We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Foolishness of the 4% rule

Comments

-

A cake can only every be cut so many ways. When some want a bigger slice than others. Then somebody will miss out. That's the nature of the American Exceptionalism culture that has polluted the Western world.Terron said:Deleted_User said:There are 4 “buckets” that each retiree needs to think about:

1. Basic, routine needs. Food. Shelter. Car if you need it. Books. Newspapers. Beer. Those kinds of things. This income is best secured by something actually safe. State pension. Other DB pension. Annuity. Government bond (sucks right now). Stockmarket is highly variable and the future is unknown. Stocks can’t do this job. Keep in mind that longevity is a good thing but also a risk for someone who relies on highly volatile investments. And if you are on a pension board then chances are you will live longer than an average Brit.

2. Contingency. Roof needs replacing. Your son needs help. Not necessarily “emergency” but non-routine expenditure. This requires a liquid source of funds. Your stocks are technically liquid but not if you use “4% rule”. In that case your investments are needed to secure your future 4% withdrawals and can’t be touched. For this pot you need a separate “slush fund” in cash.3. Discretionary income. Things that are “nice to have”. Annual holidays in Hawaii. New Porsche every 5 years. Major upgrades to your property. Stocks are perfect for this pot. They are volatile but do provide the best chance of long term growth. Given you already secured 1 and 2 with genuinely safe sources of funds, you can and should be invested aggressively. This pot should be 100% in stocks and depleted based on the size of the pot. 4% rule does not apply. If this pot goes up by a factor of 2 in 5 years or 4 in 20 years (as it often does), it would be dumb to withdraw based on its size 5 or 20 years ago.4. Legacy. This pot could be in stocks (and combined with 3). Or it could be insurance. Or certain types of annuities.

Drawdown seems to be the way that gives the greatest income from a given pot. Thus it is the method that works best for people with only a small pot. Work out what you need as a minimum to live on, on top of the SP. Using the 4% rule you then need at least 25 times that as a target. It is better to go for more but that is a good target.0 -

Pooling risk with other people and giving up the possibility of passing money onto heirs should give the biggest incomes and some people will get the mortality credit. It's a shame that sensible pensions have been replaced by the largely US invention of the DC plan which was always sold as giving the individual freedom whereas it was mostly about shifting risk to the individual.Thrugelmir said:

A cake can only every be cut so many ways. When some want a bigger slice than others. Then somebody will miss out. That's the nature of the American Exceptionalism culture that has polluted the Western world.Terron said:Deleted_User said:There are 4 “buckets” that each retiree needs to think about:

1. Basic, routine needs. Food. Shelter. Car if you need it. Books. Newspapers. Beer. Those kinds of things. This income is best secured by something actually safe. State pension. Other DB pension. Annuity. Government bond (sucks right now). Stockmarket is highly variable and the future is unknown. Stocks can’t do this job. Keep in mind that longevity is a good thing but also a risk for someone who relies on highly volatile investments. And if you are on a pension board then chances are you will live longer than an average Brit.

2. Contingency. Roof needs replacing. Your son needs help. Not necessarily “emergency” but non-routine expenditure. This requires a liquid source of funds. Your stocks are technically liquid but not if you use “4% rule”. In that case your investments are needed to secure your future 4% withdrawals and can’t be touched. For this pot you need a separate “slush fund” in cash.3. Discretionary income. Things that are “nice to have”. Annual holidays in Hawaii. New Porsche every 5 years. Major upgrades to your property. Stocks are perfect for this pot. They are volatile but do provide the best chance of long term growth. Given you already secured 1 and 2 with genuinely safe sources of funds, you can and should be invested aggressively. This pot should be 100% in stocks and depleted based on the size of the pot. 4% rule does not apply. If this pot goes up by a factor of 2 in 5 years or 4 in 20 years (as it often does), it would be dumb to withdraw based on its size 5 or 20 years ago.4. Legacy. This pot could be in stocks (and combined with 3). Or it could be insurance. Or certain types of annuities.

Drawdown seems to be the way that gives the greatest income from a given pot. Thus it is the method that works best for people with only a small pot. Work out what you need as a minimum to live on, on top of the SP. Using the 4% rule you then need at least 25 times that as a target. It is better to go for more but that is a good target.“So we beat on, boats against the current, borne back ceaselessly into the past.”1 -

The main difference between DB and DC pensions is how much the employer contributes. Typically contributions to DC pensions are much lower.Other than that, DC pensions are great. People do get more freedom and responsibility how to handle THEIR money. Its just that a point comes when some of the short term risk needs to be shifted. And there are perfectly good options for doing that if you have a DC pension.The alternative is for your employer and regulators to have all th3 decision making (DB pension). Tends to work particularly well when the employer is local or national government. That means the taxpayer takes on all the risk. A good deal for the bureaucracy. Even then employees might still carry risk. Wouldn’t want to have a DB pension from some of municipalities in the US.In general, most of these DB funds RELY on returns far in access of 4%. Kinda scary.0

-

Just something i've been pondering...

With regards to "the markets" as a whole. Most graphs I've seen where there has been a "correction" or a "crash" show a short, sharp downward trend, followed by a steady recovery. eg 25% drop over a short period.

Over time, the graphs show recovery back to where they were, and often surpass the old high point.

Have we ever had the sort of market behaviour whereby the reduction has been the same, overall (eg 25%), but it's been a slow drawn out affair, maybe only losing 1% a month for 25 months instead? Does this happen? A slow death, if you like, instead of a heart attack!!

If anyone has any examples, I'd be keen to see them. Not individual shares, but markets, sectors or funds. Or does the market just not work/respond in that way.

How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0 -

Do you mean withdrawals or returns in the last sentence. I ask because DB pensions get advantages in two 'dimensions' - firstly mortality credits, which for portfolio consisting of 60/40 US stocks/bonds a cohort of UK 65 year olds 50/50 male/female historically gave an SWR with no failures of 4.9% (this neglects fees).Deleted_User said:The main difference between DB and DC pensions is how much the employer contributes. Typically contributions to DC pensions are much lower.Other than that, DC pensions are great. People do get more freedom and responsibility how to handle THEIR money. Its just that a point comes when some of the short term risk needs to be shifted. And there are perfectly good options for doing that if you have a DC pension.The alternative is for your employer and regulators to have all th3 decision making (DB pension). Tends to work particularly well when the employer is local or national government. That means the taxpayer takes on all the risk. A good deal for the bureaucracy. Even then employees might still carry risk. Wouldn’t want to have a DB pension from some of municipalities in the US.In general, most of these DB funds RELY on returns far in access of 4%. Kinda scary.

Second, unlike with a DC pension where the retiree only gets one chance and one starting year, DB pensions get to combine multiple cohorts (i.e. multiple starting years) - for the same mortality stats as above, but combining 15 years worth of cohorts raised the SWR with no failures to 5.7% (I've not been able to model larger groupings than this, but this appears to be close to the upper limit).

An interesting recent development is the collective defined contribution pension, which are now legal in the UK (search google or have a look at the linked documents at https://www.aon.com/unitedkingdom/retirement-investment/defined-contribution/collective-defined-contribution.jsp

0 -

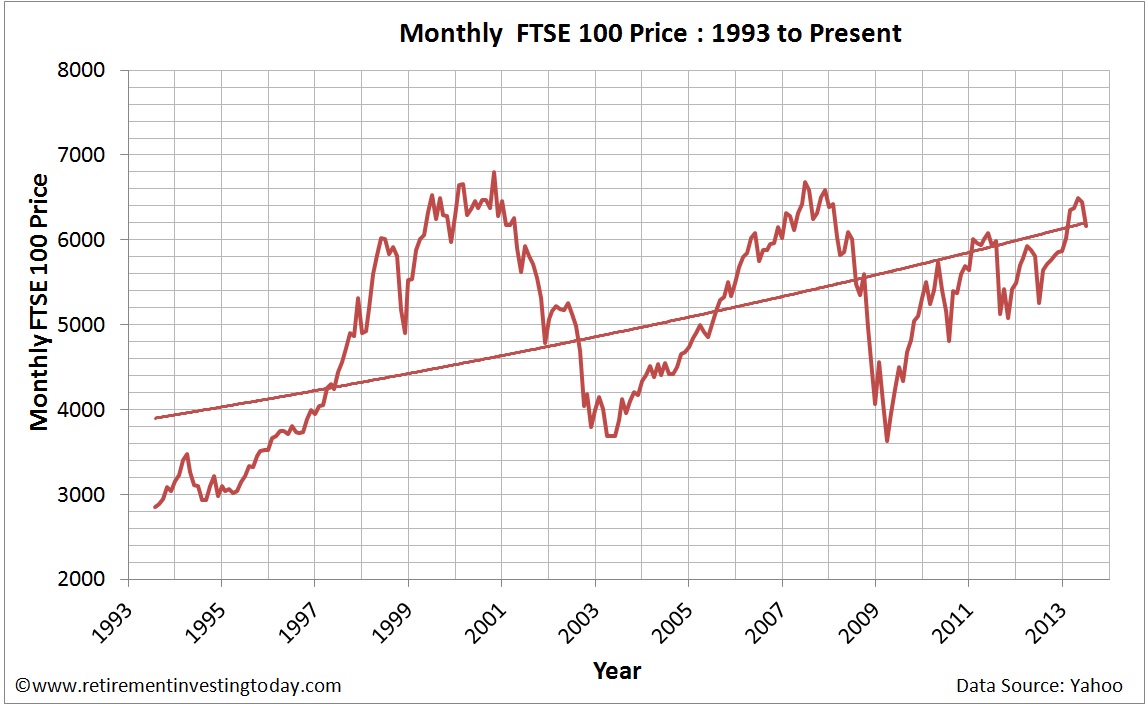

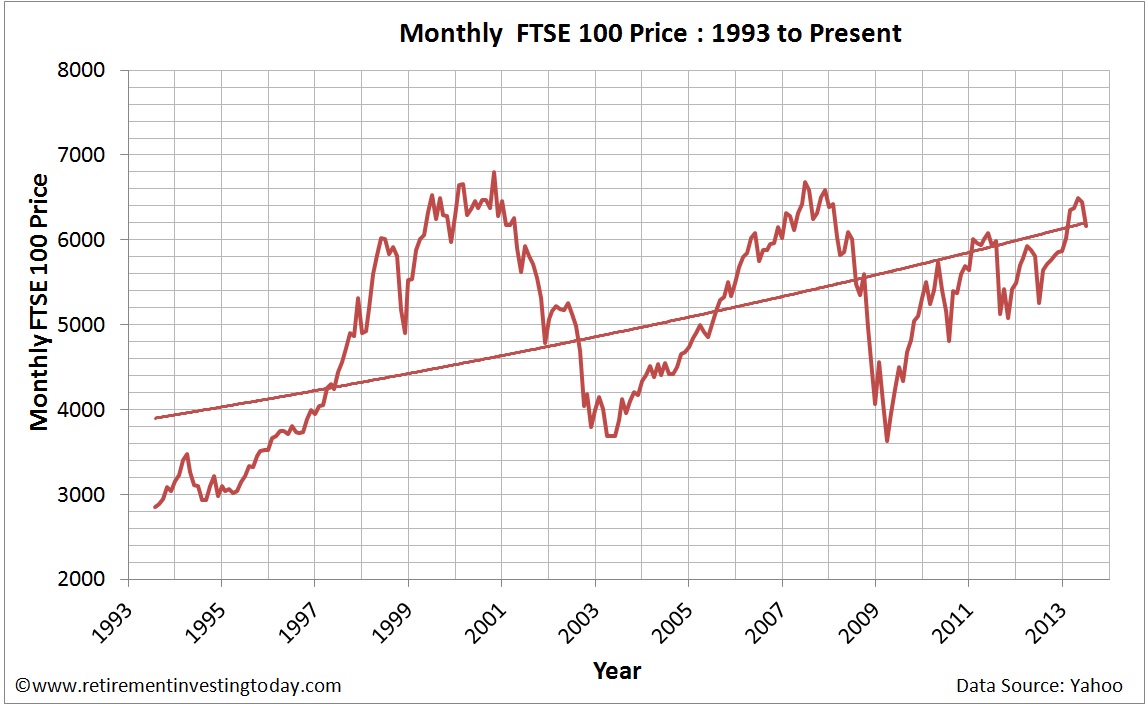

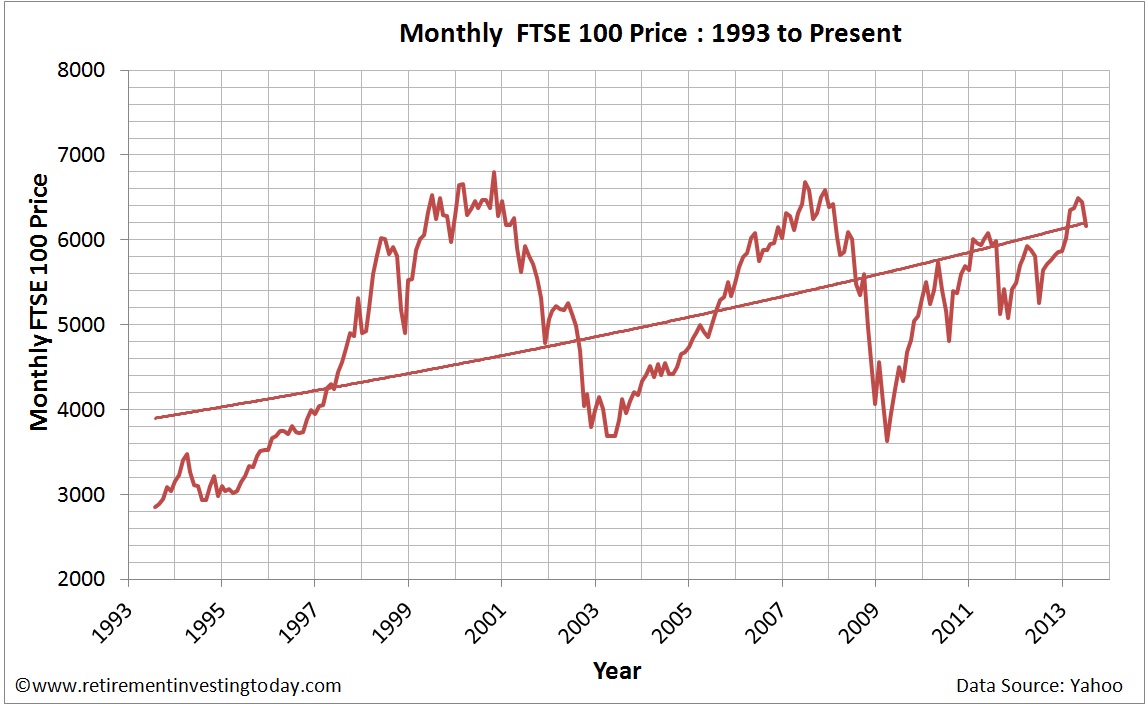

How about 2001-2003?Sea_Shell said:With regards to "the markets" as a whole. Most graphs I've seen where there has been a "correction" or a "crash" show a short, sharp downward trend, followed by a steady recovery. eg 25% drop over a short period.

Have we ever had the sort of market behaviour whereby the reduction has been the same, overall (eg 25%), but it's been a slow drawn out affair, maybe only losing 1% a month for 25 months instead? Does this happen? A slow death, if you like, instead of a heart attack!!

If anyone has any examples, I'd be keen to see them. N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.0 -

Responsibility comes hand in hand with freedom and both are considered good things. Suits me, anyway.bostonerimus said:Thrugelmir said:

It's a shame that sensible pensions have been replaced by the largely US invention of the DC plan which was always sold as giving the individual freedom whereas it was mostly about shifting risk to the individual.Terron said:Deleted_User said:There are 4 “buckets” that each retiree needs to think about:

1. Basic, routine needs. Food. Shelter. Car if you need it. Books. Newspapers. Beer. Those kinds of things. This income is best secured by something actually safe. State pension. Other DB pension. Annuity. Government bond (sucks right now). Stockmarket is highly variable and the future is unknown. Stocks can’t do this job. Keep in mind that longevity is a good thing but also a risk for someone who relies on highly volatile investments. And if you are on a pension board then chances are you will live longer than an average Brit.

2. Contingency. Roof needs replacing. Your son needs help. Not necessarily “emergency” but non-routine expenditure. This requires a liquid source of funds. Your stocks are technically liquid but not if you use “4% rule”. In that case your investments are needed to secure your future 4% withdrawals and can’t be touched. For this pot you need a separate “slush fund” in cash.3. Discretionary income. Things that are “nice to have”. Annual holidays in Hawaii. New Porsche every 5 years. Major upgrades to your property. Stocks are perfect for this pot. They are volatile but do provide the best chance of long term growth. Given you already secured 1 and 2 with genuinely safe sources of funds, you can and should be invested aggressively. This pot should be 100% in stocks and depleted based on the size of the pot. 4% rule does not apply. If this pot goes up by a factor of 2 in 5 years or 4 in 20 years (as it often does), it would be dumb to withdraw based on its size 5 or 20 years ago.4. Legacy. This pot could be in stocks (and combined with 3). Or it could be insurance. Or certain types of annuities.

Drawdown seems to be the way that gives the greatest income from a given pot. Thus it is the method that works best for people with only a small pot. Work out what you need as a minimum to live on, on top of the SP. Using the 4% rule you then need at least 25 times that as a target. It is better to go for more but that is a good target.0 -

QrizB said:

How about 2001-2003?Sea_Shell said:With regards to "the markets" as a whole. Most graphs I've seen where there has been a "correction" or a "crash" show a short, sharp downward trend, followed by a steady recovery. eg 25% drop over a short period.

Have we ever had the sort of market behaviour whereby the reduction has been the same, overall (eg 25%), but it's been a slow drawn out affair, maybe only losing 1% a month for 25 months instead? Does this happen? A slow death, if you like, instead of a heart attack!!

If anyone has any examples, I'd be keen to see them.

Ah Yes, 9/11. If you focus on the 2001-03 period, where it lost almost half* its value over that period, with very little recovery in between. It took until 2008 to recover....just in time for the banking crisis!!!

*about 6800 to 3600 by that graph, I think.

Was there more to it than 9/11 though. Obviously that was a massive shock to global markets, but what made the downturn last so long, I don't recall?

How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0 -

I think it was also the dot.com bubble around that time?Sea_Shell said:QrizB said:

How about 2001-2003?Sea_Shell said:With regards to "the markets" as a whole. Most graphs I've seen where there has been a "correction" or a "crash" show a short, sharp downward trend, followed by a steady recovery. eg 25% drop over a short period.

Have we ever had the sort of market behaviour whereby the reduction has been the same, overall (eg 25%), but it's been a slow drawn out affair, maybe only losing 1% a month for 25 months instead? Does this happen? A slow death, if you like, instead of a heart attack!!

If anyone has any examples, I'd be keen to see them.

Ah Yes, 9/11. If you focus on the 2001-03 period, where it lost almost half* its value over that period, with very little recovery in between. It took until 2008 to recover....just in time for the banking crisis!!!

*about 6800 to 3600 by that graph, I think.

Was there more to it than 9/11 though. Obviously that was a massive shock to global markets, but what made the downturn last so long, I don't recall?

N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.3 -

I mean returns. Many DB pensions rely on market returns in excess of 8%. If actual returns undershoot that number for a long period of time all these schemes will go bankrupt.OldScientist said:

Do you mean withdrawals or returns in the last sentence. I ask because DB pensions get advantages in two 'dimensions' - firstly mortality credits, which for portfolio consisting of 60/40 US stocks/bonds a cohort of UK 65 year olds 50/50 male/female historically gave an SWR with no failures of 4.9% (this neglects fees).Deleted_User said:The main difference between DB and DC pensions is how much the employer contributes. Typically contributions to DC pensions are much lower.Other than that, DC pensions are great. People do get more freedom and responsibility how to handle THEIR money. Its just that a point comes when some of the short term risk needs to be shifted. And there are perfectly good options for doing that if you have a DC pension.The alternative is for your employer and regulators to have all th3 decision making (DB pension). Tends to work particularly well when the employer is local or national government. That means the taxpayer takes on all the risk. A good deal for the bureaucracy. Even then employees might still carry risk. Wouldn’t want to have a DB pension from some of municipalities in the US.In general, most of these DB funds RELY on returns far in access of 4%. Kinda scary.

Second, unlike with a DC pension where the retiree only gets one chance and one starting year, DB pensions get to combine multiple cohorts (i.e. multiple starting years) - for the same mortality stats as above, but combining 15 years worth of cohorts raised the SWR with no failures to 5.7% (I've not been able to model larger groupings than this, but this appears to be close to the upper limit).

An interesting recent development is the collective defined contribution pension, which are now legal in the UK (search google or have a look at the linked documents at https://www.aon.com/unitedkingdom/retirement-investment/defined-contribution/collective-defined-contribution.jspSomeone with a DC pension can also benefit from mortality credits. Thats what annuities are for.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards