We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Barclaycard limit reduction post covid

Comments

-

Yey that makes more sense. Thanks. It's still not quite accurate - definitely not on Amex but Sainsbury's almost tallies....jay1804 said:

I think if you look at your credit reports you will see the payments, which will show to the lenders that you spent £8500, because they only report your statement balance, payments and Limit to the CRA's each monthfunkycredit said:

This is a strange one, in February I spent over £8,500 on Amex and paid it back in full BEFORE the statement, but then used another £120 and paid that at statement date yet all 3 credit files show a £120 spend; not the actual £8620 spend I did use on that card. Equifax shows the payment amounts and only shows £120.Alex9384 said:If they receive monthly feeds from CRAs, I assume they see my spending on my other cards, which was (on my Amex) over £900, next month cca £850, next month cca £650, last month £500, always paid off in full, while at the same time I spent ridiculously small sums on Barclaycard, only to have an active direct debit, plus have it reported on my files that the card is being used.Ditto, I spent £5k on Sainsbury's card and paid £4K off 3 days later (only used it for s.75) and left the grand till statement - shows I spent and repaid the grand. No mention of the other £4K.Seems by paying back before statement date has a negative effect, in that lenders won't see the real spend. I've never thought about that before but now won't pay any early payments as I'm sure if lenders see me spending near on £20k a month and repaying the same, it'll look better? Or do you think they don't care...?Just thinking out loud I guess.

if you look below:

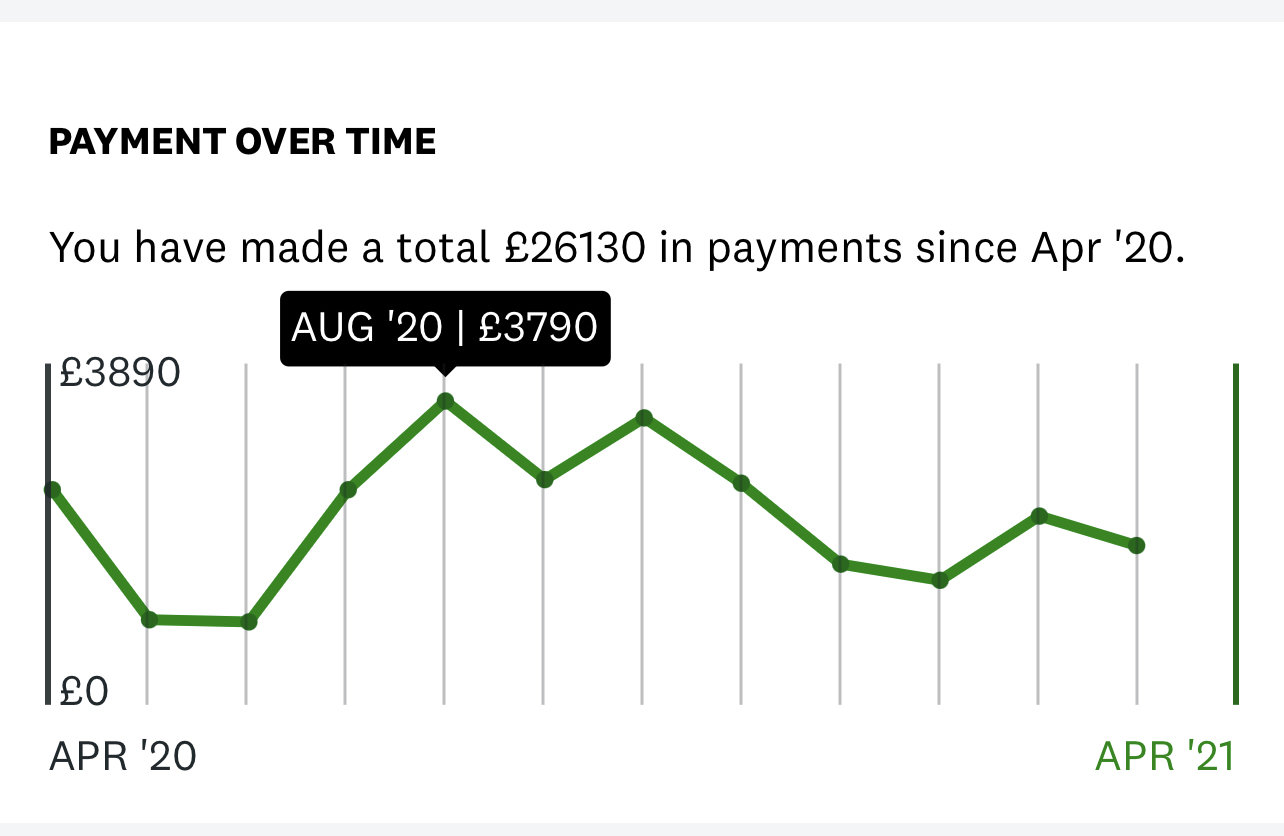

Payments AUG: £3790

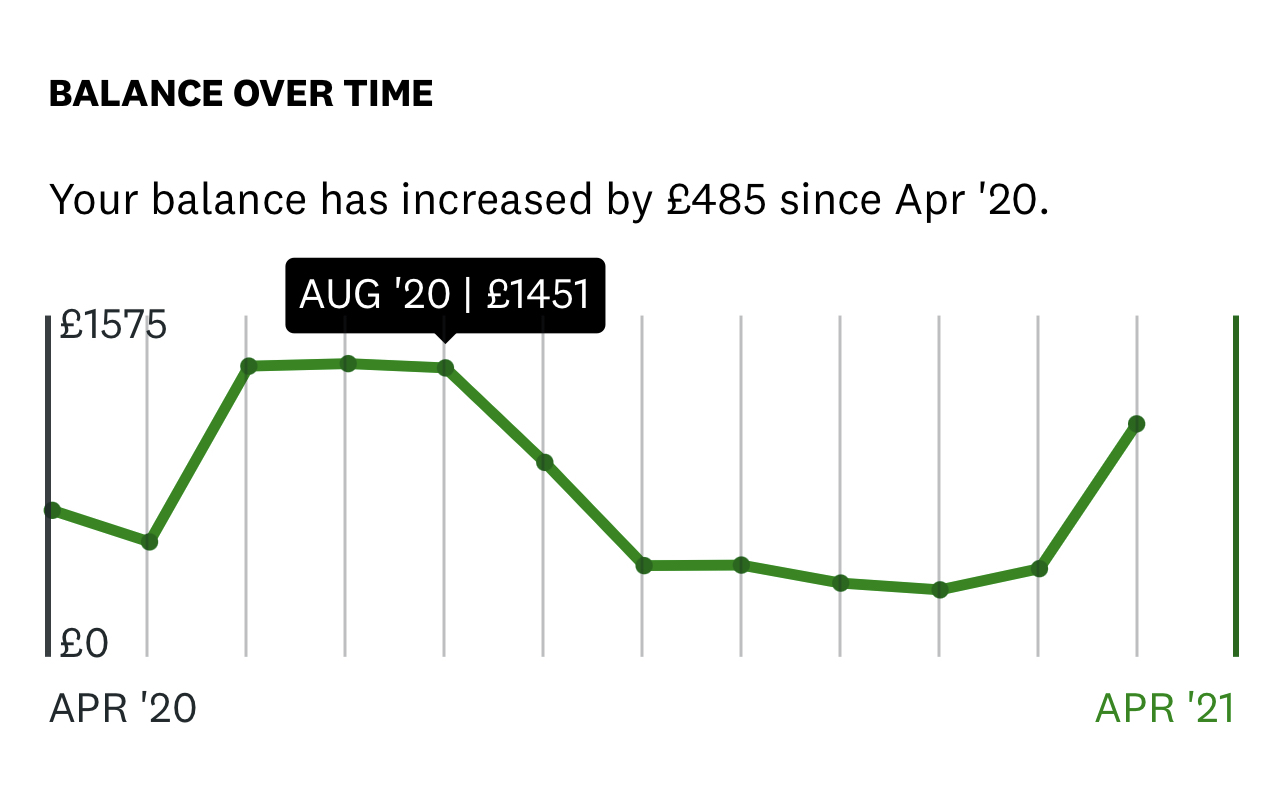

Balance/ Statement AUG: £1451

At least I know what to look for now. Never knew I could see it on credit karma. Cheers.0

At least I know what to look for now. Never knew I could see it on credit karma. Cheers.0 -

Yes, and that's perfectly fine. They aren't making money from me. They're making it from the merchant who charges me for the product. That's perfectly fine to me.Thrugelmir said:

Every time you use your cards to make purchases the banks make money. The retailer simply builds the cost of this into the price of the goods or services they sell.funkycredit said:mustiuc said:It seems that 99 out 100 people did not learned anything from the past and feel that "are entitled" to receive large available debt from lenders.

If banks increase the limit...the consumer will moan of "irresponsible lending".

If banks reduce limit the consumer will moan about and threat "doing business somewhere else" - ha ha ha what business? Banks makes money of you, not you on banks. They can do whatever they want and not care abouy your "perfect rating/history". Ridiculous

It's sad to know sooner or later I will see many of you either flooding DFW forum or being chased by bailiffs on television.

If my comments were too harsh, rude, impolite, judgmental remember this: "if you don't have to money, you can't afford it".But hey, the banks make money right? Not from me and not in over 15 years!Sorry, you're talking rubbish.The banks, as I say, do not make money from me. They make it from the retailer - whom I choose to use. Huge difference.However I made a mistake. Amex makes the annual fee from me,. Happy to pay that as I earn more back each year than the fee 1

1 -

I'm not starting any argument here and I'll stop with this post.

First of all learn how cards/transactions work and how they make money and then say you beat the banks/cards.

Secondly, if some of you spent thousands each month to receive pennies as "points or rewards" and consider "beating the system/banks" then I can't have a serious conversation with you about this topic.

Personally I consider if you really have the means of spending 5-10k a month on a monthly basis, you don't really care of £30/month compared to the available money. For me the single logical thing will be poor people acting to be rich by putting everything on CC for the sake of "honey, today we got a fiver in points whilst we booked a 7k holiday we can't afford" - but virgin were generous giving us a high limit because we have a "perfect credit rating".

I prefer having 0 debt rather than "beating the system" with 25-50k on my name.

Have fun beating the system and earning 0. peanuts in interest/rewards.

PS. Don't know why I'm so nasty today... Maybe I've seen too many of my family/friends living their life and beating the system.0 -

Haha - not sure I'd want it, the fee would be ridiculous! I'm struggling warranting the platinum fee - but it's only due to covid that I'm losing out. When I can travel it'll be worthwhile again.Alex9384 said:funkycredit said:This is a strange one, in February I spent over £8,500 on Amex and paid it back in full BEFORE the statement, but then used another £120 and paid that at statement date yet all 3 credit files show a £120 spend; not the actual £8620 spend I did use on that card. Equifax shows the payment amounts and only shows £120.Ditto, I spent £5k on Sainsbury's card and paid £4K off 3 days later (only used it for s.75) and left the grand till statement - shows I spent and repaid the grand. No mention of the other £4K.Seems by paying back before statement date has a negative effect, in that lenders won't see the real spend. I've never thought about that before but now won't pay any early payments as I'm sure if lenders see me spending near on £20k a month and repaying the same, it'll look better? Or do you think they don't care...?Just thinking out loud I guess.

Wow, those are some crazy numbers. Have you already received an invitation to their Centurion card? Why would you pay off the large chunk of the balance before the statement date?I'm not an expert on this, but yes, I personally would let it go on my credit files to show that no matter how much I owe each month, I can always pay it back in full and on time.I paid it off as I hate seeing a balance. I login see it and think nah, prefer seeing £0 next to the balance column. Sad but need to stop thinking that way - so now I'll clear in full via DD on the main cards I use, will make life easier I guess.You know what I mean! Always nicer seeing £0 owing lol0

Why would you pay off the large chunk of the balance before the statement date?I'm not an expert on this, but yes, I personally would let it go on my credit files to show that no matter how much I owe each month, I can always pay it back in full and on time.I paid it off as I hate seeing a balance. I login see it and think nah, prefer seeing £0 next to the balance column. Sad but need to stop thinking that way - so now I'll clear in full via DD on the main cards I use, will make life easier I guess.You know what I mean! Always nicer seeing £0 owing lol0 -

No, they're making it from you.funkycredit said:

Yes, and that's perfectly fine. They aren't making money from me. They're making it from the merchant who charges me for the product. That's perfectly fine to me.Thrugelmir said:

Every time you use your cards to make purchases the banks make money. The retailer simply builds the cost of this into the price of the goods or services they sell.funkycredit said:mustiuc said:It seems that 99 out 100 people did not learned anything from the past and feel that "are entitled" to receive large available debt from lenders.

If banks increase the limit...the consumer will moan of "irresponsible lending".

If banks reduce limit the consumer will moan about and threat "doing business somewhere else" - ha ha ha what business? Banks makes money of you, not you on banks. They can do whatever they want and not care abouy your "perfect rating/history". Ridiculous

It's sad to know sooner or later I will see many of you either flooding DFW forum or being chased by bailiffs on television.

If my comments were too harsh, rude, impolite, judgmental remember this: "if you don't have to money, you can't afford it".But hey, the banks make money right? Not from me and not in over 15 years!Sorry, you're talking rubbish.The banks, as I say, do not make money from me. They make it from the retailer - whom I choose to use. Huge difference.However I made a mistake. Amex makes the annual fee from me,. Happy to pay that as I earn more back each year than the fee

Just because you've decided to pretend they aren't, doesn't mean they aren't.2 -

You may know about banks, and you may know some people who live beyond their means, but you don't know a great deal about human behaviour or rich people. People who have had it tough are often marked by their upbringing and find it difficult to spend.mustiuc said:I'm not starting any argument here and I'll stop with this post.

First of all learn how cards/transactions work and how they make money and then say you beat the banks/cards.

Secondly, if some of you spent thousands each month to receive pennies as "points or rewards" and consider "beating the system/banks" then I can't have a serious conversation with you about this topic.

Personally I consider if you really have the means of spending 5-10k a month on a monthly basis, you don't really care of £30/month compared to the available money. For me the single logical thing will be poor people acting to be rich by putting everything on CC for the sake of "honey, today we got a fiver in points whilst we booked a 7k holiday we can't afford" - but virgin were generous giving us a high limit because we have a "perfect credit rating".

I prefer having 0 debt rather than "beating the system" with 25-50k on my name.

Have fun beating the system and earning 0. peanuts in interest/rewards.

PS. Don't know why I'm so nasty today... Maybe I've seen too many of my family/friends living their life and beating the system.

I know a multi-millionaire, with a personal plate worth £50k and an £80k car, who will take a 3 hour bus journey, which he could drive in less than 2 hours, because he gets it free with his bus pass.3 -

I'm not going to bother wasting my time with it.funkycredit said:

No. They aren't. How are they.... think about it then explain itBatesy1976 said:

No, they're making it from you.funkycredit said:

Yes, and that's perfectly fine. They aren't making money from me. They're making it from the merchant who charges me for the product. That's perfectly fine to me.Thrugelmir said:

Every time you use your cards to make purchases the banks make money. The retailer simply builds the cost of this into the price of the goods or services they sell.funkycredit said:mustiuc said:It seems that 99 out 100 people did not learned anything from the past and feel that "are entitled" to receive large available debt from lenders.

If banks increase the limit...the consumer will moan of "irresponsible lending".

If banks reduce limit the consumer will moan about and threat "doing business somewhere else" - ha ha ha what business? Banks makes money of you, not you on banks. They can do whatever they want and not care abouy your "perfect rating/history". Ridiculous

It's sad to know sooner or later I will see many of you either flooding DFW forum or being chased by bailiffs on television.

If my comments were too harsh, rude, impolite, judgmental remember this: "if you don't have to money, you can't afford it".But hey, the banks make money right? Not from me and not in over 15 years!Sorry, you're talking rubbish.The banks, as I say, do not make money from me. They make it from the retailer - whom I choose to use. Huge difference.However I made a mistake. Amex makes the annual fee from me,. Happy to pay that as I earn more back each year than the fee

Just because you've decided to pretend they aren't, doesn't mean they aren't.

You can pretend they don't if it helps you sleep at night. It doesn't make it true.0 -

So an item costs £5 whether I pay using cash; It's still £5 whether I pay using my bank card and It's still £5 whether I pay using a credit card.Batesy1976 said:

I'm not going to bother wasting my time with it.funkycredit said:

No. They aren't. How are they.... think about it then explain itBatesy1976 said:

No, they're making it from you.funkycredit said:

Yes, and that's perfectly fine. They aren't making money from me. They're making it from the merchant who charges me for the product. That's perfectly fine to me.Thrugelmir said:

Every time you use your cards to make purchases the banks make money. The retailer simply builds the cost of this into the price of the goods or services they sell.funkycredit said:mustiuc said:It seems that 99 out 100 people did not learned anything from the past and feel that "are entitled" to receive large available debt from lenders.

If banks increase the limit...the consumer will moan of "irresponsible lending".

If banks reduce limit the consumer will moan about and threat "doing business somewhere else" - ha ha ha what business? Banks makes money of you, not you on banks. They can do whatever they want and not care abouy your "perfect rating/history". Ridiculous

It's sad to know sooner or later I will see many of you either flooding DFW forum or being chased by bailiffs on television.

If my comments were too harsh, rude, impolite, judgmental remember this: "if you don't have to money, you can't afford it".But hey, the banks make money right? Not from me and not in over 15 years!Sorry, you're talking rubbish.The banks, as I say, do not make money from me. They make it from the retailer - whom I choose to use. Huge difference.However I made a mistake. Amex makes the annual fee from me,. Happy to pay that as I earn more back each year than the fee

Just because you've decided to pretend they aren't, doesn't mean they aren't.

You can pretend they don't if it helps you sleep at night. It doesn't make it true.It's £5 to me. End of.Yes, the retailer may be worse off due the CC fee but that affects me not one iota. Yes you're saying the fact I used my card means they're making a fee - I don't dispute this. But it's not costing me more so I don't care.Different in the old days when you were penalised for using a card, like booking a holiday. But nowadays it's all within the cost so I don't care. You're arguing schematics, the final price is all that matters.1 -

Alex9384 said:Thrugelmir said:

Profitable ones. Understand Barclaycard's credit card business model then the penny will drop.Alex9384 said:OK, they are dumping thousands of loyal customers, but what kind of customers do they wish to keep?

But did you read the rest of my post about my spending? In what way am I a profitable customer to them? It probably cost them more money to keep my account open than they make off me. If my monthly bill is £6, next month £12, next month £5, how much money they make? Yet they keep my £6000 limit.

The guy who paid them £300 in interest in the last year (didn't go anywhere near his card limit) has the limit reduced to £250 so they basically want to get rid of him.

Let's see if I receive a letter in the next few days...

I had two Barclaycards transferred from Egg, both with 5 figure limits. I wanted to close one of them, phoned to do so, and they paid me £50 to stay. I don't think I ever used it after that and two years later I closed it anyway.

My other one pays 0.5% cashback. They pay me £40-50 a year on a spend of £8-10k. That isn't viable after the law changed on interchange limits. Last year, like many other people, I got caught up in the pandemic for my travel arrangements. I tried to do a chargeback and they dealt with it extremely badly, to the point I put in a formal complaint and was ready to go to the ombudsman. They paid £1k to make me go away. I'm the polar opposite of a profitable customer.

I currently have no income, have moved home (which they know) and am not on the electoral roll.

Yet I have no letter.0 -

Nebulous2 said:

You may know about banks, and you may know some people who live beyond their means, but you don't know a great deal about human behaviour or rich people. People who have had it tough are often marked by their upbringing and find it difficult to spend.mustiuc said:I'm not starting any argument here and I'll stop with this post.

First of all learn how cards/transactions work and how they make money and then say you beat the banks/cards.

Secondly, if some of you spent thousands each month to receive pennies as "points or rewards" and consider "beating the system/banks" then I can't have a serious conversation with you about this topic.

Personally I consider if you really have the means of spending 5-10k a month on a monthly basis, you don't really care of £30/month compared to the available money. For me the single logical thing will be poor people acting to be rich by putting everything on CC for the sake of "honey, today we got a fiver in points whilst we booked a 7k holiday we can't afford" - but virgin were generous giving us a high limit because we have a "perfect credit rating".

I prefer having 0 debt rather than "beating the system" with 25-50k on my name.

Have fun beating the system and earning 0. peanuts in interest/rewards.

PS. Don't know why I'm so nasty today... Maybe I've seen too many of my family/friends living their life and beating the system.

I know a multi-millionaire, with a personal plate worth £50k and an £80k car, who will take a 3 hour bus journey, which he could drive in less than 2 hours, because he gets it free with his bus pass.

Rather like a sofa you buy on 48 months interest free credit. The actual cost of the goods are less than 30% of the selling price. New car dealers make more from the leasing/financing deals than they do from selling the vehicle. The buy now pay later culture is no free lunch. Big business is always one step ahead of the consumer.funkycredit said:Batesy1976 said:

I'm not going to bother wasting my time with it.funkycredit said:

No. They aren't. How are they.... think about it then explain itBatesy1976 said:

No, they're making it from you.funkycredit said:

Yes, and that's perfectly fine. They aren't making money from me. They're making it from the merchant who charges me for the product. That's perfectly fine to me.Thrugelmir said:

Every time you use your cards to make purchases the banks make money. The retailer simply builds the cost of this into the price of the goods or services they sell.funkycredit said:mustiuc said:It seems that 99 out 100 people did not learned anything from the past and feel that "are entitled" to receive large available debt from lenders.

If banks increase the limit...the consumer will moan of "irresponsible lending".

If banks reduce limit the consumer will moan about and threat "doing business somewhere else" - ha ha ha what business? Banks makes money of you, not you on banks. They can do whatever they want and not care abouy your "perfect rating/history". Ridiculous

It's sad to know sooner or later I will see many of you either flooding DFW forum or being chased by bailiffs on television.

If my comments were too harsh, rude, impolite, judgmental remember this: "if you don't have to money, you can't afford it".But hey, the banks make money right? Not from me and not in over 15 years!Sorry, you're talking rubbish.The banks, as I say, do not make money from me. They make it from the retailer - whom I choose to use. Huge difference.However I made a mistake. Amex makes the annual fee from me,. Happy to pay that as I earn more back each year than the fee

Just because you've decided to pretend they aren't, doesn't mean they aren't.

You can pretend they don't if it helps you sleep at night. It doesn't make it true.Different in the old days when you were penalised for using a card, like booking a holiday. But nowadays it's all within the cost so I don't care. You're arguing schematics, the final price is all that matters.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards