We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

So, where this is going?

Comments

-

So what's the allocation should be then? More towards the UK if there is still room to recover from all time high? More towards the US, if you think companies are not over valued?bostonerimus said:These questions are meaningless. Set your allocation, invest regularly and let time do the work for you rather than worrying about short term market volatility.

I have been investing for 20 years, but it doesn't mean I can't reassess my allocation from time to time.0 -

sebtomato said:

So what's the allocation should be then? More towards the UK if there is still room to recover from all time high? More towards the US, if you think companies are not over valued?bostonerimus said:These questions are meaningless. Set your allocation, invest regularly and let time do the work for you rather than worrying about short term market volatility.

I have been investing for 20 years, but it doesn't mean I can't reassess my allocation from time to time.

Serious question. How would you invest in the UK?

0 -

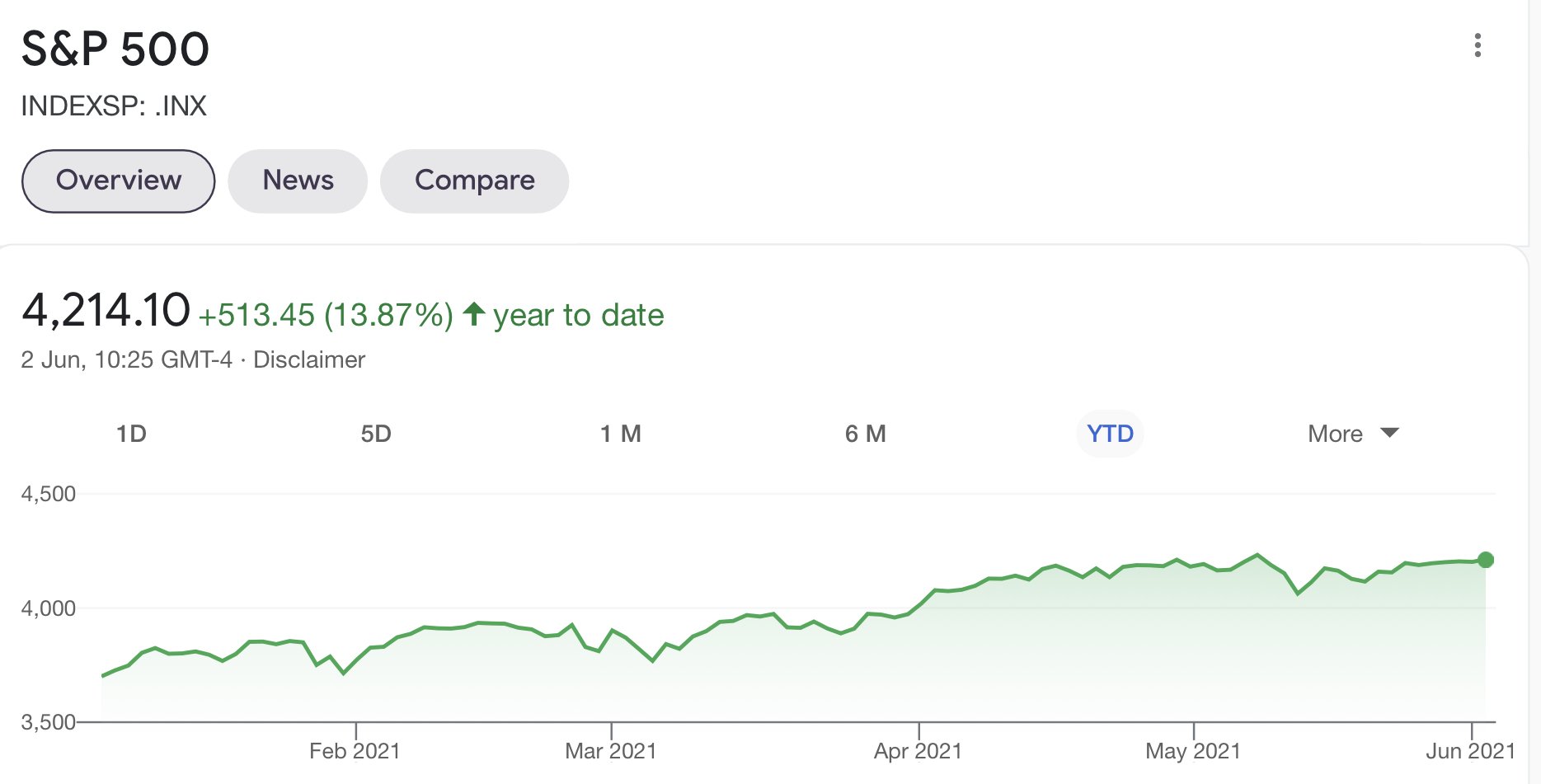

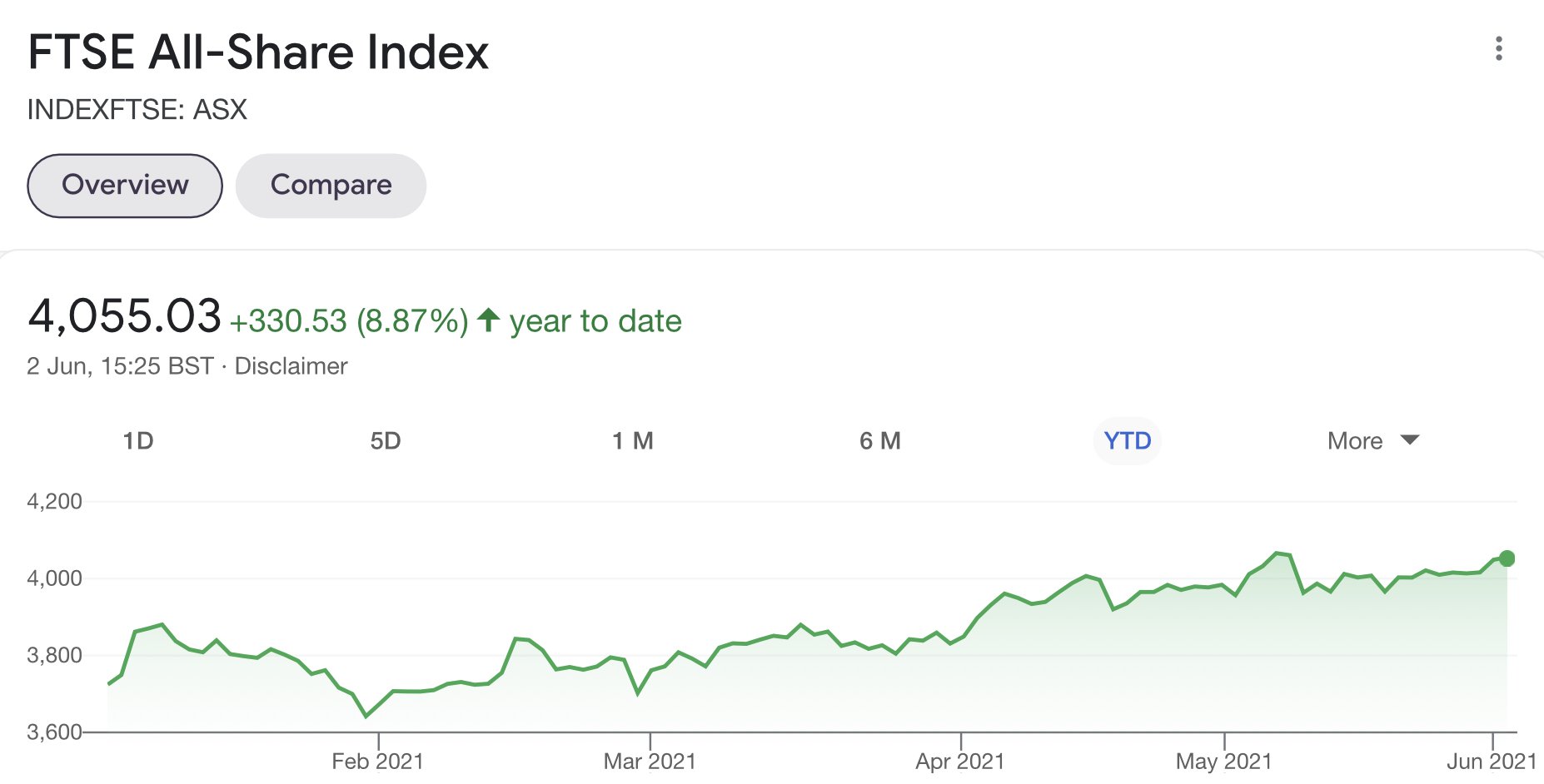

The FTSE All Share has outperformed the S&P 500 since the beginning of the year. Often markets have moved before you've realised it.

0 -

So what's your reaction been at all the other times markets have been high over that period, and why would it be different this time? What are you invested in and what do you believe is a more appropriate allocation, and why?sebtomato said:I have been investing for 20 years0 -

You need to answer those questions, if you are approaching retirement you might look at some inflation linked bonds, but make strategic changes, not the tactical ones you seem to be worried about.sebtomato said:

So what's the allocation should be then? More towards the UK if there is still room to recover from all time high? More towards the US, if you think companies are not over valued?bostonerimus said:These questions are meaningless. Set your allocation, invest regularly and let time do the work for you rather than worrying about short term market volatility.

I have been investing for 20 years, but it doesn't mean I can't reassess my allocation from time to time.

I'm retired in the US and have an 80/20, equity/bonds split, because I have a DB pension and rental income and can stay aggressive. My equity split is 70/30, US/Global ex-US. I also keep a couple of years spending in cash for emergencies“So we beat on, boats against the current, borne back ceaselessly into the past.”2 -

My reaction is the same as before. I am investing for the long term. However, doesn't mean I don't want to optimise my portfolio, at least in term of allocation. Allocation of assets, particularly between stock markets, is highly subjective (no exact science there), so I was hoping people would be able to contribute with data/facts, particularly on US/UK/EU markets.eskbanker said:

So what's your reaction been at all the other times markets have been high over that period, and why would it be different this time? What are you invested in and what do you believe is a more appropriate allocation, and why?sebtomato said:I have been investing for 20 years

Through various funds, like VLS, my portfolio is quite UK-focussed. Looking at the FTSE100, it would seem to be a good thing, as there is still some mileage to get to the previous highs.

However, I also have a large allocation in US trackers, and looking more closely, at a handful of tech companies that might be well overvalued, so not sure if there is much more mileage there.0 -

As you say its all subjective but you could use this table of CAPE ratios as a start.sebtomato said:

My reaction is the same as before. I am investing for the long term. However, doesn't mean I don't want to optimise my portfolio, at least in term of allocation. Allocation of assets, particularly between stock markets, is highly subjective (no exact science there), so I was hoping people would be able to contribute with data/facts, particularly on US/UK/EU markets.eskbanker said:

So what's your reaction been at all the other times markets have been high over that period, and why would it be different this time? What are you invested in and what do you believe is a more appropriate allocation, and why?sebtomato said:I have been investing for 20 years

Through various funds, like VLS, my portfolio is quite UK-focussed. Looking at the FTSE100, it would seem to be a good thing, as there is still some mileage to get to the previous highs.

However, I also have a large allocation in US trackers, and looking more closely, at a handful of tech companies that might be well overvalued, so not sure if there is much more mileage there.

CAPE Ratios by Country 2021 (Shiller PE) | Siblis Research

The trouble is as always is that it only looks backwards and therefore even though the UK looks cheap (even cheaper than in 2018) it doesn't tell us if that valuation is deserved or not.

Personally I have not added anything to US equities for a few years and all of my recent contributions have gone into UK and emerging markets funds, but that is more to keep the allocation in balance rather than any major thoughts on the future.2 -

My last purchase was a Global ex-US tracker as my US allocation had got a bit out of whack with the recent run up. I'll continue to buy that Global ex-US tracker when I have some spare cash so that I approach 60% US equities.Prism said:

As you say its all subjective but you could use this table of CAPE ratios as a start.sebtomato said:

My reaction is the same as before. I am investing for the long term. However, doesn't mean I don't want to optimise my portfolio, at least in term of allocation. Allocation of assets, particularly between stock markets, is highly subjective (no exact science there), so I was hoping people would be able to contribute with data/facts, particularly on US/UK/EU markets.eskbanker said:

So what's your reaction been at all the other times markets have been high over that period, and why would it be different this time? What are you invested in and what do you believe is a more appropriate allocation, and why?sebtomato said:I have been investing for 20 years

Through various funds, like VLS, my portfolio is quite UK-focussed. Looking at the FTSE100, it would seem to be a good thing, as there is still some mileage to get to the previous highs.

However, I also have a large allocation in US trackers, and looking more closely, at a handful of tech companies that might be well overvalued, so not sure if there is much more mileage there.

CAPE Ratios by Country 2021 (Shiller PE) | Siblis Research

The trouble is as always is that it only looks backwards and therefore even though the UK looks cheap (even cheaper than in 2018) it doesn't tell us if that valuation is deserved or not.

Personally I have not added anything to US equities for a few years and all of my recent contributions have gone into UK and emerging markets funds, but that is more to keep the allocation in balance rather than any major thoughts on the future.“So we beat on, boats against the current, borne back ceaselessly into the past.”1 -

It's become fashionable to say this, but it isn't true.Thrugelmir said:The FTSE All Share has outperformed the S&P 500 since the beginning of the year. Often markets have moved before you've realised it.

1 -

bluefukurou said:

It's become fashionable to say this, but it isn't true.Thrugelmir said:The FTSE All Share has outperformed the S&P 500 since the beginning of the year. Often markets have moved before you've realised it.

Indices are not an ideal way to make comparisons as they ignore dividends and are often priced in different currencies. Not much point in a 5% gain in an index if the currency it is held in has devalued 5%.

So from the point of view of lets say a UK investor they would have been better off this year from a FTSE 100 tracker (10.3%) than an S&P 500 tracker (8.9%).

For a US investor it would pretty much be the same results with the US based EWU ETF being up nearly 17% YTD.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards