We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Investing large sum - drip feed or all-in?

Comments

-

JakeHyde said:Never bet more than you are happy to lose!

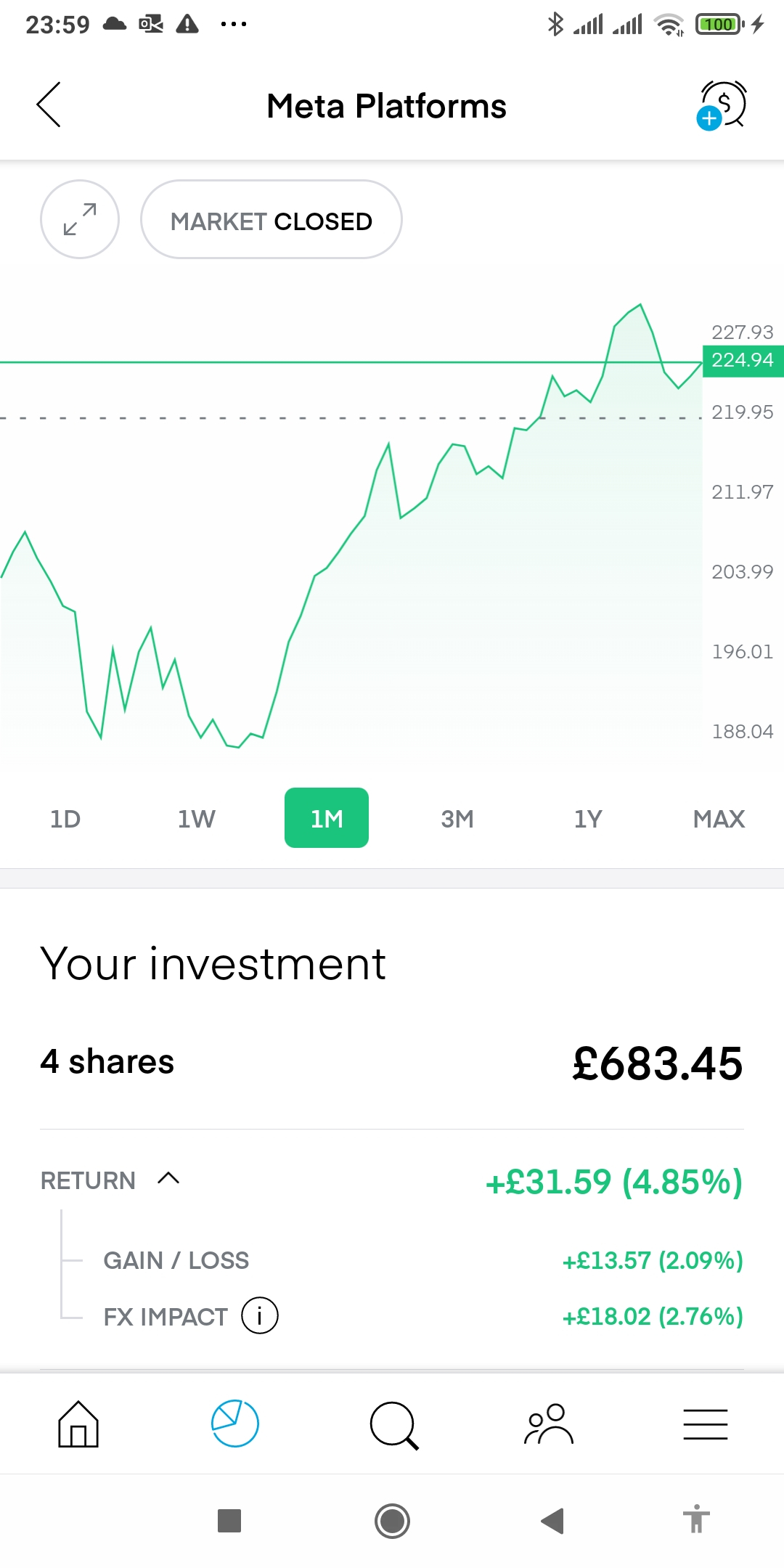

I took my first step into investing the other month, when FB stock took a 28Bil dive!

So I bought £1k of stock via Lightyear, thinking it was easy money. My £1k slowly turned into £820 🤢

But it's now back up to £980. It was a learning experiment. But even that small amount made me ill! hahaI'm wanting to max out my ISA by the end of this year, and the the thought of it makes my anxious, but I feel like I have to do it.

I know Warren Buffett is holding onto his cash, but I guess he can afford to! haha

I don'y want to miss my Tax allowance!JakeHyde. When did you buy your FB stock ??I mentioned FB in this thread on March 8, 2022.And it seems you did not buy it during this dip period and you bought it lump sum £1k in one go, where you could actually do fractional DCA of 0.25, 0.5, 1 share at a time during Feb, March?Anyway, it has happened but now take a screen shot of your FB today and watch it when the bear market is over in a bout a year time and post it here. As I mention on other thread face is facing two problems, sentiments against FB and sentiment against high growth stock in the hihg inflation, bear market environment.I also own FB here is my result with DCAs around Feb, March. I just bought 0.5 or 1 share at a time not buying in one go. I do not intend to hold it forever as I already have S&P500, VLS for long term holding which will track FB. If you want to preserve your ISA allowance this tax year, and do not want to throw lump sum randomly into the stock market, what you could do is to put the rest of your ISA allowance in the flexible cash ISA before April 6, 2022. There are a few flexible cash ISA available such as HSBC, and NW ISA. After April 6, 2022 your ISA allowance will be reset with a new ISA allowance and the cash ISA you put before April 6, could be moved to higher interest paying RSA or saving account. You could transfer this cash ISA anytime back to flexible ISA any time within this 22/23 tax year when you need allocating it to S&S using ISA a formal ISA transfer request.But of course you will need to do your own DD and decide whatever the best course of action for you. We take our own gain but we also need to take our own loss if it ever happens.

If you want to preserve your ISA allowance this tax year, and do not want to throw lump sum randomly into the stock market, what you could do is to put the rest of your ISA allowance in the flexible cash ISA before April 6, 2022. There are a few flexible cash ISA available such as HSBC, and NW ISA. After April 6, 2022 your ISA allowance will be reset with a new ISA allowance and the cash ISA you put before April 6, could be moved to higher interest paying RSA or saving account. You could transfer this cash ISA anytime back to flexible ISA any time within this 22/23 tax year when you need allocating it to S&S using ISA a formal ISA transfer request.But of course you will need to do your own DD and decide whatever the best course of action for you. We take our own gain but we also need to take our own loss if it ever happens.

0 -

Generally speaking, dollar-cost averaging DCA (E.g drip feeding) works best in bear market, falling market and with securities that have dramatic price swings up and down based on the research.Actually it is very easy to see it does not need a research to know that during the particular period of the bear market (falling market) DCA (Drip feeding) will outperform lump Sum as during this period the the price will fall more than it rises. Most research showing the Lump-sum beat DCA are looking into the bull market and long term period not particularly focus on the bear /falling market.

0 -

I agree on drip feeding or investing in large chunks rather than it all at once. If I invested only half the money and shortly after that it fell by 25% I would be still be disappointed, but hopefully I would see that as an opportunity to then invest the remaining £125k at the reduced price.Albermarle said:

Your comments are a good rational argument.sebtomato said:

It's a bit of a contradiction TBH. If you invest money on the stock market, you are betting your funds will increase in the long term.Albermarle said: I would personally stage it as well, but just because that would reduce the worry.

If you believe that's the case, zero reason to drip feed.

If you don't believe that's the case, why invest at all?

However human beings are a mixture or rationality and emotion . In many different proportions .

If most people invested in £250K in one go and it went down 25%, they would be sick as the proverbial parrot . No amount of rational argument about long term growth would console them . So drip feeding would lessen any potential pain and anxiety , although in reality it wouldn't make that much difference one way or the other .0 -

All in, but only with money that you can afford to lose. If you drip feed, Sod's Law says that the market will hold up until you are all in, and then crash.2

-

Ive been taking a look at my VLS60 this am and just looking at some of the data and playing around with stuff.

Ive noticed that when i put in my lump sum to bring my isa allowance to 20k, the following day i got a 0.67p bonus put into my cash holding! What is that for ? Unfortunately i then proceeded to invest it straight away at a higher price. The lump sum had also gone in at a higher price so theyve both increased my average unit cost. Never mind!

My personal rate of return is which is -4.52% since 27th jan, not really wrried about that.But Is there a way of working it out or is it not worth the trouble?

Ive noticed that i can withdraw money or units and transfer them back to my cash isa holding rather than my nominated bank account. I'm not saying i will do and it may not be for the best but ! From tomorrow i'm scheduled to be drip feeding this years money in. Of course Vanguard are recommending not to miss out by getting all in as soon as!

Ive read from Vanguard's education tab that computer models predictions for the next decade are 4.2-6.2% annualised returns from UK shares and 2.5-4.5% for overseas shares. Are these predictions before inflation and, i suppose, can be taken with a pinch of salt?

Daily Mail now predicting a recession, which may last 3 years in US!

0 -

Ive read from Vanguard's education tab that computer models predictions for the next decade are 4.2-6.2% annualised returns from UK shares and 2.5-4.5% for overseas shares. Are these predictions before inflation and, i suppose, can be taken with a pinch of salt?All guesswork

There is no way to predict terrorists flying into skyscrapers, nuclear power stations melting down due to a Tsunami or accountancy firms in a particular country fudging figures or invasions or plagues etc.Daily Mail now predicting a recession, which may last 3 years in US!They will probably run another article from a different hack predicting a boom and then in the future, the outcome was known, they can claim they predicted it right.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.4 -

I have had interest appearing in my Vanguard account when I have had a big cash balance.Collyflower1 said:Ive noticed that when i put in my lump sum to bring my isa allowance to 20k, the following day i got a 0.67p bonus put into my cash holding! What is that for?

Yes, but Vanguard has done it for you. Is it useful? Not particularly.Collyflower1 said:My personal rate of return is which is -4.52% since 27th jan, not really wrried about that.But Is there a way of working it out or is it not worth the trouble?

Vanguard's ISA is a flexible ISA, so you will not lose any of the current year's allowance if you withdraw money. Normally, it is best to leave cash in the ISA.Collyflower1 said:Ive noticed that i can withdraw money or units and transfer them back to my cash isa holding rather than my nominated bank account.

No, they are before inflation. Vanguard's estimates are as good as any, but that is not saying much. Stock market predictions are never reliable.Collyflower1 said:Ive read from Vanguard's education tab that computer models predictions for the next decade are 4.2-6.2% annualised returns from UK shares and 2.5-4.5% for overseas shares. Are these predictions before inflation and, i suppose, can be taken with a pinch of salt?

0 -

NedS said:sebtomato said:

It's a bit of a contradiction TBH. If you invest money on the stock market, you are betting your funds will increase in the long term.Albermarle said: I would personally stage it as well, but just because that would reduce the worry.

If you believe that's the case, zero reason to drip feed.

If you don't believe that's the case, why invest at all?Yes, of course, but equally it's not unreasonable to take a view that prices may also have the potential to fall in the short term too, and a better entry price will give better returns.

If it's to invest in the long term, then trying to time the market usually doesn't make much difference in the overall returns.

If it's to invest in the short term, then...well, stock market will be a gamble. But then, what's the point of gambling money if it's not to make the best return possible, so may as well invest all in one go and hope for the best, as opposed to averaging out, which may still not avoid a loss over a short period.0 -

Collyflower1 said:Ive been taking a look at my VLS60 this am and just looking at some of the data and playing around with stuff.

Ive noticed that when i put in my lump sum to bring my isa allowance to 20k, the following day i got a 0.67p bonus put into my cash holding! What is that for ? Unfortunately i then proceeded to invest it straight away at a higher price. The lump sum had also gone in at a higher price so theyve both increased my average unit cost. Never mind!

My personal rate of return is which is -4.52% since 27th jan, not really wrried about that.But Is there a way of working it out or is it not worth the trouble?

Ive noticed that i can withdraw money or units and transfer them back to my cash isa holding rather than my nominated bank account. I'm not saying i will do and it may not be for the best but ! From tomorrow i'm scheduled to be drip feeding this years money in. Of course Vanguard are recommending not to miss out by getting all in as soon as!

Ive read from Vanguard's education tab that computer models predictions for the next decade are 4.2-6.2% annualised returns from UK shares and 2.5-4.5% for overseas shares. Are these predictions before inflation and, i suppose, can be taken with a pinch of salt?

Daily Mail now predicting a recession, which may last 3 years in US!

Realistically the reality, probably, won't be too far off those ranges most of the time give or take a year or two at either end. Returns predictions are more to manage investor expectations (or sell high returns) than try and be the closest. The least bad method I've seen is to simply take the inverse CAPE or CAPE yield as the real total return for the next 10 years, and least for the UK example this seems to have worked fairly well. Using ONS CPI, Barclays Equity Gilts Study UK total equity returns and Barclays CAPE data (https://indices.barclays/IM/21/en/indices/welcome.app) you get an average difference close to 0 and I think when I last worked it out the standard deviation was 3%. This also works for the S&P500 using data from Robert Shiller's own website although the advent of buybacks, which started to exceed dividends around the .com bubble, and secular low interest rates has made it less reliable.At a global level I'm not as sure of its utility. Reporting requirements vary materially by country, currency fluctuations can vary figures, and the data is less available anyway.

Dividend yield can also be a good "base scenario" indicator most of the time.0 -

Returns are before inflation.Collyflower1 said:

Ive read from Vanguard's education tab that computer models predictions for the next decade are 4.2-6.2% annualised returns from UK shares and 2.5-4.5% for overseas shares. Are these predictions before inflation and, i suppose, can be taken with a pinch of salt?

Daily Mail now predicting a recession, which may last 3 years in US!

Suggest you read less sensationalist sources of information. FT, The Economist. Investors Chronicle for example. Will give you more informed understanding of the dark clouds that lie on the horizon. Hence why forecast returns even before recent events in Ukraine took centre stage for the decade ahead were muted.

In February 2021 the chair of the US Federal Reserve said that it would take the US three years to return to an inflation level of 2%. A serious misjudgement has seemingly occurred and loose monetary policy has backfired. Reccession may be the only way to put the genie back in the bottle. A medicine that has been dished out on previous occcasions in the past.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.3K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.4K Work, Benefits & Business

- 601.1K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards