We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Foolishness of the 4% rule

Comments

-

I started off in 2017 by assuming values for inflation and returns and applying a 4% starting withdrawal....and then simply calculated the remaining pot size at the end of each year for the next 40yrs (target)......alongside that is the same sheet but using the real figures as they come in each yr (in my case each tax year)......so I know how I'm doing relative to target. If it slips below target then I will reduce withdrawals accordingly and top up overall income from the cash buffer I keep (if that becomes exhausted and the pot is still behind target, then it'll be belt tightening time)

If it's over target (as it is now luckily) I can increase withdrawals to top up the cash buffer if it needs it......or just keep them the same (plus inflation) if not.

It's pretty simple, requiring no complex maths......and works well for me with my mindset.

PS.....the withdrawals will reduce when my SP becomes payable...

PPS......the amount of withdrawal reduction will depend on how far behind target the pot is.......any income reduction will depend on that plus what's in the cash buffer....

I suppose it's really just my own take on VPW.3 -

Complex maths is bad but some numerical targets for increase/reduction in withdrawal rates would be helpful, I think. Otherwise we tend to underspend. Better than the other way around but not ideal.0

-

I have used a very similar approach for the past 20 years both in deciding when to retire and in managing expenditure/income in retirement.MK62 said:I started off in 2017 by assuming values for inflation and returns and applying a 4% starting withdrawal....and then simply calculated the remaining pot size at the end of each year for the next 40yrs (target)......alongside that is the same sheet but using the real figures as they come in each yr (in my case each tax year)......so I know how I'm doing relative to target. If it slips below target then I will reduce withdrawals accordingly and top up overall income from the cash buffer I keep (if that becomes exhausted and the pot is still behind target, then it'll be belt tightening time)

If it's over target (as it is now luckily) I can increase withdrawals to top up the cash buffer if it needs it......or just keep them the same (plus inflation) if not.

It's pretty simple, requiring no complex maths......and works well for me with my mindset.

PS.....the withdrawals will reduce when my SP becomes payable...

PPS......the amount of withdrawal reduction will depend on how far behind target the pot is.......any income reduction will depend on that plus what's in the cash buffer....

I suppose it's really just my own take on VPW.

The one difference is to target a fixed amount, currently £300K in real terms, to be left in investments at the end of the plan when I am 99, and then calculate what maximum expenditure would give that result. As long as actual annual expenditure is below that figure I am happy to spend freely. For most of the time since retirement actual annual expenditure has been well below the maximum since the assumed inflation and investment returns have so far turned out to be very pessimistic.

PS Decisions on major expenses (eg moving house, new car or extravagent holidays) are made by explicitly including them in the plan.3 -

OldScientist said:

the 'real withdrawal' is the index-linked withdrawal expressed as a percentage of the initial portfolio value (so for a £1m portfolio, the initial withdrawal here would be 50k and then index linked, at year 7, the withdrawal would be 30k plus inflation over the first 7 years. The withdrawal expressed as a percentage of the current portfolio value (whether real or nominal) gets quite large by 1972 - roughly 5*500/350~7% (one of the reasons the retirements in the 60s do so badly).bostonerimus said:

Nice. This points out that small changes at the beginning of drawdown can compound and flow throughout the years of retirement. One question, in the "Real Withdrawal" step functions are these inflation adjusted back to "today's dollars" so they stay as constant percentages rather than growing with inflation?OldScientist said:

Going on your original premise, that was £25k withdrawn annually from the pot for 7 years (i.e. 5%) and then (roughly) £15k per year thereafter (i.e. 3%)MK62 said:

My apologies......in my haste to write that before going out last night, I've miscalculated.....I actually meant 4%, the original thread subject, which is £20k not £25k.....doh!!!MK62 said:It's a hypothetical, but assume good health, say £25k pa.......and as for leaving anything, ideally yes, but lets say that's not a necessity (as if it was it would exclude annuities)

PS....assume £12k essential income....

How would you do it if you were single, and then if you were married to a similar age partner?

I agree with Bostonerimus that £25k pa might be a bit ambitious in this scenario.

I'm interested to see how the proponents of annuities (at current rates) would tackle this.....

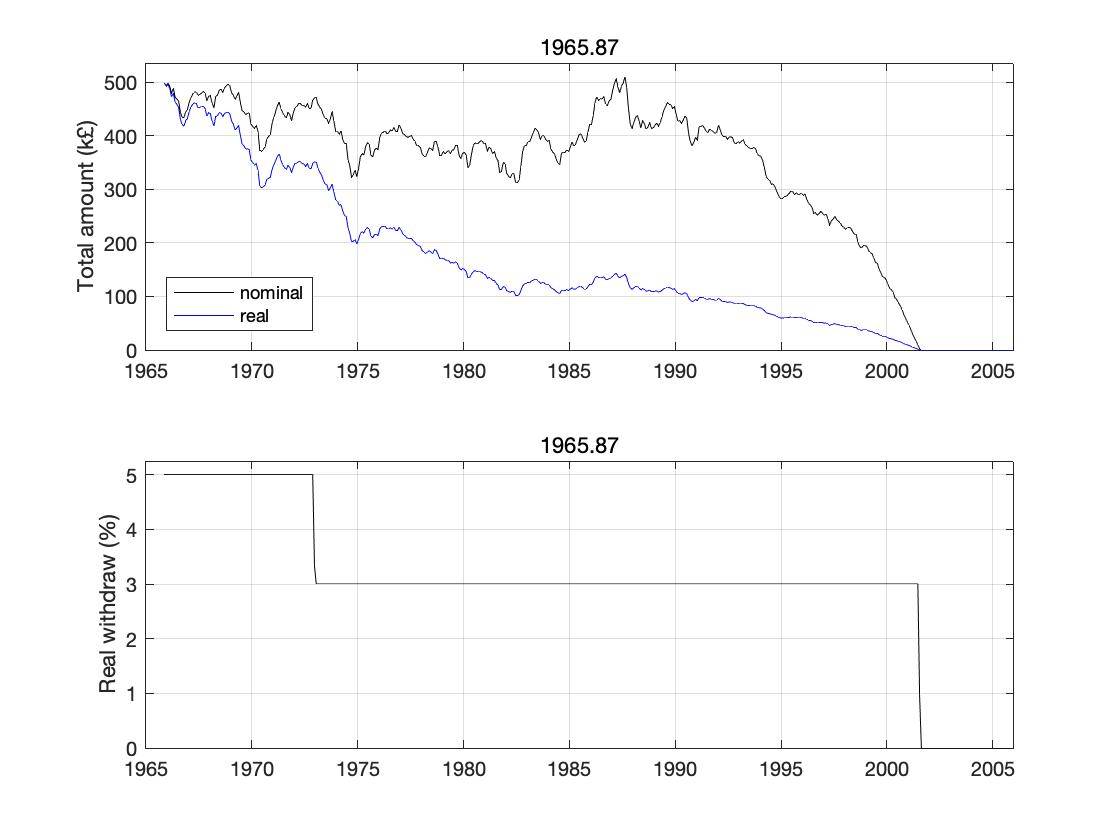

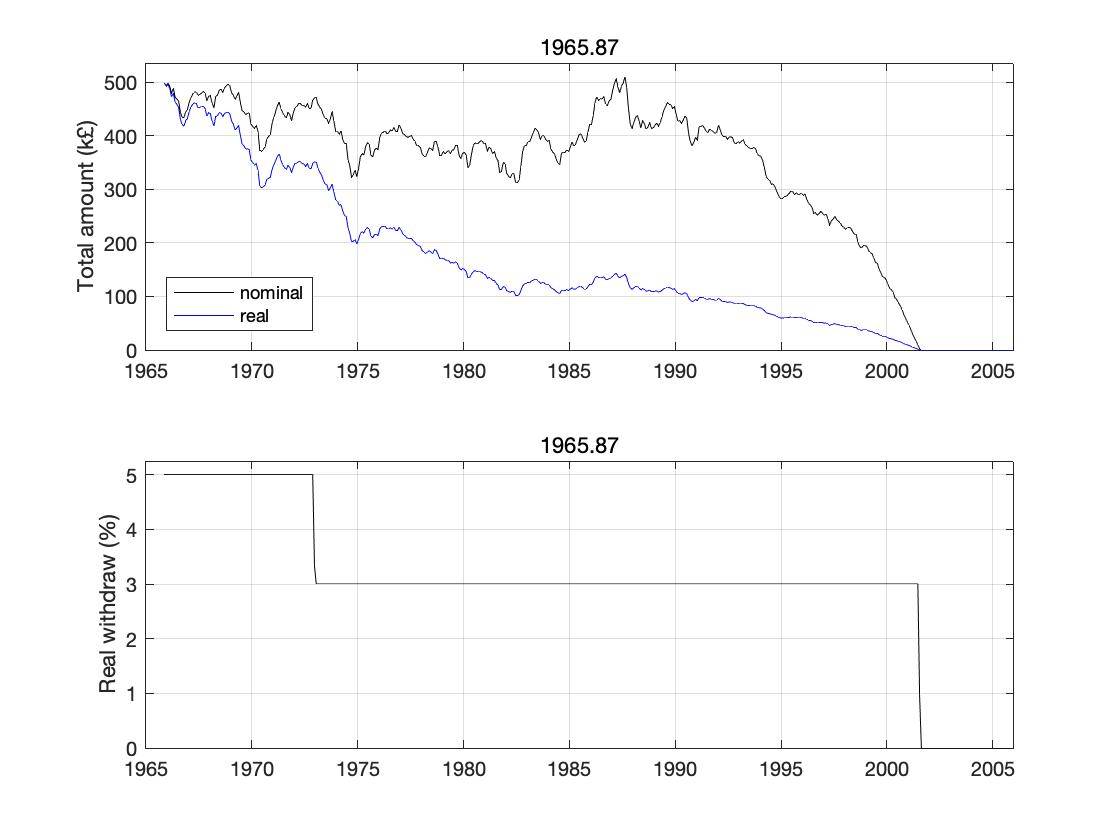

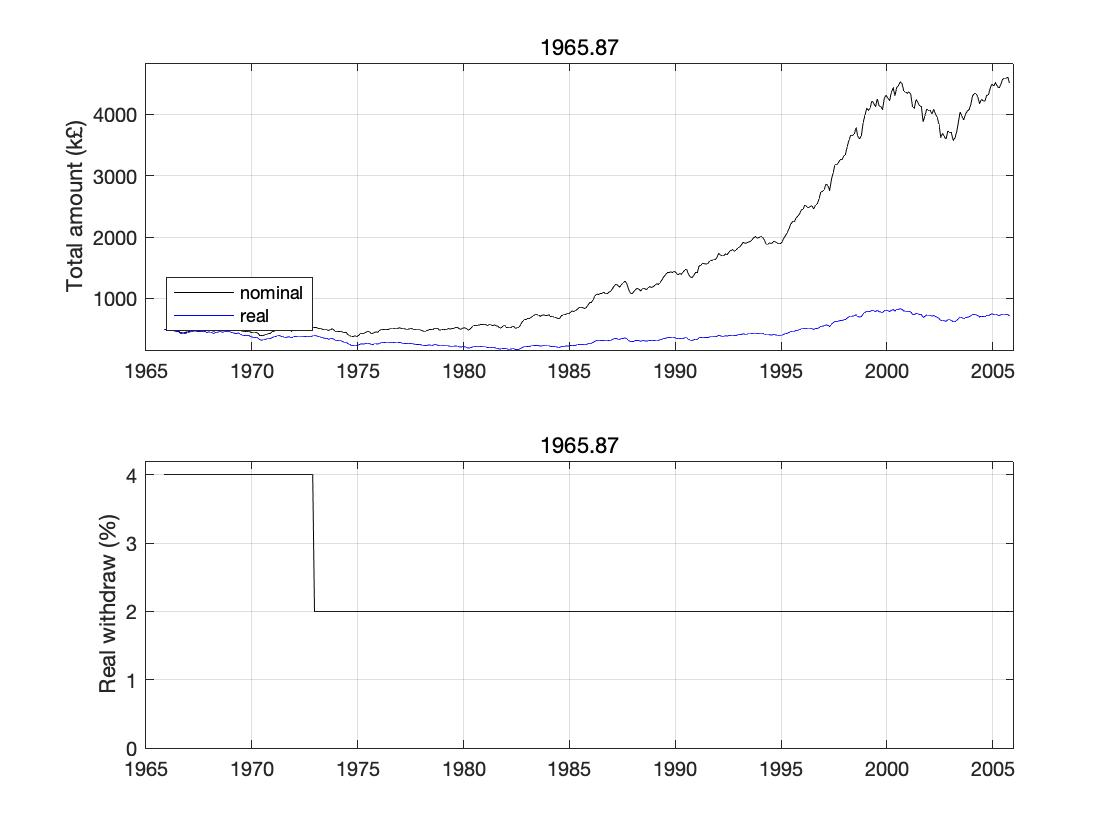

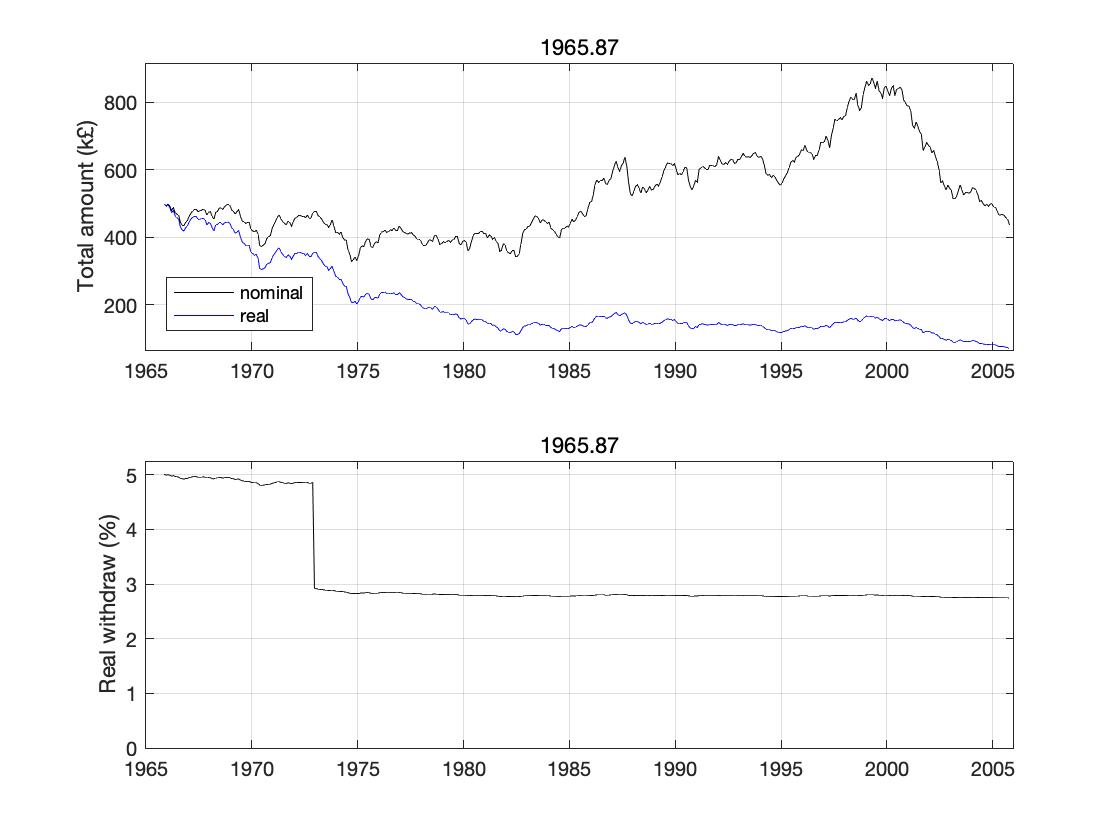

Here are some results for this withdrawal pattern (60/40 portfolio, US data - I really my update my code to deal with UK inflation at some point!)

The portfolio lasted roughly 36 years (i.e. until the retiree is 96) - the period in the mid 60s, as usual, provides the worst cases). Overall the historical failure rate was about 1% (i.e. a lot better than a 40 year retirement with constant 4% where the failure rate was ~10%).

If you take your second version (i.e. 20k is required and not 25k) then things would have been even easier with an initial withdrawal of 4% and then 2% from year 7 onwards...

Here your heirs would have usually ended up very rich indeed (for 40 year retirements starting in 1980 you'd leave £5m in real terms).

For UK retirements, the first one would have been more of a stretch (the money would have run out a bit earlier - sorry, I don't know by how much), while the second one would almost certainly have been doable. While no-one can be certain, that implies that the first one, given that is is an edge case, may (or may not) work in the future, while the second has a lot more resilience built in since the portfolio was larger in real terms at the end than at the beginning in all historic cases.

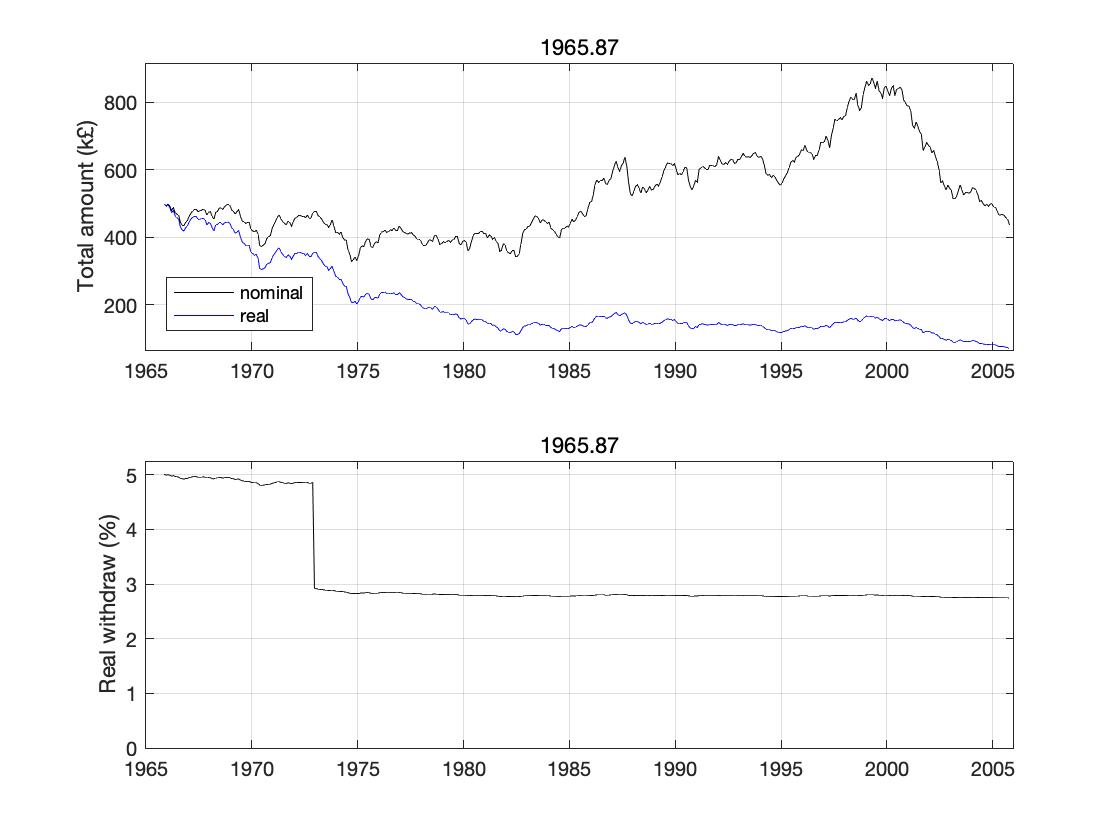

Finally, what happens if we allow a small amount of variation in the spending in the first case. Here I've adjusted the required spending by 10% of the difference between the current portfolio value and the initial portfolio value, e.g. if the current portfolio was 50% of the initial portfolio in real terms and the desired spend 5%, then the actual spend would be 5*(1-(0.1*0.5))=4.75%, while if the current portfolio was 1.5 times bigger then the actual spend would be 5*(1+(0.1*0.5))=5.25%.

While the spend in the latter half of the retirement is below the 3% required (roughly 2.8%, i.e. 14k - taken with the 10k SP, then an income of £24k - not a huge sacrifice for more resilience). While the amount at the end of 40 years is quite small (about 70k in real-terms) it would actually have lasted until about 2011 (until the retiree was 106).

We've seen earlier in this thread (and in other threads elsewhere), where people broadly following the 4% rule-of-thumb say they'll adjust spending if they think their portfolio is going to crash. The question then has to be when and by how much? The method I described above was what I was originally going to use before I found VPW (the results from either approach were acceptable to me, even the much larger swings in income with VPW, but the simplicity of VPW won the day - my OH, who has little interest in the details of finance, is going to have to run this on my demise). The big advantage is that you can scale the percentage adjustment to your minimum acceptable income - e.g. I used 10% adjustment above, so the lowest withdrawal in the initial 7 years (if the portfolio went close to zero) would be 0.9*5=4.5%. If you were happy with 4% at this time, then you could up the adjustment to 20%. The big disadvantage, compared to VPW, is that you can still run out of money using this approach (it defers it to later than blindly following a 4% withdrawal).Wade Pfau et al did a paper that ran some simulations using recent low bond yields and P/E based stock return estimates and historical statistics to put some sensible variation on annual returns. The results are not pretty; when the 4% rule is followed many failure rates are over 50%. A solution suggested is to replace bonds with an annuity, but the stocks are still a problem. But if you die early your annuity purchase will be helping your fellow man who lives longer than you and annuities are such awful value right now. Maybe they are the best of a bad lot, although I still prefer cash for now. It was studies like this that convinced me to NOT to use the 4% rule and replace it with my own 0% rule...A variable withdrawal rate would also help

https://www.financialplanningassociation.org/sites/default/files/2020-09/JUN13 JFP Finke.pdf“So we beat on, boats against the current, borne back ceaselessly into the past.”1 -

“ annuities are such awful value right now.” Popular claim with zero basis.0

-

The rate for a fixed annuity at 65 is 4.97%. This is very close to 100%/life_expectancy. So you are getting a zero investment return. All you are gaining over simply keeping the cash is longevity insurance at the cost of loss of future flexibility and capital. Since the annuity is fixed the real value in 20 years time will be much reduced by inflation so it bears significant risk. Depending on your circumstances and requirements even a very cautious investment should provide a better result than a fixed rate annuity.Deleted_User said:“ annuities are such awful value right now.” Popular claim with zero basis.

I would only consider an annuity if my life expectancy was severely shortened or I reached a seriously old age without the money to sustain my needs for an extended poeriod.

0 -

I would only consider an annuity if my life expectancy was severely shortened or I reached a seriously old age without the money to sustain my needs for an extended poeriod.

In practice its the other way around. People tend to take out annuities if they are healthy. A healthy 65 year old has an excellent chance of living past 100. The pool of people taking annuities is self-selected to have better than average mortality rates.

Individual “Return” is unknown and unpredictable. Its the wrong way of thinking about annuities. What is your return on car insurance? House insurance? What annuity does in real world is permit someone with a decent amount of money and long life expectancy to spend a lot more safely as a portion of asset allocation.

0 -

Really good paper. Haven’t seen it before. Given real returns on bonds today, Table 2 sums up the foolishness of the 4% SWR method quite nicely.bostonerimus said:OldScientist said:

the 'real withdrawal' is the index-linked withdrawal expressed as a percentage of the initial portfolio value (so for a £1m portfolio, the initial withdrawal here would be 50k and then index linked, at year 7, the withdrawal would be 30k plus inflation over the first 7 years. The withdrawal expressed as a percentage of the current portfolio value (whether real or nominal) gets quite large by 1972 - roughly 5*500/350~7% (one of the reasons the retirements in the 60s do so badly).bostonerimus said:

Nice. This points out that small changes at the beginning of drawdown can compound and flow throughout the years of retirement. One question, in the "Real Withdrawal" step functions are these inflation adjusted back to "today's dollars" so they stay as constant percentages rather than growing with inflation?OldScientist said:

Going on your original premise, that was £25k withdrawn annually from the pot for 7 years (i.e. 5%) and then (roughly) £15k per year thereafter (i.e. 3%)MK62 said:

My apologies......in my haste to write that before going out last night, I've miscalculated.....I actually meant 4%, the original thread subject, which is £20k not £25k.....doh!!!MK62 said:It's a hypothetical, but assume good health, say £25k pa.......and as for leaving anything, ideally yes, but lets say that's not a necessity (as if it was it would exclude annuities)

PS....assume £12k essential income....

How would you do it if you were single, and then if you were married to a similar age partner?

I agree with Bostonerimus that £25k pa might be a bit ambitious in this scenario.

I'm interested to see how the proponents of annuities (at current rates) would tackle this.....

Here are some results for this withdrawal pattern (60/40 portfolio, US data - I really my update my code to deal with UK inflation at some point!)

The portfolio lasted roughly 36 years (i.e. until the retiree is 96) - the period in the mid 60s, as usual, provides the worst cases). Overall the historical failure rate was about 1% (i.e. a lot better than a 40 year retirement with constant 4% where the failure rate was ~10%).

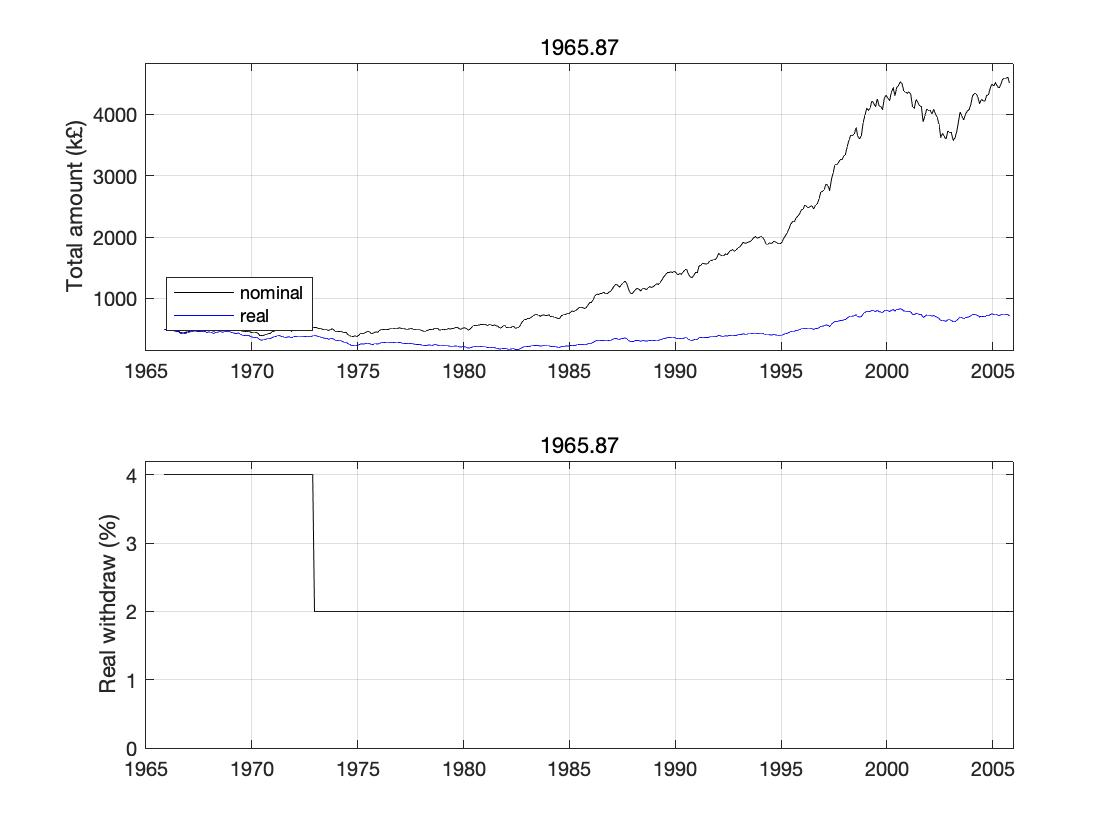

If you take your second version (i.e. 20k is required and not 25k) then things would have been even easier with an initial withdrawal of 4% and then 2% from year 7 onwards...

Here your heirs would have usually ended up very rich indeed (for 40 year retirements starting in 1980 you'd leave £5m in real terms).

For UK retirements, the first one would have been more of a stretch (the money would have run out a bit earlier - sorry, I don't know by how much), while the second one would almost certainly have been doable. While no-one can be certain, that implies that the first one, given that is is an edge case, may (or may not) work in the future, while the second has a lot more resilience built in since the portfolio was larger in real terms at the end than at the beginning in all historic cases.

Finally, what happens if we allow a small amount of variation in the spending in the first case. Here I've adjusted the required spending by 10% of the difference between the current portfolio value and the initial portfolio value, e.g. if the current portfolio was 50% of the initial portfolio in real terms and the desired spend 5%, then the actual spend would be 5*(1-(0.1*0.5))=4.75%, while if the current portfolio was 1.5 times bigger then the actual spend would be 5*(1+(0.1*0.5))=5.25%.

While the spend in the latter half of the retirement is below the 3% required (roughly 2.8%, i.e. 14k - taken with the 10k SP, then an income of £24k - not a huge sacrifice for more resilience). While the amount at the end of 40 years is quite small (about 70k in real-terms) it would actually have lasted until about 2011 (until the retiree was 106).

We've seen earlier in this thread (and in other threads elsewhere), where people broadly following the 4% rule-of-thumb say they'll adjust spending if they think their portfolio is going to crash. The question then has to be when and by how much? The method I described above was what I was originally going to use before I found VPW (the results from either approach were acceptable to me, even the much larger swings in income with VPW, but the simplicity of VPW won the day - my OH, who has little interest in the details of finance, is going to have to run this on my demise). The big advantage is that you can scale the percentage adjustment to your minimum acceptable income - e.g. I used 10% adjustment above, so the lowest withdrawal in the initial 7 years (if the portfolio went close to zero) would be 0.9*5=4.5%. If you were happy with 4% at this time, then you could up the adjustment to 20%. The big disadvantage, compared to VPW, is that you can still run out of money using this approach (it defers it to later than blindly following a 4% withdrawal).Wade Pfau et al did a paper that ran some simulations using recent low bond yields and P/E based stock return estimates and historical statistics to put some sensible variation on annual returns. The results are not pretty; when the 4% rule is followed many failure rates are over 50%. A solution suggested is to replace bonds with an annuity, but the stocks are still a problem. But if you die early your annuity purchase will be helping your fellow man who lives longer than you and annuities are such awful value right now. Maybe they are the best of a bad lot, although I still prefer cash for now. It was studies like this that convinced me to NOT to use the 4% rule and replace it with my own 0% rule...A variable withdrawal rate would also help

https://www.financialplanningassociation.org/sites/default/files/2020-09/JUN13 JFP Finke.pdf0 -

But is your "bond" allocation really less than 20% when you take into account your DB pension, state pension, BTL income etc?bostonerimus said:Well it isn't as bad as 2009 and the last decade was ok. I did some rebalancing through that P/E spike and fall and things were ok. I won't do that this time though, I'll let it all ride and my bond allocation is now less than 20% so I expect some "fun". If you worry about P/E ratios then time the market or decouple your essential income from markets as much as you can so you can stop worrying about them.Context matters. I know you say decouple your essential income, which is what you have presumably have done, but then saying "less than 20% bond allocation" is a bit misleading.0 -

Linton said:

Nothing in the future is absolutely guranteed so you have to base your future plans in general and investing strategy in particular on assumptions about the world that you are prepared to accept. A reasonable assumption backed up by theory and history is that equities will broadly over the long term increase by more than inflation. If you did not wish to assume this it is difficult to see why you would rationally invest in equities at all.itwasntme001 said:bostonerimus said:

I think the the critical word here is "normally".itwasntme001 said:Deleted_User said:Equities do normally protect from inflation. Very well. Over long term, as per usual. In the short term they could fall as the inflation and interest rates go up.Try telling that to someone who retired in 1970 at the age of 60, heavily invested in a 60/40 portfolio, and was about to start on a 10 year spending spree to enjoy retirement before they became less able.Yes thought you would change your mind about "equities do normally protect from inflation".

What does normally even mean? How do we know it is normal?

Normally could be taken to be significantly greater than 50% probability historically.But how far back in history can we go back? Is it really still significantly more than 50% that inflation rises with equities? Is the history we have even enough to come to that conclusion? I am not so sure.I invest in equities because of progress in human ingenuity. Not because of some absurd reason that equities will protect me from inflation.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards