables of fixed cash ISAs, even if it were available to all.nottsphil said:There's no need to take offence, I'm just asking you not to waste your time answering the query I've put on another thread. YBS clearly state it's a one year term with a variable rate.

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards