We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Guide discussion: Voluntary national insurance contributions

Comments

-

I meant to add - if I were you, I'd focus on the back-paying to 2006 first as it's the more urgent query. Trying to deal with other questions in the same call could cause confusion. Once you get that sorted, you can always call them again about other questions.Geeby said:Dunroving, thanks for the feedback and the personal perspective that you provided. Your comments were very helpful.The point regarding the class of NICs I should pay was one that I was a little unsure of and one which I will certainly emphasise when I contact HMRC. Speaking of which, I am currently unable to contact HMRC personally and plan on having a family member contact them on my behalf and would like to know whether this would be a problem - data protection and everything! And depending on what details HMRC ask for, would we be better calling or writing to them? Any suggestions would be much appreciated.(Nearly) dunroving1 -

Thanks once again, Dunroving, for taking the time to reply to my questions.Think I'll try writing first as I believe I still have sufficient time and I suspect calling would undoubtedly mean spending hours in a queue from hell!A short note on the writing (email) option that you mentioned however:From a cursory Google search, it appears as though HMRC do not reply to email enquiries regarding NIC's specifically.Unless I'm mistaken, any written correspondence is postal only. Can anyone confirm whether or not this is correct?0

-

I think you are correct - at least, I just searched my email folder and I only have reminders, standard notifications, etc. from HMRC. I think I was confusing myself with the US SS Federal Benefits Unit, who I communicate with via email fairly regularly.Geeby said:Thanks once again, Dunroving, for taking the time to reply to my questions.Think I'll try writing first as I believe I still have sufficient time and I suspect calling would undoubtedly mean spending hours in a queue from hell!A short note on the writing (email) option that you mentioned however:From a cursory Google search, it appears as though HMRC do not reply to email enquiries regarding NIC's specifically.Unless I'm mistaken, any written correspondence is postal only. Can anyone confirm whether or not this is correct?(Nearly) dunroving1 -

Fantastic information. Having read the guide I found this forum discussion very useful as its difficult to get through to FPC by phone.

I think I've got my head around my personal calculations now but would appreciate someone checking my thinking is correct.

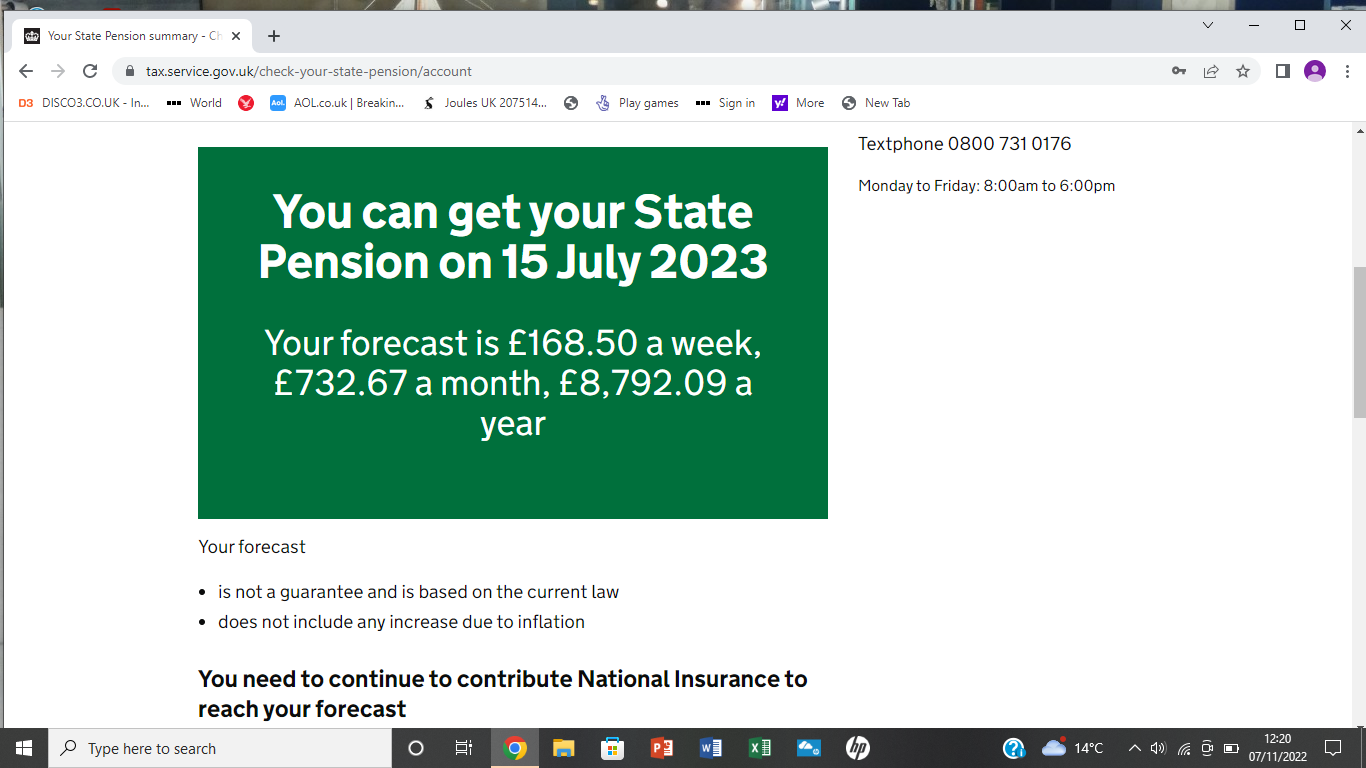

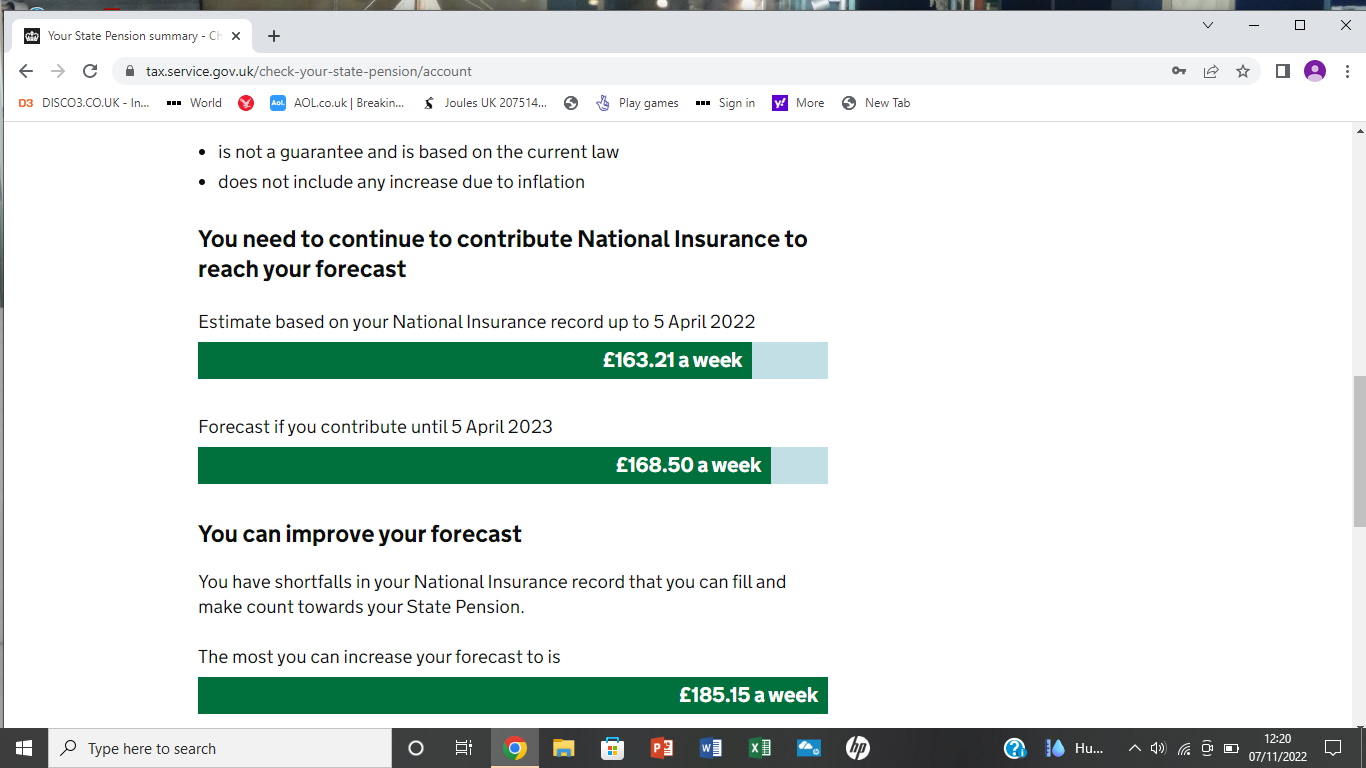

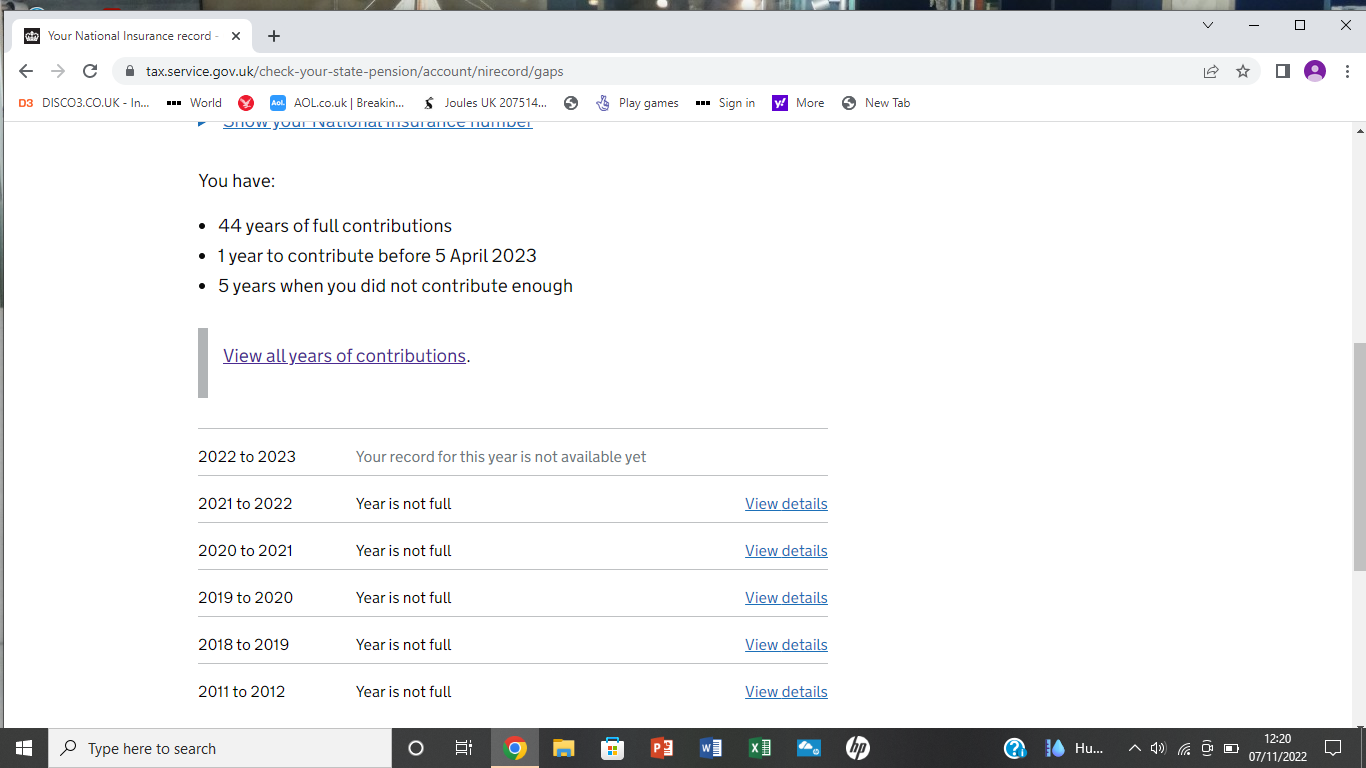

I'll attach screenshots of my pension forecast below. but in case these don't work my important information is :-

current pension amount to April 2022 £163.21

Maximum pension £185.15

no. of full NI years pre 2016 = 42y

No. of full NI years post 2016 = 2y

its not worth me paying the shortfall for 2011/2012, as ive got 42 years full NI pre 2016.

COPE amount £99.83pw

SRA reached July 2023

i haven't worked since 2019 and don't intend to.

Shortfall is £21.94pw

Divided by £5.29pw =4.15 years, so 4 years would bring me to £184.37, with the 5th year adding .78p pw.

4 years would cost me £3200, so breakeven would take 2.9 years.

therefore its a good idea to pay the £3200, as I should live longer than 69!!

1 -

There is no point buying more pre 2016 years if you already have 35 or more as the maximum number of pre 2016 years that can be counted is 35, in your case with a large COPE only 30 will be counted. Topping up therefore must be done from post 2016 gaps. Everything else you have calculated is correct. And bonus points for supplying all the information we regularly ask to help work these things out

3

3 -

Hello and thank you for the add. What a great article, also this forum has already given me such a lot of useful and clear information on the subject of topping up state pension.

My situation is as follows:-

I am a 65 year old female - due to take my state pension on my next birthday 15/4/23.

My online forecast gives me the following info....

Current entitlement = £148.81 pw

Max entitlement =£185.15 pw

I have 41 years full conts (all prior to 2016 as I took early retirement in 2013, no work or benefits since)

I have a shortfall of 8 years (contracted out civil service). These years are 2014/15 to 2021/22 inclusive, and the current 2022/23 year will also fall short.

I've spoken to the Future Pension Centre this morning - took ages to get through but very helpful once I did. Confirmed that there is no point paying for 2014/15 and 2015/16 for the same reasons as the previous poster.

So by paying a total of £4893.20 to cover 2016/17 to 2021/22 inclusive, my state pension will increase from £148.81 pw to £180.55 pw. A further payment of £824.20 for 2022/23 will give me the final £4.60 pw to achieve the max. of £185.15.

Pam at FPC gave me a phone number for the Voluntary NI conts. team 0300 200 3500 who apparently will furnish me with the info. I will need to make my payment.

Thanks in advance to you for looking at my post, and please don't hesitate to let me know if there's anything I'm missing!

1 -

PerUna said:Hello and thank you for the add. What a great article, also this forum has already given me such a lot of useful and clear information on the subject of topping up state pension.

My situation is as follows:-

I am a 65 year old female - due to take my state pension on my next birthday 15/4/23.

My online forecast gives me the following info....

Current entitlement = £148.81 pw

Max entitlement =£185.15 pw

I have 41 years full conts (all prior to 2016 as I took early retirement in 2013, no work or benefits since)

I have a shortfall of 8 years (contracted out civil service). These years are 2014/15 to 2021/22 inclusive, and the current 2022/23 year will also fall short.

I've spoken to the Future Pension Centre this morning - took ages to get through but very helpful once I did. Confirmed that there is no point paying for 2014/15 and 2015/16 for the same reasons as the previous poster.

So by paying a total of £4893.20 to cover 2016/17 to 2021/22 inclusive, my state pension will increase from £148.81 pw to £180.55 pw. A further payment of £824.20 for 2022/23 will give me the final £4.60 pw to achieve the max. of £185.15.

Pam at FPC gave me a phone number for the Voluntary NI conts. team 0300 200 3500 who apparently will furnish me with the info. I will need to make my payment.

Thanks in advance to you for looking at my post, and please don't hesitate to let me know if there's anything I'm missing!I agree with your understanding and what you;ve been told - if you have the money to make that payment you will see a return in only a few years so it's well worth doing.If you had room to pay for years going forward there are also ways you can get credits rather than paying for the Class 3 contributions - e,g, if you provide childcare for working parents you can get the credits from their Child Benefit (which are unnecessary for them if they are working) transferred to you, or by registering as self-employed you can pay the cheaper Class 2 rate. but as you necessarily nned to fill previous years I think you have to go with the voluntary Class 3 route.2 -

Thank you @p00hsticks! I'm grateful for your reply and suggestions. I'd seen the various ways that credits might help, but nothing I could use, so I'll pay up and look forward to my 66th birthday - and aspire to live as long as my mum (89 and counting) and her mum who died on her 101st birthday ;0)0

-

PerUna thank you so much for posting this, it has been a massive help, and including the relevant contact number is so useful.PerUna said:Hello and thank you for the add. What a great article, also this forum has already given me such a lot of useful and clear information on the subject of topping up state pension.

My situation is as follows:-

I am a 65 year old female - due to take my state pension on my next birthday 15/4/23.

My online forecast gives me the following info....

Current entitlement = £148.81 pw

Max entitlement =£185.15 pw

I have 41 years full conts (all prior to 2016 as I took early retirement in 2013, no work or benefits since)

I have a shortfall of 8 years (contracted out civil service). These years are 2014/15 to 2021/22 inclusive, and the current 2022/23 year will also fall short.

I've spoken to the Future Pension Centre this morning - took ages to get through but very helpful once I did. Confirmed that there is no point paying for 2014/15 and 2015/16 for the same reasons as the previous poster.

So by paying a total of £4893.20 to cover 2016/17 to 2021/22 inclusive, my state pension will increase from £148.81 pw to £180.55 pw. A further payment of £824.20 for 2022/23 will give me the final £4.60 pw to achieve the max. of £185.15.

Pam at FPC gave me a phone number for the Voluntary NI conts. team 0300 200 3500 who apparently will furnish me with the info. I will need to make my payment.

Thanks in advance to you for looking at my post, and plephone numberase don't hesitate to let me know if there's anything I'm missing!0 -

Hi

I have a 70 year old colleague who gets a reduced state pension.

He retired at 58 on a council defined benefit pension.

The a year later decided he would return to work.

At 65 he got a reduced state pension due to missing NI years

Is he too old to buy the years?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards