We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Calculating value

Comments

-

The first statistic that you should look at is PE ratio. Average PE ratios can be calculated for indices and sectors. These calculations lead to statements such as US stocks are more expensive than UK stocks. A company/sector/index with a high PE ratio is more expensive than one with a lower PE ratio.Bobziz said:how do you go about calculating the value of an individual stock or fund etc ?

It's not the only important statistic by any means. The debt/equity ratio will often explain why companies in the same sector can have significantly different PE ratios. Assets per share is also an important factor. Growth expectations together with expected and historical PE ratios affect valuations.

Having said all that, it's quite normal for a company's share price to fluctuate for no reason over a period when there is no relevant news.1 -

With hindsight.Bobziz said:

Absolutely, but what information are you using to judge that it's too good to be true ?Thrugelmir said:

Vestas Wind Systems is a great company in many respects. I had no regrets in liquidating my entire holding at an average gain of 94% after holding for for just 8 months. Sometimes it's just to good to be true. Likewise Orsted. Which faces some challenges despite it's well founded status.coastline said:

As chart patterns go the performance of INRG this year can only be described as parabolic. Google " parabolic chart " to see images. Who knows what happens next .Bobziz said:

Thanks. It was Thrugelmir's comment about the sector that provoked my question about valuation, but I'm interested in learning more about valuing stocks and funds more widely.Another_Saver said:Bobziz said:A fundamental question for those in the know, how do you go about calculating the value of an individual stock or fund etc ?

For example, I've read posters recently stating that renewables are currently trading at a premium/high, and are therefore not an attractive option in the short term. Obviously if you look at the share prices of most of the companies in the sector, you can see that prices are at all time highs and have got there in a short space of time. However, how do you go about determining that the market price is high or low relative to what would be considered fair value (par?) ?

I appreciate that value is not the only thing that drives share/fund prices, but I'd like to understand how members go about making their stock/fund picks when looking to buy low sell high. Any thoughts would be much appreciated.I think what you're asking is about premiums/discounts in relation to investment trusts that hold renewable energy assets (e.g. Greencoat UK Wind plc etc.). In general, there are any number of ways to calculate the "value" of an asset. With this specific asset class, a "premium" is probably the price relative to the book value of the assets. Greencoat is priced based on what is shareholders think its wind turbines can earn in future (just google discounted cash flow model, or watch a video of Warren Buffett explaining it), which tends to be higher than the book value of the wind turbines. This is true of most companies - if wind turbines "market value" as an investment asset was less than their cost to build or buy one, such a business would not be viable, they would not have been able to raise the capital to buy the wind turbines in the first place.

I own a few units of INRG and there are few reasons why I choose to buy it, but it struck me that I have no idea what a premium or high price looks like for the fund other than knowing it's at an all time high. This feels far from satisfactory. I'll likely hold it or similar for a good 10 years or more, so it doesn't really matter, but I'm keen to understand what overvalued looks like and why.

hold it or similar for a good 10 years or more, so it doesn't really matter, but I'm keen to understand what overvalued looks like and why.

Forget tech, solar and clean energy is the hot sector in 2020 | Shares Magazine

In no particular order. Construction issues in the US; Wind turbines freezing in Texas weather; Poor wind speeds in Europe reducing power generation and finally a profit warning.

Commercial organisations , even the best, suffer set backs. Often gets forgotten that companies are real entities. Not just names on a screen with numbers besides them which go up and down. The more demanding the rating placed on a Company the greater the danger of a significant fall when things do go wrong.1 -

MUT has quite poor income cover as far as I can see, not sure if that stats just taken from 2020 or long term.Alexland said:I suggest people sell MUT to drive the price down before I buy more at the end of the month

I quite fancy Morrisons as a growth/dividend play. Their yield of 4% seems fairly safe, and if I were to take a bet, can see their SP hitting the 200-225p range in the next year or two so a capital uplift of 8-25% give or take as well is not bad.0 -

Dividends paid would have been uncovered last year from revenue income. Hardly surprising given the cuts, bans and suspensions.DireEmblem said:

MUT has quite poor income cover as far as I can see, not sure if that stats just taken from 2020 or long term.Alexland said:I suggest people sell MUT to drive the price down before I buy more at the end of the month

All about tomorrow.0 -

What exactly are you looking at? Some of MUT's income comes from the option writing business and it's dividends were only around 15% affected by the virus which is better than average for the UK market. It's revenue reserve is low as a result of the PLI merger where the trust basically doubled in size but the PLI revenue reserve could not be carried across but the board have approved paying dividends from the capital reserve if required which is reasonable given the special circumstances of the merger which was overall to shareholder's benefit.DireEmblem said:MUT has quite poor income cover as far as I can see, not sure if that stats just taken from 2020 or long term.

0 -

Thanks, that's helpful. I've been looking at the PE 10 recently to get a feel for where the markets are at generally. Useful grounding to see that the PE10 of the s&p500 has only every been higher than it is now on one occasion over the last 120 years.maxsteam said:

The first statistic that you should look at is PE ratio. Average PE ratios can be calculated for indices and sectors. These calculations lead to statements such as US stocks are more expensive than UK stocks. A company/sector/index with a high PE ratio is more expensive than one with a lower PE ratio.Bobziz said:how do you go about calculating the value of an individual stock or fund etc ?

It's not the only important statistic by any means. The debt/equity ratio will often explain why companies in the same sector can have significantly different PE ratios. Assets per share is also an important factor. Growth expectations together with expected and historical PE ratios affect valuations.

Having said all that, it's quite normal for a company's share price to fluctuate for no reason over a period when there is no relevant news.

I wonder how many investors have a plan in place ready to follow....0 -

Hmmm... That's what I used to think too, but eventually gave up and sold at £1.90...in March 2014!DireEmblem said:I quite fancy Morrisons as a growth/dividend play. Their yield of 4% seems fairly safe, and if I were to take a bet, can see their SP hitting the 200-225p range in the next year or two so a capital uplift of 8-25% give or take as well is not bad. 0

0 -

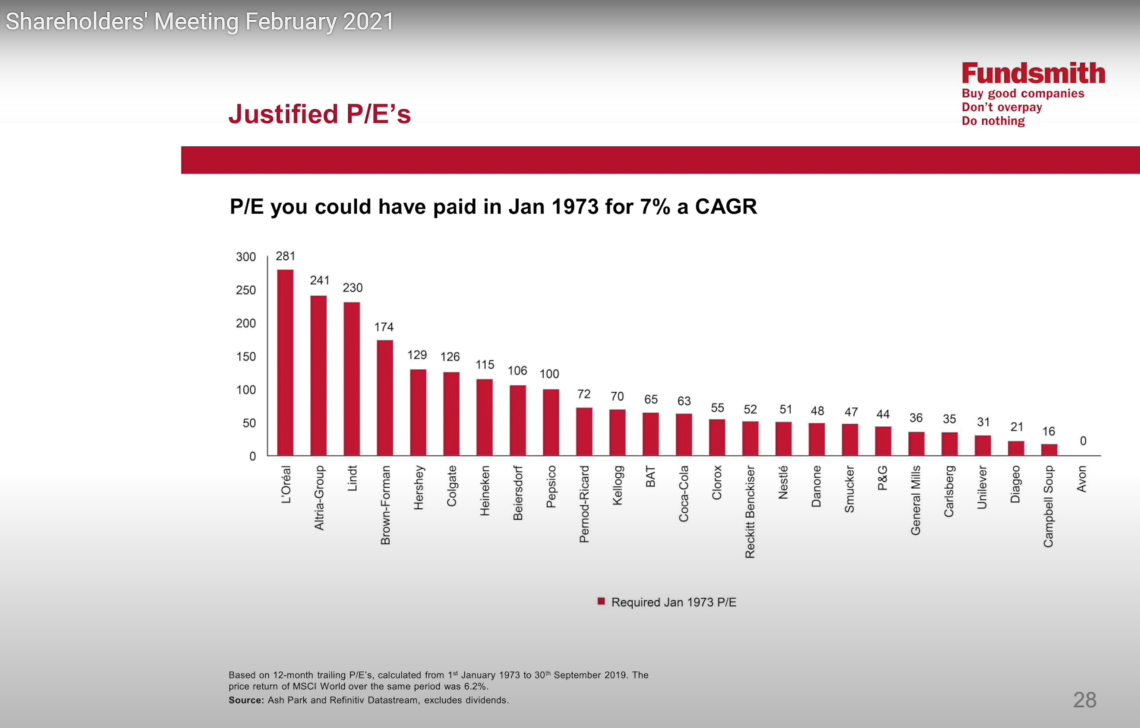

There is nothing inherently wrong with paying a high ratio of price to earnings if the earnings will grow causing the P/E to reduce over time while still allowing the price to grow. An interesting slide from Fundsmith annual meeting this year, pointing out what you could have afforded to pay in terms of P/E for a number of quality companies in Jan 1973 (the start of a two year bear market where the Dow Industrials index lost 40% just after reaching 1000) and still got a 7% compound annual growth rate from there to 2019 based on how they turned out. That 7% being considered a reasonable return, as MSCI World over the period was 6.2%.Bobziz said:

Thanks, that's helpful. I've been looking at the PE 10 recently to get a feel for where the markets are at generally. Useful grounding to see that the PE10 of the s&p500 has only every been higher than it is now on one occasion over the last 120 years.maxsteam said:

The first statistic that you should look at is PE ratio. Average PE ratios can be calculated for indices and sectors. These calculations lead to statements such as US stocks are more expensive than UK stocks. A company/sector/index with a high PE ratio is more expensive than one with a lower PE ratio.Bobziz said:how do you go about calculating the value of an individual stock or fund etc ?

It's not the only important statistic by any means. The debt/equity ratio will often explain why companies in the same sector can have significantly different PE ratios. Assets per share is also an important factor. Growth expectations together with expected and historical PE ratios affect valuations.

Having said all that, it's quite normal for a company's share price to fluctuate for no reason over a period when there is no relevant news.

I wonder how many investors have a plan in place ready to follow....

This isn't saying that those companies were trading at those multiples at that date. Its pointing out that right before the market slumped, you could have afforded to pay a PE of 60+ for coke, 100 for pepsi, 115 for Heineken, 126 for Colgate, or over 280 for L'Oreal, and still ended up with 7% CAGR in your pocket over the following 46 years to the back end of 2019.

Looking at modern day index components, Microsoft has been growing its earnings and is on a PE of about 35, but its PE10 is more like double that. The PE 10 includes looking at its 10 year earnings (including the earnings of 2011, 2012 etc which are much lower than they are now) and comparing to current price, so will generally be a much bigger number than the current PE if the company has been growing well. The idea of PE10 is that is smooths out lumps and bumps in profitability to give you a broad measure, but is maybe more useful when the companies making up an index are slow growing leviathans rather than Facebooks and Googles and Amazons that you see in some major indexes.

Anyway, are the prospects OK for Microsoft on a PE of 35 or PE10 of 70? If you could have paid over 126x Colgate's 1972 earnings right before a big market slump and still made a satisfactory return over the next five decades, then you can perhaps afford to pay 35x Microsoft's 2020 earnings and do just fine too. No doubt it will be a bumpy ride. This is only an example - I don't hold MSFT directly as I have no real opinion on it either way, but have exposure to it through some funds.

0 -

underground99 said:An interesting slide from Fundsmith annual meeting this year, pointing out what you could have afforded to pay in terms of P/E for a number of quality companies in Jan 1973 (the start of a two year bear market where the Dow Industrials index lost 40% just after reaching 1000) and still got a 7% compound annual growth rate from there to 2019 based on how they turned out. That 7% being considered a reasonable return, as MSCI World over the period was 6.2%.I was a bit sceptical when they flashed that 'justified PE' slide because of course it's a cherry picked selection of companies for which it is now known they were able to grow well so a very safe choice provided you have access to a time machine. It doesn't really reflect the risk an investor is taking today when paying high PEs for companies that on average are unlikely to do as well as that selection. A better analysis might be against something like the Nifty Fifty shares in the 60s/70s of quality companies like Kodak, IBM, PepsiCo (which is in that slide), etc. Some did well some not so well. I saw a study that suggested an investor would have done alright in the long term holding them but what would have happened if you had paid the current PEs for them?1

-

Chances of 50 year Tesla 7% CAGR when it had a PO over >2000?

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards