We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

How to open chip instant saving?

Comments

-

I wouldn't classify that as snooping though. More leaning towards potential data breach there, which could happen with any data or bank service.masonic said:

One thing they could do with the information that would impact the user in a detrimental way is to lose control of it.bazza55 said:What is the worry regarding snooping, it clearly states the data that Open Banking provides them, there is not much they can do with this information really, concerning impacting the user in a detrimental way I would not have thought, or am I overlooking something?

Link to some Open Banking information for Chip for anyone interested: https://intercom.help/get-chip/en/articles/4043796-what-is-open-banking0 -

Yes, it would be others that would do the snooping. It's true that any service could suffer a breach, but your risk of being a victim of such a breach increases the more services hold your information and the more your information is subject to processing. I would consider those pro-actively gathering and using this information to be more susceptible. Whatever processing they are doing no doubt involves third party services and will create a larger attack surface than a bank that is just cataloguing your transactions and sending you periodic account statements.bazza55 said:

I wouldn't classify that as snooping though. More leaning towards potential data breach there, which could happen with any data or bank service.masonic said:

One thing they could do with the information that would impact the user in a detrimental way is to lose control of it.bazza55 said:What is the worry regarding snooping, it clearly states the data that Open Banking provides them, there is not much they can do with this information really, concerning impacting the user in a detrimental way I would not have thought, or am I overlooking something?

0 -

I understand your point and thanks for the further detail. There are many services that use Open Banking now though and I imagine it might get even more common in the future.masonic said:

Yes, it would be others that would do the snooping. It's true that any service could suffer a breach, but your risk of being a victim of such a breach increases the more services hold your information and the more your information is subject to processing. I would consider those pro-actively gathering and using this information to be more susceptible. Whatever processing they are doing no doubt involves third party services and will create a larger attack surface than a bank that is just cataloguing your transactions and sending you periodic account statements.bazza55 said:

I wouldn't classify that as snooping though. More leaning towards potential data breach there, which could happen with any data or bank service.masonic said:

One thing they could do with the information that would impact the user in a detrimental way is to lose control of it.bazza55 said:What is the worry regarding snooping, it clearly states the data that Open Banking provides them, there is not much they can do with this information really, concerning impacting the user in a detrimental way I would not have thought, or am I overlooking something?

The detail captured is this: such as balance, transactions and how much we are spending and saving

Taken from: https://intercom.help/get-chip/en/articles/4043796-what-is-open-banking

In my opinion nothing too severe could happen with such information that would be detrimental, in the event that data was breached. The banks have that anyway.0 -

Sending money from your current account to CHIP is not an option. Just "pull-in" via OB, which is instant, or Debit Card, which is 3 days w/o interest. Which bank are you trying to pull money in from? Some seem to have really low limits.masonic said:I wish they would just let you send money via FP. For me Open Banking keeps failing (a £1 test transfer went ok), guess my bank is blocking larger payments. Doesn't look like pushing a payment using the payee they set up works either (I'll await that £1 bouncing back). Another annoying thing is that I can't use an account nickname or reference field to tell which accounts the transactions are between. Not impressed so far.

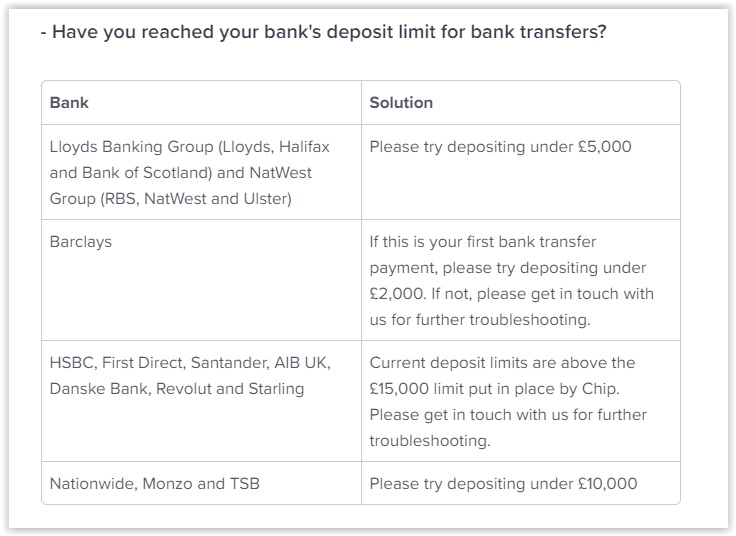

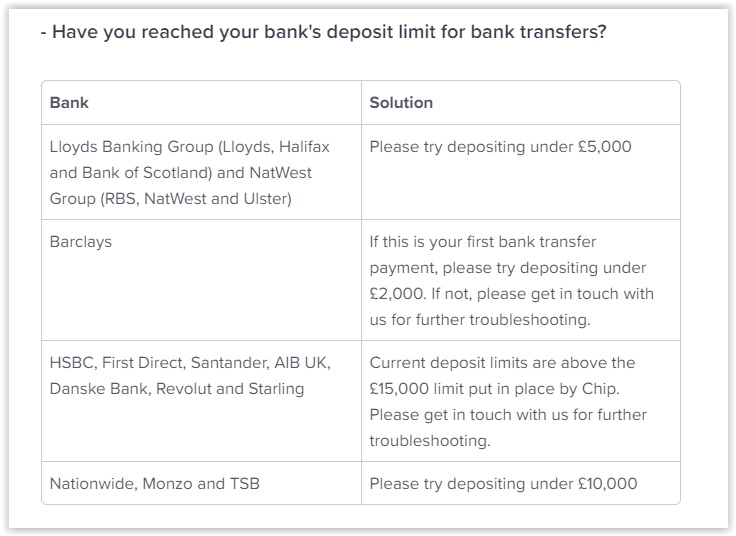

https://intercom.help/get-chip/en/articles/5628750-i-m-having-problems-depositing-money-in-chip

1 -

bazza55 said:

I understand your point and thanks for the further detail. There are many services that use Open Banking now though and I imagine it might get even more common in the future.masonic said:

Yes, it would be others that would do the snooping. It's true that any service could suffer a breach, but your risk of being a victim of such a breach increases the more services hold your information and the more your information is subject to processing. I would consider those pro-actively gathering and using this information to be more susceptible. Whatever processing they are doing no doubt involves third party services and will create a larger attack surface than a bank that is just cataloguing your transactions and sending you periodic account statements.bazza55 said:

I wouldn't classify that as snooping though. More leaning towards potential data breach there, which could happen with any data or bank service.masonic said:

One thing they could do with the information that would impact the user in a detrimental way is to lose control of it.bazza55 said:What is the worry regarding snooping, it clearly states the data that Open Banking provides them, there is not much they can do with this information really, concerning impacting the user in a detrimental way I would not have thought, or am I overlooking something?

The detail captured is this: such as balance, transactions and how much we are spending and saving

Taken from: https://intercom.help/get-chip/en/articles/4043796-what-is-open-banking

In my opinion nothing too severe could happen with such information that would be detrimental, in the event that data was breached. The banks have that anyway.It would really depend on what those transactions are. The transaction details may include details of the other savings and investment products you hold, including relevant account numbers, which could be used in spear-phishing attacks. Some transactions may be of a sensitive or embarrassing nature. So the worst case outcome of this information falling into the wrong hands, I suppose, would be getting scammed or blackmailed.As always, it's important to go in with eyes open and do your own risk-benefit analysis. In this case, there is not much on the benefit side, and the suggestion to use a dedicated linked account seems like a good precautionary measure. My main gripe with Chip is not about the information they are gathering, but rather the difficulty I've had getting money into the account.0 -

I was trying to pull in from HSBC, and nothing as high as the £15k limit mentioned there.Band7 said:

Sending money from your current account to CHIP is not an option. Just "pull-in" via OB, which is instant, or Debit Card, which is 3 days w/o interest. Which bank are you trying to pull money in from? Some seem to have really low limits.masonic said:I wish they would just let you send money via FP. For me Open Banking keeps failing (a £1 test transfer went ok), guess my bank is blocking larger payments. Doesn't look like pushing a payment using the payee they set up works either (I'll await that £1 bouncing back). Another annoying thing is that I can't use an account nickname or reference field to tell which accounts the transactions are between. Not impressed so far.

https://intercom.help/get-chip/en/articles/5628750-i-m-having-problems-depositing-money-in-chip

0 -

what exactly did / did not happen? Have they blocked the payment? I had terrible trouble with my first deposit into CHIP from Santander because they considered it a fraudulent transaction but after a looooong discuss with them, all my deposits since have gone through without a hitch. I can easily imagine that HSBC have an even more dinosaurish view of Open Banking payments than Santander have/had.

May be get in touch with CHIP (as suggested in the link above) and explain your issue to them.0 -

Band7 said:what exactly did / did not happen? Have they blocked the payment? I had terrible trouble with my first deposit into CHIP from Santander because they considered it a fraudulent transaction but after a looooong discuss with them, all my deposits since have gone through without a hitch. I can easily imagine that HSBC have an even more dinosaurish view of Open Banking payments than Santander have/had.

May be get in touch with CHIP (as suggested in the link above) and explain your issue to them.It seems to go ok on the HSBC side, then when I get bounced back to Chip it apologises and says that the payment can't be completed (nothing is actually debited). It then shows as cancelled in my transaction history at Chip. A £1 test transfer worked, but anything larger seems to fail. I've used Open Banking transfers before without issue.I'll contact them tomorrow, but there is only so much hassle I'll put up with before bailing.0 -

Sounds definitely like a matter to raise with CHIP1

-

I'm having trouble with a 2nd santander deposit. The first one of £10 as a test worked fine. The 2nd of higher value was flagged exactly like your case. I've spoken to the fraud department and all is explained. However I am awaiting my online banking with Santander to be unlocked now, seemingly another internal team has to review first. Did you experience similar?Band7 said:what exactly did / did not happen? Have they blocked the payment? I had terrible trouble with my first deposit into CHIP from Santander because they considered it a fraudulent transaction but after a looooong discuss with them, all my deposits since have gone through without a hitch. I can easily imagine that HSBC have an even more dinosaurish view of Open Banking payments than Santander have/had.

May be get in touch with CHIP (as suggested in the link above) and explain your issue to them.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards