We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Living off dividends?

Comments

-

There appears to be very little research on natural yield as drawdown strategy, but Okusanya (https://finalytiq.co.uk/natural-yield-totally-bonkers-retirement-income-strategy/, 2017) had backtested it for the UK with (as might be obvious from the web link) what he suggests are poor outcomes.

6 -

Really interested in this as we have money to save, not as an income now but more an investment , do you manage these yourself or via financial advisor?soulsaver said:I get c. £10k div income pa from £200k from a few fairly safe shares, which I use as an alternative to cash eroding by inflation in the bank .

But I couldn't imagine relying on them/it as my only source of income.

0 -

If the government does keep its promise of a state pension that's an extra 😉

The possibility that any UK government would cancel the State Pension is approx zero, as it would be political suicide.

Older people vote in large numbers , hence why we have the expensive Triple/Double Lock increases every year.

if the government a) puts state pension and workplace pension up to a rediculous age

The plans for this are already largely known and in place

You should plan your pension/retirement plans on what is known today, and not on some unknown changes that may or may not come in future, especially one so unlikely to happen as the state pension stopping .

3 -

The paper is in itself based on an academic database. Which far too often is quoted as a gospel.OldScientist said:

How about Estrada (Maximum Withdrawal Rates: An empirical and global perspective, The Journal of Retirement, 2018) - UK results are right at the end of exhibit A2 (and indeed presents a historical maximum withdrawal rate, at a 1% probability of failure, for the UK of about 3.2% (for a 60/40 portfolio)? That paper also has a nice discussion on the merits (and otherwise) of fixed and variable withdrawals.Thrugelmir said:

@Audaxer If you can point me in the direction of a published piece of UK academic research I'l happily accept the historic data (and forward forecasting) for the oft quoted 4% SWR. I should add there's little point in saying something is safe then adding the caveat that it's not guaranteed . As simply muddies the water further.Audaxer said:

@Thrugelmir, so as not to worry the OP too much, I think I would clarify that it is not just people making it up without any foundation. As you know, 4% is often quoted as a "safe withdrawal rate" based on historical data. It is not guaranteed and I think in the UK 3.5% might be safer, but it all depends on the sequence of returns. However the OP will presumably only need that amount until he gets his State Pension, which should nearly cover his basic income requirements if he qualifies for the full amount of the new State Pension. So whether its from dividend income or selling capital, I think the OP would probably be okay with a 4% withdrawal rate.Thrugelmir said:

People say lots of things, often without solid sound foundation. That's how myths and mantra's are born. If there was a fail safe system then somebody would identified it by now.DireEmblem said:

You could draw down capital and/or income. Overall if you consider 'live off' as retiring, then people say that 4% is a safe withdrawal rate.MrE1 said:How much would I need invested to live off dividends? There are articles online but I'm interested to hear from real investors who have done it. My living cost is as low as £10200 per annum

So 10200/4% is 255k

Your thinking simply reinforces my earlier comment.

I would agree that "Safe" is a misnomer, Bengen (Choosing The Highest Safe Withdrawal Rate At Retirement, 2020) has a nice disclaimer that "the term “safe” is meaningful only in its historical context, and does not imply a guarantee of future applicability"

Bengen is of course US focussed of little relevance to an investor based in the UK.

0 -

Bengen's theories so apply to a UK investor although the numbers have to be changed. A UK investor is likely to be invested in a similar portfolio to a US investor, the different being country allocations. The equity/bond split and rebalance principles are the same.Thrugelmir said:

The paper is in itself based on an academic database. Which far too often is quoted as a gospel.OldScientist said:

How about Estrada (Maximum Withdrawal Rates: An empirical and global perspective, The Journal of Retirement, 2018) - UK results are right at the end of exhibit A2 (and indeed presents a historical maximum withdrawal rate, at a 1% probability of failure, for the UK of about 3.2% (for a 60/40 portfolio)? That paper also has a nice discussion on the merits (and otherwise) of fixed and variable withdrawals.Thrugelmir said:

@Audaxer If you can point me in the direction of a published piece of UK academic research I'l happily accept the historic data (and forward forecasting) for the oft quoted 4% SWR. I should add there's little point in saying something is safe then adding the caveat that it's not guaranteed . As simply muddies the water further.Audaxer said:

@Thrugelmir, so as not to worry the OP too much, I think I would clarify that it is not just people making it up without any foundation. As you know, 4% is often quoted as a "safe withdrawal rate" based on historical data. It is not guaranteed and I think in the UK 3.5% might be safer, but it all depends on the sequence of returns. However the OP will presumably only need that amount until he gets his State Pension, which should nearly cover his basic income requirements if he qualifies for the full amount of the new State Pension. So whether its from dividend income or selling capital, I think the OP would probably be okay with a 4% withdrawal rate.Thrugelmir said:

People say lots of things, often without solid sound foundation. That's how myths and mantra's are born. If there was a fail safe system then somebody would identified it by now.DireEmblem said:

You could draw down capital and/or income. Overall if you consider 'live off' as retiring, then people say that 4% is a safe withdrawal rate.MrE1 said:How much would I need invested to live off dividends? There are articles online but I'm interested to hear from real investors who have done it. My living cost is as low as £10200 per annum

So 10200/4% is 255k

Your thinking simply reinforces my earlier comment.

I would agree that "Safe" is a misnomer, Bengen (Choosing The Highest Safe Withdrawal Rate At Retirement, 2020) has a nice disclaimer that "the term “safe” is meaningful only in its historical context, and does not imply a guarantee of future applicability"

Bengen is of course US focussed of little relevance to an investor based in the UK.0 -

I didn't say it was safe, I just referred to the often quoted "safe withdrawal rate" as it is referred to a lot on this forum and other places. I added the fact that it is not guaranteed, so that the OP wouldn't think it was a fail safe system, and I went on to say in the UK 3.5% might be safer, but even then it depends on the sequence of returns.Thrugelmir said:

@Audaxer If you can point me in the direction of a published piece of UK academic research I'l happily accept the historic data (and forward forecasting) for the oft quoted 4% SWR. I should add there's little point in saying something is safe then adding the caveat that it's not guaranteed . As simply muddies the water further.Audaxer said:

@Thrugelmir, so as not to worry the OP too much, I think I would clarify that it is not just people making it up without any foundation. As you know, 4% is often quoted as a "safe withdrawal rate" based on historical data. It is not guaranteed and I think in the UK 3.5% might be safer, but it all depends on the sequence of returns. However the OP will presumably only need that amount until he gets his State Pension, which should nearly cover his basic income requirements if he qualifies for the full amount of the new State Pension. So whether its from dividend income or selling capital, I think the OP would probably be okay with a 4% withdrawal rate.Thrugelmir said:

People say lots of things, often without solid sound foundation. That's how myths and mantra's are born. If there was a fail safe system then somebody would identified it by now.DireEmblem said:

You could draw down capital and/or income. Overall if you consider 'live off' as retiring, then people say that 4% is a safe withdrawal rate.MrE1 said:How much would I need invested to live off dividends? There are articles online but I'm interested to hear from real investors who have done it. My living cost is as low as £10200 per annum

So 10200/4% is 255k

Your thinking simply reinforces my earlier comment.1 -

The underlying principles were established back in 1952. Nothing has radically changed since.Prism said:

Bengen's theories so apply to a UK investor although the numbers have to be changed. A UK investor is likely to be invested in a similar portfolio to a US investor, the different being country allocations. The equity/bond split and rebalance principles are the same.Thrugelmir said:

The paper is in itself based on an academic database. Which far too often is quoted as a gospel.OldScientist said:

How about Estrada (Maximum Withdrawal Rates: An empirical and global perspective, The Journal of Retirement, 2018) - UK results are right at the end of exhibit A2 (and indeed presents a historical maximum withdrawal rate, at a 1% probability of failure, for the UK of about 3.2% (for a 60/40 portfolio)? That paper also has a nice discussion on the merits (and otherwise) of fixed and variable withdrawals.Thrugelmir said:

@Audaxer If you can point me in the direction of a published piece of UK academic research I'l happily accept the historic data (and forward forecasting) for the oft quoted 4% SWR. I should add there's little point in saying something is safe then adding the caveat that it's not guaranteed . As simply muddies the water further.Audaxer said:

@Thrugelmir, so as not to worry the OP too much, I think I would clarify that it is not just people making it up without any foundation. As you know, 4% is often quoted as a "safe withdrawal rate" based on historical data. It is not guaranteed and I think in the UK 3.5% might be safer, but it all depends on the sequence of returns. However the OP will presumably only need that amount until he gets his State Pension, which should nearly cover his basic income requirements if he qualifies for the full amount of the new State Pension. So whether its from dividend income or selling capital, I think the OP would probably be okay with a 4% withdrawal rate.Thrugelmir said:

People say lots of things, often without solid sound foundation. That's how myths and mantra's are born. If there was a fail safe system then somebody would identified it by now.DireEmblem said:

You could draw down capital and/or income. Overall if you consider 'live off' as retiring, then people say that 4% is a safe withdrawal rate.MrE1 said:How much would I need invested to live off dividends? There are articles online but I'm interested to hear from real investors who have done it. My living cost is as low as £10200 per annum

So 10200/4% is 255k

Your thinking simply reinforces my earlier comment.

I would agree that "Safe" is a misnomer, Bengen (Choosing The Highest Safe Withdrawal Rate At Retirement, 2020) has a nice disclaimer that "the term “safe” is meaningful only in its historical context, and does not imply a guarantee of future applicability"

Bengen is of course US focussed of little relevance to an investor based in the UK.

Looking back at the past through the lens of investing as we know it today doesn't compute. Not least that open global markets didn't even exist. Trading stocks and shares was also laborious and cumbersome. Potentially weeks for settlement by cheque, nothing instanteous.0 -

The database itself is based on historical records of asset prices, dividends/coupons, and inflation each of which have some uncertainties. For example, prior to 1948, the UK had a variety of inflation measures none of which were officially adopted or consistent and I'm aware of 4 different inflation time series which produce different values of the SWR (by 20-30 bps). These uncertainties mean that arguing over historical WR even to the nearest 20-30 bps is likely to be pointless. Historical data for a particular country are of no use in predicting the exact future WR (e.g. if the UK was to undergo even a short period of hyperinflation like Germany did in the 1920s, the 'safe' WR could easily drop to less than 1%. Where historical data are of use is in testing a proposed plan - if it failed in the past then, to me, that indicates that it is not a good plan (but the converse is not necessarily true, if plan succeeded in the past, then it doesn't indicate that the plan will be good in the future).Thrugelmir said:

The paper is in itself based on an academic database. Which far too often is quoted as a gospel.OldScientist said:

How about Estrada (Maximum Withdrawal Rates: An empirical and global perspective, The Journal of Retirement, 2018) - UK results are right at the end of exhibit A2 (and indeed presents a historical maximum withdrawal rate, at a 1% probability of failure, for the UK of about 3.2% (for a 60/40 portfolio)? That paper also has a nice discussion on the merits (and otherwise) of fixed and variable withdrawals.Thrugelmir said:

@Audaxer If you can point me in the direction of a published piece of UK academic research I'l happily accept the historic data (and forward forecasting) for the oft quoted 4% SWR. I should add there's little point in saying something is safe then adding the caveat that it's not guaranteed . As simply muddies the water further.Audaxer said:

@Thrugelmir, so as not to worry the OP too much, I think I would clarify that it is not just people making it up without any foundation. As you know, 4% is often quoted as a "safe withdrawal rate" based on historical data. It is not guaranteed and I think in the UK 3.5% might be safer, but it all depends on the sequence of returns. However the OP will presumably only need that amount until he gets his State Pension, which should nearly cover his basic income requirements if he qualifies for the full amount of the new State Pension. So whether its from dividend income or selling capital, I think the OP would probably be okay with a 4% withdrawal rate.Thrugelmir said:

People say lots of things, often without solid sound foundation. That's how myths and mantra's are born. If there was a fail safe system then somebody would identified it by now.DireEmblem said:

You could draw down capital and/or income. Overall if you consider 'live off' as retiring, then people say that 4% is a safe withdrawal rate.MrE1 said:How much would I need invested to live off dividends? There are articles online but I'm interested to hear from real investors who have done it. My living cost is as low as £10200 per annum

So 10200/4% is 255k

Your thinking simply reinforces my earlier comment.

I would agree that "Safe" is a misnomer, Bengen (Choosing The Highest Safe Withdrawal Rate At Retirement, 2020) has a nice disclaimer that "the term “safe” is meaningful only in its historical context, and does not imply a guarantee of future applicability"

Bengen is of course US focussed of little relevance to an investor based in the UK.

I'd agree with prism - some of the lessons from US research are relevant (i.e. there is a limit to spending and this is well below the rate of return) is but definitely not the numbers.

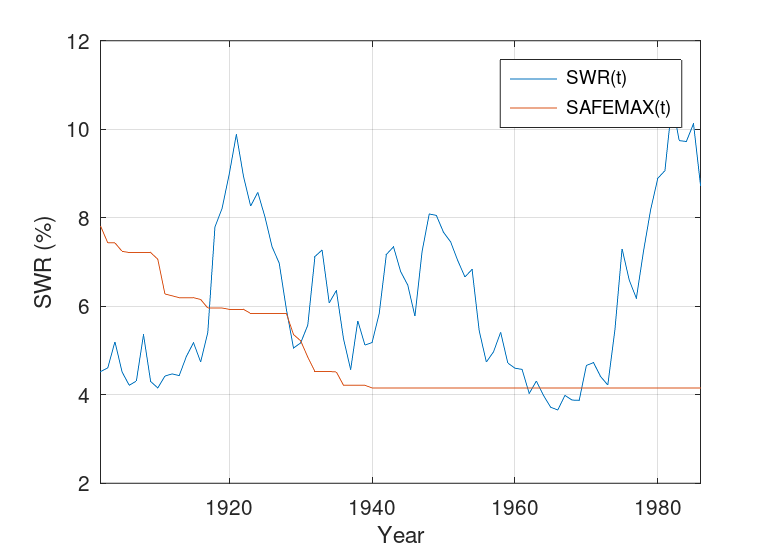

There is an easy illustration of how nonsensical SAFEMAX is in terms of future relevance (sorry in advance for using US numbers, but the lesson is relevant to any country). The following graph shows the known US 'SAFEMAX' at any year in red and the historical SWR for the 30 year retirement starting that year in blue (for a 60/40 portfolio). If the Trinity study had been published 100 years earlier, there would have been a lot of very disappointed US retirees in the early 1900s, in 1928-1929 and again in the 1960s.

1 -

Dividends are a good foundation for income, but you also need some growth or indexing to take care of inflation. A global equity index fund might get you 2% dividends and if you go for higher yields maybe 3%-4%. So it's a good strategy, but I wouldn't rely on it alone.

The OP has done the most basic thing in implementing such a strategy and looked at their budget, however, I think 10k/year spending might be a little optimistic. The level of frugality implied could be uncomfortable. Maybe they have some non traditional housing arrangement that allows them to keep costs so low.

All the Bengen/Pfau/Guyton modeling and research in the end convinced me that I wasn't comfortable planning my retirement using probability distributions produced from historical data when my portfolio's performance would depend on unknowable future data. Given the uncertainly in the world right now I'm glad I did that and I think there will be a retreat to social insurance, annuities and frugality in retirement planning and that dividends will be the icing on the cake and that capital growth will be far less emphasized because of the risk. It won't go away, but other approaches will come back into fashion.“So we beat on, boats against the current, borne back ceaselessly into the past.”2 -

I continue to pay voluntary Class 2 NI even though I have more than 35 years of contributions because of the wording about myAlbermarle said:If the government does keep its promise of a state pension that's an extra 😉The possibility that any UK government would cancel the State Pension is approx zero, as it would be political suicide.

Older people vote in large numbers , hence why we have the expensive Triple/Double Lock increases every year.

if the government a) puts state pension and workplace pension up to a rediculous age

The plans for this are already largely known and in place

You should plan your pension/retirement plans on what is known today, and not on some unknown changes that may or may not come in future, especially one so unlikely to happen as the state pension stopping .

forecast being valid under "current legislation". They've moved the goal posts on me once before so I can see them doing it again - at least until I start getting the SP.“So we beat on, boats against the current, borne back ceaselessly into the past.”0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards