We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Working out % Equity allocation

Comments

-

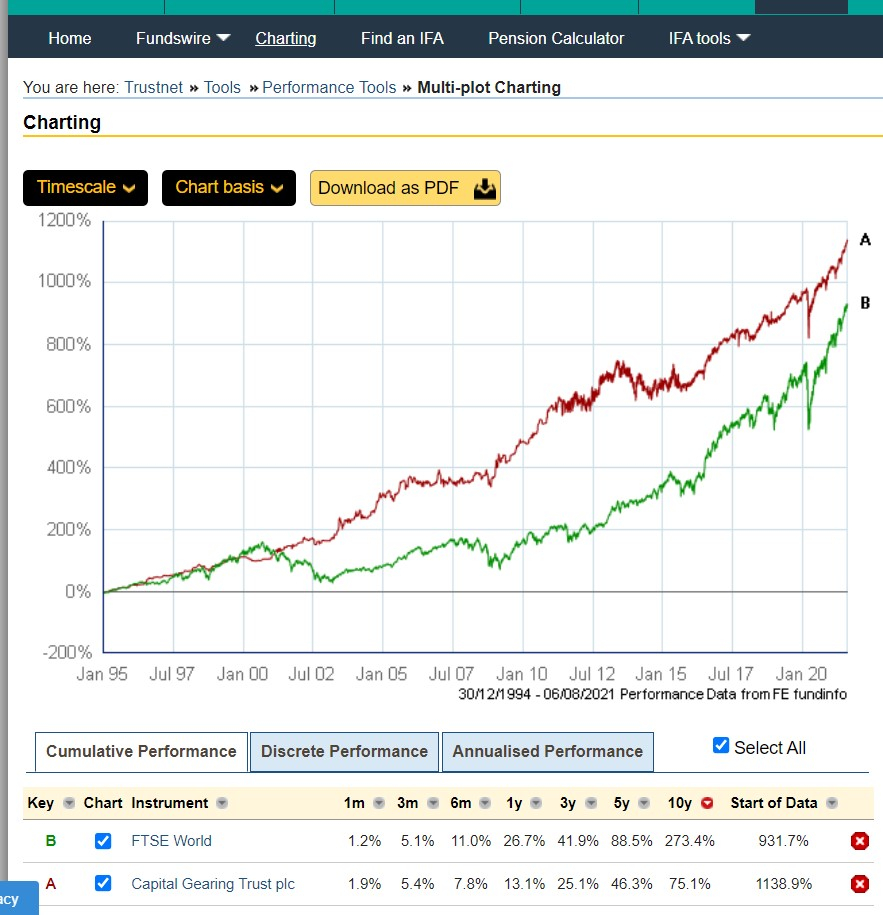

The chart went back to 1995.Linton said:I dont rate PNL very highly but perhaps Capital Gearing Trust's results will demonstrate the advantages of a WP fund during a wide range of market conditions. The graph shows CGT vs the FTSE World Index for the past 26.5 years: 1

1 -

Sorry, I misread the chart, thinking it stopped at 2000. Luckily I don't fly aeroplanes. But the returns I quoted from 1995 were those for the period 1995-2007. You can find the data in portfolio visualiser.

0 -

Coming back to equity allocation for a minute- does the non equity part of the portfolio serve a useful function? I know it reduces volatility but if you have a couple of years worth of cash reserves and are not risk averse..

I have a vague recollection of seeing a study that suggested with rebalancing a 80/20 portfolio was in the sweet spot and had a slight edge?0 -

It becomes important during retirement/drawdown. If all you see is a 2-4 year crash followed by a recovery then a couple of years of cash would likely help. You will need to decide if the cash buffer is just there to top up lower withdrawals during that time or if you are going to stop withdrawals completely and survive on the cash (in that case 2 years is likely not enough). If that is the only thing you see during a retirement then you would be fine pretty much whatever your allocation is.pip895 said:Coming back to equity allocation for a minute- does the non equity part of the portfolio serve a useful function? I know it reduces volatility but if you have a couple of years worth of cash reserves and are not risk averse..

I have a vague recollection of seeing a study that suggested with rebalancing a 80/20 portfolio was in the sweet spot and had a slight edge?

What this is really about is the very worse times in history for starting retirement. That would be the early 1930s, the late 1960s and possibly 2000 (although that one is still unknown being too recent). During those times equities did badly for a long time and in the very worse example of the late 1960s it was compounded by very high inflation. So what we are all looking for is something to help when equities go nowhere for maybe 10-15 years near the start of retirement.

There are several points to make though, the first being that most of the studies assumed single country investing, primarily in the US. Going global might be quite a different story. For example after 2000 the UK did pretty well until 2008 while the US really suffered. Through the 1970s into 1980s while the US stock market was stagnating, Japan was dragging the global markets ever higher. Also, the asset that really saves the day has always been government bonds - yet we are currently in untested waters for that to bail out terrible equities returns.

I use this site to have a play with some returns (including inflation) for the S&P 500

S&P 500 Return Calculator, with Dividend Reinvestment (dqydj.com)

Try out 1968 to 1985 to see a particularly bad example. Retiring on 80%+ equities during that time in the US would have been pretty scary. The question is are we likely to see that again? Or maybe we are about to completely wreck the retirement of those that started in 2000 and are just about clinging on in their 21st year.2 -

The bond yields (10 year treasury) over that period though were between 6 and and 16 not closer to 1 as they are now. I’m not against bonds as an asset class out of principal - it’s just there seems limited upside and plenty of downside risk I.e. the possibility of bonds returning to more “normal” rates.Prism said:

Try out 1968 to 1985 to see a particularly bad example. Retiring on 80%+ equities during that time in the US would have been pretty scary. The question is are we likely to see that again? Or maybe we are about to completely wreck the retirement of those that started in 2000 and are just about clinging on in their 21st year.

0 -

Until recently , bond investments had done rather well in terms of growth , so as well as diluting volatility of equities , they produced some decent growth themselves.pip895 said:Coming back to equity allocation for a minute- does the non equity part of the portfolio serve a useful function? I know it reduces volatility but if you have a couple of years worth of cash reserves and are not risk averse..

I have a vague recollection of seeing a study that suggested with rebalancing a 80/20 portfolio was in the sweet spot and had a slight edge?

The problem is now that the outlook for bonds is not good , so probably at best they can only reduce volatility , hence all the discussion about bond alternatives.

Could be that historical info on 80/20 ( or whatever split you prefer) will not be reflected in future due to the unusual market conditions for bonds , with QE and almost zero interest rates .2 -

Risk aversion usually comes about when you dont understand the risk isnt actually real eg a 50% fall in share prices when you are 20 tears away from needing the money. Risk in retirement can be very real even if (especially if?) you do have a good understanding of what it means. You need to be risk averse.pip895 said:Coming back to equity allocation for a minute- does the non equity part of the portfolio serve a useful function? I know it reduces volatility but if you have a couple of years worth of cash reserves and are not risk averse..

I have a vague recollection of seeing a study that suggested with rebalancing a 80/20 portfolio was in the sweet spot and had a slight edge?

In my experience having sufficient non-equity and lower risk funds to last 10 years or more separately packaged from a growth portfolio has 3 main benefits:

- a good night's sleep without any worries of running out of money no matter what happens to the stock market barring a permanent collapse

- no need to urgently reconsider spending levels whenever there is a crash

- the comfort blanket of the lower risk investments means one can invest in the 100% equity growth portfolio with no qualms whatsoever.

I do not believe you would get the same beneits with a simple xx/yy portfolio.

With a large low risk portfolio you probably need it to produce some return. Hence cash on its own would not be appropriate.

3 -

I agree that it won't be as easy next time, but I also doubt that inflation will be allowed to run as high either. Then again who knows. You did say non-equity rather than bonds.pip895 said:

The bond yields (10 year treasury) over that period though were between 6 and and 16 not closer to 1 as they are now. I’m not against bonds as an asset class out of principal - it’s just there seems limited upside and plenty of downside risk I.e. the possibility of bonds returning to more “normal” rates.Prism said:

Try out 1968 to 1985 to see a particularly bad example. Retiring on 80%+ equities during that time in the US would have been pretty scary. The question is are we likely to see that again? Or maybe we are about to completely wreck the retirement of those that started in 2000 and are just about clinging on in their 21st year.0 -

Whilst I think this may well be true I suspect it would just change the composition of the 20% from bonds to cash and perhaps move the optimum % a bit perhaps. The main driver for outperformance is that it allows you to rebalance - buy low and sell high - on an incremental basis.Albermarle said:

Until recently , bond investments had done rather well in terms of growth , so as well as diluting volatility of equities , they produced some decent growth themselves.pip895 said:Coming back to equity allocation for a minute- does the non equity part of the portfolio serve a useful function? I know it reduces volatility but if you have a couple of years worth of cash reserves and are not risk averse..

I have a vague recollection of seeing a study that suggested with rebalancing a 80/20 portfolio was in the sweet spot and had a slight edge?

The problem is now that the outlook for bonds is not good , so probably at best they can only reduce volatility , hence all the discussion about bond alternatives.

Could be that historical info on 80/20 ( or whatever split you prefer) will not be reflected in future due to the unusual market conditions for bonds , with QE and almost zero interest rates .

I think the old 60/40 portfolio is probably dead, the key is to keep a diverse portfolio - including as many types of asset as possible (Cash, Bonds, Equity, Resources, Gold, Property & Infrastructure) there is limited point in looking backwards, things are going to be different.1 -

pip895 said:Albermarle said:

Until recently , bond investments had done rather well in terms of growth , so as well as diluting volatility of equities , they produced some decent growth themselves.pip895 said:Coming back to equity allocation for a minute- does the non equity part of the portfolio serve a useful function? I know it reduces volatility but if you have a couple of years worth of cash reserves and are not risk averse..

I have a vague recollection of seeing a study that suggested with rebalancing a 80/20 portfolio was in the sweet spot and had a slight edge?

The problem is now that the outlook for bonds is not good , so probably at best they can only reduce volatility , hence all the discussion about bond alternatives.

Could be that historical info on 80/20 ( or whatever split you prefer) will not be reflected in future due to the unusual market conditions for bonds , with QE and almost zero interest rates .

I think the old 60/40 portfolio is probably dead,“Successful investing is only common sense. Each system for investing will eventually become obsolete.”

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards