We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

How much longer will this bear market go on for?

Comments

-

Only another -77.5% to go... over the next 100 days or so.Prism said:

Thats fair enough (I have a gold ETF too), but can we agree that on the same basis the S&P500 is only down around -2.5% YTDType_45 said:

Gold is up 7.5% YTD.Stargunner said:

I remember you previously saying that you were heavily invested in Gold, so I imagine you are not being totally honest about being flat YTDType_45 said:My being flat YTD seems to have ruffled a few feathers.

I'm not only in crypto and cash.

6 -

Prism said:

Thats fair enough (I have a gold ETF too), but can we agree that on the same basis the S&P500 is only down around -2.5% YTDType_45 said:

Gold is up 7.5% YTD.Stargunner said:

I remember you previously saying that you were heavily invested in Gold, so I imagine you are not being totally honest about being flat YTDType_45 said:My being flat YTD seems to have ruffled a few feathers.

I'm not only in crypto and cash.

No, we can't. The S&P500 is down about 19% YTD.

0 -

Sorry to say but crazy Type is right. It's only down 2.5% on an unhedged fund. Check a hedged fund which reflects the true value and c.19% is correct.Type_45 said:Prism said:

Thats fair enough (I have a gold ETF too), but can we agree that on the same basis the S&P500 is only down around -2.5% YTDType_45 said:

Gold is up 7.5% YTD.Stargunner said:

I remember you previously saying that you were heavily invested in Gold, so I imagine you are not being totally honest about being flat YTDType_45 said:My being flat YTD seems to have ruffled a few feathers.

I'm not only in crypto and cash.

No, we can't. The S&P500 is down about 19% YTD.0 -

Hang on, so you want to price gold in pounds even though the rest of the world prices it in dollars but you don't want to do the same for equities? Make your mind up on a currencyType_45 said:Prism said:

Thats fair enough (I have a gold ETF too), but can we agree that on the same basis the S&P500 is only down around -2.5% YTDType_45 said:

Gold is up 7.5% YTD.Stargunner said:

I remember you previously saying that you were heavily invested in Gold, so I imagine you are not being totally honest about being flat YTDType_45 said:My being flat YTD seems to have ruffled a few feathers.

I'm not only in crypto and cash.

No, we can't. The S&P500 is down about 19% YTD.7 -

My true value isn't in dollars - its in pounds. I imagine that is the case for most UK investors. From my perspective the S&P500 has barely dropped. The fact that it has dropped in dollars is heavily related to the dollar rising in value so why ignore it.aroominyork said:

Sorry to say but crazy Type is right. It's only down 2.5% on an unhedged fund. Check a hedged fund which reflects the true value and c.19% is correct.Type_45 said:Prism said:

Thats fair enough (I have a gold ETF too), but can we agree that on the same basis the S&P500 is only down around -2.5% YTDType_45 said:

Gold is up 7.5% YTD.Stargunner said:

I remember you previously saying that you were heavily invested in Gold, so I imagine you are not being totally honest about being flat YTDType_45 said:My being flat YTD seems to have ruffled a few feathers.

I'm not only in crypto and cash.

No, we can't. The S&P500 is down about 19% YTD.

Besides, I'm only bringing this up because they want to ignore the fact that the only reason that gold has done well is because of the dollar. I'm just making things fair 6

6 -

aroominyork said:

Sorry to say but crazy Type is right. It's only down 2.5% on an unhedged fund. Check a hedged fund which reflects the true value and c.19% is correct.Type_45 said:Prism said:

Thats fair enough (I have a gold ETF too), but can we agree that on the same basis the S&P500 is only down around -2.5% YTDType_45 said:

Gold is up 7.5% YTD.Stargunner said:

I remember you previously saying that you were heavily invested in Gold, so I imagine you are not being totally honest about being flat YTDType_45 said:My being flat YTD seems to have ruffled a few feathers.

I'm not only in crypto and cash.

No, we can't. The S&P500 is down about 19% YTD.A hedged fund doesn't reflect the true value. If you'd bought a GBP hedged fund, you'd have done worse than an American investing their USD in the S&P500. You'd be down nearly 40% when they valued your fund in USD. You'd now own fewer underlying Apple, Microsoft, Amazon... shares than someone who'd invested the same amount into the index.Either:- Gold is down 9% YTD and S&P500 is down 19%; or

- Gold is up 7.5% YTD and S&P500 is down 2.5%; or even

- S&P500 is down 10% in oz Gold

You can't measure one in GBP and the other in USD. Well you can, but you're being dishonest if you do.10 -

Absolutely correct, and another illustration of crazyType45’s complete misunderstanding of his own alleged investments.masonic said:aroominyork said:

Sorry to say but crazy Type is right. It's only down 2.5% on an unhedged fund. Check a hedged fund which reflects the true value and c.19% is correct.Type_45 said:Prism said:

Thats fair enough (I have a gold ETF too), but can we agree that on the same basis the S&P500 is only down around -2.5% YTDType_45 said:

Gold is up 7.5% YTD.Stargunner said:

I remember you previously saying that you were heavily invested in Gold, so I imagine you are not being totally honest about being flat YTDType_45 said:My being flat YTD seems to have ruffled a few feathers.

I'm not only in crypto and cash.

No, we can't. The S&P500 is down about 19% YTD.A hedged fund doesn't reflect the true value. If you'd bought a GBP hedged fund, you'd have done worse than an American investing their USD in the S&P500. You'd be down nearly 40% when they valued your fund in USD. You'd now own fewer underlying Apple, Microsoft, Amazon... shares than someone who'd invested the same amount into the index.Either:- Gold is down 9% YTD and S&P500 is down 19%; or

- Gold is up 7.5% YTD and S&P500 is down 2.5%; or even

- S&P500 is down 10% in oz Gold

You can't measure one in GBP and the other in USD. Well you can, but you're being dishonest if you do.Please, please, please take his posts as light entertainment and Do Your Own Research. Just like many of us, he was asking for the most basic investment advice on this board only a year or so ago. Somehow, he has now become so clued up that he believes that with his raft of experience, it is reasonable for him to posit with total conviction that equities are heading for an 80% crash by the end of the year.

As ever, just be careful not to listen too intently to the trolls and narcissists.10 -

2

-

FedEx warns of a global recession, cutting sales forecast by half a billion dollars0

-

Type_45 said:FedEx warns of a global recession, cutting sales forecast by half a billion dollars"Shares of FedEx (FDX) plunged 21% Friday — the biggest one-day drop in its history — after the company warned late Thursday that a slowing economy will cause it to fall $500 million short of its revenue target."Oops, somebody else's fault. I wonder what my postie's view on the global economic outlook is.3

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

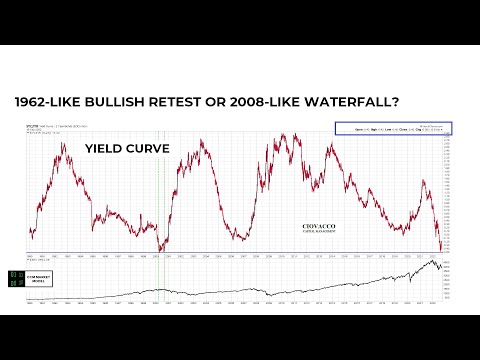

https://www.youtube.com/watch?v=6Qs14ULAWa4

https://www.youtube.com/watch?v=6Qs14ULAWa4