We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Working out % Equity allocation

Comments

-

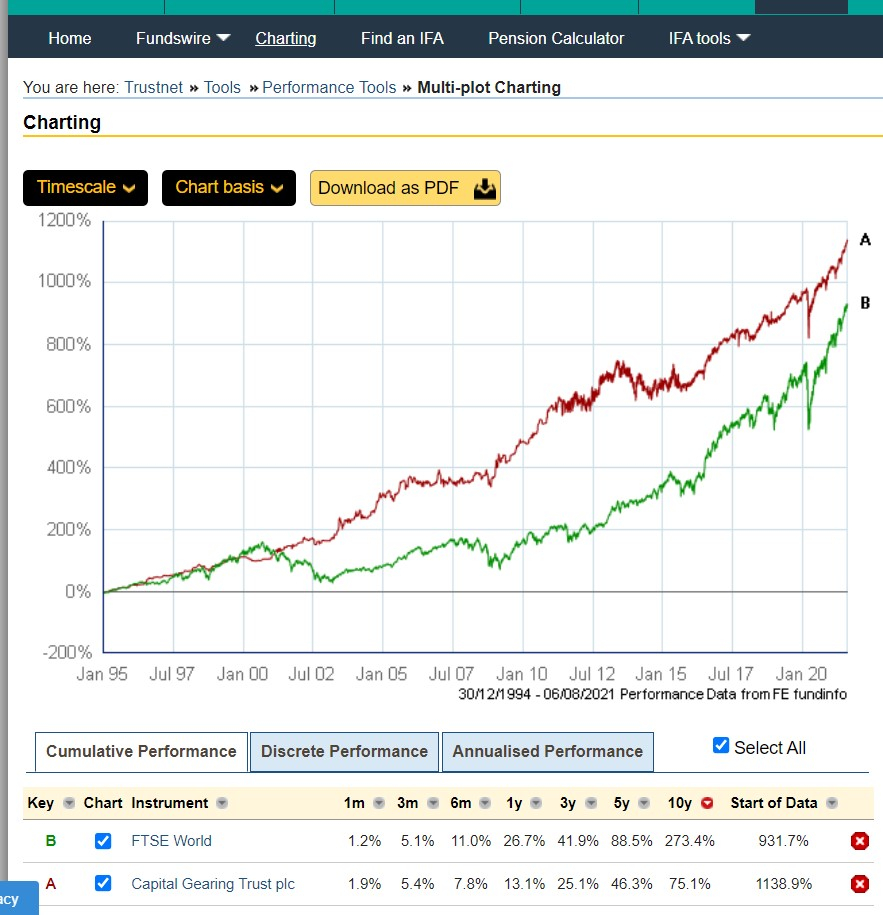

I dont rate PNL very highly but perhaps Capital Gearing Trust's results will demonstrate the advantages of a WP fund during a wide range of market conditions. The graph shows CGT vs the FTSE World Index for the past 26.5 years:

3 -

So one fund outperformed FTSE world in the first decade of the century. Slightly underperformed during the next decade. There are other funds with similar records. Yes, its impressive and would have been a good one to have. The problem is we don’t know how it will perform in the 20s and 30s.0

-

Of course a fund with the documented expectation of holding only about 30% equity will be outperformed by a 100% equity tracker during an unusually long bull market. If you want the gains and falls of 100% equity that is what you should buy. CGTs objective is to provide steady returns which the graph shows it did throughout the displayed period, especially during the first half when there were 2 major crashes in which the global tracker fell 40-50%.Deleted_User said:So one fund outperformed FTSE world in the first decade of the century. Slightly underperformed during the next decade. There are other funds with similar records. Yes, its impressive and would have been a good one to have. The problem is we don’t know how it will perform in the 20s and 30s.

2 -

More importantly it didn't suffer the volatility of the FTSE World. Two periods stand out on the graph. The market down turns in 2000-2003 and 2007-2013. The investment achieved it's set out goals.Deleted_User said:So one fund outperformed FTSE world in the first decade of the century. Slightly underperformed during the next decade. There are other funds with similar records. Yes, its impressive and would have been a good one to have. The problem is we don’t know how it will perform in the 20s and 30s.0 -

Linton said:I dont rate PNL very highly but perhaps Capital Gearing Trust's results will demonstrate the advantages of a WP fund during a wide range of market conditions.No, neither did I before we did some comparing. But it's mentioned in the same breath as CGT often enough, and we started comparing it with VLS40, so let's sort that out before getting to CGT.We saw a three year comparison with VLS40, showing PNL with better annual returns and less fall in a crisis. But we've got 10 years of data from Fidelity, why don't we look at that?When I do, I find an arithmetic average annual return over 10 year for VLS40 is 7.03%, and for PNL is 5.62%. PNL also had wider variation in returns, so more risk by that measure. VLS40, at lower cost, had higher returns and lower risk. True enough, it might have turned out the other way, and maybe it will when we look at CGT. But we shouldn't be surprised at the result since comparisons of more comparable funds (not, gold vs no gold) by SPIVA shows actively managed funds usually don't outperform trackers over periods longer than about 3 years.So I still don't rate PNL very highly. It's a fine, diversified fund that shouldn't break too many hearts, but I'd take VLS40 ahead of it.0

-

Yes it does. But how good is it? Using the same 10 year period as for VLS40 and PNL, I find from the Fidelity site that CGT had an annualised average return of 5.57%, with more variation in annual returns than either VLS40 or PNL. I've no idea how its cost compares, or even what its asset allocation is, but lower returns and more risk than a similar blended tracker fund won't win me over.Linton said:perhaps Capital Gearing Trust's results will demonstrate the advantages of a WP fund during a wide range of market conditions.

0 -

So, I looked under the hood of CGT: https://www.capitalgearingtrust.com/sites/cgt/files/literature/Factsheets/Capital_Gearing_Trust_July21.pdfLinton said:

Of course a fund with the documented expectation of holding only about 30% equity will be outperformed by a 100% equity tracker during an unusually long bull market. If you want the gains and falls of 100% equity that is what you should buy. CGTs objective is to provide steady returns which the graph shows it did throughout the displayed period, especially during the first half when there were 2 major crashes in which the global tracker fell 40-50%.Deleted_User said:So one fund outperformed FTSE world in the first decade of the century. Slightly underperformed during the next decade. There are other funds with similar records. Yes, its impressive and would have been a good one to have. The problem is we don’t know how it will perform in the 20s and 30s.

Second page shows a nice plot illustrating how asset allocation changed over time. Things to note:

1. Its a balanced fund. “Wealth preservation” = marketing, as we thought.2. The fund holds gold but such a tiny fraction that I can’t fathom why they bother.

3. Cash holdings vary between 0 and 10%.4. They hold about 10% in preferred shares. So do I (since March 2020). I treat prefs as 50% FI and 50% equity. Its a volatile asset with limited upside.5. So, overall they have about 50% equity and 50% fixed income with a bit of market timing.

6. Most of the bonds are high quality/government.

its a high percentage of bonds. Worked great for the last 40 years. I don’t know the future but mathematically its likely to be a disappointing allocation over the next couple of decades. Nothings wrong with this for a conservative investor. The fund certainly isnt meant to replace bonds within a portfolio. Its a multi-asset fund designed to be your whole portfolio.

They give two OCFs and I am too lazy to figure out the meaning but even the lower one is too high for my taste (0.6%). That would take away all their bond returns. In other words 50% of this fund is designed to lose out to inflation over the next 2 decades.0 -

One can cherry pick the data to get the result one wants, but for the most data we have VSL40 seems to have outperformed CGT by a more than 'noise' margin. Lower fees don't always equate to better returns, but they're one of the better predictors according to Morningstar. Sometimes selective asset purchase does pay off, often probably, even frequently, but just not in a majority of cases according to the SPIVA data.Thrugelmir said:Over the past 5 years CGT has returned capital appreciation of 40.9% (and paid out £1.69 per share in dividends) while VLS40 has returned 33.66%. Lower fees don't always equate to a better total return. Sometimes selective asset purchase does pays off.

0 -

For the CGT you mention, 'to preserve, and over time to grow shareholders' real wealth'....'The Company does not have a formal benchmark'.Thrugelmir said:The investment achieved it's set out goals.

Cash achieved that goal over the last 50 years; it's not a very high standard to set yourself and expect investors to be pay whizz-bang managers higher fees for when we can get more for less.

0 -

I don’t actually own CGT - I looked at it, but agree it is more of a multi asset fund than a bond replacement.I am not knocking VLS40, but that base is covered by my straight bond funds and the equity trackers I hold. It wouldn’t add anything to my portfolio. Besides extolling the past performance of a fund including a high percentage of bonds also rather misses the point, as it’s the stellar past performance of bonds and there now, very low yields, that is making me concerned about holding them.

What I am really after is that holly grail of a fund that will protect me against falling equity, rising bond yields and inflation ☺️0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards