We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Is a perfectly balanced portfolio possible? What would it look like? How would it perform?

Comments

-

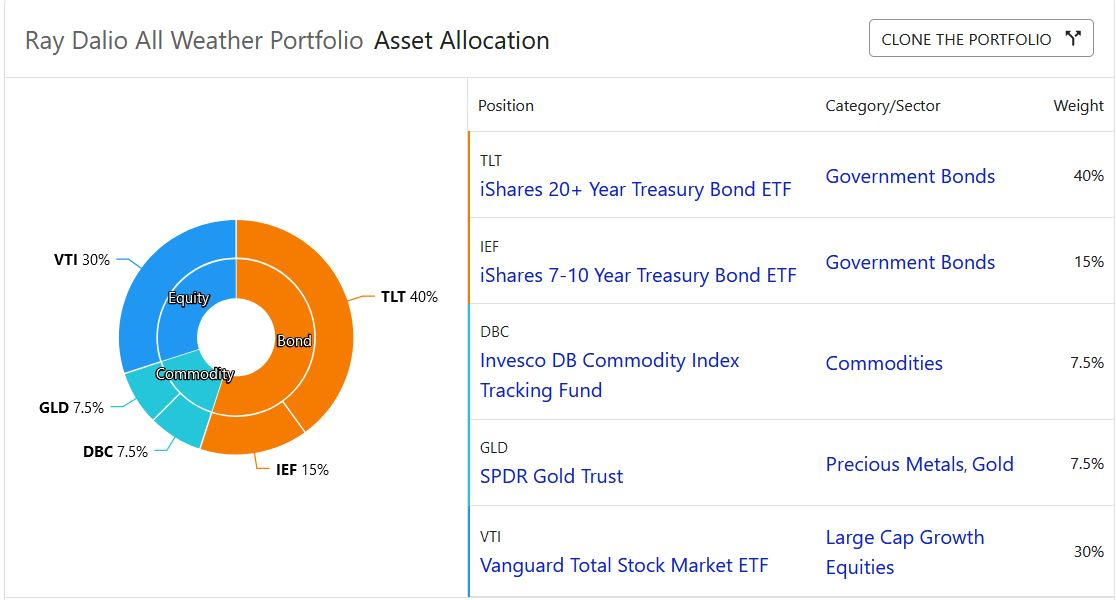

Now we are in Boglehead "four fund" territory. Personally I have income covered by things like DB pensions, an annuity, and rent and the rest is mostly in a couple of equity index trackers that give me a vaguely cap weighted global equity portfolio.adindas said:Nothing is perfect.But one quite close to that is proposed by one of the well know hedge fund Ray Dalio. It is called "all whether portfolio". With such portfolio it will be less volatile, less risky, less intervention is needed but you are sacrificing the potential return. The return is more likely to be lower than the market, the S&P500. Here is how the so called "balanced portfolio", "all whether portfolio" is performing against the market S&P500

Here is how the so called "balanced portfolio", "all whether portfolio" is performing against the market S&P500 Volatility has a correlation with the reward (e.g return). The less volatile your portfolio is (e.g balance port folio, all weather port folio) the less reward you will likely to get. It is represented by a ratio called "Treynor Ratio"Another one is the ratio of the return of your investment vs the risk you are willing to take which is already mentioned above formulated by William F. Sharpe called "Sharpe Ratio"Unless you are lucky, the "Balanced portfolio", "All whether portfolio"are less volatile, less risky than S&P500 (say) but are more likely to produce a lower return.“So we beat on, boats against the current, borne back ceaselessly into the past.”0

Volatility has a correlation with the reward (e.g return). The less volatile your portfolio is (e.g balance port folio, all weather port folio) the less reward you will likely to get. It is represented by a ratio called "Treynor Ratio"Another one is the ratio of the return of your investment vs the risk you are willing to take which is already mentioned above formulated by William F. Sharpe called "Sharpe Ratio"Unless you are lucky, the "Balanced portfolio", "All whether portfolio"are less volatile, less risky than S&P500 (say) but are more likely to produce a lower return.“So we beat on, boats against the current, borne back ceaselessly into the past.”0 -

What tends to set these types of all weather portfolios aside from the Boglehead ones is the inclusion of general commodities, gold and REITs - the last two being quite popular. The cost can still be very low but the inclusion of other elements than equities and bonds has, at least historically, given a better outcome for someone taking income from their pot - i.e. a retiree.bostonerimus said:

Now we are in Boglehead "four fund" territory. Personally I have income covered by things like DB pensions, an annuity, and rent and the rest is mostly in a couple of equity index trackers that give me a vaguely cap weighted global equity portfolio.0 -

Surely if it was "perfectly balanced" by some definition at 10:00:00 on some particular day, it wouldn't be by 10::01:00 because some one (or more) of its constituents would have gone up or down relative to the rest.

2 -

Would be good to see some evidence for this from a non-U.S. perspective.Prism said:

What tends to set these types of all weather portfolios aside from the Boglehead ones is the inclusion of general commodities, gold and REITs - the last two being quite popular. The cost can still be very low but the inclusion of other elements than equities and bonds has, at least historically, given a better outcome for someone taking income from their pot - i.e. a retiree.bostonerimus said:

Now we are in Boglehead "four fund" territory. Personally I have income covered by things like DB pensions, an annuity, and rent and the rest is mostly in a couple of equity index trackers that give me a vaguely cap weighted global equity portfolio.0 -

Not always that clear cutadindas said:Volatility has a correlation with the reward (e.g return). The less volatile your portfolio is (e.g balance port folio, all weather port folio) the less reward you will likely to get.

https://www.aqr.com/Insights/Datasets/Betting-Against-Beta-Equity-Factors-Monthly

0 -

BritishInvestor said:

Not always that clear cutadindas said:Volatility has a correlation with the reward (e.g return). The less volatile your portfolio is (e.g balance port folio, all weather port folio) the less reward you will likely to get.

https://www.aqr.com/Insights/Datasets/Betting-Against-Beta-Equity-Factors-MonthlyWell that has never been any clear cut in the market. But theoretically that is what is formulated in the "Treynor Ratio". Treynor Ratio is a function of "Beta" of the asset. the Beta Value could easily be found from the summary sheet.How accurate the Treynor ratio is highly dependent on how accurate and benchmarks use to measure beta value. As the paper above the value of Beta is not always be that accurate.Also treynor ratio is backward-looking. Any asset and/or Investments are likely to perform and behave differently in the future than they did in the past.0 -

A portfolio you describe containing loads of equity, bond , commodity etc trackers, would most likely perform just like a multi-asset fund (but with much more effort required and most likely higher fees).

All in all, an investor would be more suited to buy a multi-asset fund as their core holding and maybe a few satellite funds if investor wants exposure to more niche areas."If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes” Warren Buffett

Save £12k in 2025 - #024 £1,450 / £15,000 (9%)0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards