We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

News: Energy bills to rise by £700/yr for many | Chancellor unveils up to £350 households support

Comments

-

I'm on a fixed tariff with Octopus until May 2023. Nice to see taxpayer's money being wasted on people like me who don't need any £200 loan.

Now I'll have to faff about with direct debits amounts in an attempt to basically give the £200 back.1 -

I find myself wondering how those who live in residential park homes will be helped - several hundred thousand, predominantly, elderly and low income individuals. I have an elderly relative who lives on a residential site who tells me that it is the norm for the site owner to bill each home based on a proportion of the bulk charge they receive both for gas and electricity. I’m aware for many the gas would be LPG but not for all. He will get the £150 via his council tax, he’s tax band A but I can’t see any mechanism for him to receive the £200 “loan”.If anything I say starts to make sense, PANIC!0

-

arealbasketcase said:I find myself wondering how those who live in residential park homes will be helped - several hundred thousand, predominantly, elderly and low income individuals. I have an elderly relative who lives on a residential site who tells me that it is the norm for the site owner to bill each home based on a proportion of the bulk charge they receive both for gas and electricity. I’m aware for many the gas would be LPG but not for all. He will get the £150 via his council tax, he’s tax band A but I can’t see any mechanism for him to receive the £200 “loan”.

I think they'll get stung with the double whammy of being on an un-capped commercial tariff, and not getting the £200 as they aren't the account holder.

AIUI it only applies to domestic accounts.

Some sites may have individual meters, but unlikely the residents have separate accounts. The site owners would then apportion their bill, based on their usage.

How's it going, AKA, Nutwatch? - 12 month spends to date = 3.24% of current retirement "pot" (as at end December 2025)1 -

Car1980 said:I'm on a fixed tariff with Octopus until May 2023. Nice to see taxpayer's money being wasted on people like me who don't need any £200 loan.

Now I'll have to faff about with direct debits amounts in an attempt to basically give the £200 back.

............

1 -

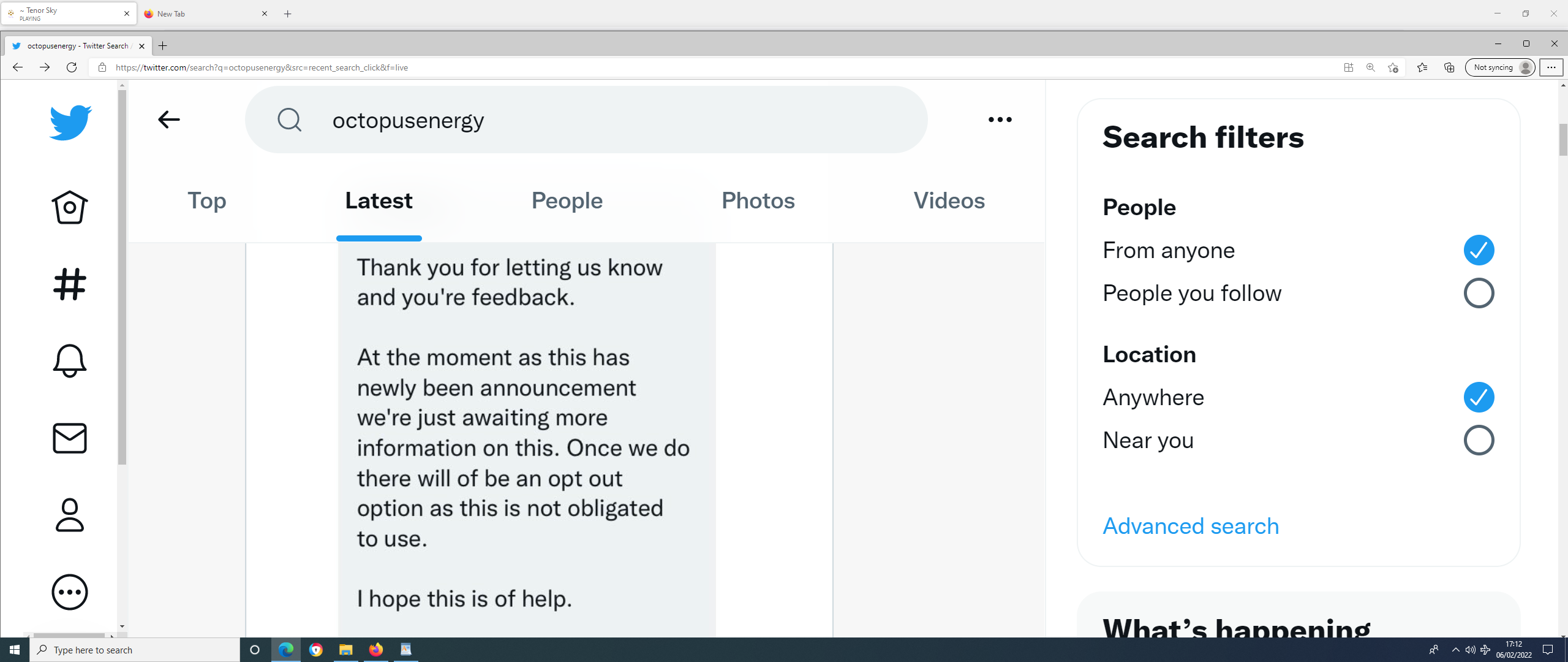

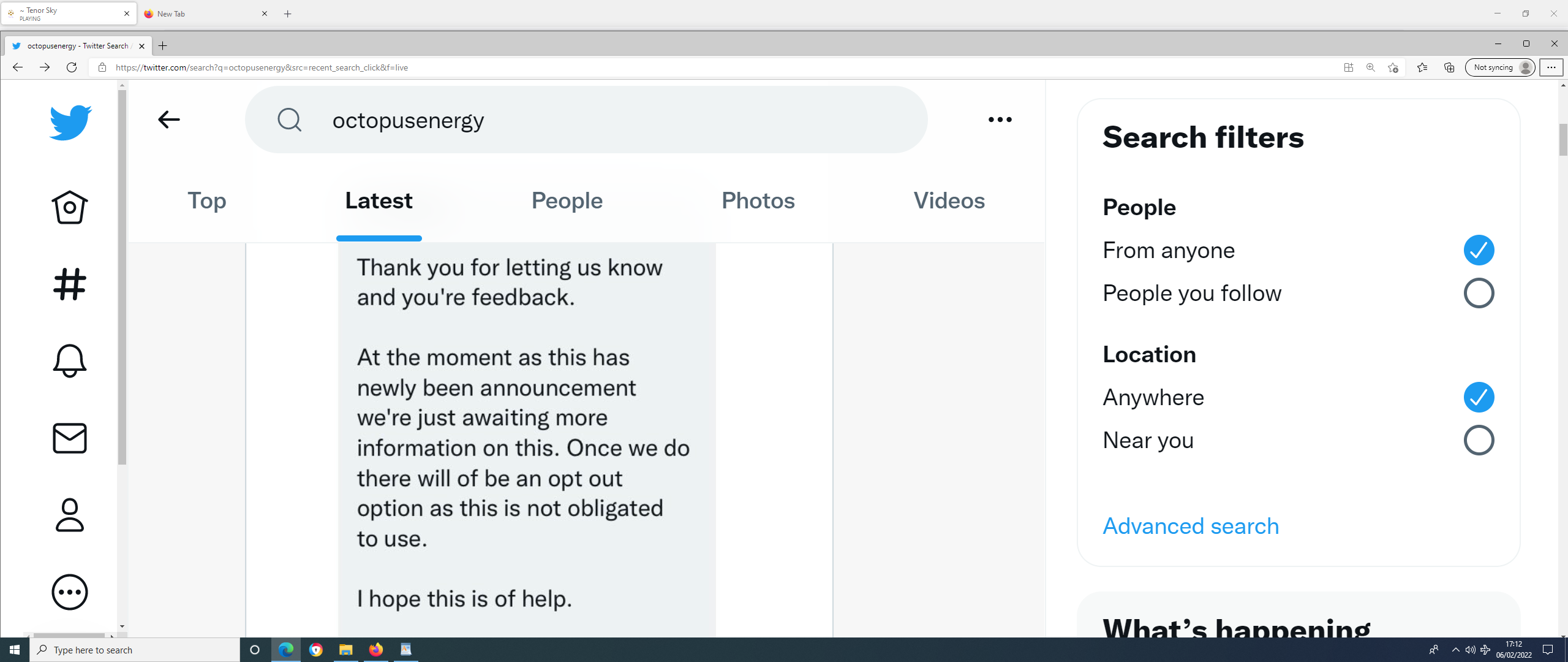

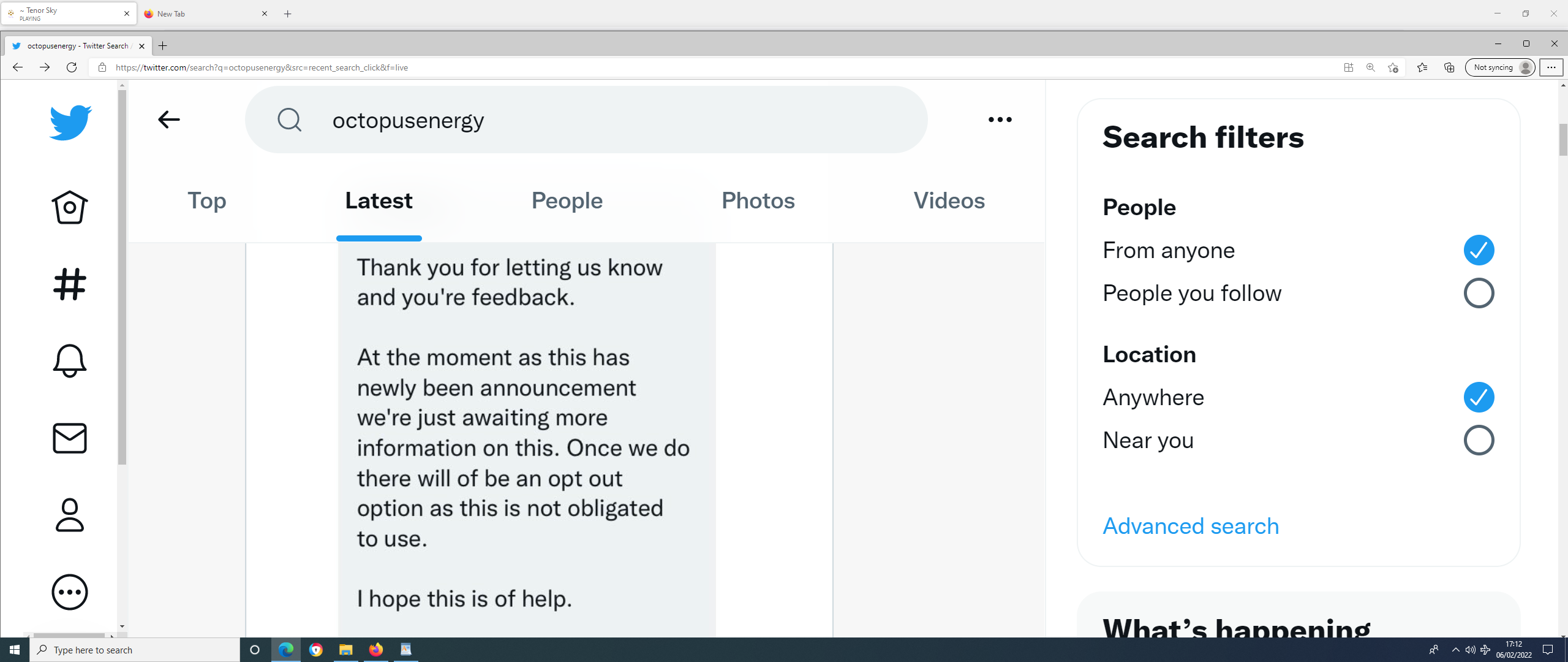

Am I reading that right, Octopus are hoping/planning to give customers an opt out? What happens if you changed supplier, move house, or any one of the myriad variations of what can happen over the next five years. I’d prefer to opt out too, I’d prefer real targeted help for those who need it, but with the scheme as set out keeping track of individual account holders and whether or not they’ve opted out could be an administrative nightmare…. couldn’t it??bristolleedsfan said:Car1980 said:I'm on a fixed tariff with Octopus until May 2023. Nice to see taxpayer's money being wasted on people like me who don't need any £200 loan.

Now I'll have to faff about with direct debits amounts in an attempt to basically give the £200 back.

............ If anything I say starts to make sense, PANIC!4

If anything I say starts to make sense, PANIC!4 -

You'll might find you can opt out of the "loan" but not the repayments ...arealbasketcase said:Am I reading that right, Octopus are hoping/planning to give customers an opt out?

N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 35 MWh generated, long-term average 2.6 Os.3 -

I wouldn't of thought it would be that difficult for the energy suppliers to put a flag on every one's electricity account which, if set, indicates that the £200 loan was credited and then check the flag again to see whether the repayments are necessary in subsequent years, and to pass on the flag's value during the switch process.arealbasketcase said:

Am I reading that right, Octopus are hoping/planning to give customers an opt out? What happens if you changed supplier, move house, or any one of the myriad variations of what can happen over the next five years. I’d prefer to opt out too, I’d prefer real targeted help for those who need it, but with the scheme as set out keeping track of individual account holders and whether or not they’ve opted out could be an administrative nightmare…. couldn’t it??bristolleedsfan said:Car1980 said:I'm on a fixed tariff with Octopus until May 2023. Nice to see taxpayer's money being wasted on people like me who don't need any £200 loan.

Now I'll have to faff about with direct debits amounts in an attempt to basically give the £200 back.

............

The problem at the moment is, until Ofgem/Government publish how the loan/repayment process is going to work, all anyone can do is speculate.1 -

The more straightforward explanation is that the random Octopus rep is talking cobblers.

5 -

Car1980 said:I'm on a fixed tariff with Octopus until May 2023. Nice to see taxpayer's money being wasted on people like me who don't need any £200 loan.

Now I'll have to faff about with direct debits amounts in an attempt to basically give the £200 back.That's the thing though, making it so it's more personal makes a whole load more expensive to administer.and if you don't need the £200 loan then leave your DDs as they are, you'll be in credit more and eventually give the £200 back automatically.1 -

QrizB said:

You'll might find you can opt out of the "loan" but not the repayments ...arealbasketcase said:Am I reading that right, Octopus are hoping/planning to give customers an opt out?

This...

I'd be very wary about turning down the £200 credit, without a guarantee that I wouldn't still be expected to pay it back via higher standing charges etc in the future, especially if I moved house or changed supplier.

The OFGEM cap tables are confusing enough without adding a whole additional category of Standing Charge with/without levy!!

It would add a whole additional layer of complexity to bills.

Obviously there is always the option of donating £200 to a charity, if you so choose, but I'd be very surprised if there is an option to opt out of the scheme as a whole.How's it going, AKA, Nutwatch? - 12 month spends to date = 3.24% of current retirement "pot" (as at end December 2025)1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.3K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards