We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Unilever shares

petelondon

Posts: 53 Forumite

Has anyone opinions on the Unilever share price lately.

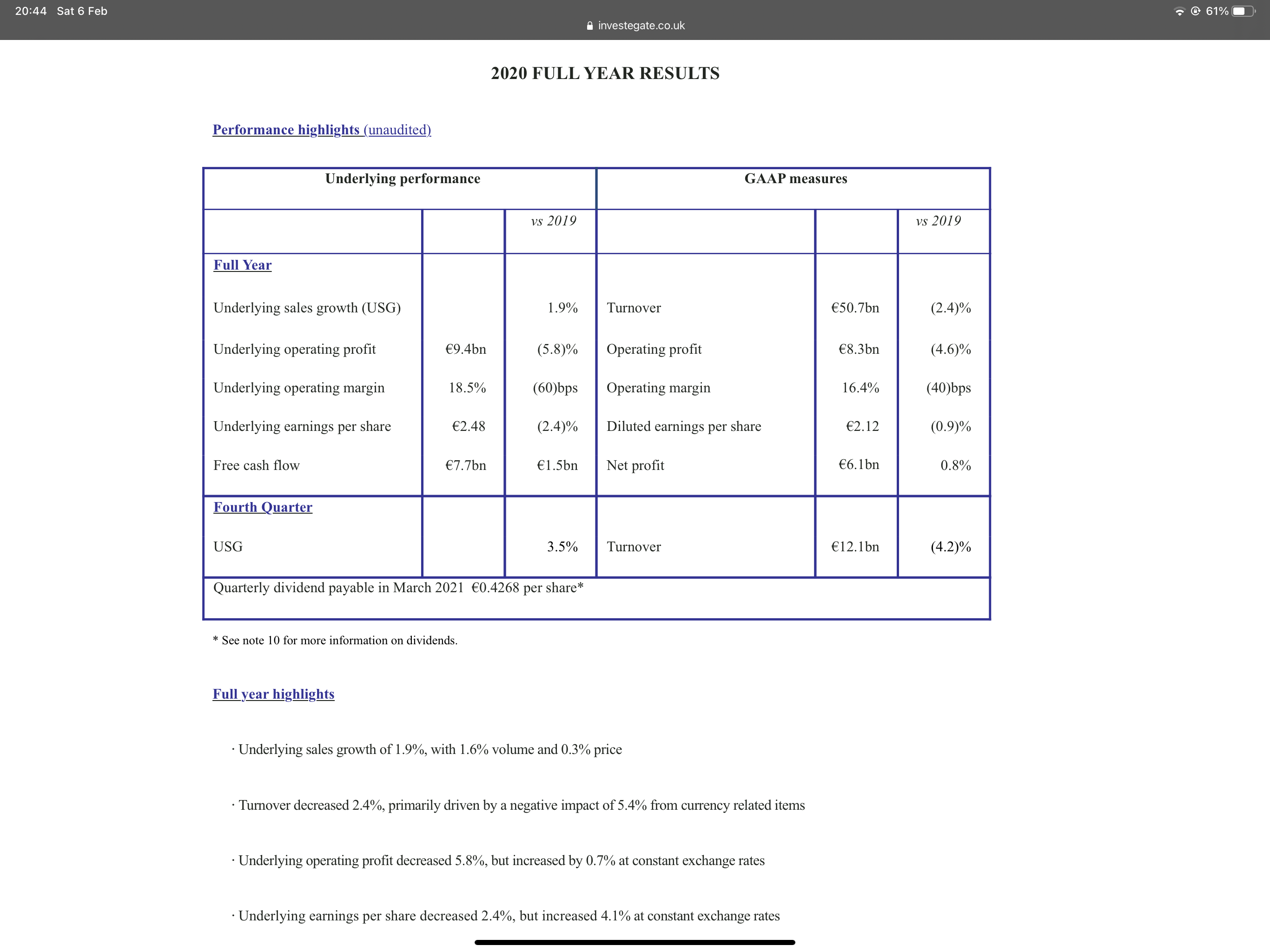

It has dropped over 10% in the last couple of weeks from about 4400 to 3980. I know they have just published their revenue figures and fell a bit short of their forecast but it didnt appear to be a complete disaster.

I always thought of them as a solid company - as far as any company is solid these days.

I was thinking it could be worth a punt at their current price (bearing in mind the usual caveats of buying individual stocks)

Any thoughts?

It has dropped over 10% in the last couple of weeks from about 4400 to 3980. I know they have just published their revenue figures and fell a bit short of their forecast but it didnt appear to be a complete disaster.

I always thought of them as a solid company - as far as any company is solid these days.

I was thinking it could be worth a punt at their current price (bearing in mind the usual caveats of buying individual stocks)

Any thoughts?

0

Comments

-

Firstly, I don't invest in individual shares, so anything I say is wild speculation on my part. Having said that:

It could be that Unilever has simply followed the trajectory of the wider stock market and FTSE 100 in its recent drops. Therefore as markets recover Unilever will recover too. Then again, maybe it won't, what do I know?

If you're looking for a short term gain then Unilever is probably as good a company as any to invest in now. Whether it does better than investing in a FTSE 100 tracker / FTSE 250 tracker / Global tracker is anyone's guess.0 -

I don't think the market likes what it's hearing from Unilever. Go woke, go broke, as they say...BP is another one to avoid, for exactly the same reason.2

-

Yesterday's drop was massive for what is supposed to be a safe defensive share. It is on a clear down trajectory.0

-

Shows that Covid is hitting even the better well run companies. If people aren't eating out. Then there's reduced demand for product. Unilever is simply a reflection of wider woes that many companies will be reporting when announcing their annual results. There's been a pretty wide news void over the past 10 months with requirements on companies suspended.

0 -

As the OP said, their recent results disappointed, but the stock is also sensitive to movements in sterling, which has gone up nearly ten percent against the dollar in the past quarter. Because the company earns most of its revenue abroad, a weaker pound is good for its revenues and earnings, and also its share price, which are all denominated in sterling. A stronger pound, such as we have seen since the Brexit trade deal was agreed, and with the apparent success of the UK vaccine programme boosting confidence in a domestic recovery, has hit sterling-hedge counters like Unilever. If you think the pound is near the top of its upward run, then this could be a good time to buy. It yields a dividend of nearly 4 percent at current prices with little to suggest it can't maintain its dividend.

1 -

Interesting replies - thank you. Have learnt something there.

Although i usually only invest in funds, i would have a small pot to invest long-term in a couple of stocks and at that price I was thinking Unilever is worth a go at their current price , especially with the dividend situation as Keith80 mentions.

I'm in the travel business and have been watching stocks on IAG and Easyjet, and have similar thoughts there.

0 -

No, it reports in euros. This strengthened against the dollar and various other currencies, too, so it does explain some of the story but overall it was a weak year and given it isn't valued cheaply it cannot afford to miss.Keith80 said:As the OP said, their recent results disappointed, but the stock is also sensitive to movements in sterling, which has gone up nearly ten percent against the dollar in the past quarter. Because the company earns most of its revenue abroad, a weaker pound is good for its revenues and earnings, and also its share price, which are all denominated in sterling. A stronger pound, such as we have seen since the Brexit trade deal was agreed, and with the apparent success of the UK vaccine programme boosting confidence in a domestic recovery, has hit sterling-hedge counters like Unilever. If you think the pound is near the top of its upward run, then this could be a good time to buy. It yields a dividend of nearly 4 percent at current prices with little to suggest it can't maintain its dividend.

1 -

I’m a long term investor in Unilever and believe it is a good long term hold. The company is very forward thinking and the current share price in my opinion is very attractive, I have added at £40.00 and think this is a good buy. Only time will tell....

Edited £14.00 to £40.00 typo mistake!3 -

Why not just invest in a UK sector fund which holds Unilever, like the Lindsell Train UK Equity Fund?

As well as Unilever, it holds Diageo (alcohol based if it doesn't go against your principles), amongst others.2 -

Because, by holding just one company you are not only accepting 'market risk' - the 'risk' ('outcome' might be better) of all the shares in the market moving up or down similarly in response to some general event eg pandemic, but you are also accepting the idiosyncratic risks particular to one company eg they patent a new product consumers love, or their genius CEO runs off to work for a competitor. As a result you can get better returns than you could with a fund in the same market, but it's a gamble (is that the best word?) you take compared with just accepting what are essentially broad market returns. People vary in their propensity to gamble (is that the right word?).If you only chose Unilever, or a small bunch of shares, rather than a fund holding hundreds, and you did so because you thought their price was very attractive (compared to one you didn't choose I suppose), then your thinking is probably different from the highly paid, well resourced professional investors'. Because if they thought the price was attractive (compared to the comparable alternatives) then they'd be buying Unilever shares to take advantage of that attractive price, thus pushing the price up with their purchases until the price no longer seemed more attractive than the alternatives. And there the price movement would stop. Isn't that where the price is now unless one has knowledge others don't have (except for those too small to move the price)?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards