We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

The Top Fixed Interest Savings Discussion Area

Comments

-

Invalid account number, it said. Impossible to overwrite this, can't continue. I did also try it from my Starling account who said they couldn't verify the account.wiseonesomeofthetime said:Did it insist that the account number was invalid, or that the payee details did not match?

I doubt very much whether Santander would know all of Atom's account numbers tbh.

You can override the former.

Anyway, something updated overnight and Santander do recognise the account now.1 -

I've been with them for some time and while frequently up there near the top of the interest charts, they are not exactly Speedy Gonzales when it comes to changes or paying interest out to external accounts! I opened the 2-year fix on the 10th, funded it on 11th and the error in the interest rate has only just been corrected late yesterday/this morning! They get there eventuallyTed_E_Bear said:Despite talking to them on the phone yesterday afternoon, my Charter Savings Bank fixed 2 year savings account is still saying 4.6%.Unimpressed. Compiler of the RS League Table.

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

Re Charter accounts

I am on my first fixed term account with Charter. I opened it on the 10th, made my first deposit on the 16th. The maturity date now shows as 16/11/2024, not 10/11/2024.

This made me wonder whether one of you knows: if you make a deposit within the 14-day window, does the 14 day deposit window then start on the day you make your first deposit? or does the deposit period always start from account opening date?

0 -

I opened my 2-year Fix on 10th and funded it on 11th ..... showing maturity date 11/11/2024.Band7 said:Re Charter accounts

I am on my first fixed term account with Charter. I opened it on the 10th, made my first deposit on the 16th. The maturity date now shows as 16/11/2024, not 10/11/2024.

This made me wonder whether one of you knows: if you make a deposit within the 14-day window, does the 14 day deposit window then start on the day you make your first deposit? or does the deposit period always start from account opening date?

OH opened hers on 10th and funded it on 12th .... showing maturity date as 12/11/2024.

Never noticed it before, but it seems like your question as to when the account starts appears to be the funding date!

Not sure about the 14-day window bit though!Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

The email clearly says "We need to receive your initial deposit within 14 days of the date of your application" and "After we receive your initial deposit, you can send multiple, separate deposits if you wish, as long as we receive them within 14 days of the application"

2 -

This is interesting - I fully expected to have to make my first Santander > Atom transfer for the previous account I opened with them without account details being verified as I had literally just opened the account. To my astonishment it verified my details immediately. I'm glad your issue had resolved by this morning.Band7 said:

I opened a 6 month Atom one tonight, as a holding account for my 2023-24 ISA balance. Then tried to pay money in from Santander - wasn't able to do this as Santander insisted that the Atom account number was invalid. Hope this will sort itself sometime tomorrow.EssexHebridean said:Atom 1 year fixed just opened here - we already have a 9 month fix with them, the plan is to leave the 1 year unfunded until next week hoping we see what effect the autumn statement tomorrow has, if any. At least then if rates do fall we have it locked in.🎉 MORTGAGE FREE (First time!) 30/09/2016 🎉 And now we go again…New mortgage taken 01/09/23 🏡

Balance as at 01/09/23 = £115,000.00 Balance as at 31/12/23 = £112,000.00

Balance as at 31/08/24 = £105,400.00 Balance as at 31/12/24 = £102,500.00

Balance as at 31/08/25 = £ 95,450.00. Balance as at 31/12/25 = £ 91,100.00

£100k barrier broken 1/4/25SOA CALCULATOR (for DFW newbies): SOA Calculatorshe/her0 -

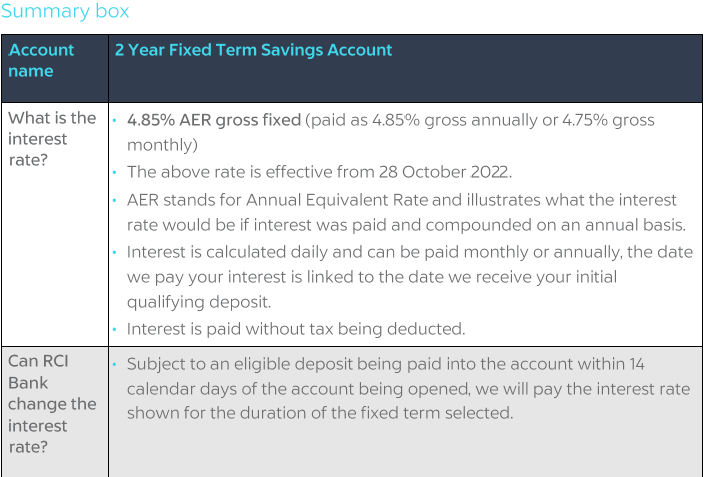

RCI Bank 2 year fixed rate has dropped from 4.85% to 4.50%

https://www.rcibank.co.uk/savings/2-year-fixed-term-account

Don't wait for your ship to come in, swim out to it.2 -

Haven't funded mine yet but hopefully the 4.85 will be honoured:littlemissbossy said:RCI Bank 2 year fixed rate has dropped from 4.85% to 4.50%

https://www.rcibank.co.uk/savings/2-year-fixed-term-account

16 Panel (250W JASolar) 4kWp, facing 170 degrees, 40 degree slope, Solis Inverter. Installed 29/9/2015 - £4700 (Norfolk Solar Together Scheme); 9.6kWh US2000C Pylontech batteries + Solis Inverter installed 12/4/2022 Year target (PVGIS-CMSAF) = 3880kWh - Installer estimate 3452 kWh:Average over 6 years = 4400 :j0 -

Have Kent Reliance pulled their fixed savers as I don't see them on their website? Though there is a message that comes up about exclusive fixed rate accounts for existing customers?0

-

Yes, it looks like they've pulled all their fixed rate accounts - to new customers at least.andyhicks88 said:Have Kent Reliance pulled their fixed savers as I don't see them on their website? Though there is a message that comes up about exclusive fixed rate accounts for existing customers?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards