We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Foolishness of the 4% rule

Comments

-

Firstly, I said “equities”. Bonds are terrible when dealing with unexpected inflation. So, “60/40” isn’t relevant.itwasntme001 said:Deleted_User said:Equities do normally protect from inflation. Very well. Over long term, as per usual. In the short term they could fall as the inflation and interest rates go up.Try telling that to someone who retired in 1970 at the age of 60, heavily invested in a 60/40 portfolio, and was about to start on a 10 year spending spree to enjoy retirement before they became less able.Yes thought you would change your mind about "equities do normally protect from inflation".

Secondly, William Bernstein has dealt with this better than I would in his “investing for adults” series. It included this and other examples from a range of countries which experienced high inflation. Get back to me once you had a chance to read it. You’ll find that a globally diversified equity portfolio provides an excellent long term hedge against inflation.0 -

A counter example would be the last 30 years in the USA. a 60/40 portfolio delivered average annual growth of 9% and average annual inflation was 2.4%. There is no guaranteed inflation link or protection from equities, bonds or a combination of the two, but many times they do beat inflation considerably. This is the bedrock of the 4% rule. Bengen did not come up with 4% for 1970s Japan.itwasntme001 said:Deleted_User said:Equities do normally protect from inflation. Very well. Over long term, as per usual. In the short term they could fall as the inflation and interest rates go up.Try telling that to someone who retired in 1970 at the age of 60, heavily invested in a 60/40 portfolio, and was about to start on a 10 year spending spree to enjoy retirement before they became less able.Yes thought you would change your mind about "equities do normally protect from inflation".“So we beat on, boats against the current, borne back ceaselessly into the past.”0 -

RETIRE.. a dirty word.. id rather be doing something useful. working thru the pandemic and thru 30 yrs driving for ambulance carrying patients for hospital appointments. try it folks, extremely rewarding whichever way you look at it.0

-

My apologies......in my haste to write that before going out last night, I've miscalculated.....I actually meant 4%, the original thread subject, which is £20k not £25k.....doh!!!MK62 said:It's a hypothetical, but assume good health, say £25k pa.......and as for leaving anything, ideally yes, but lets say that's not a necessity (as if it was it would exclude annuities)

PS....assume £12k essential income....

How would you do it if you were single, and then if you were married to a similar age partner?

I agree with Bostonerimus that £25k pa might be a bit ambitious in this scenario.

I'm interested to see how the proponents of annuities (at current rates) would tackle this.....

0 -

Going on your original premise, that was £25k withdrawn annually from the pot for 7 years (i.e. 5%) and then (roughly) £15k per year thereafter (i.e. 3%)MK62 said:

My apologies......in my haste to write that before going out last night, I've miscalculated.....I actually meant 4%, the original thread subject, which is £20k not £25k.....doh!!!MK62 said:It's a hypothetical, but assume good health, say £25k pa.......and as for leaving anything, ideally yes, but lets say that's not a necessity (as if it was it would exclude annuities)

PS....assume £12k essential income....

How would you do it if you were single, and then if you were married to a similar age partner?

I agree with Bostonerimus that £25k pa might be a bit ambitious in this scenario.

I'm interested to see how the proponents of annuities (at current rates) would tackle this.....

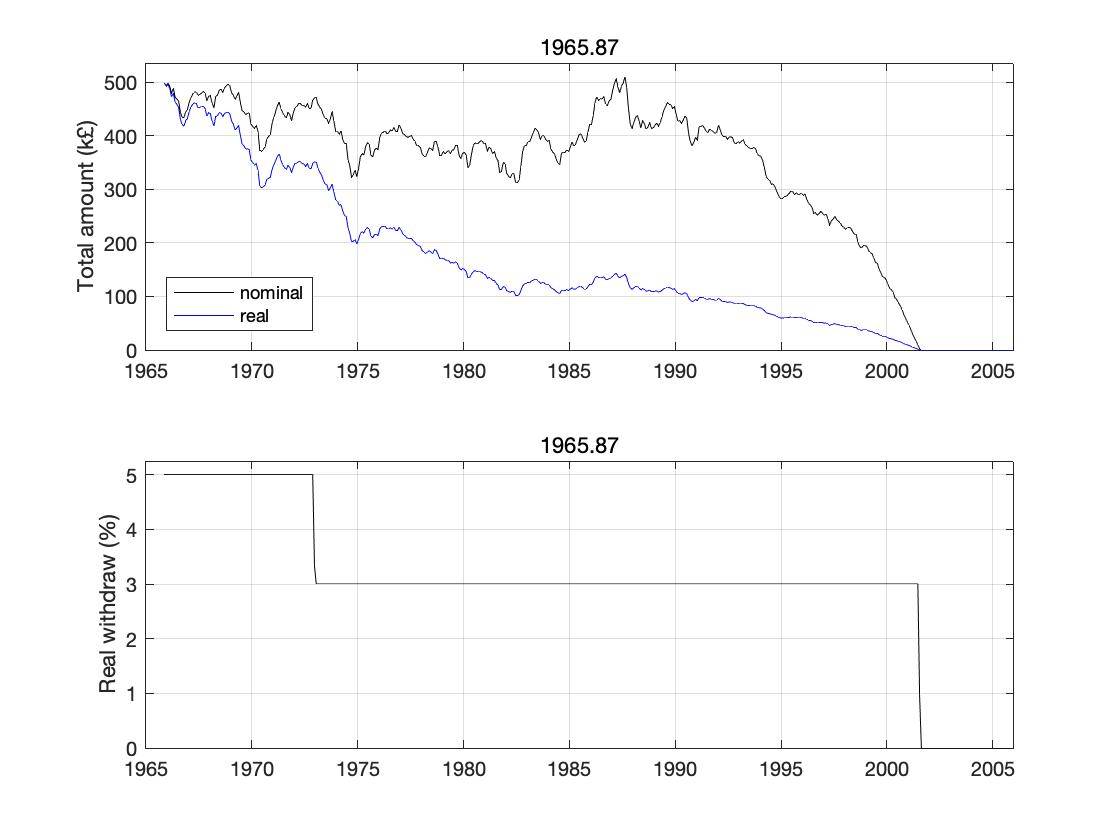

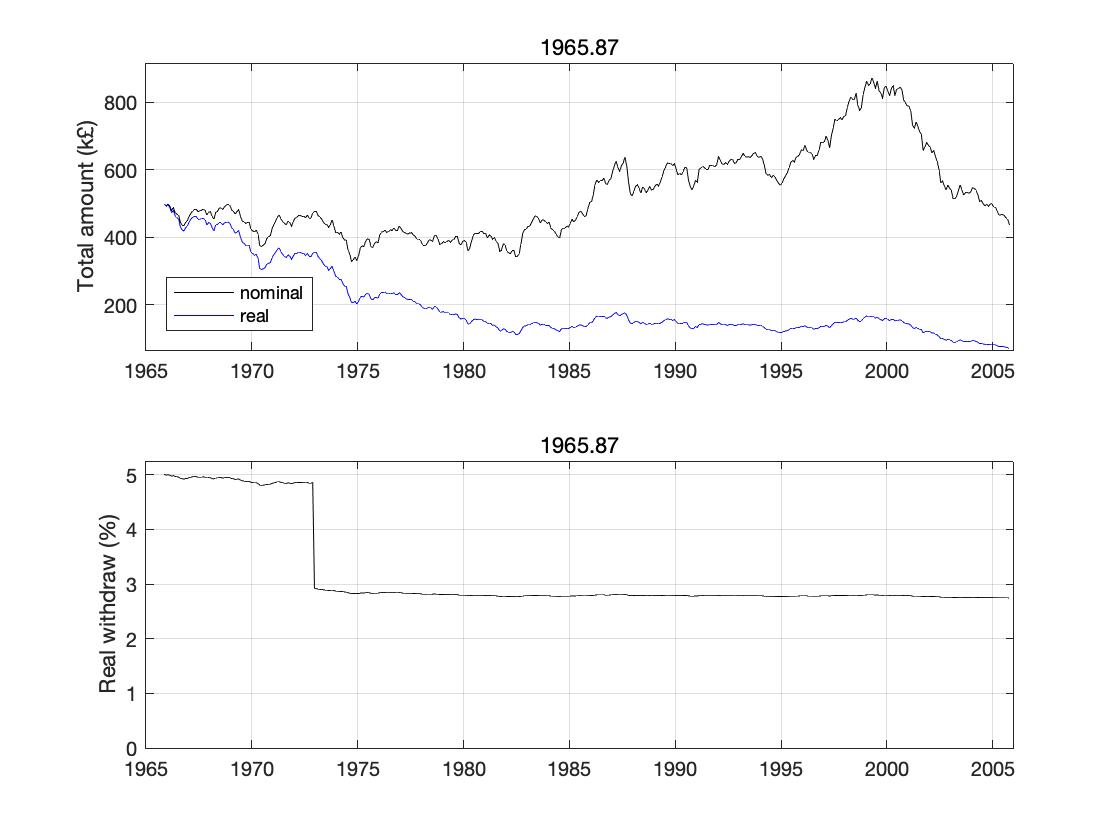

Here are some results for this withdrawal pattern (60/40 portfolio, US data - I really my update my code to deal with UK inflation at some point!)

The portfolio lasted roughly 36 years (i.e. until the retiree is 96) - the period in the mid 60s, as usual, provides the worst cases). Overall the historical failure rate was about 1% (i.e. a lot better than a 40 year retirement with constant 4% where the failure rate was ~10%).

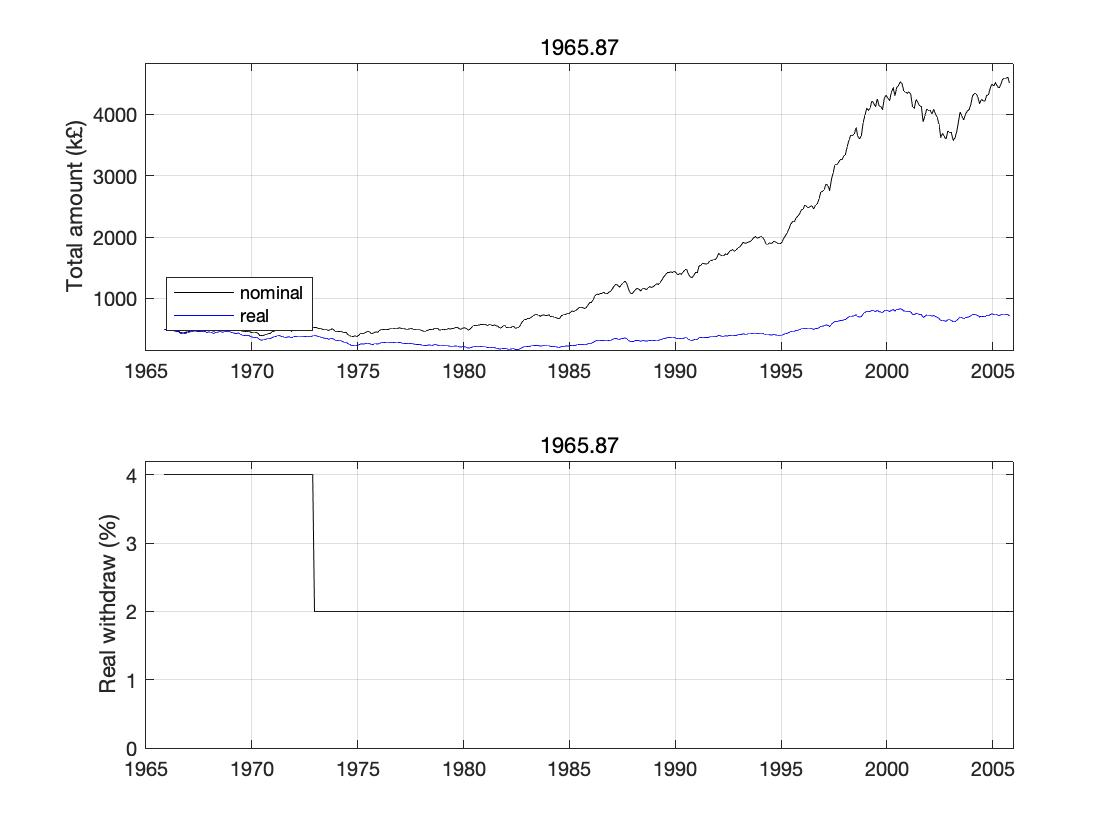

If you take your second version (i.e. 20k is required and not 25k) then things would have been even easier with an initial withdrawal of 4% and then 2% from year 7 onwards...

Here your heirs would have usually ended up very rich indeed (for 40 year retirements starting in 1980 you'd leave £5m in real terms).

For UK retirements, the first one would have been more of a stretch (the money would have run out a bit earlier - sorry, I don't know by how much), while the second one would almost certainly have been doable. While no-one can be certain, that implies that the first one, given that is is an edge case, may (or may not) work in the future, while the second has a lot more resilience built in since the portfolio was larger in real terms at the end than at the beginning in all historic cases.

Finally, what happens if we allow a small amount of variation in the spending in the first case. Here I've adjusted the required spending by 10% of the difference between the current portfolio value and the initial portfolio value, e.g. if the current portfolio was 50% of the initial portfolio in real terms and the desired spend 5%, then the actual spend would be 5*(1-(0.1*0.5))=4.75%, while if the current portfolio was 1.5 times bigger then the actual spend would be 5*(1+(0.1*0.5))=5.25%.

While the spend in the latter half of the retirement is below the 3% required (roughly 2.8%, i.e. 14k - taken with the 10k SP, then an income of £24k - not a huge sacrifice for more resilience). While the amount at the end of 40 years is quite small (about 70k in real-terms) it would actually have lasted until about 2011 (until the retiree was 106).

0 -

a 10 year period from now with income generation requirements isn't "long term". IMHO you should be in 100% cash if you wanted to guarantee 5 years of income and invested cautiously for the second 5 years.itwasntme001 said:Deleted_User said:Equities do normally protect from inflation. Very well. Over long term, as per usual. In the short term they could fall as the inflation and interest rates go up.Try telling that to someone who retired in 1970 at the age of 60, heavily invested in a 60/40 portfolio, and was about to start on a 10 year spending spree to enjoy retirement before they became less able.Yes thought you would change your mind about "equities do normally protect from inflation".0 -

Thanks for the rather comprehensive reply......it pretty much sums up my current view too (despite my temporary inability to calculate 4% of 500k....😉).....

That said I'm genuinely interested in alternative views.....it would be interesting to see how the above compared to taking an annuity back in 1965......the rates on offer then might have been quite different.

I'm not against the concept of annuities, per se, just the current rates on offer........0 -

bostonerimus said:

I think the the critical word here is "normally".itwasntme001 said:Deleted_User said:Equities do normally protect from inflation. Very well. Over long term, as per usual. In the short term they could fall as the inflation and interest rates go up.Try telling that to someone who retired in 1970 at the age of 60, heavily invested in a 60/40 portfolio, and was about to start on a 10 year spending spree to enjoy retirement before they became less able.Yes thought you would change your mind about "equities do normally protect from inflation".

What does normally even mean? How do we know it is normal?

0 -

Deleted_User said:

Firstly, I said “equities”. Bonds are terrible when dealing with unexpected inflation. So, “60/40” isn’t relevant.itwasntme001 said:Deleted_User said:Equities do normally protect from inflation. Very well. Over long term, as per usual. In the short term they could fall as the inflation and interest rates go up.Try telling that to someone who retired in 1970 at the age of 60, heavily invested in a 60/40 portfolio, and was about to start on a 10 year spending spree to enjoy retirement before they became less able.Yes thought you would change your mind about "equities do normally protect from inflation".

Secondly, William Bernstein has dealt with this better than I would in his “investing for adults” series. It included this and other examples from a range of countries which experienced high inflation. Get back to me once you had a chance to read it. You’ll find that a globally diversified equity portfolio provides an excellent long term hedge against inflation.But it is reasonable to expect a 60 year old retiree to have a decent chunk in fixed income assets and I think 60:40 is quite appropriate.I am just giving an example where your thesis fails. Even assuming a 100% stocks portfolio for a 60 year old in 1970 spending 4% a year. That is a depletion of more than 40% of the value over a 10 year period. Even more so if you adjust the 4% by inflation. I haven't done the numbers, but I imagine it would be significantly more than a 40% depletion, probably in the region of 60%?And all because equities did not keep up with inflation. They fell. I even assumed above equities did keep up exactly.So Mr or Mrs 70 year old retiree in 1980 now has a pot that has depleted at least by half in nominal terms, even more in real terms and the favourable returns that are about to occur in the next few decades won't help a huge amount given the capital has been depleted so much. Sequence of returns risk is very real.0 -

bostonerimus said:

A counter example would be the last 30 years in the USA. a 60/40 portfolio delivered average annual growth of 9% and average annual inflation was 2.4%. There is no guaranteed inflation link or protection from equities, bonds or a combination of the two, but many times they do beat inflation considerably. This is the bedrock of the 4% rule. Bengen did not come up with 4% for 1970s Japan.itwasntme001 said:Deleted_User said:Equities do normally protect from inflation. Very well. Over long term, as per usual. In the short term they could fall as the inflation and interest rates go up.Try telling that to someone who retired in 1970 at the age of 60, heavily invested in a 60/40 portfolio, and was about to start on a 10 year spending spree to enjoy retirement before they became less able.Yes thought you would change your mind about "equities do normally protect from inflation".The key point being last 30 years.We have history of financial markets (that represents more or less the current form) going back a 100 years or so.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards