We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Natwest digital regular saver - what to do after saving £1000

Comments

-

I do a few transactions each day so normally receive the roundups Tues-Sat dated the previous day.I transferred funds yesterday to cover the roundups, so a bit annoying as missed out on £90 & £70.0

-

Southcoast01 said:I do a few transactions each day so normally receive the roundups Tues-Sat dated the previous day.I transferred funds yesterday to cover the roundups, so a bit annoying as missed out on £90 & £70.Southcoast01 said:I do a few transactions each day so normally receive the roundups Tues-Sat dated the previous day.I transferred funds yesterday to cover the roundups, so a bit annoying as missed out on £90 & £70.

What time did you do the transfer? I think the roundups appear quite late on Monday, because when I checked yesterday at around midnight in the part of world where I'm (7 hours ahead of UK time) they hadn't appeared. Only when I checked this morning (Tuesday where I'm - it would've been early hours in UK) it was showing (with 'yesterday' for date).

I'd ensure that there's enough funds in reward account on the day before. i.e. Sunday. Just in case they start going through as soon as the clock strikes 12 on SUnday night. i.e. the banking systems start operating again after weekend.0 -

I transferred funds to the accounts on Monday afternoon ready for the roundups to appear Tuesday am, although have not and just shows the pending transactions now cleared.

oh well, let’s hope they work tomorrow.0 -

Round ups usually appear by 2:30am after they have completed their daily service between 1:55 and 2:30am. So funds should be in by 1:55 am. This allows to transfer in at 00:01 am so you can get interest credited for the previous day elsewhere. In the morning after you get up you can move any "left over" cash back to your savings account and repear the following night so money never sits in 0% current counts. Works for RBS and Natwest in the same way.0

-

Limit Increased to £5000 a few weeks back. You can now round up debit card payments to the nearest pound and you can double this up And it does not count towards your monthly max amount. When you are near the £5000 mark say £4950 reduce your SO to £1OceanSound said:Just wondering what everyone's doing after hitting the £1000 threshold for the higher interest rate. Anything over £1000 is accruing peanuts in interest.

So, do you wait for the standing order (or if you pay manually, deposit the money) then immediately take it out to put elsewhere (where it pays a higher interest)?0 -

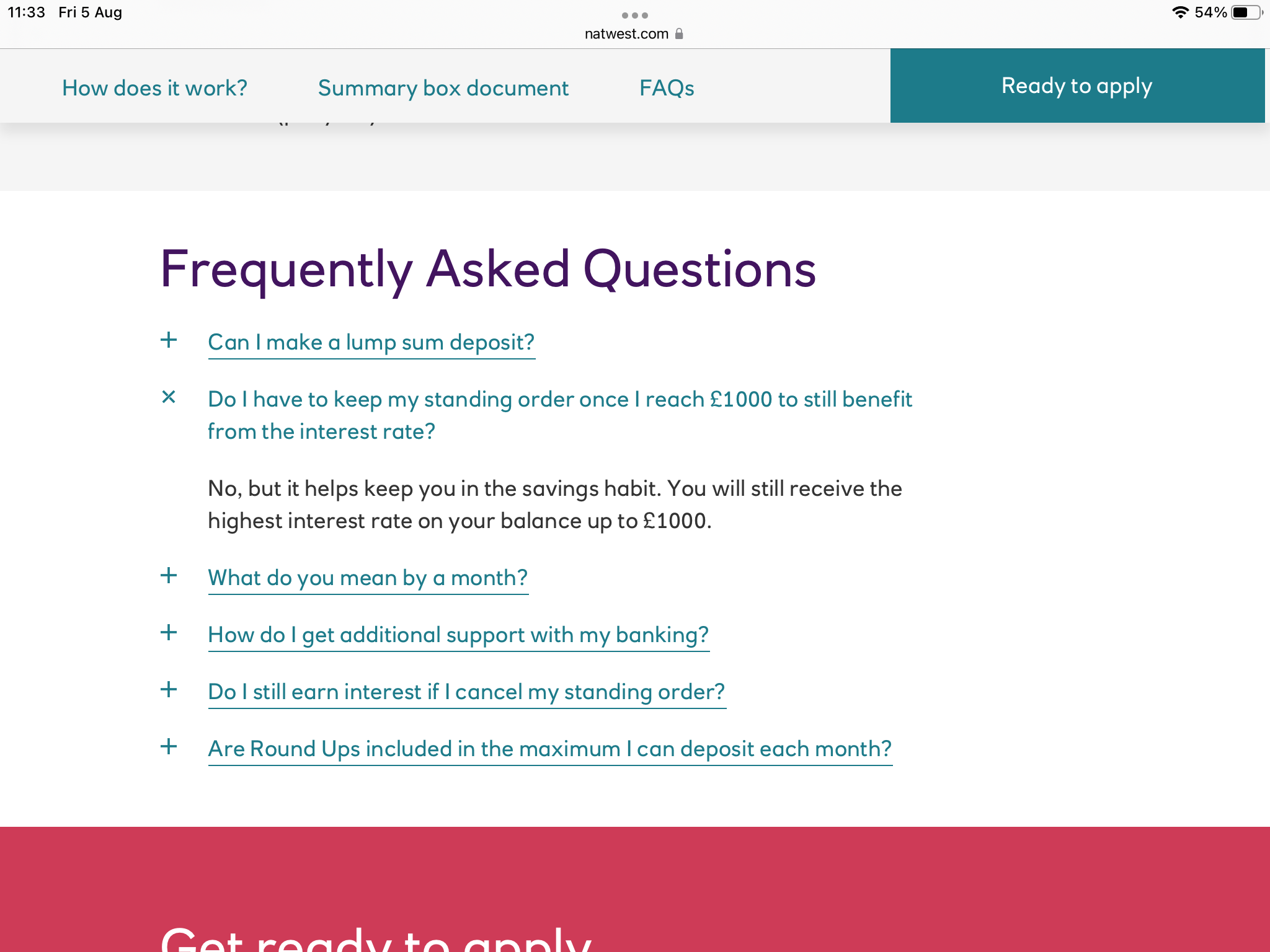

It took sometime for Nat West to change the above Screen Shot but they have now done soMrFrugalFever said: It’s in black and white, same as RBS

It’s in black and white, same as RBSDigital Regular Saver

Join over 750,000 customers (as at Nov 2022) who save every month with our regular savings accountCommonly used for:

Getting into a regular savings habit

Flexibility in building up a savings pot

Achieving the higher interest rate on balances up to £5,000

Plus, you could top up with Round Ups DOES NOT COUNT TOWARDS MONTHLY PAYMENT

Key infoInterest rate- Instant Access

- Save between £1 - £150

- Apply online only in 5 minutes

5.12% / 5.00% on balances up to £5,000AER/Gross p.a (variable)

0.50% on balances over £5,000Exclusively for current account customers, aged 16 and over. UK residents only.

0 - Instant Access

-

I think you forgot to subtract the interest in your calculation also the round ups that can be added on top of your standing orderMrFrugalFever said:I know this is an old thread but I thought it better revive this as opposed to start a new one.So NatWest have now increased their 5.12% AER offer for balances up to £5,000 however, they haven't increased the total monthly limit to be transferred (still £150), so in order to benefit from this you'd have to carry on transferring £150 for a total of 33.33 months (34 in reality), by that time who knows what would have happened to interest rates etc...I really think they should allow either a greater sum to be transferred monthly (i.e 5 x £150 as there's now 5 x the amount that can be used to earn 5.12%AER) or just allow the whole lot in one transfer!!Grrr.0 -

Thought the round ups went directly to the savings accountpecunianonolet said:Round ups usually appear by 2:30am after they have completed their daily service between 1:55 and 2:30am. So funds should be in by 1:55 am. This allows to transfer in at 00:01 am so you can get interest credited for the previous day elsewhere. In the morning after you get up you can move any "left over" cash back to your savings account and repear the following night so money never sits in 0% current counts. Works for RBS and Natwest in the same way.0 -

Any update on this?Bridlington1 said:

Essentially you open a YouGov account, then you sign into YouGov finance with those details. YouGov finance will then give you 500 YouGov points for each current account/credit card and 100 YouGov points for each savings account you link to them using open banking. 5000 YouGov points can be redeemed for £50 which can be paid into your bank account so it's effectively £5 per current account/credit card and £1 per savings account. I've found points appear within a day normally and once redeemed the money arrived in your bank account within a couple of days.pecunianonolet said:What I am interested in is the YouGov way of making extra money. @Bridlington1 would you be able to explain how long it takes for them to pay out? Are you not concerned that a lot of personal data is shared? Not sure if I want to link all my accounts, credit cards and saving accounts and maybe only go with dummy accounts.

YouGov then analyse your data. The whole point is to analyse consumer behaviour, so shopping patterns and that sort of thing for marketing purposes and is meant to compliment the YouGov surveys that people do. I personally do not link my main accounts, but do link the others and credit cards.

The one thing you will need to watch out for is that they will only give points for accounts deemed as "active accounts". The word active gets defined as "Active accounts are your open GBP account(s) with regular bank transactions"and they do not tell you how regular they want the regular transactions to be. They gave me the points for 7 of the 10 current accounts I tried linking last week however so I imagine it's fairly broad.

One of the advantages of this scheme though is that the accounts are only linked for 90 days before the connection expires. Once the connection has expired you can then relink the accounts to get the points again.

I only discovered this scheme last week so am still unsure as to how many accounts they will give you points for. As a result I am opening extra current accounts, then bouncing money through them for about 3-4 weeks in an attempt to make the accounts appear "active". I opened another 5 current accounts (Lloyds, Halifax, Bank of Scotland, RBS & Natwest) the other day and shall gradually keep opening more for the time being. I've had £50 out of them so far so either way it will be worth at least £200/yr to me.

I shall then link them en masse (probably by the end of the month) so shall update you with results.

For details see:

https://yougov.zendesk.com/hc/en-gb/sections/4413107645841-YouGov-Finance

0 -

The YouGov Finance bribe? A whole thread to itself hereOceanSound said:

Any update on this?Bridlington1 said:

Essentially you open a YouGov account, then you sign into YouGov finance with those details. YouGov finance will then give you 500 YouGov points for each current account/credit card and 100 YouGov points for each savings account you link to them using open banking. 5000 YouGov points can be redeemed for £50 which can be paid into your bank account so it's effectively £5 per current account/credit card and £1 per savings account. I've found points appear within a day normally and once redeemed the money arrived in your bank account within a couple of days.pecunianonolet said:What I am interested in is the YouGov way of making extra money. @Bridlington1 would you be able to explain how long it takes for them to pay out? Are you not concerned that a lot of personal data is shared? Not sure if I want to link all my accounts, credit cards and saving accounts and maybe only go with dummy accounts.

YouGov then analyse your data. The whole point is to analyse consumer behaviour, so shopping patterns and that sort of thing for marketing purposes and is meant to compliment the YouGov surveys that people do. I personally do not link my main accounts, but do link the others and credit cards.

The one thing you will need to watch out for is that they will only give points for accounts deemed as "active accounts". The word active gets defined as "Active accounts are your open GBP account(s) with regular bank transactions"and they do not tell you how regular they want the regular transactions to be. They gave me the points for 7 of the 10 current accounts I tried linking last week however so I imagine it's fairly broad.

One of the advantages of this scheme though is that the accounts are only linked for 90 days before the connection expires. Once the connection has expired you can then relink the accounts to get the points again.

I only discovered this scheme last week so am still unsure as to how many accounts they will give you points for. As a result I am opening extra current accounts, then bouncing money through them for about 3-4 weeks in an attempt to make the accounts appear "active". I opened another 5 current accounts (Lloyds, Halifax, Bank of Scotland, RBS & Natwest) the other day and shall gradually keep opening more for the time being. I've had £50 out of them so far so either way it will be worth at least £200/yr to me.

I shall then link them en masse (probably by the end of the month) so shall update you with results.

For details see:

https://yougov.zendesk.com/hc/en-gb/sections/4413107645841-YouGov-Finance

https://forums.moneysavingexpert.com/discussion/6416681/yougov-finance-bribe/p1

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards