We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Barclaycard limit reduction post covid

Comments

-

This is a strange one, in February I spent over £8,500 on Amex and paid it back in full BEFORE the statement, but then used another £120 and paid that at statement date yet all 3 credit files show a £120 spend; not the actual £8620 spend I did use on that card. Equifax shows the payment amounts and only shows £120.Alex9384 said:If they receive monthly feeds from CRAs, I assume they see my spending on my other cards, which was (on my Amex) over £900, next month cca £850, next month cca £650, last month £500, always paid off in full, while at the same time I spent ridiculously small sums on Barclaycard, only to have an active direct debit, plus have it reported on my files that the card is being used.Ditto, I spent £5k on Sainsbury's card and paid £4K off 3 days later (only used it for s.75) and left the grand till statement - shows I spent and repaid the grand. No mention of the other £4K.Seems by paying back before statement date has a negative effect, in that lenders won't see the real spend. I've never thought about that before but now won't pay any early payments as I'm sure if lenders see me spending near on £20k a month and repaying the same, it'll look better? Or do you think they don't care...?Just thinking out loud I guess. 0

0 -

It seems that 99 out 100 people did not learned anything from the past and feel that "are entitled" to receive large available debt from lenders.

If banks increase the limit...the consumer will moan of "irresponsible lending".

If banks reduce limit the consumer will moan about and threat "doing business somewhere else" - ha ha ha what business? Banks makes money of you, not you on banks. They can do whatever they want and not care abouy your "perfect rating/history". Ridiculous

It's sad to know sooner or later I will see many of you either flooding DFW forum or being chased by bailiffs on television.

If my comments were too harsh, rude, impolite, judgmental remember this: "if you don't have to money, you can't afford it".

3 -

Idiotic comment. Funny thing, I earn almost a grand a year from my cards and banking arrangements (as does my wife). It's really easy - example 3x Halifax Rewards each = 6 x £5 (£30 monthly); then there's the Virgin accounts. Of course my credit cards allow me large 0% spends thus my savings earn full interest. Some cards pay me in points which I convert, others pay me rewards and others give me free airport passes and free 0% foreign spend.mustiuc said:It seems that 99 out 100 people did not learned anything from the past and feel that "are entitled" to receive large available debt from lenders.

If banks increase the limit...the consumer will moan of "irresponsible lending".

If banks reduce limit the consumer will moan about and threat "doing business somewhere else" - ha ha ha what business? Banks makes money of you, not you on banks. They can do whatever they want and not care abouy your "perfect rating/history". Ridiculous

It's sad to know sooner or later I will see many of you either flooding DFW forum or being chased by bailiffs on television.

If my comments were too harsh, rude, impolite, judgmental remember this: "if you don't have to money, you can't afford it".But hey, the banks make money right? Not from me and not in over 15 years!Sorry, you're talking rubbish.4 -

I was making a general observation. Think macro not micro. The letters coming out are generic not personalised. There'll be using metrics to identify the customers that they progressively target to hit their ultimate objectives.Alex9384 said:Thrugelmir said:

Profitable ones. Understand Barclaycard's credit card business model then the penny will drop.Alex9384 said:OK, they are dumping thousands of loyal customers, but what kind of customers do they wish to keep?

But did you read the rest of my post about my spending? In what way am I a profitable customer to them? It probably cost them more money to keep my account open than they make off me. If my monthly bill is £6, next month £12, next month £5, how much money they make? Yet they keep my £6000 limit.

The guy who paid them £300 in interest in the last year (didn't go anywhere near his card limit) has the limit reduced to £250 so they basically want to get rid of him.

Let's see if I receive a letter in the next few days...2 -

I think if you look at your credit reports you will see the payments, which will show to the lenders that you spent £8500, because they only report your statement balance, payments and Limit to the CRA's each monthfunkycredit said:

This is a strange one, in February I spent over £8,500 on Amex and paid it back in full BEFORE the statement, but then used another £120 and paid that at statement date yet all 3 credit files show a £120 spend; not the actual £8620 spend I did use on that card. Equifax shows the payment amounts and only shows £120.Alex9384 said:If they receive monthly feeds from CRAs, I assume they see my spending on my other cards, which was (on my Amex) over £900, next month cca £850, next month cca £650, last month £500, always paid off in full, while at the same time I spent ridiculously small sums on Barclaycard, only to have an active direct debit, plus have it reported on my files that the card is being used.Ditto, I spent £5k on Sainsbury's card and paid £4K off 3 days later (only used it for s.75) and left the grand till statement - shows I spent and repaid the grand. No mention of the other £4K.Seems by paying back before statement date has a negative effect, in that lenders won't see the real spend. I've never thought about that before but now won't pay any early payments as I'm sure if lenders see me spending near on £20k a month and repaying the same, it'll look better? Or do you think they don't care...?Just thinking out loud I guess.

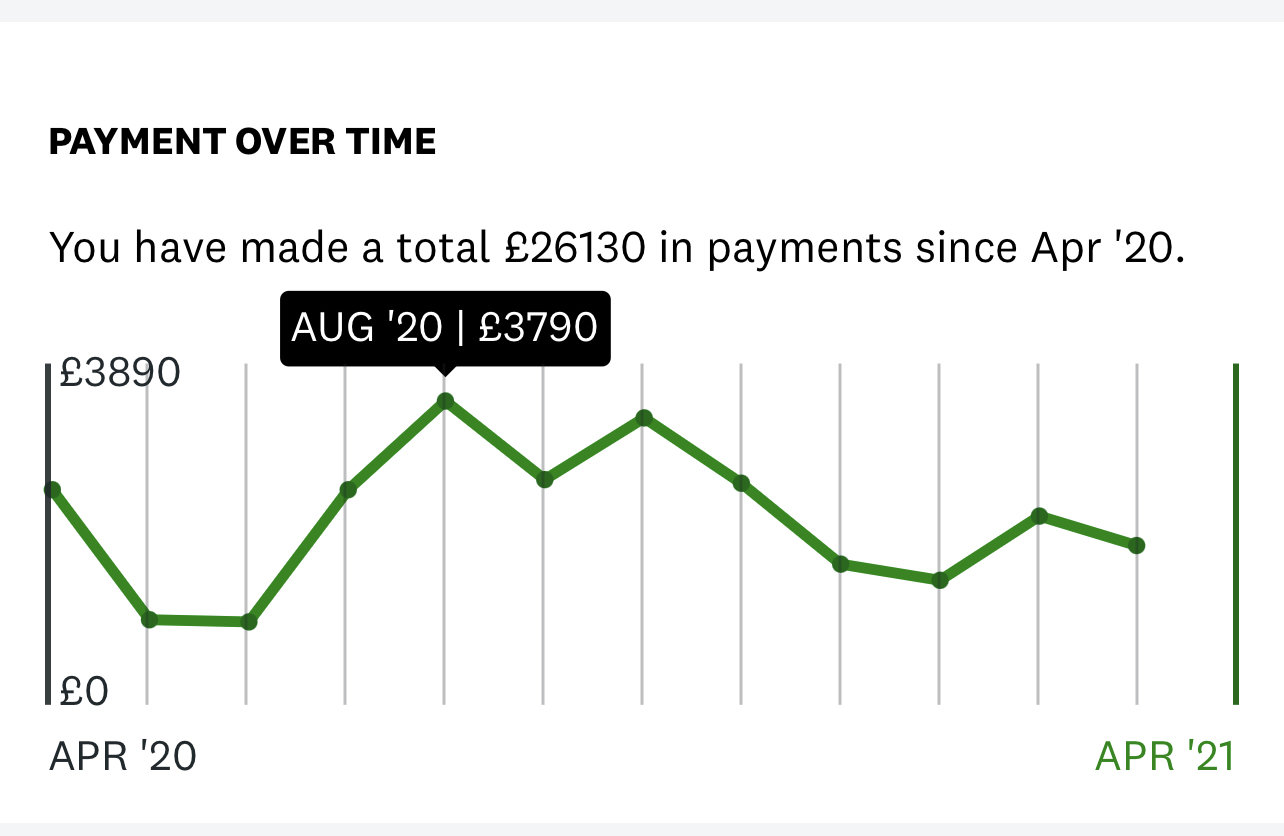

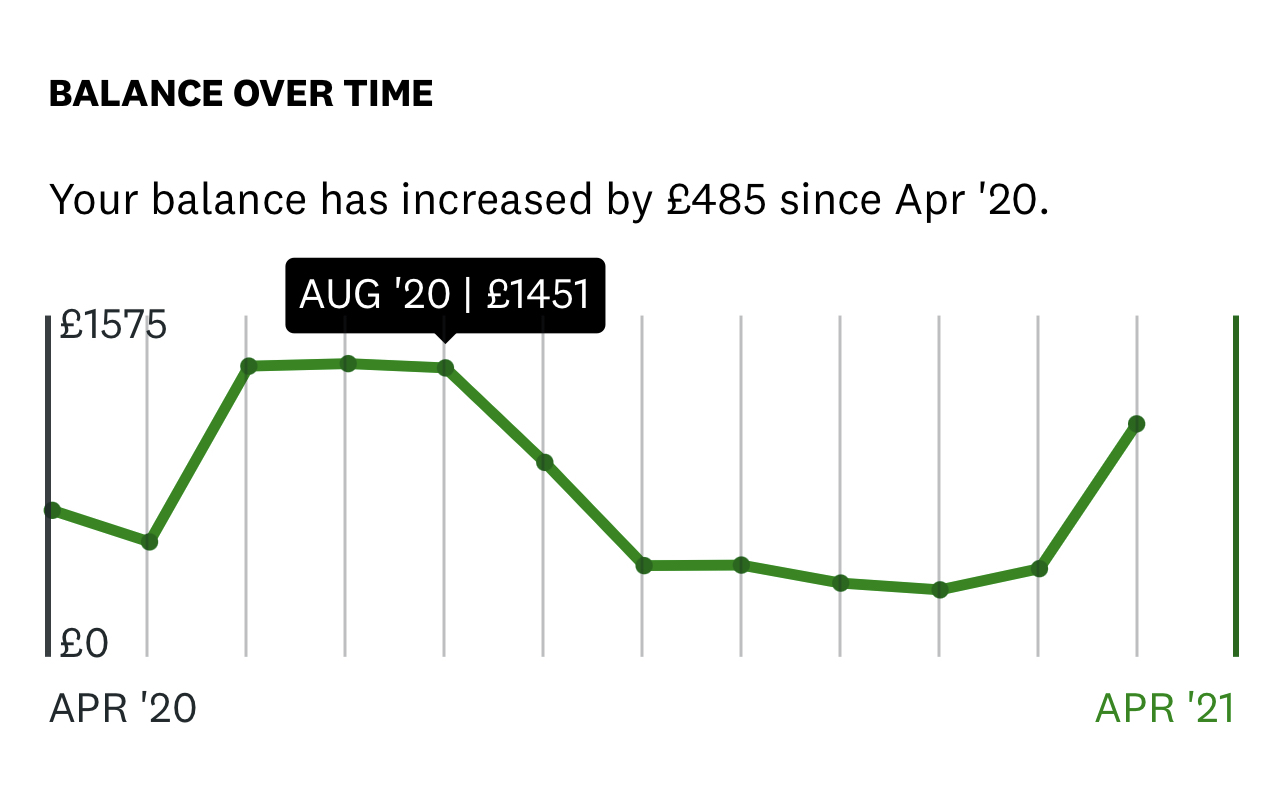

if you look below:

Payments AUG: £3790

Balance/ Statement AUG: £1451

1 -

Every time you use your cards to make purchases the banks make money. The retailer simply builds the cost of this into the price of the goods or services they sell.funkycredit said:mustiuc said:It seems that 99 out 100 people did not learned anything from the past and feel that "are entitled" to receive large available debt from lenders.

If banks increase the limit...the consumer will moan of "irresponsible lending".

If banks reduce limit the consumer will moan about and threat "doing business somewhere else" - ha ha ha what business? Banks makes money of you, not you on banks. They can do whatever they want and not care abouy your "perfect rating/history". Ridiculous

It's sad to know sooner or later I will see many of you either flooding DFW forum or being chased by bailiffs on television.

If my comments were too harsh, rude, impolite, judgmental remember this: "if you don't have to money, you can't afford it".But hey, the banks make money right? Not from me and not in over 15 years!Sorry, you're talking rubbish.4 -

Alex9384 said:Thrugelmir said:

Profitable ones. Understand Barclaycard's credit card business model then the penny will drop.Alex9384 said:OK, they are dumping thousands of loyal customers, but what kind of customers do they wish to keep?

But did you read the rest of my post about my spending? In what way am I a profitable customer to them? It probably cost them more money to keep my account open than they make off me. If my monthly bill is £6, next month £12, next month £5, how much money they make? Yet they keep my £6000 limit.

The guy who paid them £300 in interest in the last year (didn't go anywhere near his card limit) has the limit reduced to £250 so they basically want to get rid of him.

Let's see if I receive a letter in the next few days...

From that point if he didn't go anywhere near the limit, then he doesn't need a high limit. Also the people limit's that are getting lowered are old customers 8 years +, a lot can change in that time, positive or negative. I'm sure if people provide Barclaycard their payslips they will reinstate their limit to an acceptable level.

I have a decent limit with Barclaycard with a 0% balance and it hasn't changed yet.0 -

Thrugelmir said:Every time you use your cards to make purchases the banks make money. The retailer simply builds the cost of this into the price of the goods or services they sell.But lots of you have mentioned non-profitable customers. It means banks don't make money of everyone.

Btw, the higher cost built into the price of goods is still offset by rewards. It's paid for by those who don't use reward cards (or pay interest on them).

EPICA - the best symphonic metal band in the world !3 -

funkycredit said:This is a strange one, in February I spent over £8,500 on Amex and paid it back in full BEFORE the statement, but then used another £120 and paid that at statement date yet all 3 credit files show a £120 spend; not the actual £8620 spend I did use on that card. Equifax shows the payment amounts and only shows £120.Ditto, I spent £5k on Sainsbury's card and paid £4K off 3 days later (only used it for s.75) and left the grand till statement - shows I spent and repaid the grand. No mention of the other £4K.Seems by paying back before statement date has a negative effect, in that lenders won't see the real spend. I've never thought about that before but now won't pay any early payments as I'm sure if lenders see me spending near on £20k a month and repaying the same, it'll look better? Or do you think they don't care...?Just thinking out loud I guess.

Wow, those are some crazy numbers. Have you already received an invitation to their Centurion card? Why would you pay off the large chunk of the balance before the statement date?I'm not an expert on this, but yes, I personally would let it go on my credit files to show that no matter how much I owe each month, I can always pay it back in full and on time.EPICA - the best symphonic metal band in the world !1

Why would you pay off the large chunk of the balance before the statement date?I'm not an expert on this, but yes, I personally would let it go on my credit files to show that no matter how much I owe each month, I can always pay it back in full and on time.EPICA - the best symphonic metal band in the world !1 -

mustiuc said:It seems that 99 out 100 people did not learned anything from the past and feel that "are entitled" to receive large available debt from lenders.

If banks increase the limit...the consumer will moan of "irresponsible lending".

If banks reduce limit the consumer will moan about and threat "doing business somewhere else" - ha ha ha what business? Banks makes money of you, not you on banks. They can do whatever they want and not care abouy your "perfect rating/history". Ridiculous

It's sad to know sooner or later I will see many of you either flooding DFW forum or being chased by bailiffs on television.

If my comments were too harsh, rude, impolite, judgmental remember this: "if you don't have to money, you can't afford it".

I don't know why some people are moaning about credit limit being raised too high. You can choose whether you want your limit to be raised automatically or whether their need your approval. I always turn the automatic increases off and increase my limits manually, when I want and how much I want, or not increase them at all.

I definitely make money of banks, not vice versa. Current account switch bonuses + credit cards cashback and rewards. Also 0% purchase periods for 17 months or so. That's saved money that would otherwise go on interest payments if it was a loan. I never paid a penny in interest. Banks make money off merchants if I use their card, not off me directly.

EPICA - the best symphonic metal band in the world !2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.8K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.9K Work, Benefits & Business

- 603.4K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards