We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Foolishness of the 4% rule

Comments

-

With regards to "the markets" as a whole. Most graphs I've seen where there has been a "correction" or a "crash" show a short, sharp downward trend, followed by a steady recovery. eg 25% drop over a short period.

Human brain is wired to look for patterns even if there aren’t any. That’s how the whole “technical analysis” astrology was developed.

1 -

From https://www.ons.gov.uk/economy/investmentspensionsandtrusts/bulletins/fundedoccupationalpensionschemesintheuk/octobertodecember2020, it sould appear the UK DB pensions schemes are predominantly invested in "long term debt securities" with, I would assume, maturity dates matching liabilities. Given typical CETVs your figure of an assumption of a reliance on 8% returns seems odd.Deleted_User said:

I mean returns. Many DB pensions rely on market returns in excess of 8%. If actual returns undershoot that number for a long period of time all these schemes will go bankrupt.OldScientist said:

Do you mean withdrawals or returns in the last sentence. I ask because DB pensions get advantages in two 'dimensions' - firstly mortality credits, which for portfolio consisting of 60/40 US stocks/bonds a cohort of UK 65 year olds 50/50 male/female historically gave an SWR with no failures of 4.9% (this neglects fees).Deleted_User said:The main difference between DB and DC pensions is how much the employer contributes. Typically contributions to DC pensions are much lower.Other than that, DC pensions are great. People do get more freedom and responsibility how to handle THEIR money. Its just that a point comes when some of the short term risk needs to be shifted. And there are perfectly good options for doing that if you have a DC pension.The alternative is for your employer and regulators to have all th3 decision making (DB pension). Tends to work particularly well when the employer is local or national government. That means the taxpayer takes on all the risk. A good deal for the bureaucracy. Even then employees might still carry risk. Wouldn’t want to have a DB pension from some of municipalities in the US.In general, most of these DB funds RELY on returns far in access of 4%. Kinda scary.

Second, unlike with a DC pension where the retiree only gets one chance and one starting year, DB pensions get to combine multiple cohorts (i.e. multiple starting years) - for the same mortality stats as above, but combining 15 years worth of cohorts raised the SWR with no failures to 5.7% (I've not been able to model larger groupings than this, but this appears to be close to the upper limit).

An interesting recent development is the collective defined contribution pension, which are now legal in the UK (search google or have a look at the linked documents at https://www.aon.com/unitedkingdom/retirement-investment/defined-contribution/collective-defined-contribution.jspSomeone with a DC pension can also benefit from mortality credits. Thats what annuities are for.2 -

Linton said:

From https://www.ons.gov.uk/economy/investmentspensionsandtrusts/bulletins/fundedoccupationalpensionschemesintheuk/octobertodecember2020, it sould appear the UK DB pensions schemes are predominantly invested in "long term debt securities" with, I would assume, maturity dates matching liabilities. Given typical CETVs your figure of an assumption of a reliance on 8% returns seems odd.Deleted_User said:

I mean returns. Many DB pensions rely on market returns in excess of 8%. If actual returns undershoot that number for a long period of time all these schemes will go bankrupt.OldScientist said:

Do you mean withdrawals or returns in the last sentence. I ask because DB pensions get advantages in two 'dimensions' - firstly mortality credits, which for portfolio consisting of 60/40 US stocks/bonds a cohort of UK 65 year olds 50/50 male/female historically gave an SWR with no failures of 4.9% (this neglects fees).Deleted_User said:The main difference between DB and DC pensions is how much the employer contributes. Typically contributions to DC pensions are much lower.Other than that, DC pensions are great. People do get more freedom and responsibility how to handle THEIR money. Its just that a point comes when some of the short term risk needs to be shifted. And there are perfectly good options for doing that if you have a DC pension.The alternative is for your employer and regulators to have all th3 decision making (DB pension). Tends to work particularly well when the employer is local or national government. That means the taxpayer takes on all the risk. A good deal for the bureaucracy. Even then employees might still carry risk. Wouldn’t want to have a DB pension from some of municipalities in the US.In general, most of these DB funds RELY on returns far in access of 4%. Kinda scary.

Second, unlike with a DC pension where the retiree only gets one chance and one starting year, DB pensions get to combine multiple cohorts (i.e. multiple starting years) - for the same mortality stats as above, but combining 15 years worth of cohorts raised the SWR with no failures to 5.7% (I've not been able to model larger groupings than this, but this appears to be close to the upper limit).

An interesting recent development is the collective defined contribution pension, which are now legal in the UK (search google or have a look at the linked documents at https://www.aon.com/unitedkingdom/retirement-investment/defined-contribution/collective-defined-contribution.jspSomeone with a DC pension can also benefit from mortality credits. Thats what annuities are for.“From 1992 to 2012, the median pension fund’s assumed rate of return changed only modestly, decreasing by 0.25 percentage points, from 8 percent to 7.75 percent.”

https://www.pewtrusts.org/~/media/assets/2014/06/state_public_pension_investments_shift_over_past_30_years.pdf

UK might be different.1 -

I had a Virgin PEP at the time which invested in the FTSE All Share. Looking back at my figures, I see that the value of it dropped by around 41% between Feb 2001 and Feb 2003, but by Feb 2006 the total value was back to nearly 9% above the Feb 2001 value. That was with dividends automatically reinvested, but also included the deduction of Virgin charges. So not quite as long to recover with dividends reinvested.Sea_Shell said:QrizB said:

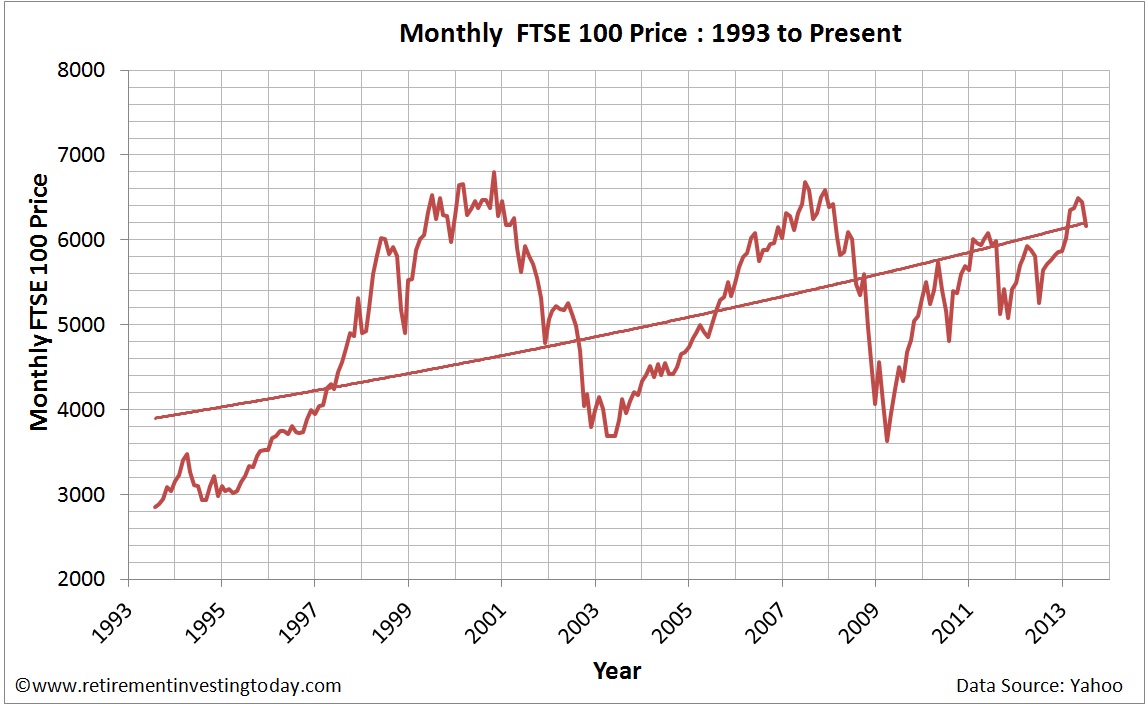

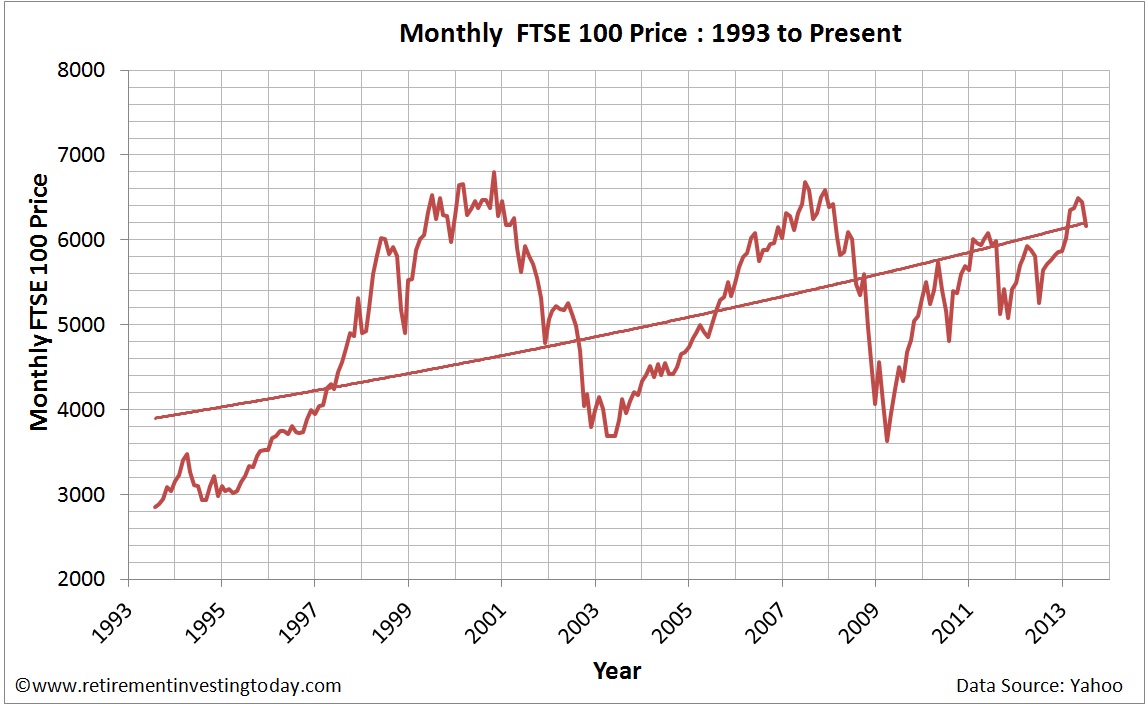

How about 2001-2003?Sea_Shell said:With regards to "the markets" as a whole. Most graphs I've seen where there has been a "correction" or a "crash" show a short, sharp downward trend, followed by a steady recovery. eg 25% drop over a short period.

Have we ever had the sort of market behaviour whereby the reduction has been the same, overall (eg 25%), but it's been a slow drawn out affair, maybe only losing 1% a month for 25 months instead? Does this happen? A slow death, if you like, instead of a heart attack!!

If anyone has any examples, I'd be keen to see them.

Ah Yes, 9/11. If you focus on the 2001-03 period, where it lost almost half* its value over that period, with very little recovery in between. It took until 2008 to recover....just in time for the banking crisis!!!1 -

Linton said:

From https://www.ons.gov.uk/economy/investmentspensionsandtrusts/bulletins/fundedoccupationalpensionschemesintheuk/octobertodecember2020, it sould appear the UK DB pensions schemes are predominantly invested in "long term debt securities" with, I would assume, maturity dates matching liabilities. Given typical CETVs your figure of an assumption of a reliance on 8% returns seems odd.Deleted_User said:

I mean returns. Many DB pensions rely on market returns in excess of 8%. If actual returns undershoot that number for a long period of time all these schemes will go bankrupt.OldScientist said:

Do you mean withdrawals or returns in the last sentence. I ask because DB pensions get advantages in two 'dimensions' - firstly mortality credits, which for portfolio consisting of 60/40 US stocks/bonds a cohort of UK 65 year olds 50/50 male/female historically gave an SWR with no failures of 4.9% (this neglects fees).Deleted_User said:The main difference between DB and DC pensions is how much the employer contributes. Typically contributions to DC pensions are much lower.Other than that, DC pensions are great. People do get more freedom and responsibility how to handle THEIR money. Its just that a point comes when some of the short term risk needs to be shifted. And there are perfectly good options for doing that if you have a DC pension.The alternative is for your employer and regulators to have all th3 decision making (DB pension). Tends to work particularly well when the employer is local or national government. That means the taxpayer takes on all the risk. A good deal for the bureaucracy. Even then employees might still carry risk. Wouldn’t want to have a DB pension from some of municipalities in the US.In general, most of these DB funds RELY on returns far in access of 4%. Kinda scary.

Second, unlike with a DC pension where the retiree only gets one chance and one starting year, DB pensions get to combine multiple cohorts (i.e. multiple starting years) - for the same mortality stats as above, but combining 15 years worth of cohorts raised the SWR with no failures to 5.7% (I've not been able to model larger groupings than this, but this appears to be close to the upper limit).

An interesting recent development is the collective defined contribution pension, which are now legal in the UK (search google or have a look at the linked documents at https://www.aon.com/unitedkingdom/retirement-investment/defined-contribution/collective-defined-contribution.jspSomeone with a DC pension can also benefit from mortality credits. Thats what annuities are for.A lot (most?) of the DB schemes were introduced in the 70s when they were offered whilst interest rates and expected returns on capital were in the region of 8%. Since then, we know these schemes were very generous in hindsight, as rates of return fell (especially following dot com and GFC busts).Schemes are required to hold a certain amount in "safe" investments just as gov and corporate bonds. They would also be quite foolish to hold a significant amount in equities given the riskiness (which is an interesting takeaway given the topic of this thread....).CETVs need to be generous enough for the holder to consider the payout (i.e. at lowish single digit capitalisation rates), as clearly these DB schemes have become unsustainable - as expected rates of returns have fallen drastically since the 70s.0 -

They have been forced to shift as much as permitted into stocks and private equity to juice returns. And many (most?) are underwater wth typically just 60% funding level. I believe some UK schemes purchased annuities to ensure adequate funding provisions but many can’t afford it exactly because they are underfunded.itwasntme001 said:Linton said:

From https://www.ons.gov.uk/economy/investmentspensionsandtrusts/bulletins/fundedoccupationalpensionschemesintheuk/octobertodecember2020, it sould appear the UK DB pensions schemes are predominantly invested in "long term debt securities" with, I would assume, maturity dates matching liabilities. Given typical CETVs your figure of an assumption of a reliance on 8% returns seems odd.Deleted_User said:

I mean returns. Many DB pensions rely on market returns in excess of 8%. If actual returns undershoot that number for a long period of time all these schemes will go bankrupt.OldScientist said:

Do you mean withdrawals or returns in the last sentence. I ask because DB pensions get advantages in two 'dimensions' - firstly mortality credits, which for portfolio consisting of 60/40 US stocks/bonds a cohort of UK 65 year olds 50/50 male/female historically gave an SWR with no failures of 4.9% (this neglects fees).Deleted_User said:The main difference between DB and DC pensions is how much the employer contributes. Typically contributions to DC pensions are much lower.Other than that, DC pensions are great. People do get more freedom and responsibility how to handle THEIR money. Its just that a point comes when some of the short term risk needs to be shifted. And there are perfectly good options for doing that if you have a DC pension.The alternative is for your employer and regulators to have all th3 decision making (DB pension). Tends to work particularly well when the employer is local or national government. That means the taxpayer takes on all the risk. A good deal for the bureaucracy. Even then employees might still carry risk. Wouldn’t want to have a DB pension from some of municipalities in the US.In general, most of these DB funds RELY on returns far in access of 4%. Kinda scary.

Second, unlike with a DC pension where the retiree only gets one chance and one starting year, DB pensions get to combine multiple cohorts (i.e. multiple starting years) - for the same mortality stats as above, but combining 15 years worth of cohorts raised the SWR with no failures to 5.7% (I've not been able to model larger groupings than this, but this appears to be close to the upper limit).

An interesting recent development is the collective defined contribution pension, which are now legal in the UK (search google or have a look at the linked documents at https://www.aon.com/unitedkingdom/retirement-investment/defined-contribution/collective-defined-contribution.jspSomeone with a DC pension can also benefit from mortality credits. Thats what annuities are for.A lot (most?) of the DB schemes were introduced in the 70s when they were offered whilst interest rates and expected returns on capital were in the region of 8%. Since then, we know these schemes were very generous in hindsight, as rates of return fell (especially following dot com and GFC busts).Schemes are required to hold a certain amount in "safe" investments just as gov and corporate bonds. They would also be quite foolish to hold a significant amount in equities given the riskiness (which is an interesting takeaway given the topic of this thread....).CETVs need to be generous enough for the holder to consider the payout (i.e. at lowish single digit capitalisation rates), as clearly these DB schemes have become unsustainable - as expected rates of returns have fallen drastically since the 70s.0 -

Although one of my pension pots, without contributions, rose 34.4% over the period 2001 - 2007 whereas the FTSE 100 only recovered it's value. Lies, damn lies and statistics....Sea_Shell said:QrizB said:

How about 2001-2003?Sea_Shell said:With regards to "the markets" as a whole. Most graphs I've seen where there has been a "correction" or a "crash" show a short, sharp downward trend, followed by a steady recovery. eg 25% drop over a short period.

Have we ever had the sort of market behaviour whereby the reduction has been the same, overall (eg 25%), but it's been a slow drawn out affair, maybe only losing 1% a month for 25 months instead? Does this happen? A slow death, if you like, instead of a heart attack!!

If anyone has any examples, I'd be keen to see them.

Ah Yes, 9/11. If you focus on the 2001-03 period, where it lost almost half* its value over that period, with very little recovery in between. It took until 2008 to recover....just in time for the banking crisis!!!

*about 6800 to 3600 by that graph, I think.

Was there more to it than 9/11 though. Obviously that was a massive shock to global markets, but what made the downturn last so long, I don't recall?1 -

Chronic underfunding of pensions and poor management is usually the reason for requiring high returns to meet obligations. DB schemes are often pillaged by politicians, company boards and financiers and when they have put them in a situation where they are almost certain to fail they bad mouth them and transfer the risk entirely to the individual by selling DC plans and charge a pretty penny for them.Deleted_User said:Linton said:

From https://www.ons.gov.uk/economy/investmentspensionsandtrusts/bulletins/fundedoccupationalpensionschemesintheuk/octobertodecember2020, it sould appear the UK DB pensions schemes are predominantly invested in "long term debt securities" with, I would assume, maturity dates matching liabilities. Given typical CETVs your figure of an assumption of a reliance on 8% returns seems odd.Deleted_User said:

I mean returns. Many DB pensions rely on market returns in excess of 8%. If actual returns undershoot that number for a long period of time all these schemes will go bankrupt.OldScientist said:

Do you mean withdrawals or returns in the last sentence. I ask because DB pensions get advantages in two 'dimensions' - firstly mortality credits, which for portfolio consisting of 60/40 US stocks/bonds a cohort of UK 65 year olds 50/50 male/female historically gave an SWR with no failures of 4.9% (this neglects fees).Deleted_User said:The main difference between DB and DC pensions is how much the employer contributes. Typically contributions to DC pensions are much lower.Other than that, DC pensions are great. People do get more freedom and responsibility how to handle THEIR money. Its just that a point comes when some of the short term risk needs to be shifted. And there are perfectly good options for doing that if you have a DC pension.The alternative is for your employer and regulators to have all th3 decision making (DB pension). Tends to work particularly well when the employer is local or national government. That means the taxpayer takes on all the risk. A good deal for the bureaucracy. Even then employees might still carry risk. Wouldn’t want to have a DB pension from some of municipalities in the US.In general, most of these DB funds RELY on returns far in access of 4%. Kinda scary.

Second, unlike with a DC pension where the retiree only gets one chance and one starting year, DB pensions get to combine multiple cohorts (i.e. multiple starting years) - for the same mortality stats as above, but combining 15 years worth of cohorts raised the SWR with no failures to 5.7% (I've not been able to model larger groupings than this, but this appears to be close to the upper limit).

An interesting recent development is the collective defined contribution pension, which are now legal in the UK (search google or have a look at the linked documents at https://www.aon.com/unitedkingdom/retirement-investment/defined-contribution/collective-defined-contribution.jspSomeone with a DC pension can also benefit from mortality credits. Thats what annuities are for.“From 1992 to 2012, the median pension fund’s assumed rate of return changed only modestly, decreasing by 0.25 percentage points, from 8 percent to 7.75 percent.”

https://www.pewtrusts.org/~/media/assets/2014/06/state_public_pension_investments_shift_over_past_30_years.pdf

UK might be different.

DC and BD plans can both be managed poorly, but the pooling of risk in the DB plan should give it some efficiencies over the DC structure and is a far more sensible way to fund retirement. If you want to leave money to people then the DC plan is the way to go or you reduce the DB income and add a death benefit. However, even the passing of DC wealth between generations is not encouraged by the finance industry or the zeitgeist with SWR rates and the encouragement to spend down the pot even if you don't really need to.

IMO the ideal solution is a hybrid of guaranteed pooled risk income and a DC pot to manage yourself, but if annuity rates are kept so low I don't see that happening in the current landscape.“So we beat on, boats against the current, borne back ceaselessly into the past.”0 -

I think that “low annuity rates” are a red herring. The past does not matter. We dont know the future. Lots of great and highly competitive rates are available today.Agree that combining a “guarantee” with market exposure is the best solution for retirees. Which is readily available to DC pension holders.0

-

That rather depends on your definition of "great" and "highly competitive"....Deleted_User said:I think that “low annuity rates” are a red herring. The past does not matter. We dont know the future. Lots of great and highly competitive rates are available today.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards