We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

SWR Question

Comments

-

Deferral has the distinct drawback that it is only one partner in a couple that benefits so needs to be compared against a single life annuity. Does the deferral increment gain the same triple lock benefits as the standard pension tranche?jamesd said:Deleted_User said:

Lets arbitrarily assume that the future will be very much like the recent past. A 1 in 20 probability of running out of money and dying in abject poverty does not make me think “safe”. If you live for 40 or 50 years after retirement that probability goes up quite a bit. The constant should really be called UWR.jamesd said:The US moved from an emerging economy to an economic powerhouse and the UK from a global empire to an ordinary developed country. So the SWRs appear safe against radically different economic progressions.

No reason not to use an SWR for more than thirty years, just calculate one for the desired term. Thirty is long enough that 35 or 40 is close enough to work if people follow the usual pattern of spending declining over time.

Given that the usual 4% rule is calculated for no failures, where does the 1 in 20 probability of failure come from?

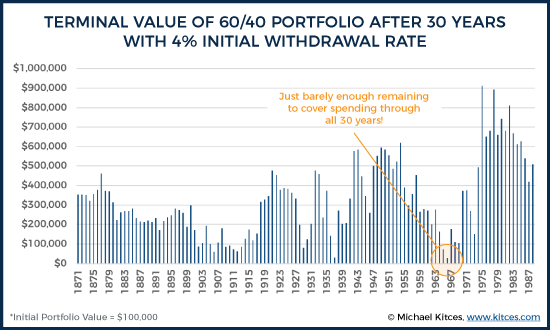

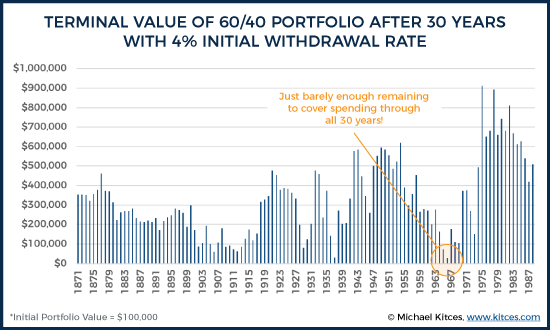

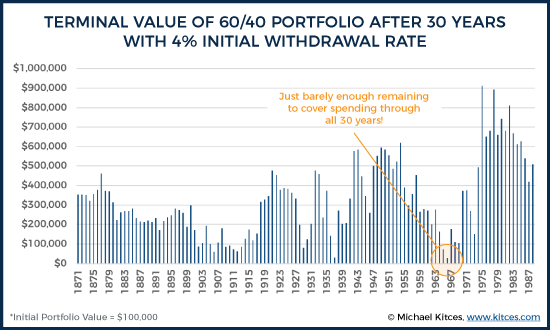

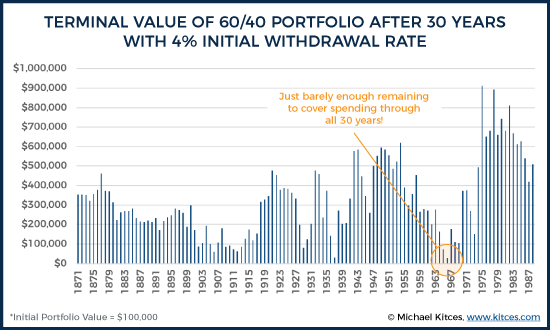

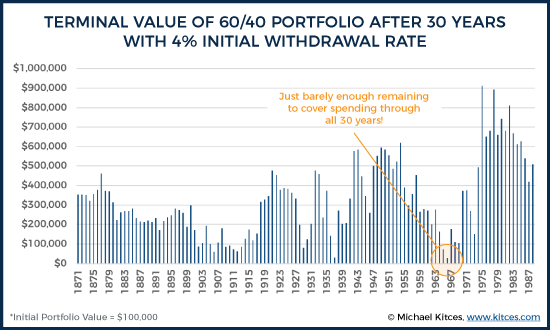

Life expectancy is perhaps one possible source, given that I tend to suggest a planning horizon no shorter than giving a five percent chance of still being alive. But the 4% rule is so cautious that even if you're in that five percent you're likely to have lots of money when you die anyway, as Kitces illustrates in The Extraordinary Upside Potential Of Sequence Of Return Risk In Retirement

So if in that five percent you'd also need to be in the less than five percent of cases where the 4% rule isn't likely to have lots of money left. That takes it down to 0.25% chance of running out, or less.

But abject poverty isn't in the picture for those in the UK who qualify for a state pension and thereby pension credit. There's not even a need to go there for anyone who acts as I suggest and does lots of state pension deferring for longevity insurance and does significant annuity buying when that starts to beat drawdown. You could have a sequence that blocks those but it's really hard to block deferral because it pays more than drawdown, improving the position of the pot.

There's no need to fear the very long life case because you can prepare for it instead.I think....0 -

On the plus side, Extra State Pension from a deferral is inherited by a spouse, so it benefits both members of a married couple.****michaels said:

Deferral has the distinct drawback that it is only one partner in a couple that benefits so needs to be compared against a single life annuity. Does the deferral increment gain the same triple lock benefits as the standard pension tranche?jamesd said:Deleted_User said:

Lets arbitrarily assume that the future will be very much like the recent past. A 1 in 20 probability of running out of money and dying in abject poverty does not make me think “safe”. If you live for 40 or 50 years after retirement that probability goes up quite a bit. The constant should really be called UWR.jamesd said:The US moved from an emerging economy to an economic powerhouse and the UK from a global empire to an ordinary developed country. So the SWRs appear safe against radically different economic progressions.

No reason not to use an SWR for more than thirty years, just calculate one for the desired term. Thirty is long enough that 35 or 40 is close enough to work if people follow the usual pattern of spending declining over time.

Given that the usual 4% rule is calculated for no failures, where does the 1 in 20 probability of failure come from?

Life expectancy is perhaps one possible source, given that I tend to suggest a planning horizon no shorter than giving a five percent chance of still being alive. But the 4% rule is so cautious that even if you're in that five percent you're likely to have lots of money when you die anyway, as Kitces illustrates in The Extraordinary Upside Potential Of Sequence Of Return Risk In Retirement

So if in that five percent you'd also need to be in the less than five percent of cases where the 4% rule isn't likely to have lots of money left. That takes it down to 0.25% chance of running out, or less.

But abject poverty isn't in the picture for those in the UK who qualify for a state pension and thereby pension credit. There's not even a need to go there for anyone who acts as I suggest and does lots of state pension deferring for longevity insurance and does significant annuity buying when that starts to beat drawdown. You could have a sequence that blocks those but it's really hard to block deferral because it pays more than drawdown, improving the position of the pot.

There's no need to fear the very long life case because you can prepare for it instead.

But on the minus side, once it payment it only increases by CPI. However it is based on the SP when you cease deferring so it increases with the triple lock until then.

**** only if the deceased reached SP age prior to April 2016.1 -

Is that the case? I thought that was only under the old rules and that it is no longer payable to the surviving spouse - would love to be told otherwise though?Linton said:

On the plus side, Extra State Pension from a deferral is inherited by a spouse, so it benefits both members of a married couple.michaels said:

Deferral has the distinct drawback that it is only one partner in a couple that benefits so needs to be compared against a single life annuity. Does the deferral increment gain the same triple lock benefits as the standard pension tranche?jamesd said:Deleted_User said:

Lets arbitrarily assume that the future will be very much like the recent past. A 1 in 20 probability of running out of money and dying in abject poverty does not make me think “safe”. If you live for 40 or 50 years after retirement that probability goes up quite a bit. The constant should really be called UWR.jamesd said:The US moved from an emerging economy to an economic powerhouse and the UK from a global empire to an ordinary developed country. So the SWRs appear safe against radically different economic progressions.

No reason not to use an SWR for more than thirty years, just calculate one for the desired term. Thirty is long enough that 35 or 40 is close enough to work if people follow the usual pattern of spending declining over time.

Given that the usual 4% rule is calculated for no failures, where does the 1 in 20 probability of failure come from?

Life expectancy is perhaps one possible source, given that I tend to suggest a planning horizon no shorter than giving a five percent chance of still being alive. But the 4% rule is so cautious that even if you're in that five percent you're likely to have lots of money when you die anyway, as Kitces illustrates in The Extraordinary Upside Potential Of Sequence Of Return Risk In Retirement

So if in that five percent you'd also need to be in the less than five percent of cases where the 4% rule isn't likely to have lots of money left. That takes it down to 0.25% chance of running out, or less.

But abject poverty isn't in the picture for those in the UK who qualify for a state pension and thereby pension credit. There's not even a need to go there for anyone who acts as I suggest and does lots of state pension deferring for longevity insurance and does significant annuity buying when that starts to beat drawdown. You could have a sequence that blocks those but it's really hard to block deferral because it pays more than drawdown, improving the position of the pot.

There's no need to fear the very long life case because you can prepare for it instead.

But on the minus side, once it payment it only increases by CPI. However it is based on the SP when you cease deferring so it increases with the triple lock until then.I think....1 -

The usual 4% rule is calculated with a 95% confidence level of not outliving your money within a 30 year period assuming the future is like the past. That translates to a 5% or 1 in 20 probability of failure.jamesd said:Deleted_User said:

Lets arbitrarily assume that the future will be very much like the recent past. A 1 in 20 probability of running out of money and dying in abject poverty does not make me think “safe”. If you live for 40 or 50 years after retirement that probability goes up quite a bit. The constant should really be called UWR.jamesd said:The US moved from an emerging economy to an economic powerhouse and the UK from a global empire to an ordinary developed country. So the SWRs appear safe against radically different economic progressions.

No reason not to use an SWR for more than thirty years, just calculate one for the desired term. Thirty is long enough that 35 or 40 is close enough to work if people follow the usual pattern of spending declining over time.

Given that the usual 4% rule is calculated for no failures, where does the 1 in 20 probability of failure come from?1 -

Whenever I run cfiresim I just put the money needs to last until I am 95 and I want to see zero failure swr rate.Deleted_User said:

The usual 4% rule is calculated with a 95% confidence level of not outliving your money within a 30 year period assuming the future is like the past. That translates to a 5% or 1 in 20 probability of failure.jamesd said:Deleted_User said:

Lets arbitrarily assume that the future will be very much like the recent past. A 1 in 20 probability of running out of money and dying in abject poverty does not make me think “safe”. If you live for 40 or 50 years after retirement that probability goes up quite a bit. The constant should really be called UWR.jamesd said:The US moved from an emerging economy to an economic powerhouse and the UK from a global empire to an ordinary developed country. So the SWRs appear safe against radically different economic progressions.

No reason not to use an SWR for more than thirty years, just calculate one for the desired term. Thirty is long enough that 35 or 40 is close enough to work if people follow the usual pattern of spending declining over time.

Given that the usual 4% rule is calculated for no failures, where does the 1 in 20 probability of failure come from?I think....0 -

Linton said:Running a set of cfiresim data to produce SWRs at 95% success rate:

50% equity, 75% equity

30 year: 4.0%, 4.1%

40 year 3.5%, 3.7%

Interesting that the % equity doesnt make as much difference as one may have guessed.I wonder how much of the cfiresim data is in anyway similar to the current day situation of being at the tail end of an extremely long bull run in bonds? Interest rates have surely got to go up (or at least stop going down) at some point which would be a drag on bonds going forward.0 -

Major policy changes impacting fiscal and monetary policy, eg changes in how the Feds define their targets, will have an impact on what happens next. Its a major shift vs what we’ve been used to since 1970s0

-

Wasn't even possible for overseas investors to directly hold US shares. For the majority of that time frame. Which makes historical data of UK investors holding overseas shares subjective. Japanese shares actually came first , and that was purely in nominee form for institutional investors. Much has changed in less than 50 years.Linton said:

Agree on all points. To illustrate how short a period 150 years is, in the past 150 years more than 2/3 of all 40 year periods include at least one world war.Deleted_User said:

Over that period US moved from an emerging economy to the dominant economic powerhouse of the world. Scenario which is pretty rare. People do use SWR for periods far exceeding 30 years; nor do those retiring at 65 know how long they would need it. Still, 150 years is very short, in statistical terms, when compared to 30. On top of that, fiat money we currently use have existed for a MUCH shorter period. And the fiscal and monetary systems are undergoing rapid and fundamental changes over the last 10 years. We have no idea if any of the preceding history of the stockmarket is relevant to the future.Linton said:

Also the figures are based on the performance of US investments over the past 150 years and are believed to be lower for UK investors, particularly those who invest in the UK which as been the majority for most of that time. On the other hand the past 150 years include 2 world wars, several technological revolutions, the rise and fall of empires and major economic powers etc etc which may or may not be relevent to the next 50 years.JohnWinder said:Yes, it's worth reading more fully on this, as one would discover that 'safe' means the method fails in only 5% of circumstances based on history. That wouldn't be safe enough for me, but you only have drop to about 3.7% instead of 4% withdrawal to be 99% certain of never running out. And if one kept reading one discovers it's not designed for 50 years of withdrawal, but 30.

So all in all I think SWR figures may be useful for a sanity check but cannot provide any sort of guaranteed basis for one's entire retirement. Certainly anyone who says that their plan has a x% chance of future success is fooling themselves.0 -

Good point, yes it's only if the deceased reached State Pension Age before 2016 - apologies. I did so we are OK!michaels said:

Is that the case? I thought that was only under the old rules and that it is no longer payable to the surviving spouse - would love to be told otherwise though?Linton said:

On the plus side, Extra State Pension from a deferral is inherited by a spouse, so it benefits both members of a married couple.michaels said:

Deferral has the distinct drawback that it is only one partner in a couple that benefits so needs to be compared against a single life annuity. Does the deferral increment gain the same triple lock benefits as the standard pension tranche?jamesd said:Deleted_User said:

Lets arbitrarily assume that the future will be very much like the recent past. A 1 in 20 probability of running out of money and dying in abject poverty does not make me think “safe”. If you live for 40 or 50 years after retirement that probability goes up quite a bit. The constant should really be called UWR.jamesd said:The US moved from an emerging economy to an economic powerhouse and the UK from a global empire to an ordinary developed country. So the SWRs appear safe against radically different economic progressions.

No reason not to use an SWR for more than thirty years, just calculate one for the desired term. Thirty is long enough that 35 or 40 is close enough to work if people follow the usual pattern of spending declining over time.

Given that the usual 4% rule is calculated for no failures, where does the 1 in 20 probability of failure come from?

Life expectancy is perhaps one possible source, given that I tend to suggest a planning horizon no shorter than giving a five percent chance of still being alive. But the 4% rule is so cautious that even if you're in that five percent you're likely to have lots of money when you die anyway, as Kitces illustrates in The Extraordinary Upside Potential Of Sequence Of Return Risk In Retirement

So if in that five percent you'd also need to be in the less than five percent of cases where the 4% rule isn't likely to have lots of money left. That takes it down to 0.25% chance of running out, or less.

But abject poverty isn't in the picture for those in the UK who qualify for a state pension and thereby pension credit. There's not even a need to go there for anyone who acts as I suggest and does lots of state pension deferring for longevity insurance and does significant annuity buying when that starts to beat drawdown. You could have a sequence that blocks those but it's really hard to block deferral because it pays more than drawdown, improving the position of the pot.

There's no need to fear the very long life case because you can prepare for it instead.

But on the minus side, once it payment it only increases by CPI. However it is based on the SP when you cease deferring so it increases with the triple lock until then.1 -

And a much higher rate for deferment...but like most things age related, despite the advantages I wouldn't trade them for the extra years....Linton said:

Good point, yes it's only if the deceased reached State Pension Age before 2016 - apologies. I did so we are OK!michaels said:

Is that the case? I thought that was only under the old rules and that it is no longer payable to the surviving spouse - would love to be told otherwise though?Linton said:

On the plus side, Extra State Pension from a deferral is inherited by a spouse, so it benefits both members of a married couple.michaels said:

Deferral has the distinct drawback that it is only one partner in a couple that benefits so needs to be compared against a single life annuity. Does the deferral increment gain the same triple lock benefits as the standard pension tranche?jamesd said:Deleted_User said:

Lets arbitrarily assume that the future will be very much like the recent past. A 1 in 20 probability of running out of money and dying in abject poverty does not make me think “safe”. If you live for 40 or 50 years after retirement that probability goes up quite a bit. The constant should really be called UWR.jamesd said:The US moved from an emerging economy to an economic powerhouse and the UK from a global empire to an ordinary developed country. So the SWRs appear safe against radically different economic progressions.

No reason not to use an SWR for more than thirty years, just calculate one for the desired term. Thirty is long enough that 35 or 40 is close enough to work if people follow the usual pattern of spending declining over time.

Given that the usual 4% rule is calculated for no failures, where does the 1 in 20 probability of failure come from?

Life expectancy is perhaps one possible source, given that I tend to suggest a planning horizon no shorter than giving a five percent chance of still being alive. But the 4% rule is so cautious that even if you're in that five percent you're likely to have lots of money when you die anyway, as Kitces illustrates in The Extraordinary Upside Potential Of Sequence Of Return Risk In Retirement

So if in that five percent you'd also need to be in the less than five percent of cases where the 4% rule isn't likely to have lots of money left. That takes it down to 0.25% chance of running out, or less.

But abject poverty isn't in the picture for those in the UK who qualify for a state pension and thereby pension credit. There's not even a need to go there for anyone who acts as I suggest and does lots of state pension deferring for longevity insurance and does significant annuity buying when that starts to beat drawdown. You could have a sequence that blocks those but it's really hard to block deferral because it pays more than drawdown, improving the position of the pot.

There's no need to fear the very long life case because you can prepare for it instead.

But on the minus side, once it payment it only increases by CPI. However it is based on the SP when you cease deferring so it increases with the triple lock until then.I think....0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards