We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

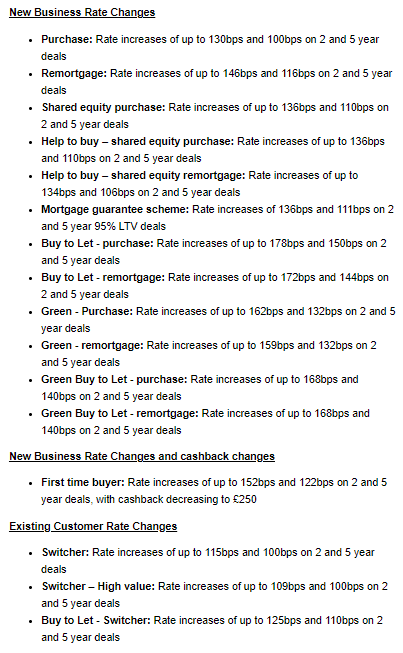

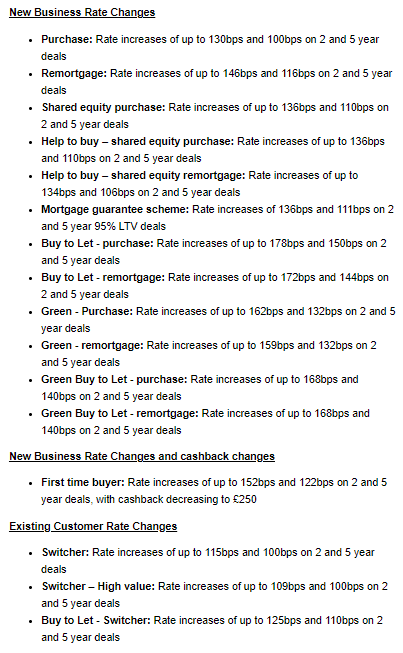

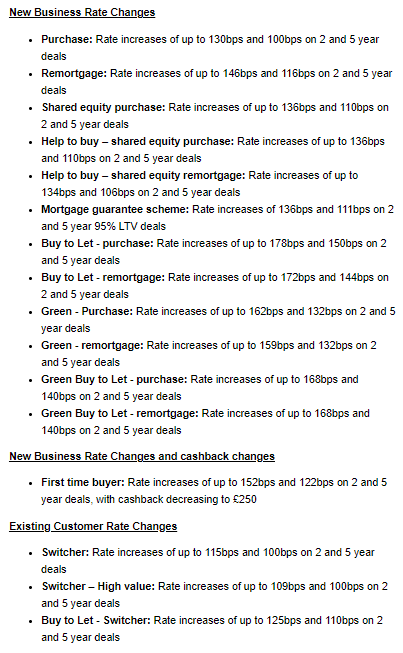

NatWest broker rates going up from tomorrow (3rd Oct)

Comments

-

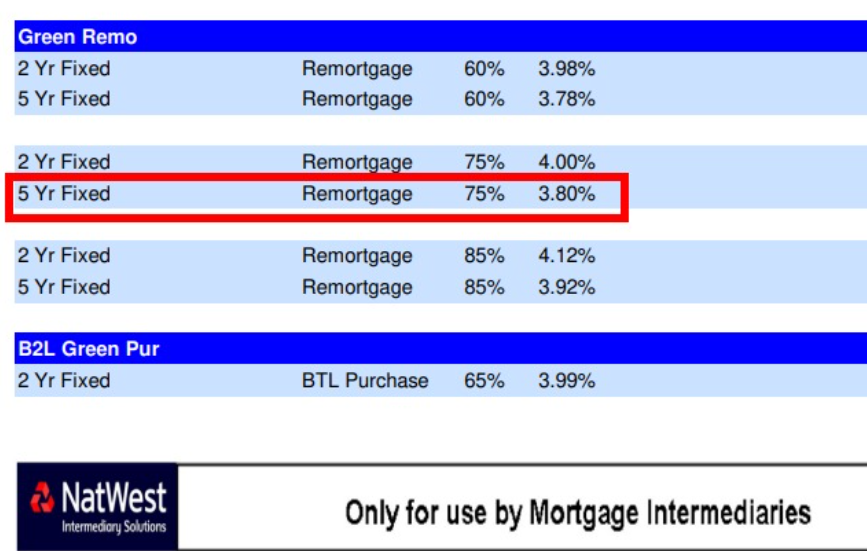

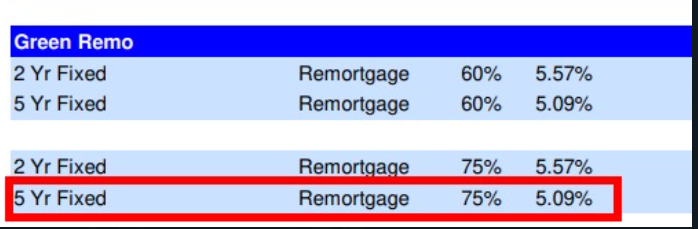

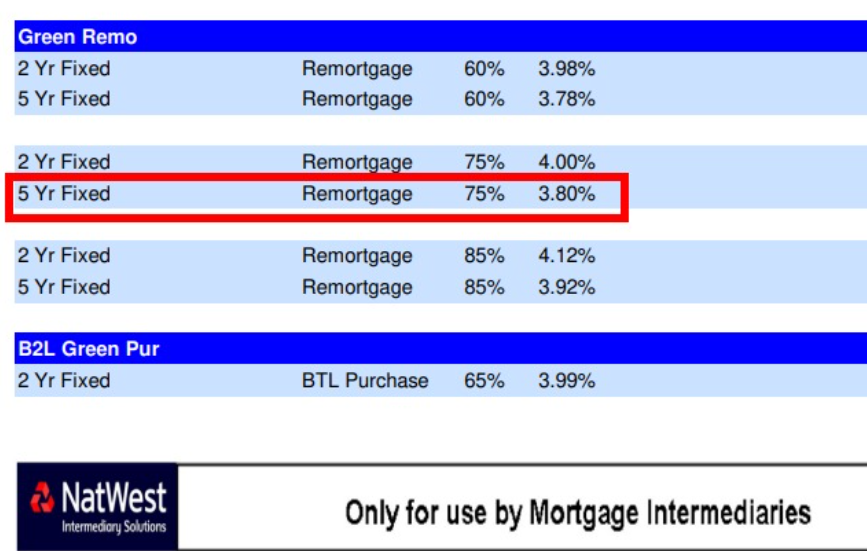

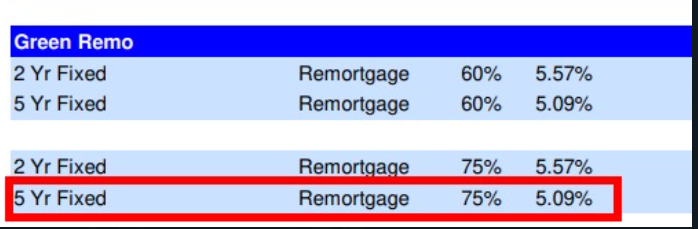

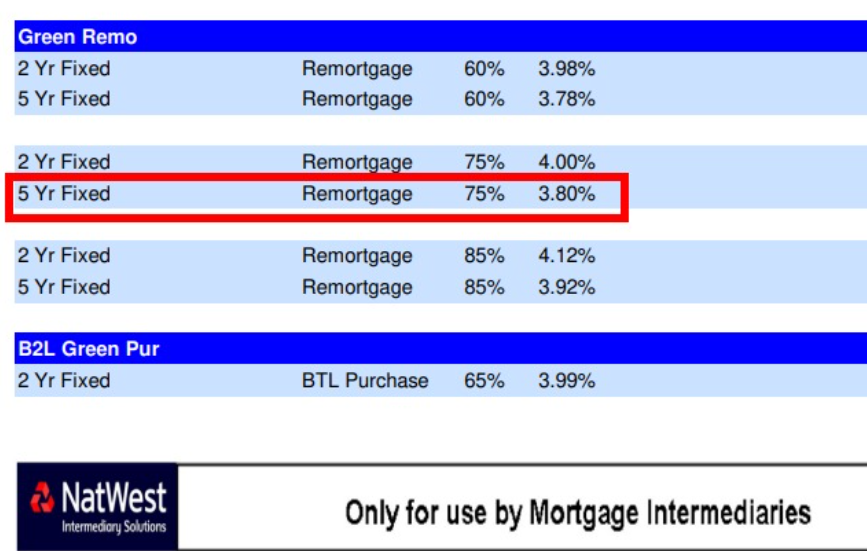

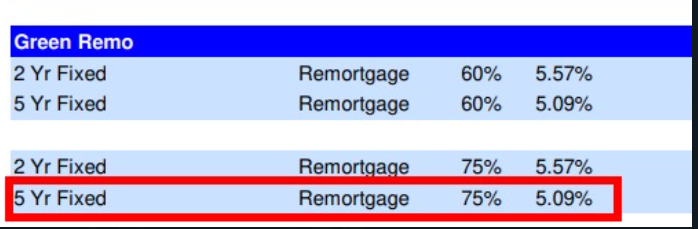

Yes this was the one we applied for yesterday afternoon thanks to the OP of this thread:thriftypatos said:FYI looks like Natwest's online (direct) rates have now also gone up. Eg. the rate we were looking at has jumped from 3.8 to 5.39.

This is what it changed to today:

0 -

Does application submitted = funds booked = rate secured?ChemistDude said:

Yes this was the one we applied for yesterday afternoon thanks to the OP of this thread:thriftypatos said:FYI looks like Natwest's online (direct) rates have now also gone up. Eg. the rate we were looking at has jumped from 3.8 to 5.39.

This is what it changed to today: 1

1 -

I'll let you know when I next hear from my broker.thriftypatos said:

Does application submitted = funds booked = rate secured?ChemistDude said:

Yes this was the one we applied for yesterday afternoon thanks to the OP of this thread:thriftypatos said:FYI looks like Natwest's online (direct) rates have now also gone up. Eg. the rate we were looking at has jumped from 3.8 to 5.39.

This is what it changed to today: 0

0 -

How did you manage that? My broker on Friday said there was nothing he could do without going through the whole affordability checks again even though I knew exactly what we wanted to do. Ours renews July and I made an appointment for a zoom call with NatWest in 6 weeks! It’s already gone up £43 since Friday.ChemistDude said:

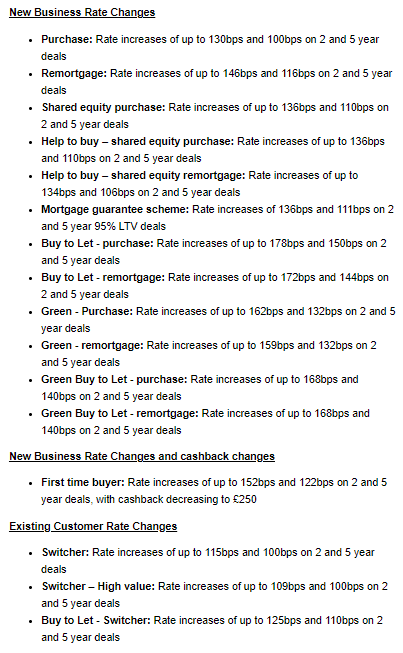

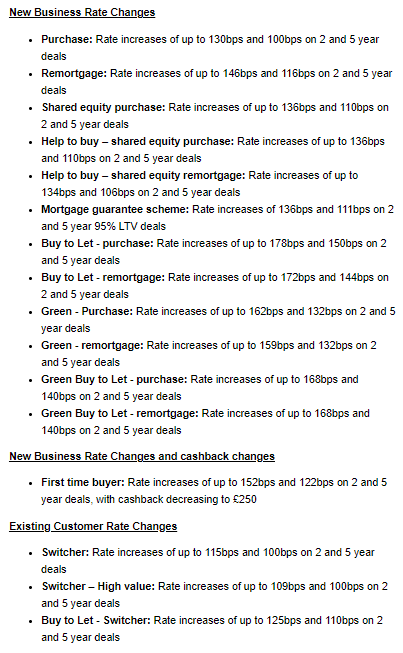

Just want to say a huge THANK YOU! I already had an urgent session with my broker booked for today as I was concerned about what's happening with rates. Our 5 year fix at 2.25% ends June 2023 and we managed to get an application in today with NatWest today for a 5 year fix at 3.8%. Had I not seen your post I may have stalled and waited till next week so thank you for that!K_S said:Just received notification from NatWest about broker rates going up, available from tomorrow. The email says the new rates are "immediately effective" so I imagine it's no longer possible to submit an application for the old rates but do check with your brokers if you have any applications ready to go.

See here for the latest product guide https://www.intermediary.natwest.com/intermediary-solutions/products.html

Please note this may or may not be applicable for direct rates, I am only talking about NatWest broker rates.

is my broker able to sort it for me in one day0 -

When you saying you got the application in today do you mean you booked an appointment or do you mean it’s all sorted? Did you pay the early redemption fee today as well?ChemistDude said:

Just want to say a huge THANK YOU! I already had an urgent session with my broker booked for today as I was concerned about what's happening with rates. Our 5 year fix at 2.25% ends June 2023 and we managed to get an application in today with NatWest today for a 5 year fix at 3.8%. Had I not seen your post I may have stalled and waited till next week so thank you for that!UK_S said:Just received notification from NatWest about broker rates going up, available from tomorrow. The email says the new rates are "immediately effective" so I imagine it's no longer possible to submit an application for the old rates but do check with your brokers if you have any applications ready to go.

See here for the latest product guide https://www.intermediary.natwest.com/intermediary-solutions/products.html

Please note this may or may not be applicable for direct rates, I am only talking about NatWest broker rates. 0

0 -

So on Wed/Thurs I started panicking about what the rates could be like next year and arranged a call with my broker for Sunday to see what we could do (our current fix ends June 2023). He asked me to get all my paperwork in order and so I had scanned and pdf’d everything and put in Dropbox.kazzyb123 said:

How did you manage that? My broker on Friday said there was nothing he could do without going through the whole affordability checks again even though I knew exactly what we wanted to do. Ours renews July and I made an appointment for a zoom call with NatWest in 6 weeks! It’s already gone up £43 since Friday.ChemistDude said:

Just want to say a huge THANK YOU! I already had an urgent session with my broker booked for today as I was concerned about what's happening with rates. Our 5 year fix at 2.25% ends June 2023 and we managed to get an application in today with NatWest today for a 5 year fix at 3.8%. Had I not seen your post I may have stalled and waited till next week so thank you for that!K_S said:Just received notification from NatWest about broker rates going up, available from tomorrow. The email says the new rates are "immediately effective" so I imagine it's no longer possible to submit an application for the old rates but do check with your brokers if you have any applications ready to go.

See here for the latest product guide https://www.intermediary.natwest.com/intermediary-solutions/products.html

Please note this may or may not be applicable for direct rates, I am only talking about NatWest broker rates.

is my broker able to sort it for me in one dayThe OP of this thread then alerted us all that NatWest was upping their rates but computer systems hadn’t been updated yet, and so during the call with the broker Sunday afternoon, they checked my affordability etc and proceeded with the application there and then so we could lock in and secure the rate at 3.8%. It would have been 5.1% if we had waited 1 more day!

To give you an idea, I probably spoke to my broker for less than 2 hours tops as I had scanned and saved everything off (ID/payslips/statements/checkmyfile report etc) and produced a spreadsheet with salary/income information, details of all my mortgages/loans, a soft debt to income calculation, etc so make it as simple and straightforward as possible.2 -

No we are merely at the application submitted stage. From what I understand, when you apply, you secure the rate - so even if they subsequently change the rate for the product later for new applications, my rate is secured.kazzyb123 said:

When you saying you got the application in today do you mean you booked an appointment or do you mean it’s all sorted? Did you pay the early redemption fee today as well?ChemistDude said:

Just want to say a huge THANK YOU! I already had an urgent session with my broker booked for today as I was concerned about what's happening with rates. Our 5 year fix at 2.25% ends June 2023 and we managed to get an application in today with NatWest today for a 5 year fix at 3.8%. Had I not seen your post I may have stalled and waited till next week so thank you for that!UK_S said:Just received notification from NatWest about broker rates going up, available from tomorrow. The email says the new rates are "immediately effective" so I imagine it's no longer possible to submit an application for the old rates but do check with your brokers if you have any applications ready to go.

See here for the latest product guide https://www.intermediary.natwest.com/intermediary-solutions/products.html

Please note this may or may not be applicable for direct rates, I am only talking about NatWest broker rates.

Due to urgency using a broker was the best situation for me and they know what all the lenders criteria is/how likely it is they will accept an application for given circumstances. As you say, trying to do it yourself you end up with an appointment weeks away (and the rates keep moving higher) and so in this climate we really need to be applying fast and securing the rate immediately.

Re: redemption fee - way too early for that I think. I presume that would only be payable once we receive a formal mortgage offer and even then, it would be at the point we actually pay off the old mortgage we are replacing.1 -

Exactly this.ChemistDude said:

No we are merely at the application submitted stage. From what I understand, when you apply, you secure the rate - so even if they subsequently change the rate for the product later for new applications, my rate is secured.kazzyb123 said:

When you saying you got the application in today do you mean you booked an appointment or do you mean it’s all sorted? Did you pay the early redemption fee today as well?ChemistDude said:

Just want to say a huge THANK YOU! I already had an urgent session with my broker booked for today as I was concerned about what's happening with rates. Our 5 year fix at 2.25% ends June 2023 and we managed to get an application in today with NatWest today for a 5 year fix at 3.8%. Had I not seen your post I may have stalled and waited till next week so thank you for that!UK_S said:Just received notification from NatWest about broker rates going up, available from tomorrow. The email says the new rates are "immediately effective" so I imagine it's no longer possible to submit an application for the old rates but do check with your brokers if you have any applications ready to go.

See here for the latest product guide https://www.intermediary.natwest.com/intermediary-solutions/products.html

Please note this may or may not be applicable for direct rates, I am only talking about NatWest broker rates.

Due to urgency using a broker was the best situation for me and they know what all the lenders criteria is/how likely it is they will accept an application for given circumstances. As you say, trying to do it yourself you end up with an appointment weeks away (and the rates keep moving higher) and so in this climate we really need to be applying fast and securing the rate immediately.

Paid broker a chunky sum to come in on Sunday and submit my application for me.So likewise massive thanks to the OP.3 -

Yes, I received the same email once I submitted my mortgage application online on Sunday. Let's hope the rate has been reserved.I did an online only application for a new customer remortgage with NatWest yesterday and at the point of submitting my application, the email confirmation says “The rate you've chosen won't change, as long as you return all documents and information within 28 days”2 -

Good luck to all of you! Please do let us know if you managed to secure those low rates after all!2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards