We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

How much to live on

Comments

-

I'm well over £2k on insurances alone, but I have some unusual circumstances. I do shop around, but I'm limited as many insurers won't quote me. I've seen a big increase in the last few years.

Even breakdown cover is difficult as I need European cover and tow a caravan, with limited companies willing to offer that.2 -

It's always amazing to see how different people's circumstances are.

Anyway, I've decided that my credit card applications this morning were the kick up the backside I needed and so I've closed my Amex Visa and my HSBC visa.

I still have my main stooze purchase cards (X5) and two balance transfer cards, a Barclaycard and an M&S card. The latter two are next for the cull!!2 -

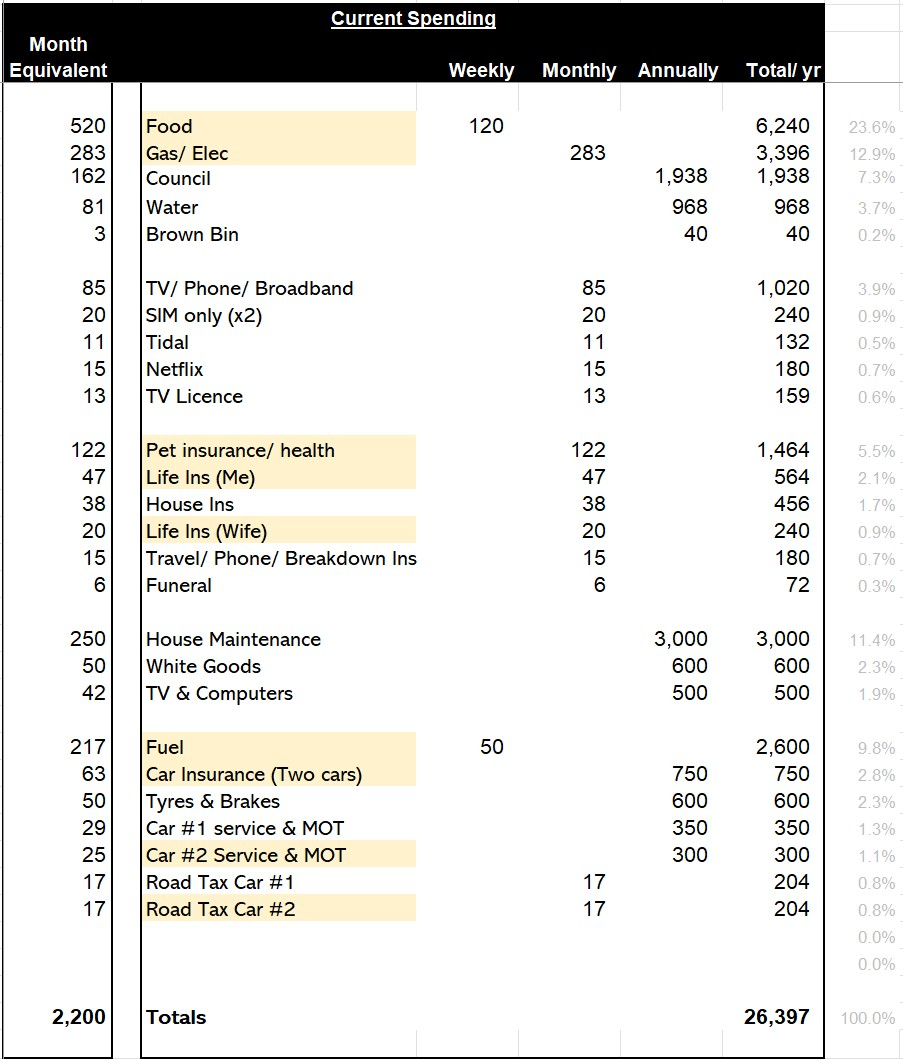

For insurances I account for the on a monthly or yearly basis (depends how each is paid). Dental I just deal with from an emergency pot, which varies in size though I tend to keep it in the several thousands. I also have a 'personal' spend that I budget on a monthly basis for me and my wife which covers clothing, subscriptions eating out etc.. I haven't detailed that below so as to keep those that will nit-pick over individual amounts guessing.. The coloured items are where my retirement spend estimates are lower/ removed all together. Hope the detail helps give you some feel for the level of Insurance spend and/ or a way to track your own expenditure.Tastiger said:Finally retiring this summer - no mortgage, no debt, pensions/ISAs/cash all in place, plus an emergency fund. Just doing final checks. Monthly normal spend is covered. I just wondered how everyone works out how much to put aside for the irregular occurances such as car/house insurance, medical/dental. We put £100 a month aside for Christmas. We only have the one car. So if I said an extra £2-3k a year for the irregular, would that seem reasonable? Just want to be sure the necessaries are in place, so that anything extra can go on fun/holidays/meals out etc.

Thank you for your thoughts. Not long to go now. 6

6 -

The coloured items are where my retirement spend estimates are lower/ removed all together.

@Phossy why would food, Gas / Elec be cheaper for you in retirement?0 -

I expect our kids to have finally moved out - that's a big part of it. The intention is also to move to a smaller, more modern, better insulated house.Lifematters said:The coloured items are where my retirement spend estimates are lower/ removed all together.

@Phossy why would food, Gas / Elec be cheaper for you in retirement?1 -

ummm

I have been looking in my region and most are EPC D, a very few C. I suppose very new build will be C+. Some have been modernised quite recently and are still 'D'. Wary of flats though if I leave it much longer sespect that will be my option - this is because of lease and service charges.0 -

@Tastiger We have 1800pm plus £3k pa for annual bills including dentist/car mot insurances xmas birthdays. We spend about 750pm on bills per month and 600 on food which leaves us 450pm on anything else We currently support an extra adult on this as well (29year old wont move out heavy sigh) This has been us since 2021/22 and even manage about 2 hotel breaks a year as well.21k savings no debt3

-

Well talking of energy bills.......I can switch to EDF via topcashback and get £75 cashback. This makes it considerably cheaper than what I pay now for 3 months and to get the cashback I need only stay that long.

It's a competitive rate anyway and if fixes go up I'll be paying the equivalent of my cheapest possible fix over 12 months (same as now). If rates go down I can switch away.

Sounds like a plan1 -

Very difficult to estimate what our costs will be because our daughter is still with us.

We take sandwiches to work she has chicken pasta/salad/rice. Her 2 or 3 showers a day last forever.

Multiple clothes changes every day, to save money the boyfriend comes here at weekend to eat and drink (my beer & wine).

TMI but how can one one person use so much toilet roll, does she make like a Mummy

She earns over double mine & her mothers combined wage and pays no board.

But we will be absolutely gutted when she moves out, she lights up our life. 6

6

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards