We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Working out % Equity allocation

pip895

Posts: 1,178 Forumite

In common with most in retirement, we have money from various sources making up our monthly income. It includes :- Drawdown, State Pension, A small annuity, rental income and even Solar panels. We also have ISAs and unwrapped funds - mainly cash & PB.

I have tended to consider my "paper" investments as a whole rather than considering only the funds within the SIPP. For example the majority of our cash sits outside the SIPP in PB and other accounts. My thinking is that if there were a significant downturn in the SIPP we could stop drawing from it and draw from the PB/cash.

Using this methodology my Equity allocation is about 65%.

We are now considering purchasing a second rental property. The effect of this will increase the apparent equity percentage by reducing cash reserves - although it will obviously increase our property portfolio and provide an income. My first thought was that the property (both existing and proposed) should perhaps sit within the non equity part of the portfolio. Doing this would reduce my equity percentage to under 50%?? Then I thought - if I include rental properties shouldn't the Annuity, State pension and even the Solar panels also be included somehow?? Obviously some things would not be included - our home for instance, although even that could be utilised by downsizing or equity release??

I guess the dire situation in the bond market has rather brought this to a head, I only have about 5% of my assets directly in bonds with much more in funds like PNL which themselves contain a range of bonds, Reits, and equity. I directly hold a small percentage of Reits and at present I sit them in the equity part of my portfolio. Should my rental property also sit among the equity? Is there a convention for dealing with all this? What do others include/Exclude in non equity, and as part of their portfolio?

I have tended to consider my "paper" investments as a whole rather than considering only the funds within the SIPP. For example the majority of our cash sits outside the SIPP in PB and other accounts. My thinking is that if there were a significant downturn in the SIPP we could stop drawing from it and draw from the PB/cash.

Using this methodology my Equity allocation is about 65%.

We are now considering purchasing a second rental property. The effect of this will increase the apparent equity percentage by reducing cash reserves - although it will obviously increase our property portfolio and provide an income. My first thought was that the property (both existing and proposed) should perhaps sit within the non equity part of the portfolio. Doing this would reduce my equity percentage to under 50%?? Then I thought - if I include rental properties shouldn't the Annuity, State pension and even the Solar panels also be included somehow?? Obviously some things would not be included - our home for instance, although even that could be utilised by downsizing or equity release??

I guess the dire situation in the bond market has rather brought this to a head, I only have about 5% of my assets directly in bonds with much more in funds like PNL which themselves contain a range of bonds, Reits, and equity. I directly hold a small percentage of Reits and at present I sit them in the equity part of my portfolio. Should my rental property also sit among the equity? Is there a convention for dealing with all this? What do others include/Exclude in non equity, and as part of their portfolio?

0

Comments

-

Rightly, asset allocation and their percentages gets a lot of attention in investing because it’s such an important determinant of returns, both size and wobble.

But every ‘asset’ including state pension or home doesn’t need to be artificially forced into this asset allocation characterisation, and a second rental property doesn’t need to be called an equity when clearly it isn’t.

True enough, housing has a habit of providing returns more like equities than bonds or cash, but it’s not too complex to think of rental housing a category of its own; and the ‘rules’ about having at least x% in equities for this or that reason are not rules but guides.Most of us can hold equities, safely, in widely diversified funds. Few of us can afford that diversification in rental properties. They’re like chalk and cheese as investments for most of us. The lack of diversification in rental properties makes them like no other. I think they deserve to be in different parts of our brains.Global bonds returned about 5.8%/year over the last two years. I don’t know that we can say the bond market is dire when that just happened.pip895 said:I guess the dire situation in the bond market has rather brought this to a head, I only have about 5% of my assets directly in bonds with much more in funds like PNL which themselves contain a range of bonds, Reits, and equity.

I’ll annoy a few fans of PNL here, but if you’re holding stocks and bonds and reits (which are stocks) in PNL, are you paying more to do that than simply holding diversified funds of those assets? And if so, is it worth it?

1 -

I would tend to include the property portfolio as part of your net worth, along with main property, cars, expensive possessions etc. The property income becomes part of your income stream, along with your pension etc.

Your investment portfolio then is mentally easier to balance as you can move money between the three categories cash, bonds and equities.

Decisions on whether the property investment is sensible you can make comparing your property cash flow, with your investment portfolio performance.

Hope this makes more sense than it looks now I have read it back.1 -

You should consider your finances holistically and a retirement income portfolio starts with a budget and seeing how much income you need to generate. That will guide the organization of your portfolio and how much risk you take on. Also, can you afford a second property that is going to lock up capital?“So we beat on, boats against the current, borne back ceaselessly into the past.”3

-

An increase in the value of bond investments beyond the ongoing interest paid simply represents transfer of future interest into current capital. This situation will be unwound by maturity. There can be no increase in overall long term value. The person to whom you sell the bond prior to maturity receives a lower yield than would otherwise be the case. Unless you are cashing out of your bond investments permanently you will be a future buyer.JohnWinder said:Rightly, asset allocation and their percentages gets a lot of attention in investing because it’s such an important determinant of returns, both size and wobble.

But every ‘asset’ including state pension or home doesn’t need to be artificially forced into this asset allocation characterisation, and a second rental property doesn’t need to be called an equity when clearly it isn’t.

True enough, housing has a habit of providing returns more like equities than bonds or cash, but it’s not too complex to think of rental housing a category of its own; and the ‘rules’ about having at least x% in equities for this or that reason are not rules but guides.Most of us can hold equities, safely, in widely diversified funds. Few of us can afford that diversification in rental properties. They’re like chalk and cheese as investments for most of us. The lack of diversification in rental properties makes them like no other. I think they deserve to be in different parts of our brains.Global bonds returned about 5.8%/year over the last two years. I don’t know that we can say the bond market is dire when that just happened.pip895 said:I guess the dire situation in the bond market has rather brought this to a head, I only have about 5% of my assets directly in bonds with much more in funds like PNL which themselves contain a range of bonds, Reits, and equity.

I’ll annoy a few fans of PNL here, but if you’re holding stocks and bonds and reits (which are stocks) in PNL, are you paying more to do that than simply holding diversified funds of those assets? And if so, is it worth it?

You could run a PNL type operation yourself but you would need to determine which stocks/bonds/reits etc to buy. Bonds in particular can behave very differently depending on yield, time to maturity and degree of risk. However unlike stocks, key spects of their behaviour are 100% predictable. Choosing bonds at random or because they happen to be the most popular is unlikely to provide the same outcome. Do you have the skills, access to data, and time to do the job of consistently matching inflation as well as PNL, CGT etc?3 -

My bonds haven't done that well - Overall they haven't kept up with inflation - still better than cash I suppose.. PNL is one of four "Wealth preservation" funds I hold in the wider portfolio - my hope is that they will do a better job than I will at picking the right bonds, Reits and other instruments. I picked them because they are distinct, weathered the last few crashes reasonably well and are generally not closely corelated with global equity.JohnWinder said:Global bonds returned about 5.8%/year over the last two years. I don’t know that we can say the bond market is dire when that just happened.

I’ll annoy a few fans of PNL here, but if you’re holding stocks and bonds and reits (which are stocks) in PNL, are you paying more to do that than simply holding diversified funds of those assets? And if so, is it worth it?0 -

I have spent quite a bit of time trying to work out a budget and overall plan - or rather correct the original one - there are just so many uncertainties.bostonerimus said:You should consider your finances holistically and a retirement income portfolio starts with a budget and seeing how much income you need to generate. That will guide the organization of your portfolio and how much risk you take on. Also, can you afford a second property that is going to lock up capital?

We will retain about 2 years spending in cash/PB even after purchasing the property - so I guess its affordable. Its actually only half a property as I am purchasing it with my sister, we wont be taking out a mortgage. The property in question belongs to a mutual friend who desperately needs to move as its an upstairs flat and she is struggling to get up the stairs. She hasn't been able to sell as there is an empty shop downstairs - been empty for some time. The most likely outcome is that it will be converted to residential but as it stands no one can get a mortgage on the flat because of it. There is quite a shortage of lettable property locally so we will have no difficulty renting it out and even if we were to use an agent (which we won't) the returns would be pretty good.0 -

That is an excellent observation about bonds. Overall, their returns are only their interest; because when a nominal bond is issued with a value £x, the promise is that only £x will be returned at maturity, so there’s no capital appreciation.Linton said:An increase in the value of bond investments beyond the ongoing interest paid simply represents transfer of future interest into current capital. This situation will be unwound by maturity. There can be no increase in overall long term value.You could run a PNL type operation yourself but ... Do you have the skills, access to data, and time to do the job of consistently matching inflation as well as PNL, CGT etc?

Yes one could diy PNL, and without thinking too hard about it one could simply buy global stocks and government bonds. And no, I don’t have the skills, data, time or inclination of the PNL managers. But the recurring thoughts I have when I’m tempted to jump into a PNL that has performed as well as it has, are: it’s actively managed; the best evidence is that active management usually does not outperform passive management on a risk adjusted basis over terms beyond about 5 years; it’s likely more expensive than the alternative; and I don’t know how to identify the active fund that is going to outperform in the coming decades that I expect to be invested for. I just can’t get passed that hurdle, and I wasn’t one of the lucky that picked up PNL for however long it’s been a goodie.0 -

Fixed interest stocks never will.pip895 said:

My bonds haven't done that well - Overall they haven't kept up with inflation -JohnWinder said:Global bonds returned about 5.8%/year over the last two years. I don’t know that we can say the bond market is dire when that just happened.

I’ll annoy a few fans of PNL here, but if you’re holding stocks and bonds and reits (which are stocks) in PNL, are you paying more to do that than simply holding diversified funds of those assets? And if so, is it worth it?0 -

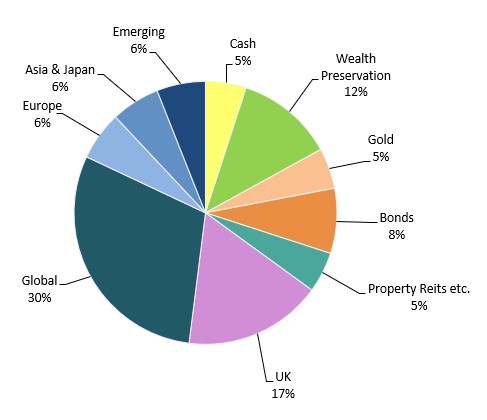

Well I have taken your advise (there seemed to be a definite consensus on keeping it simple) and removed investment properties and external cash/PB. More than 2 years cash will be retained outside the portfolio even after the proposed property purchase. What I am left with inside the SIPPs and ISAs is this:-

So 70% Equity 30% Other. I justify ignoring the % equity within "Wealth Preservation" because as a group they have less correlation with equity than say medium duration corporate bonds. Does that seem reasonable?1 -

I separately track total asset allocation and asset allocation in liquid assets.Houses and rentals would be classified as “illiquid assets”. REIT is really equity under “liquid assets”. “Wealth preservation” is not an asset class but a marketing term. You should X-ray the fund to figure out your asset allocation.

When I have DB income (including state pension), I am thinking of including it in the overall asset allocation as well. Will probably just do a fairly random x25 annual DB income and use it as “fixed income” portion of the portfolio. In fact, there is an argument for doing it now and then discounting by 6% per annum to reflect the number of years left.But only the asset allocation within the liquid portion of my net worth can be accurately tracked and rebalanced.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards