We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Foolishness of the 4% rule

Comments

-

Asian debt crisis of 1997/98. Enron scandal of 2001.Sea_Shell said:QrizB said:

How about 2001-2003?Sea_Shell said:With regards to "the markets" as a whole. Most graphs I've seen where there has been a "correction" or a "crash" show a short, sharp downward trend, followed by a steady recovery. eg 25% drop over a short period.

Have we ever had the sort of market behaviour whereby the reduction has been the same, overall (eg 25%), but it's been a slow drawn out affair, maybe only losing 1% a month for 25 months instead? Does this happen? A slow death, if you like, instead of a heart attack!!

If anyone has any examples, I'd be keen to see them.

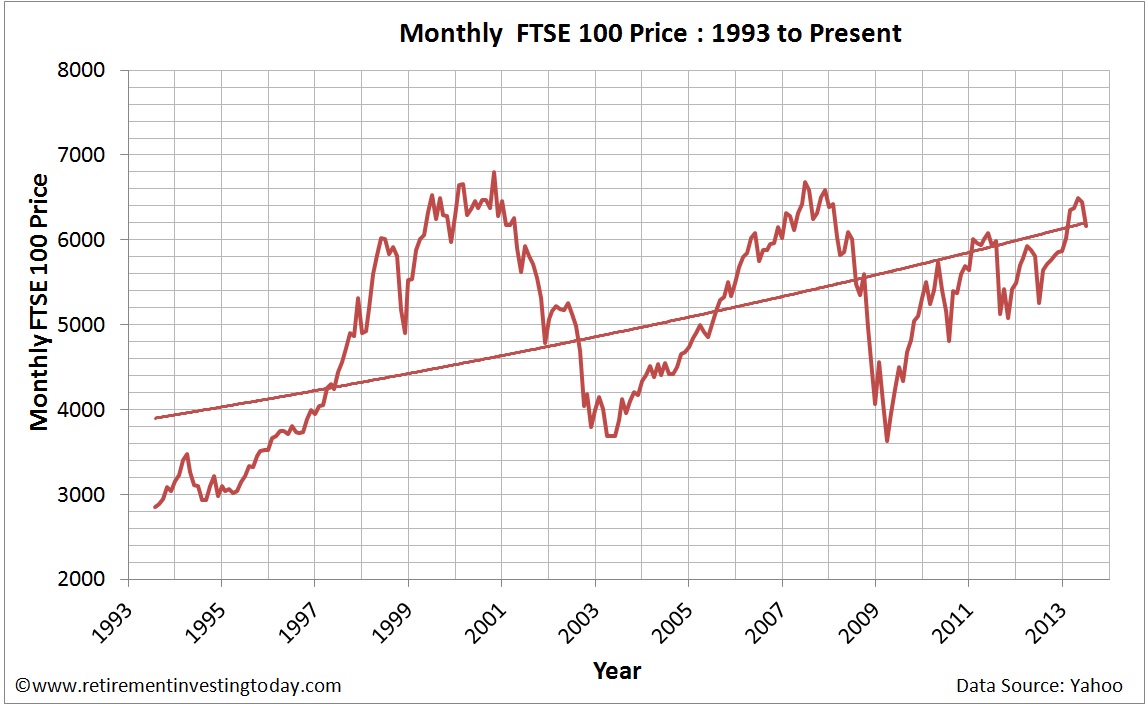

Ah Yes, 9/11. If you focus on the 2001-03 period, where it lost almost half* its value over that period, with very little recovery in between. It took until 2008 to recover....just in time for the banking crisis!!!

*about 6800 to 3600 by that graph, I think.

Was there more to it than 9/11 though. Obviously that was a massive shock to global markets, but what made the downturn last so long, I don't recall?

Dot Com boom valued companies at unsustainable levels. Remember Last Minute.Com. Valued at around £500 million, turnover of £29 million and never achieved profitablity. Martha Fox was set up for life. While investors lost their shirts. Around 75% of nearly listed companies on the Nasdaq went bust. As commercially unviable.

Amazon had a sare price of $100 fell to $6. Back then was a very different business being just a retailer. BT was once over £20 a share. Didn't benefit from the internet as expected.

Was the banks (and other financial institutions) that drove the stock market upwards leading up to 2008. The banking crisis then caused the collapse of numerous financial institutions........ how many demutualised building societies survived as banks?

Lloyds Bank became the UK's 4th largest housebuilder after the GFC. Due to taking stakes in property companies that were indebted to the bank.1 -

Be foolish to work on an average expected. Many people do live into their 90's.bostonerimus said:

When you compare !!!!!! with !!!!!! then that will be true. You are basically just buying longevity insurance with an annuity today. You will lock in very low income and most people will be better off with the flexibility of a savings bond ladder. A 60 year old male can get a flat lifetime payout rate of 4.9% today which equates to an annual return of about 2% over the 25 years of their expected average lifespan of 85. No wonder annuities are not that popular.Deleted_User said:

They are extremely competitive when pitched against other fixed income instruments. Do you want a steady guaranteed income for some of your portfolio? And, given the title of this thread, they are very competitive with SWR (which isnt even guaranteed).Linton said:

Really? What rates available in the UK do you consider "great"? What are they competitive with?Deleted_User said:I think that “low annuity rates” are a red herring. The past does not matter. We dont know the future. Lots of great and highly competitive rates are available today.Agree that combining a “guarantee” with market exposure is the best solution for retirees. Which is readily available to DC pension holders.0 -

This is interesting because Vanguard had a similar fund in the US called the Managed Payout Fund, but they just admitted that they could not pay 4% out each year in monthly dividends and changed the name to Managed Allocation Fund and went to a variable single annual dividend.DarwinBoy said:Vanguard (in Canada) have an Retirement Income ETF that pays approx 4% pa. ETF Symbol (VRIF), 3rd party assessment of the fund in this youtube (just google youtube vanguard VRIF). Fund pays monthly. I believe a similar fund maybe coming to the UK soon.“So we beat on, boats against the current, borne back ceaselessly into the past.”0 -

I am too lazy to go into analysis but pretty sure this is wrong re bond ladder. A 60 year old wouldn’t normally buy annuities unless its a deferred one so that’s irrelevant.bostonerimus said:

You will lock in very low income and most people will be better off with the flexibility of a savings bond ladder. A 60 year old male can get a flat lifetime payout rate of 4.9% today which equates to an annual return of about 2% over the 25 years of their expected average lifespan of 85. No wonder annuities are not that popular.Deleted_User said:

They are extremely competitive when pitched against other fixed income instruments. Do you want a steady guaranteed income for some of your portfolio? And, given the title of this thread, they are very competitive with SWR (which isnt even guaranteed).Linton said:

Really? What rates available in the UK do you consider "great"? What are they competitive with?Deleted_User said:I think that “low annuity rates” are a red herring. The past does not matter. We dont know the future. Lots of great and highly competitive rates are available today.Agree that combining a “guarantee” with market exposure is the best solution for retirees. Which is readily available to DC pension holders.Strike that. A 60 year old can buy a fixed term annuity for 20 years and still beat your bond ladder. Nor is it really “locked in”. You could always reinvest your annuity payments. But yes, this is what spooks many people. They want to be in the game. Annuity has a finality to it, without a chance of massive gains.0 -

Agreed and then the equivalent annual return of the annuity goes up to a "whopping" 3%. People do need to have longevity insurance, but right now buying an annuity at age 65 is an expensive way to do it.Thrugelmir said:

Be foolish to work on an average expected. Many people do live into their 90's.bostonerimus said:

When you compare !!!!!! with !!!!!! then that will be true. You are basically just buying longevity insurance with an annuity today. You will lock in very low income and most people will be better off with the flexibility of a savings bond ladder. A 60 year old male can get a flat lifetime payout rate of 4.9% today which equates to an annual return of about 2% over the 25 years of their expected average lifespan of 85. No wonder annuities are not that popular.Deleted_User said:

They are extremely competitive when pitched against other fixed income instruments. Do you want a steady guaranteed income for some of your portfolio? And, given the title of this thread, they are very competitive with SWR (which isnt even guaranteed).Linton said:

Really? What rates available in the UK do you consider "great"? What are they competitive with?Deleted_User said:I think that “low annuity rates” are a red herring. The past does not matter. We dont know the future. Lots of great and highly competitive rates are available today.Agree that combining a “guarantee” with market exposure is the best solution for retirees. Which is readily available to DC pension holders.“So we beat on, boats against the current, borne back ceaselessly into the past.”0 -

They are pooling your money with those from the big boys, like DB pension funds which use them. Not much effort per client.Deleted_User said:

They are extremely competitive when pitched against other fixed income instruments. Do you want a steady guaranteed income for some of your portfolio? And, given the title of this thread, they are very competitive with SWR (which isnt even guaranteed).Linton said:

Really? What rates available in the UK do you consider "great"? What are they competitive with?Deleted_User said:I think that “low annuity rates” are a red herring. The past does not matter. We dont know the future. Lots of great and highly competitive rates are available today.Agree that combining a “guarantee” with market exposure is the best solution for retirees. Which is readily available to DC pension holders.0 -

SWR is a random claim of a “safe” withdrawal from an unsafe and highly variable asset class. They can offer 3,5 or 6.5%, can adjust by RPI, 10x RPI or 0.1% RPI or whatever. Its a made up number, not actually guaranteed. RPI annuity is a wrong product. If you want to buy something crazy, the price will be high. In reality a person’s needs go down with age, not up with RPI.Linton said:

Annuities are not competitive with an SWR. An SWR is based on taking an inflation adjusrted income from a fixed pot. SWRs normally used here are 3.5%. An RPI inflation adjusted annuity at 65 in the UK is about 2.7%. That rate is for a single person, so nothing left for a grieving spouse whereas one would expect an SWR to provide cover.Deleted_User said:

They are extremely competitive when pitched against other fixed income instruments. Do you want a steady guaranteed income for some of your portfolio? And, given the title of this thread, they are very competitive with SWR (which isnt even guaranteed).Linton said:

Really? What rates available in the UK do you consider "great"? What are they competitive with?Deleted_User said:I think that “low annuity rates” are a red herring. The past does not matter. We dont know the future. Lots of great and highly competitive rates are available today.Agree that combining a “guarantee” with market exposure is the best solution for retirees. Which is readily available to DC pension holders.0 -

Annuity is a fixed income product. What is your return on your bonds with similar level of risk to annuities right now? Of course annuity companies get better returns then you would on a bond. For one thing, their duration is far longer and costs far lower.bostonerimus said:

Agreed and then the equivalent annual return of the annuity goes up to a "whopping" 3%. People do need to have longevity insurance, but right now buying an annuity at age 65 is an expensive way to do it.Thrugelmir said:

Be foolish to work on an average expected. Many people do live into their 90's.bostonerimus said:

When you compare !!!!!! with !!!!!! then that will be true. You are basically just buying longevity insurance with an annuity today. You will lock in very low income and most people will be better off with the flexibility of a savings bond ladder. A 60 year old male can get a flat lifetime payout rate of 4.9% today which equates to an annual return of about 2% over the 25 years of their expected average lifespan of 85. No wonder annuities are not that popular.Deleted_User said:

They are extremely competitive when pitched against other fixed income instruments. Do you want a steady guaranteed income for some of your portfolio? And, given the title of this thread, they are very competitive with SWR (which isnt even guaranteed).Linton said:

Really? What rates available in the UK do you consider "great"? What are they competitive with?Deleted_User said:I think that “low annuity rates” are a red herring. The past does not matter. We dont know the future. Lots of great and highly competitive rates are available today.Agree that combining a “guarantee” with market exposure is the best solution for retirees. Which is readily available to DC pension holders.Below is an example for a life-only income annuity. Returns start out negative and exceed 3% at age 88. Age 90 represents the median life expectancy for a female 65 year old. That means half of them live longer. You’ll find a surprisingly large percent expected to live to 100 and beyond. Particularly so among wealthier people who are into retirement instruments.Return isnt the best parameter in my book, unless you are using annuities like bonds. Payout ratio is what we are after. Its the guarantee regardless of your duration.Think of it like a game. You all get together and whoever lives longer than average wins. Whoever lives less than average does not lose. He still gets to safely spend more than otherwise. 0

0 -

Yes, I'm sorry I made some mistakes that make the annuity look better than it actually is. So here we go for realDeleted_User said:

I am too lazy to go into analysis but pretty sure this is wrong re bond ladder. A 60 year old wouldn’t normally buy annuities unless its a deferred one so that’s irrelevant.bostonerimus said:

You will lock in very low income and most people will be better off with the flexibility of a savings bond ladder. A 60 year old male can get a flat lifetime payout rate of 4.9% today which equates to an annual return of about 2% over the 25 years of their expected average lifespan of 85. No wonder annuities are not that popular.Deleted_User said:

They are extremely competitive when pitched against other fixed income instruments. Do you want a steady guaranteed income for some of your portfolio? And, given the title of this thread, they are very competitive with SWR (which isnt even guaranteed).Linton said:

Really? What rates available in the UK do you consider "great"? What are they competitive with?Deleted_User said:I think that “low annuity rates” are a red herring. The past does not matter. We dont know the future. Lots of great and highly competitive rates are available today.Agree that combining a “guarantee” with market exposure is the best solution for retirees. Which is readily available to DC pension holders.Strike that. A 60 year old can buy a fixed term annuity for 20 years and still beat your bond ladder. Nor is it really “locked in”. You could always reinvest your annuity payments. But yes, this is what spooks many people. They want to be in the game. Annuity has a finality to it, without a chance of massive gains.

at 65 a man has a life expectancy of 20 years and today can get a payout rate of 4.9% - women on average live a little longer so the numbers are a bit better for them. So it's easy to see that the annuity actually costs him money if he lives for 20 years or less, but if he lives to 91 ie 26 years beyond 65 then he'll get the implied annual growth of 2% that I worked out. Today you can get a 5 year fixed bond around 1.75% so the majority of people will be better off with that than buying an annuity and they will be able to buy new saving bonds at better rates if they go up...Today annuities are purely about longevity insurance as even if you live a couple of years longer than the average you'll be better off just keeping the money in a saving account at 0.6% interest and if you use a 5 years saving ladder paying a constant 1.75% you'll still be better off than the annuity holder up to age 90.“So we beat on, boats against the current, borne back ceaselessly into the past.”0 -

The problem is that the markets grew a lot, so paying 4% of a much larger number translates to fast escalating payouts. VRIF does not promise 4%. Its a variable number. Payout Increases if the market goes up and the other way around, but not by the full amount so will deviate from 4%. Its basically a variable withdrawal rate product by design.bostonerimus said:

This is interesting because Vanguard had a similar fund in the US called the Managed Payout Fund, but they just admitted that they could not pay 4% out each year in monthly dividends and changed the name to Managed Allocation Fund and went to a variable single annual dividend.DarwinBoy said:Vanguard (in Canada) have an Retirement Income ETF that pays approx 4% pa. ETF Symbol (VRIF), 3rd party assessment of the fund in this youtube (just google youtube vanguard VRIF). Fund pays monthly. I believe a similar fund maybe coming to the UK soon.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards