We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Thinking for car change

Comments

-

Can I ask what the equity figure is based on? And why an old diesel has zero equity? That part is messing with my mind.2

-

How do you get paid that equity each month? - by that I mean, cold hard cash in your pocket?Petriix said:

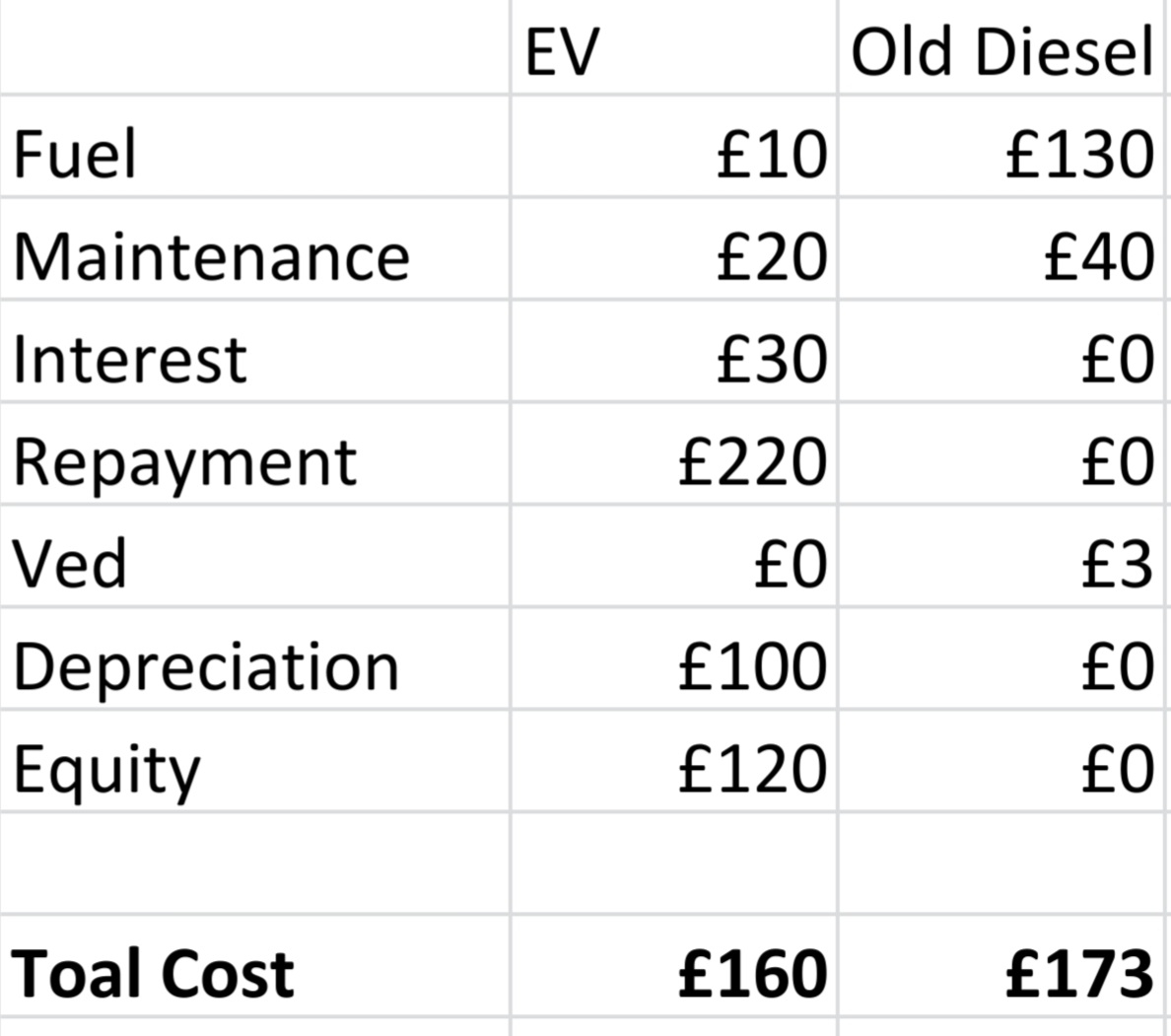

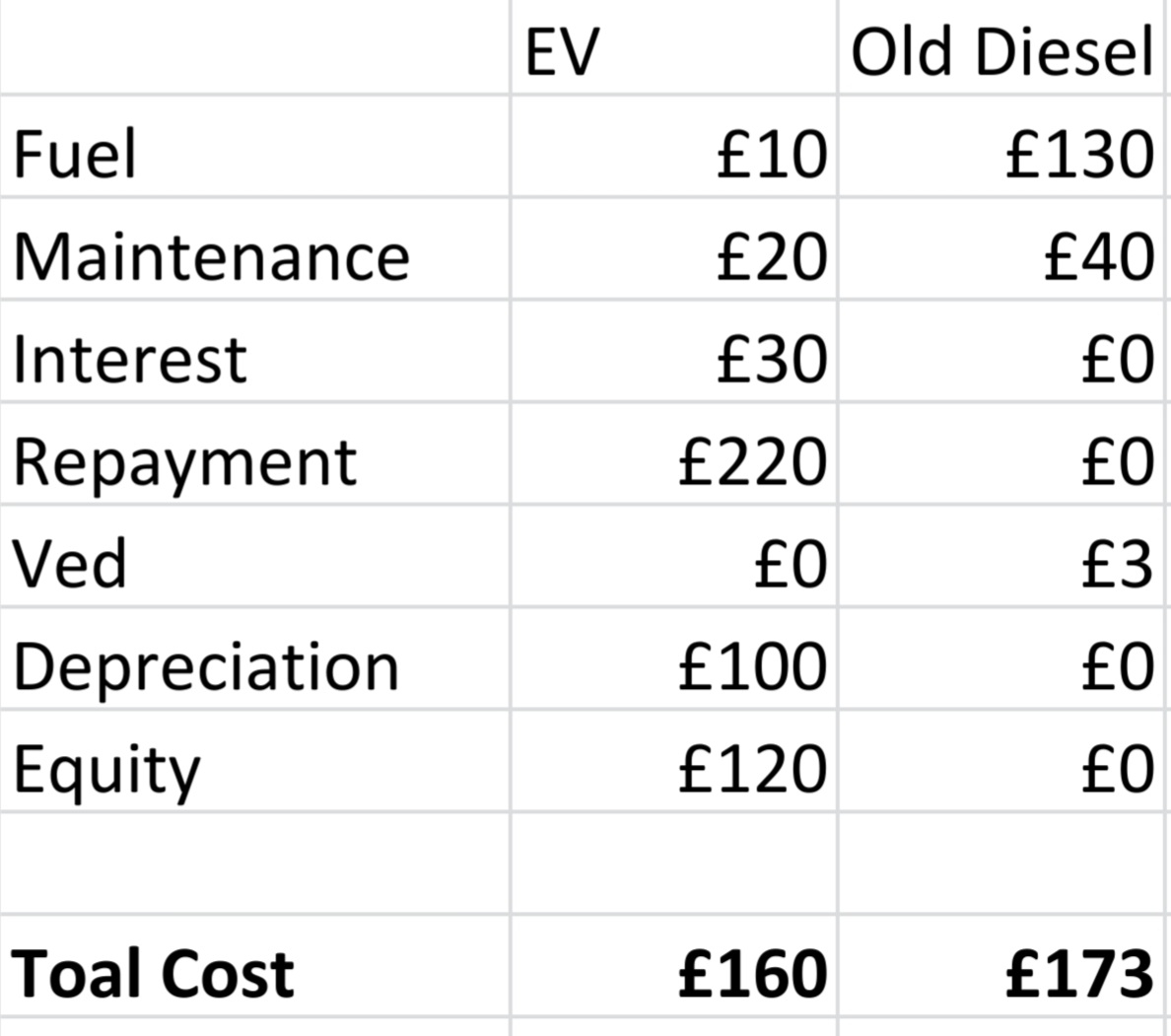

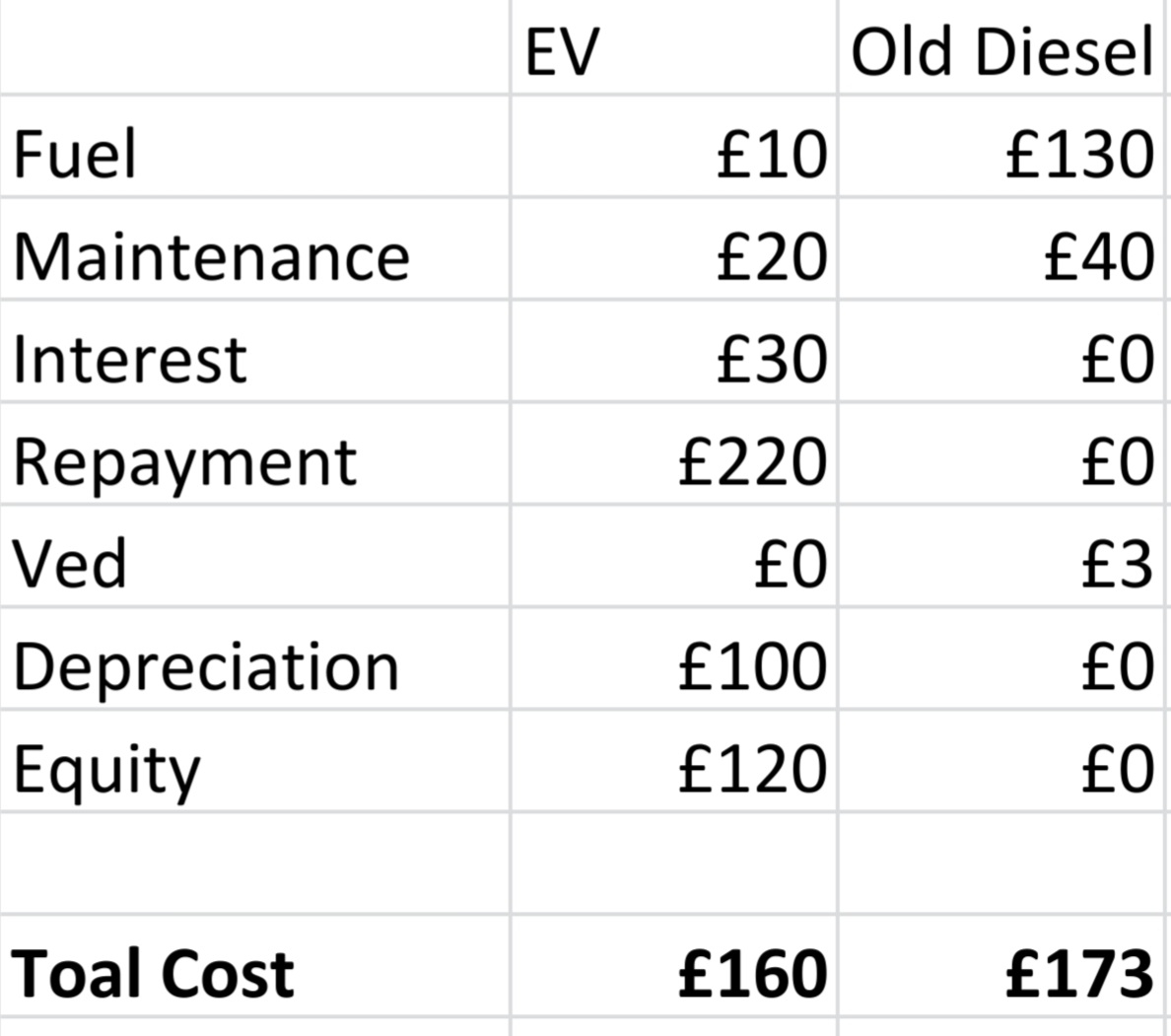

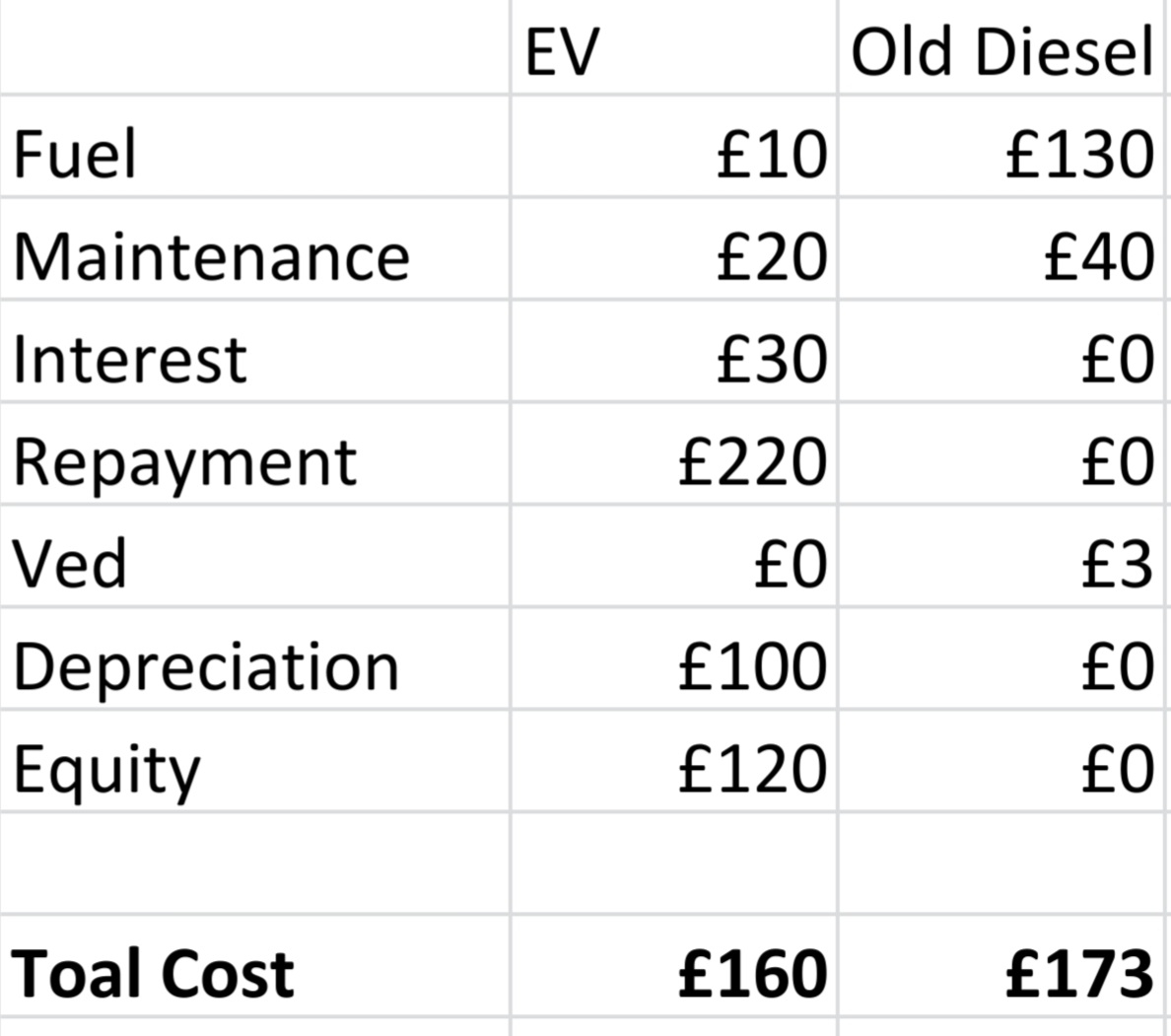

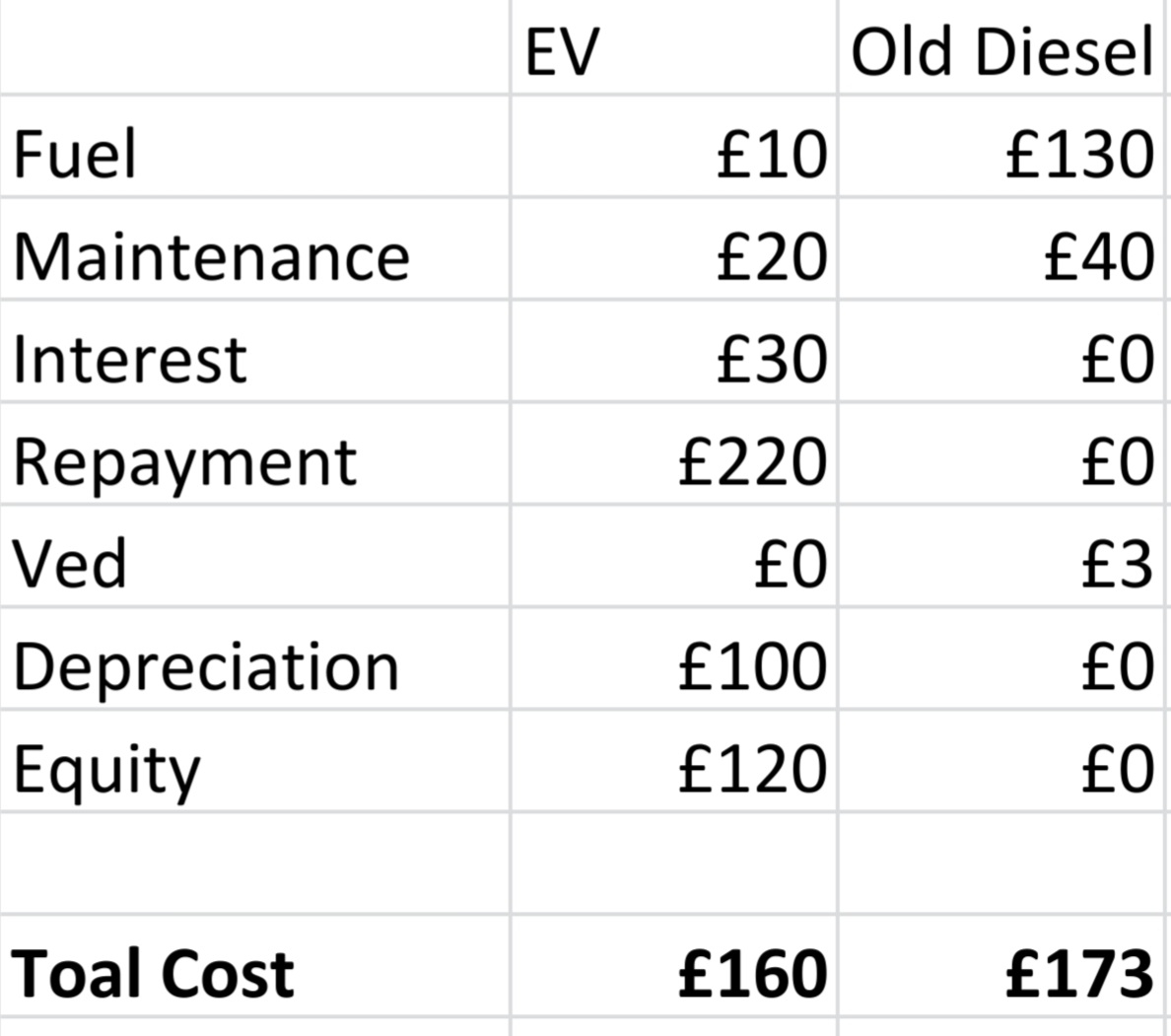

I made a simple spreadsheet to demonstrate how paying more each month can save you money...jimjames said:

But the OP already has their car so they're not paying out for it any more. Anything that increases costs to save a small amount doesn't seem very sensible.Herzlos said:

What planet are you on?Ibrahim5 said:Only £250 per month. LOL. Plus electricity. Petrol Fiesta nowhere near that cost.

The best monthly rate I can see for a new Fiesta (I know you hate like for like comparisons) is £249/month.

That depreciation figure is the key variable. It's highly unpredictable and represents the element of risk with my approach. Obviously fuel costs may change too. But I demonstrably have more money by switching from a 16 year old (fairly economical) diesel to a brand new EV; albeit some of that is locked in the equity in the car.

In reality it's actually better than those figures. Maintenance on the EV has been just £33 in 16 months and depreciation has been zero. The old diesel needed £800 of work to keep on the road. I owe £17,500 on the mortgage (having paid off £2,500 and paid £3k towards the EV from savings) so would be £5,500 in credit if I sold it today.

So, with capital outlay equaling equity, I can currently ignore those costs. I could stop paying the mortgage for the next year without penalty due to the overpayment reserve. While I'm happy to risk the value of that equity dropping, for comparison I only need to look at the running costs and interest.

The old diesel would have cost ~ £2,600 to cover the same 14k miles. The EV has cost ~ £600. That's a £2,000 contribution towards the current equity and potential future depreciation. But, if I sold it today, I'd have that £2k as profit.

But, it gets even better... The next 14k miles would cost more like £3k in the diesel while it will still be around £600 in the EV. With inflation at such a high level, money already paid for an asset effectively appreciates in value. The best deal on a new MG5 is around £4k more than I paid. The money I owe is devaluing faster than the interest rate I fixed at.

It's not rocket surgery. I know it's counterintuitive and not without risk, but sometimes spending money saves you more.3 -

I'd love to know what spreadsheet software you use to calculate those numbers and the accounting standards used to get that number.Petriix said:

I made a simple spreadsheet to demonstrate how paying more each month can save you money...jimjames said:

But the OP already has their car so they're not paying out for it any more. Anything that increases costs to save a small amount doesn't seem very sensible.Herzlos said:

What planet are you on?Ibrahim5 said:Only £250 per month. LOL. Plus electricity. Petrol Fiesta nowhere near that cost.

The best monthly rate I can see for a new Fiesta (I know you hate like for like comparisons) is £249/month.

That depreciation figure is the key variable. It's highly unpredictable and represents the element of risk with my approach. Obviously fuel costs may change too. But I demonstrably have more money by switching from a 16 year old (fairly economical) diesel to a brand new EV; albeit some of that is locked in the equity in the car.

In reality it's actually better than those figures. Maintenance on the EV has been just £33 in 16 months and depreciation has been zero. The old diesel needed £800 of work to keep on the road. I owe £17,500 on the mortgage (having paid off £2,500 and paid £3k towards the EV from savings) so would be £5,500 in credit if I sold it today.

So, with capital outlay equaling equity, I can currently ignore those costs. I could stop paying the mortgage for the next year without penalty due to the overpayment reserve. While I'm happy to risk the value of that equity dropping, for comparison I only need to look at the running costs and interest.

The old diesel would have cost ~ £2,600 to cover the same 14k miles. The EV has cost ~ £600. That's a £2,000 contribution towards the current equity and potential future depreciation. But, if I sold it today, I'd have that £2k as profit.

But, it gets even better... The next 14k miles would cost more like £3k in the diesel while it will still be around £600 in the EV. With inflation at such a high level, money already paid for an asset effectively appreciates in value. The best deal on a new MG5 is around £4k more than I paid. The money I owe is devaluing faster than the interest rate I fixed at.

It's not rocket surgery. I know it's counterintuitive and not without risk, but sometimes spending money saves you more.

For example the £220 a month takes 10 years to pay off the £25k car. Since when is equity is payable on a monthly basis? And what about the additional cost of paying 42p standing charge / 34p/kwh daytime rate with Octopus? Cost of installing a charger?

Aside from the gross miscalculation, it seems your enthusiasm for EV / MG5 has lost the context of this thread completely. If the MG5 works out good for you then so be it but the OP has a £5k Fiesta doing just over 4k miles per year costing about £600 per year in fuel.

If the OP can get the 7.5p electric rate then it would be about £80 a year in fuel costs - saving £520. That means the OP would get about £44 a month to play with to upgrade their car without making a loss.

But then there is £1000 to pay for the EV charger at home, so that will take the first 2 years out of the £44 a month saving.

Over the next 5 years that will leave about £1500 to play with, so the OP could get a £6.5k EV and break even after 5 years.

That is assuming no interest charges on the extra spend as if it was from savings.

I know non-fuel running costs will potentially be lower than a 10 year old Fiesta with less chance of a big bill, lets say the Fiesta will cost £2k more than the EV to keep it on the road in the next 5 years with repairs etc, then the OP could spend £8.5k on an EV and break even.

So at best a 7 - 10 year old EV would fit the bill, maybe save £1000 over 5 years if you scrape the bottom of the barrel and get the cheapest EV from Autotrader which will probably a miserable dreary looking high mileage model.

2 -

But it'd probably in this specific case be best to cut the charger out of this completely and go with a standard 3 pin plug, although this will remove some abilities for the best EV tariffs due to the terms of these. OP will be charging a cheap Leaf at most twice a week with their mileage (and may be able to squeeze once a week out of the car in summer), so over 2 years is looking at around £5/charge for the charger which relistically wouldn't be recouped through cheaper electricity.[Deleted User] said:

I'd love to know what spreadsheet software you use to calculate those numbers and the accounting standards used to get that number.Petriix said:

I made a simple spreadsheet to demonstrate how paying more each month can save you money...jimjames said:

But the OP already has their car so they're not paying out for it any more. Anything that increases costs to save a small amount doesn't seem very sensible.Herzlos said:

What planet are you on?Ibrahim5 said:Only £250 per month. LOL. Plus electricity. Petrol Fiesta nowhere near that cost.

The best monthly rate I can see for a new Fiesta (I know you hate like for like comparisons) is £249/month.

That depreciation figure is the key variable. It's highly unpredictable and represents the element of risk with my approach. Obviously fuel costs may change too. But I demonstrably have more money by switching from a 16 year old (fairly economical) diesel to a brand new EV; albeit some of that is locked in the equity in the car.

In reality it's actually better than those figures. Maintenance on the EV has been just £33 in 16 months and depreciation has been zero. The old diesel needed £800 of work to keep on the road. I owe £17,500 on the mortgage (having paid off £2,500 and paid £3k towards the EV from savings) so would be £5,500 in credit if I sold it today.

So, with capital outlay equaling equity, I can currently ignore those costs. I could stop paying the mortgage for the next year without penalty due to the overpayment reserve. While I'm happy to risk the value of that equity dropping, for comparison I only need to look at the running costs and interest.

The old diesel would have cost ~ £2,600 to cover the same 14k miles. The EV has cost ~ £600. That's a £2,000 contribution towards the current equity and potential future depreciation. But, if I sold it today, I'd have that £2k as profit.

But, it gets even better... The next 14k miles would cost more like £3k in the diesel while it will still be around £600 in the EV. With inflation at such a high level, money already paid for an asset effectively appreciates in value. The best deal on a new MG5 is around £4k more than I paid. The money I owe is devaluing faster than the interest rate I fixed at.

It's not rocket surgery. I know it's counterintuitive and not without risk, but sometimes spending money saves you more.

For example the £220 a month takes 10 years to pay off the £25k car. Since when is equity is payable on a monthly basis? And what about the additional cost of paying 42p standing charge / 34p/kwh daytime rate with Octopus? Cost of installing a charger?

Aside from the gross miscalculation, it seems your enthusiasm for EV / MG5 has lost the context of this thread completely. If the MG5 works out good for you then so be it but the OP has a £5k Fiesta doing just over 4k miles per year costing about £600 per year in fuel.

If the OP can get the 7.5p electric rate then it would be about £80 a year in fuel costs - saving £520. That means the OP would get about £44 a month to play with to upgrade their car without making a loss.

But then there is £1000 to pay for the EV charger at home, so that will take the first 2 years out of the £44 a month saving.

Over the next 5 years that will leave about £1500 to play with, so the OP could get a £6.5k EV and break even after 5 years.

That is assuming no interest charges on the extra spend as if it was from savings.

I know non-fuel running costs will potentially be lower than a 10 year old Fiesta with less chance of a big bill, lets say the Fiesta will cost £2k more than the EV to keep it on the road in the next 5 years with repairs etc, then the OP could spend £8.5k on an EV and break even.

So at best a 7 - 10 year old EV would fit the bill, maybe save £1000 over 5 years if you scrape the bottom of the barrel and get the cheapest EV from Autotrader which will probably a miserable dreary looking high mileage model.

We worked out we were slightly better off on a non-EV E7 tariff for domestic usage when fixed, however need to do the numbers again now. This may not mean that everyone is better off.doing things this way though.💙💛 💔2 -

I should have labelled it 'increase in equity'. It's the change in difference between what the car is worth and what I still owe on that part of the mortgage.iwb100 said:Can I ask what the equity figure is based on? And why an old diesel has zero equity? That part is messing with my mind.

In my example the old diesel was effectively worthless - they scrapped it when I traded it in, but would probably have some value in today's inflated market.

While you call it a 'gross miscalculation' to factor in the residual value of the EV, I'd suggest it's wildly inaccurate to completely ignore it. Of course you don't get the equity in your pocket each month, but you do receive it all as a lump sum on the day you sell. The OP could drive their £15k Zoe for a year, then likely sell it for the same or more, having only actually cost them some interest as all of the capital repayments would come back to them.[Deleted User] said:

I'd love to know what spreadsheet software you use to calculate those numbers and the accounting standards used to get that number.Petriix said:

I made a simple spreadsheet to demonstrate how paying more each month can save you money...jimjames said:

But the OP already has their car so they're not paying out for it any more. Anything that increases costs to save a small amount doesn't seem very sensible.Herzlos said:

What planet are you on?Ibrahim5 said:Only £250 per month. LOL. Plus electricity. Petrol Fiesta nowhere near that cost.

The best monthly rate I can see for a new Fiesta (I know you hate like for like comparisons) is £249/month.

That depreciation figure is the key variable. It's highly unpredictable and represents the element of risk with my approach. Obviously fuel costs may change too. But I demonstrably have more money by switching from a 16 year old (fairly economical) diesel to a brand new EV; albeit some of that is locked in the equity in the car.

In reality it's actually better than those figures. Maintenance on the EV has been just £33 in 16 months and depreciation has been zero. The old diesel needed £800 of work to keep on the road. I owe £17,500 on the mortgage (having paid off £2,500 and paid £3k towards the EV from savings) so would be £5,500 in credit if I sold it today.

So, with capital outlay equaling equity, I can currently ignore those costs. I could stop paying the mortgage for the next year without penalty due to the overpayment reserve. While I'm happy to risk the value of that equity dropping, for comparison I only need to look at the running costs and interest.

The old diesel would have cost ~ £2,600 to cover the same 14k miles. The EV has cost ~ £600. That's a £2,000 contribution towards the current equity and potential future depreciation. But, if I sold it today, I'd have that £2k as profit.

But, it gets even better... The next 14k miles would cost more like £3k in the diesel while it will still be around £600 in the EV. With inflation at such a high level, money already paid for an asset effectively appreciates in value. The best deal on a new MG5 is around £4k more than I paid. The money I owe is devaluing faster than the interest rate I fixed at.

It's not rocket surgery. I know it's counterintuitive and not without risk, but sometimes spending money saves you more.

For example the £220 a month takes 10 years to pay off the £25k car. Since when is equity is payable on a monthly basis? And what about the additional cost of paying 42p standing charge / 34p/kwh daytime rate with Octopus? Cost of installing a charger?

Aside from the gross miscalculation, it seems your enthusiasm for EV / MG5 has lost the context of this thread completely. If the MG5 works out good for you then so be it but the OP has a £5k Fiesta doing just over 4k miles per year costing about £600 per year in fuel.

If the OP can get the 7.5p electric rate then it would be about £80 a year in fuel costs - saving £520. That means the OP would get about £44 a month to play with to upgrade their car without making a loss.

But then there is £1000 to pay for the EV charger at home, so that will take the first 2 years out of the £44 a month saving.

Over the next 5 years that will leave about £1500 to play with, so the OP could get a £6.5k EV and break even after 5 years.

That is assuming no interest charges on the extra spend as if it was from savings.

I know non-fuel running costs will potentially be lower than a 10 year old Fiesta with less chance of a big bill, lets say the Fiesta will cost £2k more than the EV to keep it on the road in the next 5 years with repairs etc, then the OP could spend £8.5k on an EV and break even.

So at best a 7 - 10 year old EV would fit the bill, maybe save £1000 over 5 years if you scrape the bottom of the barrel and get the cheapest EV from Autotrader which will probably a miserable dreary looking high mileage model.

Do you really think that a £15k Zoe will lose significantly more value than a £5k Fiesta over say 5 years? There aren't any EVs under 7 years old for < £7,500 on Autotrader. Demand is high and will only get higher in the medium term. Now is a great time to buy.

And you're completely barking up the wrong tree suggesting that an EV tariff might cost you more money than the standard variable rate. All you have to do is switch 30% of your usage to the off peak window and you're saving money. It's saving me hundreds because I was able to fix in January at 5p/24p while no other fix made sense. That's another massive benefit of EV ownership.1 -

If you make so much money out of buying new EVs I would suggest it's best to buy as many as you can. Maybe that's why they are all sold out.2

-

Whilst I generally support your arguments, I'd suggest that in this case probably "yes".Petriix said:Do you really think that a £15k Zoe will lose significantly more value than a £5k Fiesta over say 5 years? There aren't any EVs under 7 years old for < £7,500 on Autotrader. Demand is high and will only get higher in the medium term. Now is a great time to buy.

At the OPs mileage rates, if they take care of it the Fiesta will probably retain at least some of it's value. Lets say £2000 - which is a drop of £3000.

It's not unlikely that a £15k Zoe would lose more than that in 5 years - if it went down to £9000 (to make the sums easy), that would be twice the loss on the Fiesta.

Proportionally it'd be a lower amount, but in terms of actual £, less - because 100% of the Fiesta's value is only 1/3 of the Zoe's.

This is also based on personal circumstances. For instance, tt would be very hard for us to shift 30% of our usage to the off-peak window as our biggest use of electricity is underfloor heating (grrrr, don't get me started!) which we use during the day.Petriix said:And you're completely barking up the wrong tree suggesting that an EV tariff might cost you more money than the standard variable rate. All you have to do is switch 30% of your usage to the off peak window and you're saving money. It's saving me hundreds because I was able to fix in January at 5p/24p while no other fix made sense. That's another massive benefit of EV ownership.

3 -

The assumption about EV value might be flawed. There are some technologies that can significant boost range and performance. They could hit the market in the next five years leading to current EVs being far less desirable. An American company is working on bringing it to market.

Even that aside there are efficiencies in battery prep and management that are coming all the time so EVs even using the same battery tech as now will be significantly better in 5 years time. If the membrane stuff hits then current EVs will potentially be worth very little.I think it’s a high risk time to buy an EV personally - speaking to dealers selling them and they often say the same, it’s too early for that. Leasing them makes a lot of sense as the technology matures and the standards iterate. Just my view.Spoke to a dealer last week selling EVs and the demand is ever rising and their point is that the cars of 2022 with batter degradation alongside the new developments and whatever simply won’t be viable in the market in 8 years because the market is moving so fast due to legislation and of course emissions standards.4 -

It's fair enough to assume some depreciation. EVs do seem to have a floor in that the battery has an intrinsic value. Future technologies may alter things; but 7 year old EVs are still retaining significant value despite having half the battery size of current equivalent models.

The point is that the ongoing savings will likely add up to more than the depreciation. Add in the effects of inflation and money spent today on cutting future costs has a compound effect. What price do you think petrol might be in 5 years? How will that compare to electricity? My guess is that fossil fuels will continue to go up while electricity will stabilise.

It may be too marginal for the OP, but anyone doing 8k miles plus would likely save significantly by switching to an EV.1 -

Petriix said:I made a simple spreadsheet to demonstrate how paying more each month can save you money...

I don't want to entirely discount the potential that buying a new EV (or even a new ICE) could work in such a way that there could be a "pay-back". I had a similar consideration once when I was driving a 2.5 litre petrol-guzzling Mondeo that was starting to accrue maintenance costs. I did compare the option to a C4 diesel that was on an attractive offer and in theory the fuel savings would have eventually paid for the car.

However, that calculation seems entirely flawed. Which lines are + costs and which lines are - savings to reach the £160?

The scenario is not right in the idea of "buying equity" every month.

You start with £25k equity (cash) and exchange that for £25k equity (car) on day 1.

After 1 month you pay £30 interest and £220 capital repayment (£250 total). You also have reduced equity as the car is no longer worth £25k.

Repeat each subsequent month.

In an extreme scenario, the car could be an appreciating asset in which case you'd have an "equity" value but no "depreciation" value - it is simply not possible to have an individual item showing depreciation and accumulation in the same period.

Anyway, it is entirely irrelevant for the OP who is likely frustrated by the de-railing of their thread. They have a perfectly good Fiesta (paid for) that will last them for many years and provide low-cost motoring. It is possible the OP could make a reduction in operating costs by swapping to an early Leaf, but they may well not feel that they have been "upgraded" in their car if they make that change. Whatever operating cost reduction might be possible, the OP will need to set that against the extra capital required to achieve that and, for the mileage profile in consideration, that is likely to be quite a long time even if the increase in purchase price was from the current £5k Fiesta to a £7k Leaf.

Proposals and consideration to a new £25k MG5 or any equivalent car would only be relevant if the OP was considering against a brand new car but that does not seem to be the OP's suggestion.

3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards