We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Living off dividends?

Comments

-

The inherent danger with a focus on a dividend stream is that it restricts the potential pool of investments. With investors naturally gravitating to higher yield stocks. Which in themselves offer these yields for underlying reasons. Many of the securest dividend paying companies on a fundamental basis are low yielding. There's rarely free lunches to be found with stocks being mispriced.0

-

My income portfolio is currently providing around £13,600 income per year at a trailing yield of 6.5% to book price (£209k), so I would think you could comfortably achieve your target from around a £200k investment. It's taken me over two years to build my portfolio as purchase price is everything - buying at the right price minimises downside capital risks and maximises dividend yield (buying M&G last Monday is a case in point). For me, it meets a specific purpose of allowing me to draw down my personal tax allowance without having to sell assets. As others have said, I wouldn't want to rely on that as my sole source of income (I also have a growth portfolio and DB/SP to come) but my income portfolio is doing OK for me.

Our green credentials: 12kW Samsung ASHP for heating, 7.2kWp Solar (South facing), Tesla Powerwall 3 (13.5kWh), Net exporter3 -

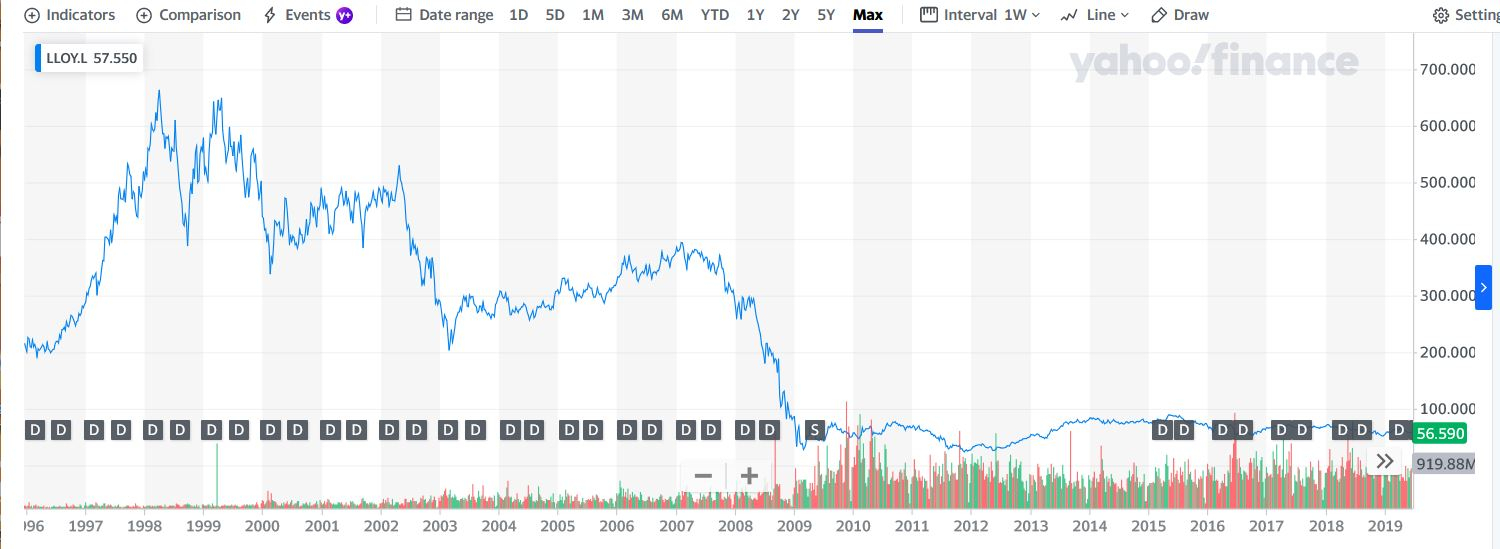

The problem with your question is that it is assuming that your initial investment stay the same. What about if you get 3% dividend but your investment went down 7% on that particular years ??MrE1 said:How much would I need invested to live off dividends? There are articles online but I'm interested to hear from real investors who have done it. My living cost is as low as £10200 per annumAFAIK there has not been any advice or tips from authoritative source that suggest people to make investment decision with the main criteria based on dividend let alone solely based on this??Not to mention investment that provide high dividend will in majority of cases correspond to low performance.This stock Forward dividend yield is around 3.00%. If you invested in this stock around 2008 see what happen your money now.. Even you invest in index fund, just remember the performance of Nikkei 225, more than a decades of negative return.

0 -

I don't think OP is assuming the initial investment will stay the same. Some retirees will be less concerned with the capital value if they continue to receive income by way of dividends that increase with inflation. I know that is not guaranteed and I like to have some growth funds as well as funds and ITs that produce dividend income.adindas said:

The problem with your question is that it is assuming that your initial investment stay the same. What about if you get 3% dividend but your investment went down 7% on that particular years ??MrE1 said:How much would I need invested to live off dividends? There are articles online but I'm interested to hear from real investors who have done it. My living cost is as low as £10200 per annum0 -

FeralHog, I am indeed trying my absolute best for an early retirement.

Coldiron, I agree 10,200 is indeed grim to retire on but if I first aim to meet the most basic of needed income I know I can live off I can then think about emergencies, luxuries and extra perks. If the government does keep its promise of a state pension that's an extra 😉

Soulsaver and NedS I found your comments reassuring that your currently able to get 10k dividends from 200k, if that's the case a potential retirement position isn't as far off as I thought (but as you duly suggest I certainly won't rely on it as my only source income). I just want a chance to try to support myself if the government a) puts state pension and workplace pension up to a rediculous age or b) in the future bases retirement on capacity to work rather than age or c) breaks promises of retirement entirely.0 -

You could draw down capital and/or income. Overall if you consider 'live off' as retiring, then people say that 4% is a safe withdrawal rate.MrE1 said:How much would I need invested to live off dividends? There are articles online but I'm interested to hear from real investors who have done it. My living cost is as low as £10200 per annum

So 10200/4% is 255k

1 -

People say lots of things, often without solid sound foundation. That's how myths and mantra's are born. If there was a fail safe system then somebody would identified it by now.DireEmblem said:

You could draw down capital and/or income. Overall if you consider 'live off' as retiring, then people say that 4% is a safe withdrawal rate.MrE1 said:How much would I need invested to live off dividends? There are articles online but I'm interested to hear from real investors who have done it. My living cost is as low as £10200 per annum

So 10200/4% is 255k0 -

@Thrugelmir, so as not to worry the OP too much, I think I would clarify that it is not just people making it up without any foundation. As you know, 4% is often quoted as a "safe withdrawal rate" based on historical data. It is not guaranteed and I think in the UK 3.5% might be safer, but it all depends on the sequence of returns. However the OP will presumably only need that amount until he gets his State Pension, which should nearly cover his basic income requirements if he qualifies for the full amount of the new State Pension. So whether its from dividend income or selling capital, I think the OP would probably be okay with a 4% withdrawal rate.Thrugelmir said:

People say lots of things, often without solid sound foundation. That's how myths and mantra's are born. If there was a fail safe system then somebody would identified it by now.DireEmblem said:

You could draw down capital and/or income. Overall if you consider 'live off' as retiring, then people say that 4% is a safe withdrawal rate.MrE1 said:How much would I need invested to live off dividends? There are articles online but I'm interested to hear from real investors who have done it. My living cost is as low as £10200 per annum

So 10200/4% is 255k0 -

@Audaxer If you can point me in the direction of a published piece of UK academic research I'l happily accept the historic data (and forward forecasting) for the oft quoted 4% SWR. I should add there's little point in saying something is safe then adding the caveat that it's not guaranteed . As simply muddies the water further.Audaxer said:

@Thrugelmir, so as not to worry the OP too much, I think I would clarify that it is not just people making it up without any foundation. As you know, 4% is often quoted as a "safe withdrawal rate" based on historical data. It is not guaranteed and I think in the UK 3.5% might be safer, but it all depends on the sequence of returns. However the OP will presumably only need that amount until he gets his State Pension, which should nearly cover his basic income requirements if he qualifies for the full amount of the new State Pension. So whether its from dividend income or selling capital, I think the OP would probably be okay with a 4% withdrawal rate.Thrugelmir said:

People say lots of things, often without solid sound foundation. That's how myths and mantra's are born. If there was a fail safe system then somebody would identified it by now.DireEmblem said:

You could draw down capital and/or income. Overall if you consider 'live off' as retiring, then people say that 4% is a safe withdrawal rate.MrE1 said:How much would I need invested to live off dividends? There are articles online but I'm interested to hear from real investors who have done it. My living cost is as low as £10200 per annum

So 10200/4% is 255k

Your thinking simply reinforces my earlier comment.0 -

How about Estrada (Maximum Withdrawal Rates: An empirical and global perspective, The Journal of Retirement, 2018) - UK results are right at the end of exhibit A2 (and indeed presents a historical maximum withdrawal rate, at a 1% probability of failure, for the UK of about 3.2% (for a 60/40 portfolio)? That paper also has a nice discussion on the merits (and otherwise) of fixed and variable withdrawals.Thrugelmir said:

@Audaxer If you can point me in the direction of a published piece of UK academic research I'l happily accept the historic data (and forward forecasting) for the oft quoted 4% SWR. I should add there's little point in saying something is safe then adding the caveat that it's not guaranteed . As simply muddies the water further.Audaxer said:

@Thrugelmir, so as not to worry the OP too much, I think I would clarify that it is not just people making it up without any foundation. As you know, 4% is often quoted as a "safe withdrawal rate" based on historical data. It is not guaranteed and I think in the UK 3.5% might be safer, but it all depends on the sequence of returns. However the OP will presumably only need that amount until he gets his State Pension, which should nearly cover his basic income requirements if he qualifies for the full amount of the new State Pension. So whether its from dividend income or selling capital, I think the OP would probably be okay with a 4% withdrawal rate.Thrugelmir said:

People say lots of things, often without solid sound foundation. That's how myths and mantra's are born. If there was a fail safe system then somebody would identified it by now.DireEmblem said:

You could draw down capital and/or income. Overall if you consider 'live off' as retiring, then people say that 4% is a safe withdrawal rate.MrE1 said:How much would I need invested to live off dividends? There are articles online but I'm interested to hear from real investors who have done it. My living cost is as low as £10200 per annum

So 10200/4% is 255k

Your thinking simply reinforces my earlier comment.

I would agree that "Safe" is a misnomer, Bengen (Choosing The Highest Safe Withdrawal Rate At Retirement, 2020) has a nice disclaimer that "the term “safe” is meaningful only in its historical context, and does not imply a guarantee of future applicability"

6

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards